Pourquoi les obligations en monnaie forte des marchés émergents peuvent afficher des performances de qualité pendant un cycle de resserrement des taux aux États-Unis.

-

L’histoire récente montre que les obligations en monnaie forte des marchés émergents peuvent afficher des performances de qualité pendant les cycles de resserrement de la Fed américaine

-

La panique du marché observée à l’approche d’un cycle de resserrement de la politique monétaire poursuivie par le Fed donne lieu à des spreads et à des rendements initiaux plus élevés pour les marchés émergents, ce qui a tendance à générer des rendements totaux qui pourraient être plus élevés au cours de la période à venir du fait d’un portage plus important.

-

Les obligations des marchés émergents restent attrayantes par rapport à leurs homologues des marchés développés, car elles offrent des rendements plus élevés pour une notation de crédit similaire

-

Le recours à des techniques telles que l’optimisation des spreads et la prise en compte de considérations ESG peuvent, en outre, stimuler encore davantage le rendement et contribuer à réduire les risques

Lorsque les taux augmentent, les obligations des marchés émergents chutent. Telle est la perception générale que peuvent alors avoir les acteurs du marché. À court terme, cela n’est pas faux non plus.

Voilà comment cela tend à se passer dans la réalité : lorsque les taux d’intérêt commencent à augmenter, les investisseurs en obligations des marchés émergents s’inquiètent et sortent de leurs positions. La baisse des prix des obligations qui s’ensuit fournit alors une grande partie des gros titres de l’actualité financière, jusqu’à ce que l’autre histoire se mette en place. Ce que l’on obtient, c’est une courte réaction ponctuelle à court terme qui génère une perception selon laquelle des investisseurs entrent et sortent pour faire de l’argent rapide.

La réalité, c’est que les investisseurs en obligations des marchés émergents opérant sur le long terme ont, dans les faits, réalisé des bénéfices dans un environnement de hausse des taux. L’essentiel réside ici dans le mouvement de liquidation initial observé (avant le cycle de relèvement redouté de la Fed), lequel se traduit par un portage beaucoup plus élevé. Or, au fur et à mesure que le cycle de relèvement des taux progresse, la peur se dissipe et les spreads des marchés émergents se resserrent, de sorte que cela génère des gains en capital au bénéfice des détenteurs d’obligations.

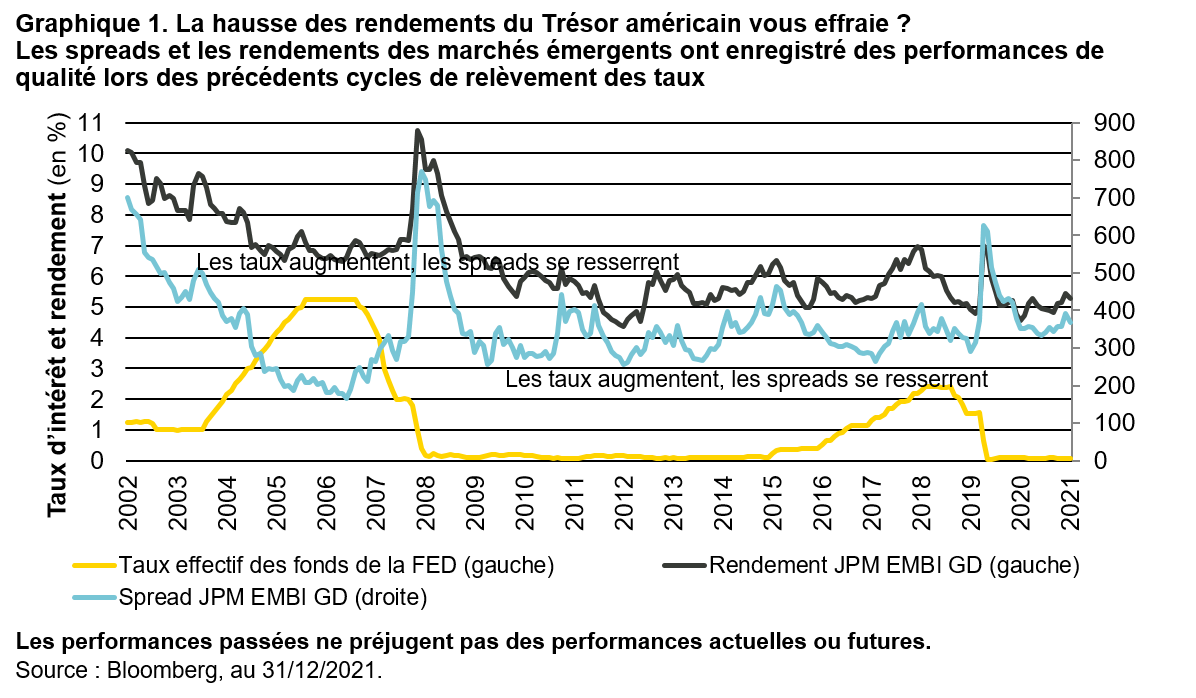

Les spreads des marchés émergents s’élargissent avant le cycle de relèvement des taux, puis se resserrent au fur et à mesure que la Fed relève ses taux

Jetons un coup d’œil sur les deux derniers cycles de relèvement des taux de la Fed. Les taux américains ont commencé à augmenter en décembre 2015, et cette hausse s’est poursuivie jusqu’en 2018. Pourtant, les spreads des marchés émergents ont, eux, connu un resserrement en 2016 et 2017 (voir graphique 1) et l’indice EMBI Global Diversified a, quant à lui, dégagé des rendements totaux supérieurs à 10 % au cours de chacune de ces années. Ce n’est ensuite qu’en 2018 qu’un nouvel élargissement des spreads a pu être observé, lorsque les États-Unis et la Chine se sont engagé dans la guerre commerciale qui les opposent et que des crises monétaires ont éclaté en Turquie et en Argentine. Pourtant, même lorsque les spreads ont commencé à s’élargir en 2018, ils ont alors atteint un pic inférieur de 100 points de base au pic qu’ils avaient précédemment atteint au début du cycle, et ils ont perdu 4,2 % sur l’année.

Cet exemple ne constitue toutefois pas un pas isolé. Remontons ainsi plus loin dans l’histoire, et passons en revue le précédent cycle de hausse observé entre 2004 et 2007 : les spreads des marchés émergents s’étaient alors également resserrés de manière significative, ce qui avait permis de bénéficier des rendements totaux allant de 6,2 % à 10,2 % par an au cours de cette période. Nous estimons que le fait de croire que les cycles de hausse des taux impliquent des rendements médiocres pour les obligations des marchés émergents n’est ni plus ni moins qu’un mythe (et un mythe tenace).

Les cycles de relèvement des taux ont, en effet, constitué des jours heureux pour les investisseurs en obligations de marchés émergents ayant investi à long terme, et cela leur a permis de choisir des obligations offrant un rendement supérieur et de tirer également parti de l’appréciation du capital générée par le resserrement des spreads.

Pour les investisseurs actifs et opérant sur le long terme, les hausses de taux offrent une opportunité d’exploiter les fluctuations à court terme – le bruit – que génèrent les hausses de taux. Les épisodes de volatilité qui en résultent offrent en effet alors de nombreuses occasions de sélectionner des obligations offrant un rendement de qualité et un véritable potentiel d’appréciation du capital.

À titre d’exemple, les obligations souveraines des marchés émergents n’ont jamais connu deux années consécutives de rendements négatifs (voir graphique 2). Et, lorsqu’une année de rendements négatifs a été observée, l’année suivante a alors enregistré un redressement significatif.

Ceci n’est nullement le fruit du hasard, mais d’une causalité parfaitement claire et identifiable. Après le mouvement de liquidation initial (observé avant le cycle de resserrement des taux de la Fed), les marchés émergents affichent des niveaux de rendement inhabituellement élevés, ce qui implique un portage inhabituellement élevé pour la période qui vient. Une fois que la peur s’est dissipée, les investisseurs remarquent toutefois que les rendements sont plus élevés que d’habitude et reviennent vers les marchés émergents. Ces afflux donnent alors lieu à un resserrement des spreads des marchés émergents, ce qui a pour effet de générer des gains en capital qui s’ajoutent à un important portage pour ceux qui sont entrés tôt sur le marché.

L’optimisation des spreads permet de générer des rendements supplémentaires

La persistance de conceptions erronées quant aux obligations des marchés émergents alimente une certaine inefficacité du marché, car certains investisseurs s’appuient précisément sur ses conceptions pour mettre en œuvre leur action, ce qui provoque des fluctuations de prix. Il en résulte que les obligations des marchés émergents présentent des rendements plus élevés, des spreads plus larges et une duration plus faible que leurs homologues des marchés développés. C’est cela qui fait des obligations des marchés émergents un véritable paradis sur terre pour les gestionnaires actifs. Pour pousser au maximum les rendements des obligations des marchés émergents, les investisseurs doivent également chercher à exploiter le spread au maximum pour tout niveau de risque donné. En fondant leur action sur une approche active, les investisseurs peuvent rechercher les obligations présentant le meilleur spread pour un niveau de risque donné : c’est ce que nous appelons « l’optimisation du spread ».

Un exemple permet d’illustrer nos propos : les trackers indiciels passifs n’achètent que les obligations de l’indice sous-jacent. Or, il arrive toutefois souvent que les obligations du même émetteur, non incluses dans l’indice affichent un rendement supérieur, car les fonds trackers font aveuglément monter le prix des obligations incluses dans l’indice. L’investisseur avisé se voit alors offert la possibilité d’acheter une obligation présentant un risque de crédit similaire (même émetteur), mais un meilleur rendement. Cette approche peut, en outre, être étendue afin d’identifier les obligations se révélant relativement bon marché pour d’autres raisons, et qui sont en avance ou en retard sur les tendances du marché.

Le fait de sélectionner ces obligations de manière répétée permet ensuite aux investisseurs d’optimiser le spread qu’ils obtiennent. D’après l’expérience que nous avons de ce genre de situation, cette approche peut permettre d’obtenir 150 à 300 points de base de spread supplémentaire, tout en conservant une notation et une duration similaires à celles de l’indice de référence FI des marchés émergents.

La prise en compte des critères ESG joue un rôle important dans l’optimisation des spreads et doit être intégrée à l’analyse de crédit. À l’heure actuelle, les marchés émergents sont en effet en train de rattraper leur retard dans le domaine ESG et les investisseurs exigent de plus en plus que les obligations et les émetteurs respectent les normes ESG. Le fait d’identifier les émetteurs de marchés émergents mettant en œuvre les normes ESG donnera probablement lieu à un resserrement des spreads, car les investisseurs commencent à récompenser ces émetteurs en achetant leurs obligations.

Conclusion

Une conception erronée persiste salon laquelle les cycles de resserrement des taux ne peuvent qu’impacter négativement les rendements des obligations des marchés émergents. Dans les faits, les obligations des marchés émergents ont plutôt tendance à très bien se comporter pendant les cycles de resserrement des taux de la Fed, car ces cycles succèdent généralement une période initiale de panique du marché qui intervient avant le début des relèvements effectifs. Nous pensons que cette phase de crainte des marchés est désormais derrière nous, car les prix ont d’ores et déjà intégré un cycle de resserrement plus rapide de la politique monétaire menée par la Fed.

La croissance mondiale se trouvant en outre toujours en bonne voie de reprise, nous estimons donc que le moment est opportun pour les investisseurs à long terme d’investir dans des obligations des marchés émergents. Lorsque l’objectif est de pousser les rendements à leur maximum, le fait d’adopter une approche active et de se concentrer sur l’optimisation des spreads peut constituer un moyen efficace d’augmenter le rendement et de générer des rendements globaux sur l’ensemble du cycle.

Pour accéder au site, cliquez ICI.