««We Can. We Will» (nous pouvons, nous le ferons) », tel est le message actuellement lancé à New York où les dirigeants et les experts du monde entier se réunissent pour la Semaine du climat. C’est également ce même cri de ralliement en faveur d’une action climatique urgente que les conférences, les études et les rapports du monde entier lancent depuis des années. Les sonnettes d’alarme n’ont jamais retenti aussi fort.

Le réchauffement climatique poursuit sa marche et fait ressentir ses effets avec une férocité croissante. Cet été, plusieurs régions de l’hémisphère nord ont affiché des températures jamais enregistrées auparavant. De plus, la gestion des déchets est hors de contrôle, à tel point que nous approchons du stade où le poids du plastique présent dans les océans de la planète dépassera celui des poissons qui y vivent. Quant à la biodiversité mondiale, qui est essentielle au maintien de la vie sur terre et dont la valeur économique est estimée à 44 000 milliards de dollars (soit près de deux fois le PIB des États-Unis) , elle est confrontée à ce que les Nations unies qualifient de véritable «apocalypse de la nature».

Des mesures sont prises, mais notre monde reste au bord du gouffre. Certains pays comme le Brésil sont récemment parvenus à réduire les taux de déforestation, mais il n’en reste pas moins qu’en 2022, la destruction de la forêt tropicale a rejeté dans l’atmosphère des niveaux de dioxyde de carbone comparables à ceux des émissions annuelles de combustibles fossiles de l’Inde. Et cela s’est produit malgré l’accord de Paris de 2015 visant à réduire les gaz à effet de serre de 80 à 95 % et l’engagement de mettre un terme à la déforestation qui avait été pris lors du sommet de la COP26 il y a près de deux ans.

Les investisseurs peuvent-ils vraiment apporter une contribution…

Serons-nous en mesure de déployer à temps l’impact nécessaire? Pour réussir, la communauté internationale doit se doter d’un plan qui lui permettra de relever en toute urgence les défis qui se posent. Et ce plan nécessitera un financement massif.

En tant que gestionnaires d’allocation de capitaux, les sociétés d’investissement ont, à cet égard, un rôle clairement défini à jouer. Il nous semble, à cet égard, que les investisseurs s’orientent de plus en plus vers la durabilité, dont ils affichent une prise de conscience croissante tout en lui portant une attention particulière, y compris dans le cadre de leurs décisions d’investissement. La Conférence des Nations unies sur le commerce et le développement (CNUCED) estime ainsi que le volume mondial des fonds consacrés aux investissements dans la durabilité s’élève désormais à 1 300 milliards USD. Au cours des dix prochaines années, les produits liés à la durabilité devraient connaître une forte croissance.

C’est la raison pour laquelle l’approche de Vontobel en matière d’investissement à impact vise à offrir aux clients ce que nous appelons le «double dividende»: l’opportunité de générer des rendements financiers tout en ayant un impact positif et mesurable sur notre planète et notre société. Notre approche entend répondre à l’urgence des problèmes mondiaux en investissant dans des sociétés proposant des produits et services innovants et évolutifs.

… et bénéficier des besoins de croissance? Réfléchir aux opportunités structurelles

Il arrive que certains investisseurs associent l’investissement à impact à la nécessité de renoncer à des rendements. Outre notre contribution grâce à l’expertise dont nous disposons dans le processus d’investissement, le potentiel de rendement que recèle l’investissement à impact repose également sur un élément plus structurel.

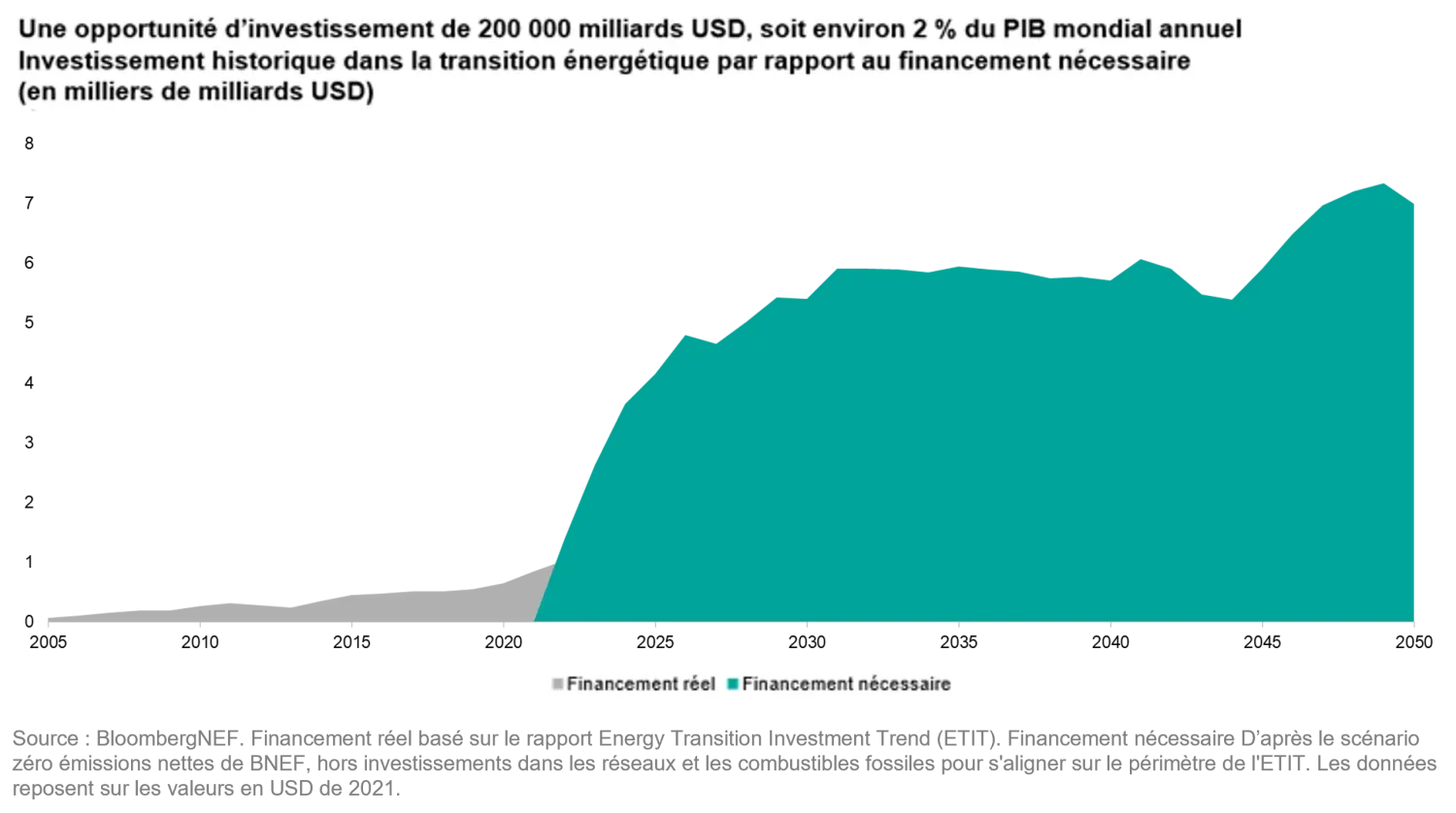

BloombergNEF a ainsi quantifié l’opportunité d’investissement à 200 000 milliards USD, car les efforts à déployer en matière de transition énergétique doivent s’intensifier pour que le monde puisse atteindre les objectifs de zéro émission nette qu’il s’est fixés pour l’horizon 2050. Cela implique des dépenses annuelles d’environ 6 500 milliards USD, contre 2 000 milliards USD en 2021. Soit, autrement dit, une moyenne d’environ 2 % du PIB mondial (et à peu près ce que les alliés de l’OTAN dépensent pour leur budget militaire).

Des domaines tels que l’énergie éolienne, les véhicules électriques et les pompes à chaleur sont donc promis à une croissance spectaculaire. L’exemple de l’énergie éolienne aux États-Unis est particulièrement éloquent: les capacités vont devoir passer de 100 gigawatts actuellement à 4 200 gigawatts à l’horizon 2050, selon la Bank of America Global Research. La mise en place de centaines de milliers de stations de recharge pour véhicules électriques dans le cadre du passage à des transports routiers alimentés par des batteries constitue une autre illustration saisissante des défis à relever.

Tous ces secteurs devront assister à une croissance de leurs marchés multipliée par 40, à près de 200 fois leur taille actuelle, et cette croissance nécessitera des capitaux. BloombergNEF estime que près de 110 000 milliards USD seront nécessaires pour transformer notre façon de consommer l’énergie: les pompes à chaleur, les véhicules électriques et le recyclage durable s’en trouveront stimulés. Les 90 000 milliards USD restants devraient être consacrés à des actifs liés à l’approvisionnement en énergie, notamment aux infrastructures de réseau et à la capture du dioxyde de carbone.

Les dispositifs incitatifs ont commencé à se renforcer aux États-Unis et en Europe, et les investissements consacrés à la transition énergétique sont effectivement déjà sur le point de dépasser ceux dont bénéficient les combustibles fossiles, une tendance devant notamment s’accélérer considérablement au cours des prochaines années. Les entreprises disposant d’un avantage concurrentiel dans ce domaine sont exactement le type d’investissements que nous ciblons, car elles sont appelées à bénéficier d’un afflux de capitaux, et proposent souvent des solutions moins coûteuses et la possibilité d’une croissance plus rapide.

Mais même en l’absence de soutien politique et de programmes de subvention, ces tendances devraient persister et constituer de puissants moteurs à long terme, ainsi que de véritables atouts structurels pour les sociétés fournissant des solutions viables face aux menaces environnementales auxquelles nous sommes confrontés. Les investissements dans les technologies améliorant l’efficacité énergétique des bâtiments, dans les transports routiers écologiques et dans les alternatives aux processus à forte intensité de carbone sont tout aussi cruciaux que le développement des énergies renouvelables telles que les parcs éoliens et solaires. C’est la raison pour laquelle nous estimons que les titres que nous détenons dans nos portefeuilles via différents piliers d’impact sont bien placés pour en bénéficier.

Qu’est-ce que tout cela signifie pour les investisseurs? L’essentiel réside ici dans le fait que les investisseurs ont la possibilité de prendre part à l’investissement à impact pour saisir des opportunités de croissance à long terme au sein du panier d’actions mondial, et ce, tout en soutenant des solutions évolutives permettant de lutter contre le changement climatique et de relever les défis qui se posent dans d’autres domaines environnementaux et sociétaux. Cela constitue une opportunité potentielle de récolter les bénéfices financiers que réalisent des sociétés apportant des solutions aux problèmes mondiaux et de semer les graines pour de meilleurs lendemains.

Les cris de ralliement sont entendus

L’appétit pour de tels investissements est clairement présent. Notre propre étude exclusive met en évidence l’intérêt considérable que portent les professionnels à l’adoption de stratégies d’investissement à impact et indique que le marché présente encore un énorme potentiel inexploité.

Plus de la moitié des investisseurs interrogés dans le cadre de notre enquête 2023 consacrée aux investissements à impact et menée auprès d’investisseurs institutionnels et professionnels nous ont affirmé que leur appétit pour les investissements à impact était motivé par le désir d’obtenir des rendements tout autant financiers que non financiers. Et 70 % d’entre eux ont annoncé qu’ils prévoyaient d’augmenter leurs allocations à impact en actions de sociétés cotées au cours des trois prochaines années.

Les pressions réglementaires devraient, elles aussi, contribuer à aiguiser l’appétit des investisseurs pour les investissements à impact. La Maison Blanche a récemment annoncé que l’objectif du président Biden visait à réduire de moitié les émissions américaines par rapport aux niveaux de 2005, ce qui correspond à un quasi-doublement de l’objectif initialement fixé par l’administration Obama. Les législateurs de l’UE ont, quant à eux, accepté le principe d’une augmentation de leur objectif de réduction des émissions de 40 à 55 % par rapport aux niveaux de 1990. Cela va accroître la pression exercée sur les entreprises pour qu’elles se joignent à la lutte contre le changement climatique.

Les sonnettes d’alarme retentissent désormais si fort qu’elles en deviennent assourdissantes. Mais il n’est pas question, pour l’humanité, de tout abandonner et de prendre la poudre d’escampette. Il nous faut redoubler d’efforts et les investisseurs joueront un rôle crucial dans le redressement de la situation. Ce n’est pas demain, ni la semaine prochaine ni l’année prochaine qu’il faudra agir. C’est maintenant.

Pour accéder au site, cliquez ICI.