Vous vous rappelez les clameurs des supporteurs dans les stades ? Ces temps sont révolus, mais la ola de l’investissement durable semble partie pour durer, et ce pour de bonnes raisons. Cependant, un nouveau règlement européen va guider les investisseurs vers des produits dignes d’intérêt.

Le 10 mars 2021, les nouvelles règles plus strictes du règlement européen sur la publication d’informations en matière de durabilité dans le secteur des services financiers (SFDR) prendront effet dans l’Union européenne, confirmant la réputation de pionnière (ou de supporter, en termes sportifs) de la région en ce qui concerne les investissements durables. Ces règles vont rendre obligatoires l’attribution d’un label écologique aux produits financiers et la publication de certaines informations1 qui vont contraindre les acteurs du marché et les conseillers financiers à faire preuve d’une plus grande transparence lorsqu’ils présentent leurs produits financiers comme des investissements durables.

Les passages du règlement SFDR à prendre en considération sont les articles 8 et 9. Les produits financiers conformes à l’article 8, c’est-à-dire qui promeuvent des caractéristiques environnementales ou sociales, arborent un logo reproduisant une feuille vert pâle. Les produits conformes à l’article 9, plus strict, qui ont pour objectif l’investissement durable, portent un logo qui prend la forme de deux feuilles vert foncé. Par ailleurs, les sociétés d’investissement devront fournir des informations détaillées sur leurs politiques d’intégration des risques et des objectifs de durabilité dans leurs processus d’investissement et sur la manière dont leurs produits répondent réellement à leurs allégations en matière de critères ESG. Par exemple, elles devront évaluer la mesure dans laquelle les investissements réalisés par les gérants d’actifs respectent les normes environnementales et sociales que la société affirme respecter.

Le Pacte vert pour l’Europe va déclencher des investissements massifs

Les investisseurs et gérants d’actifs axés sur la durabilité vont approuver cette avancée. D’une part, le durcissement de la réglementation va renforcer la concurrence. D’autre part, l’initiative européenne ne va pas seulement mettre en place un système de classification « écologique » des produits financiers (investissements en actions et normes pour les obligations vertes), elle s’accompagne également d’un plan de plusieurs milliards d’euros pour parvenir à la neutralité carbone d’ici 2050. Intitulée Pacte vert pour l’Europe, cette action comprend l’établissement d’une Taxonomie européenne, c’est-à-dire d’un système de classification visant à distinguer les activités économiques durables des activités non durables. Cette initiative va provoquer des investissements massifs dans le secteur des entreprises de technologies propres, ce qui entraînera in fine de nouvelles opportunités d’investissement pour l’industrie financière.

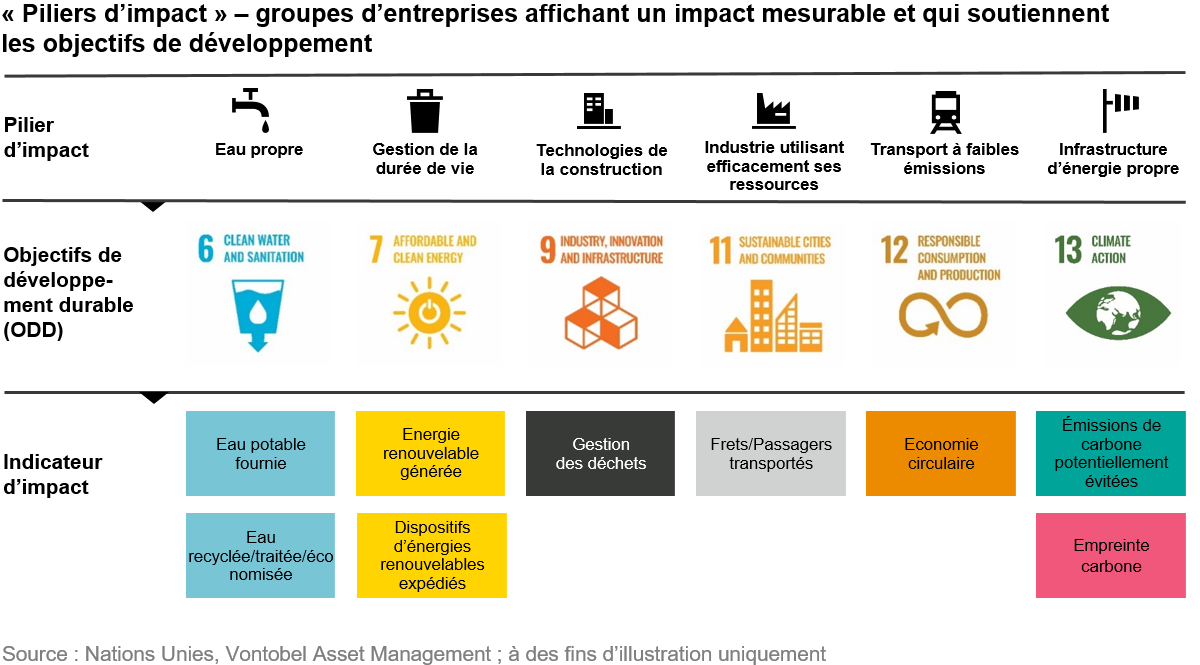

De notre côté, nous constatons que les six objectifs environnementaux figurant au centre de la Taxonomie européenne (atténuation du changement climatique, adaptation au changement climatique, protection des ressources aquatiques, transition vers une économie circulaire) sont en grande partie alignés sur les Objectifs de développement durable (ODD) des Nations Unies2, ainsi que sur nos propres piliers d’impact (voir le tableau ci-dessous). Ce constat nous a convaincus que notre produit Clean Technology pouvait prétendre au statut de produit dit « article 9 », soit la catégorie la plus élevée du programme du SFDR.

Qu’avons-nous appris au cours des douze dernières années, depuis le lancement de ce produit ? A l’époque, les ODD n’existaient pas et l’investissement d’impact était associé à des projets privés ou philanthropiques. Même si initialement nous n’utilisions pas le terme d’investissement d’impact, nous savions dès le départ ce que nous voulions faire : investir dans des entreprises qui améliorent notre quotidien, contribuent à réduire notre empreinte écologique et offrent des opportunités d’investissement attrayantes. Les six piliers d’impact décrits ci-dessus, qui n’ont pas changé depuis 2008, ont toujours guidé nos pas. Au fil du temps, nous avons élaboré de nouvelles mesures environnementales. Il y a cinq ans, nous avons commencé à mesurer ce que nous appelons les émissions potentiellement évitées. Trois ans plus tard, nous avons mis en place un train complet d’indicateurs clés de performance afin de mesurer la contribution des entreprises de nos portefeuilles aux avancées environnementales et sociales.

Si l’argent compte, « adopter une bonne conduite » importe aussi

Nous sommes des investisseurs et, à ce titre, des rendements compétitifs sont importants. Cependant, nous avons également appris que l’argent ne fait pas tout : souvent, les investisseurs souhaitent associer leurs placements à un résultat environnemental ou social positif. Les jeunes générations accordent plus d’importance au respect de l’environnement que les baby-boomers, plus matérialistes, notamment en raison des défis mondiaux tels que le changement climatique et la pollution. Cela dit, les millenials vont hériter de plus de 70.000 milliards de dollars US de leurs parents, ce qui représente l’un des transferts de richesse les plus importants jamais réalisés. Le changement de mentalité va augmenter les transferts de fonds vers les produits financiers affichant des références « vertes ». La prise de conscience croissante des problèmes à l’échelle mondiale transforme également l’état d’esprit des investisseurs institutionnels qui alignent de plus en plus leur allocation d’actifs sur les objectifs de développement des Nations Unies.

Nous croyons qu’il est possible d’allier « bien faire » et performance. De nombreuses études indépendantes et nos propres recherches montrent que sur le long terme, la performance de l’investissement d’impact est comparable à celle de l’investissement traditionnel. La performance du portefeuille répond largement ou dépasse les attentes des investisseurs en matière d’impact environnemental et de rendement financier.

Ce qui est mesuré est mis en œuvre

Mesurer l’impact positif des produits financiers sur le plan social ou environnemental s’avère complexe en raison de l’absence de valeurs de référence. Cependant, la disponibilité des données ne cesse de s’améliorer, non seulement en raison du renforcement de la surveillance réglementaire, mais aussi parce qu’avec d’autres gérants d’actifs, nous continuons d’encourager les entreprises à renforcer leur transparence. Les mesures du secteur financier qui visent à évaluer la durabilité des entreprises en portefeuille ne sont peut-être pas parfaites, mais ces indicateurs perfectibles ont le mérite d’exister. Alors que nous améliorons nos méthodes de mesure telles que le calculateur d’impact qui présente neuf résultats environnementaux différents (les chiffres évoluent de façon dynamique en fonction du montant que les investisseurs souhaitent investir, et, de temps à autre au fil du développement de notre portefeuille), nous continuons à apprendre avec le temps.

Des bénéfices, oui, mais pas sans principes

Si l’on revient à notre exemple initial, nous sommes assurément des supporteurs de l’investissement durable. Bien qu’imparfait, le SFDR représente incontestablement un mécanisme essentiel pour permettre aux investisseurs de faire des choix éclairés en ce qui concerne la finalité de leurs investissements. Et pas seulement pour des raisons éthiques. Avec la mise en œuvre du Pacte vert pour l’Europe et d’autres dispositifs similaires à travers le monde, les investisseurs devraient être en mesure de combiner bénéfices et principes.

1 Voir Vontobel Insights : « Plan d’action européen : la neutralité climatique en 2050 ? », 10 juin 2020 https://am.vontobel.com/fr/insights/eu-sustainable-finance-action-plan-climate-neutral-in-2050 ou « Le plan d’action de l’UE : une transparence accrue pour les placements durables », 24 juin 2020 https://am.vontobel.com/fr/insights/the-eu-action-plan-greater-transparency-in-the-area-of-sustainable-investments

Parmi les lectures de référence, voir, par exemple, « Sustainable finance Disclosure Regulation – is the financial industry ready for the Big One? », Deloitte 2020, https://www2.deloitte.com/lu/en/pages/sustainable-development/articles/sustainable-finance-disclosure-regulation.html, ou « Sustainable Finance Disclosure Regulation (SFDR) », PwC, 2020 https://www.pwc.ch/en/publications/2020/sustainable-finance-disclosure-regulation.pdf

2 Les Objectifs de développement durable, qui se composent de 17 initiatives visant à améliorer la situation environnementale et sociale de la population sur toute la planète, ont été adoptés par 193 pays en 2015. Seuls principes en matière de durabilité acceptés à travers le monde actuellement, les ODD doivent être atteints à l’échelle mondiale et par tous les Etats membres des Nations Unies d’ici 2030

Matthias Fawer, Analyst ESG & Impact Assessment

Matthias Fawer, Analyst ESG & Impact Assessment

Pour accéder au site, cliquez ICI.

, Head of Listed Impact, Portfolio Manager

, Head of Listed Impact, Portfolio Manager , Client Portfolio Manager

, Client Portfolio Manager