En bref :

- L’histoire nous conforte dans l’idée que nous démarrons la nouvelle année dans une meilleure position qu’en 2022.

- L’inflation, et le rythme auquel elle va ralentir, constituera la principale interrogation en 2023.

- La réouverture de la Chine et le ralentissement attendu des relèvements de taux devraient soutenir les obligations des marchés émergents et semblent de bon augure pour le segment des investissements réalisés dans le crédit aux entreprises des marchés développés.

2022 a été une année difficile pour les obligations. Alors que le monde dans lequel nous évoluons demeure très incertain, j’en viens à penser que les investissements dans les titres obligataires ne constituent peut-être pas un mauvais choix à l’aube de 2023.

2022 a été une année difficile pour les obligations. Alors que le monde dans lequel nous évoluons demeure très incertain, j’en viens à penser que les investissements dans les titres obligataires ne constituent peut-être pas un mauvais choix à l’aube de 2023.

Nous savons tous que nous nous trouvons dans une situation unique en son genre. L’année dernière n’était en effet que la troisième fois en un siècle où les rendements des obligations et des actions étaient négatifs. L’examen des deux fois précédentes, soit en 1969 et en 1931, permet d’identifier un détail essentiel: la décennie qui avait suivi avait alors donné lieu à d’importants défis en matière de croissance. Dans les années 1930, nous avons eu la Grande Dépression, tandis que dans les années 1970, la stagflation s’était imposée.

Il n’est nullement question de sous-estimer le fait que nous nous trouvons dans une position difficile et que nous y sommes déjà depuis un certain temps. Dans ce sombre tableau, une bonne nouvelle vient toutefois apporter quelque lueur: à chaque fois qu’un risque de récession ou de ralentissement de la croissance se profile, je ne suis pas trop mécontent de détenir des obligations.

La seule grande question demeurant en suspens pour l’année à venir me semble être celle de l’inflation et de la vitesse à laquelle elle baissera. L’histoire peut ici nous permettre de tirer certains enseignements. L’examen des tendances de l’inflation depuis les années 1970 permet ainsi de constater qu’il est facile de revenir à 3 %, c’est-à-dire à un niveau d’inflation acceptable, à partir d’un taux de 4 %. Dans le même temps, cependant, l’histoire montre également qu’il est de plus en plus difficile de revenir en arrière lorsque l’inflation dépasse la marque des 6 %. Une fois que ce taux dépasse les 8 %, il peut falloir jusqu’à 20 ans pour revenir à 3 %.

Après l’âge d’or de l’inflation faible et des taux d’intérêt quasi nuls dont nous avons bénéficié au cours des deux dernières décennies, il va donc peut-être falloir nous préparer à parcourir un long chemin cahoteux. Maintenant que nous avons tiré tous les enseignements que peut nous donner l’histoire, que nous réserve l’avenir?

Comment fixer le cap des rendements futurs des obligations sur des marchés volatils?

Pour fixer le cap à suivre en matière d’investissements obligataires au cours de l’année à venir, le recours à l’analogie du cockpit d’un avion me semble tout indiqué. Lorsque l’on veut savoir où l’on va, il est tout d’abord utile de savoir d’où l’on vient.

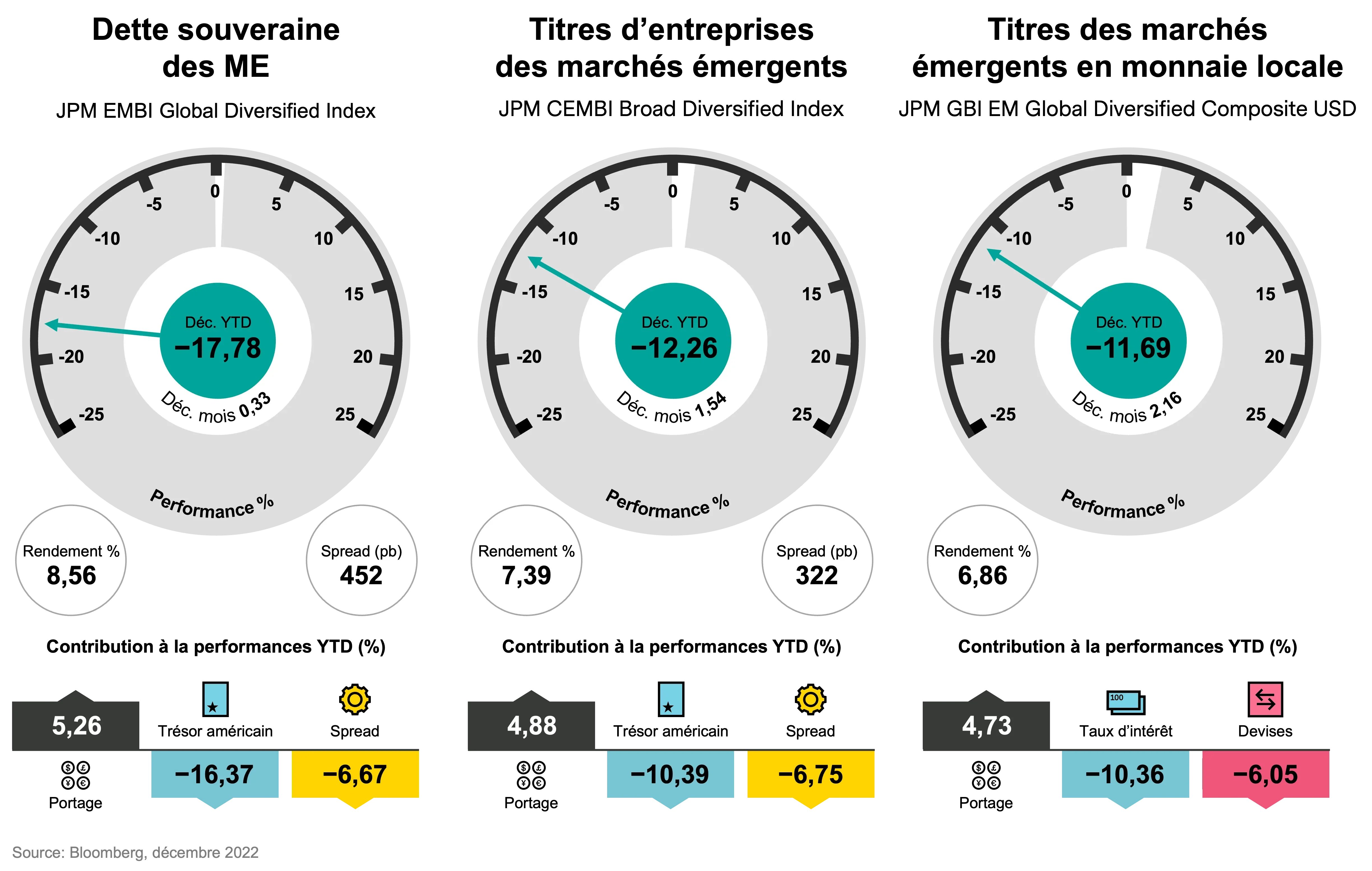

Nous avons, dans l’illustration ci-dessous, décomposé les rendements de trois classes d’actifs des marchés émergents: dette souveraine, entreprise et monnaie locale.

Analysons d’une manière générale comment nous en sommes arrivés là. La performance est le produit des trois moteurs du rendement obligataire. Le portage est votre protection. Il n’y en avait pas assez en 2022, mais cet état de fait est en cours de rééquilibrage. Les rendements de cette année sont plus élevés, de sorte que la protection le sera aussi en 2023.

En 2022, le moteur que constitue le Trésor américain a fléchi et nui aux rendements, car les banques centrales ont relevé les taux en vue de lutter contre l’inflation. Enfin, les spreads reflètent quant à eux la prime de risque et ils se sont élargis en 2022, de sorte que ce moteur a, lui aussi, nui aux rendements.

Prenons, à titre d’exemple, la dette souveraine des marchés émergents telle qu’elle est représentée à gauche. En décembre 2022, elle affichait une baisse de près de 18 % pour l’ensemble de l’année qui s’achevait. À quelles raisons cette performance tient-elle? L’examen des trois moteurs du rendement obligataire montre que le portage est ressorti à 5,26 % et que les bons du Trésor américain ont subi une baisse de 16,37 %. Ensuite, les spreads se sont élargis de −6,67 % et ont nui aux rendements.

Maintenant que nous savons d’où nous venons, il est désormais temps de nous demander vers quoi nous nous dirigeons cette année. La bonne nouvelle se trouve sous le cadran, à gauche: nous avons actuellement un rendement de 8,56 %. Et l’histoire nous enseigne que le rendement initial constitue un excellent indicateur de solides rendements.

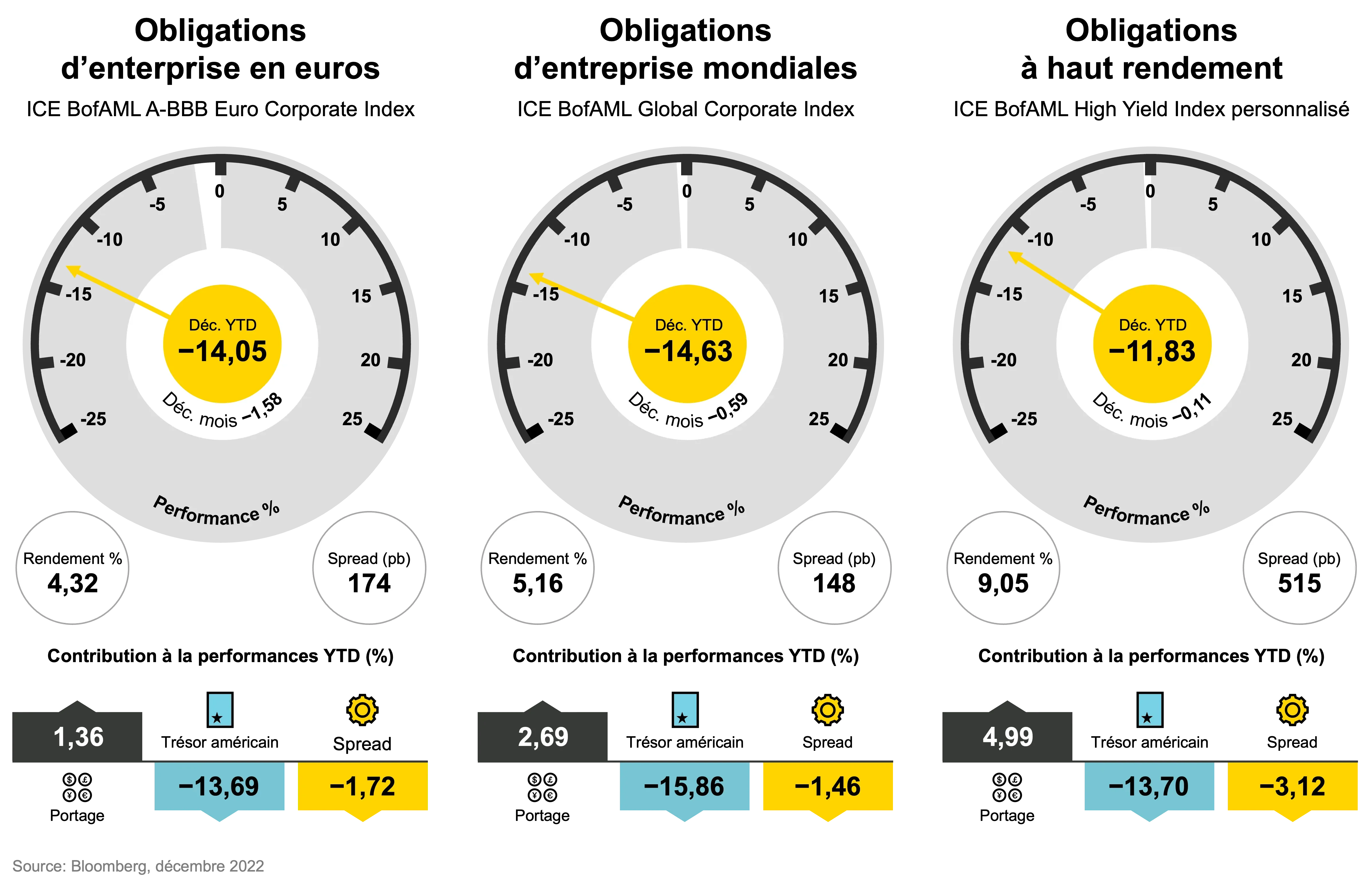

Intéressons-nous maintenant aux bons du Trésor américain, qui ont également fléchi en 2022 et ont donc nui aux rendements lorsque les taux ont augmenté en vue de contrecarrer l’inflation. Les banques centrales du monde entier se trouvent dans une situation difficile, un peu comme si elles tentaient de trouver la bonne température de l’eau sous une douche: en en faisant trop peu, elles courent le risque que cela ne suffise pas et de prendre une douche froide; en relevant trop les taux, elles courent, en revanche, le risque de s’ébouillanter.

Il me semble que la volatilité des bons du Trésor à 10 ans sera très élevée, car l’inflation devrait constituer l’un des facteurs clés de l’année 2023. Nous savons que si l’inflation décroît, les rendements deviennent plus conséquents, mais que si elle augmente, ils se contractent. Compte tenu du caractère incertain et ambigu que revêt l’environnement actuel, et même si d’importants mouvements de hausse et de baisse sont susceptibles de faire évoluer les rendements, je maintiens ma prévision selon laquelle les bons du Trésor à 10 ans termineront l’année au niveau où ils l’ont commencée.

Pour ce qui concerne le dernier moteur, c’est-à-dire celui des spreads, un certain nombre d’éléments ont d’ores et déjà été intégrés par les marchés, car nous sommes tous bien conscients des incertitudes que nous réservent les périodes à venir. Il me semble probable que les spreads pourraient enregistrer une hausse d’environ 50 points de base pour le simple fait que nous sommes confrontés à un niveau d’incertitude désormais moindre. La situation se présente donc comme suit: 8,56 % de portage, des rendements stables pour les bons du Trésor, puis 50 points de base. Cela signifie, à mon sens, que les investisseurs pourraient potentiellement bénéficier d’un taux de 12 %.

Nul n’est bien sûr obligé d’être d’accord avec mes chiffres; ce qui importe ici tient au fait qu’en ayant désormais bien saisi d’où l’on venait, il est possible d’appliquer le même raisonnement aux obligations d’entreprise des marchés développés, ce qu’illustre d’ailleurs le cockpit ci-dessous.

Quelle voie s’ouvre pour les obligations en 2023?

Un regard porté sur les cycles précédents, montre qu’il est rare de voir les obligations offrir des rendements négatifs sur deux années consécutives. Nous connaissons les incertitudes qui pèsent sur le monde. Il semble acquis que l’inflation continuera de faire les gros titres en 2023. La bonne nouvelle est que des ajustements ont eu lieu sur le marché et que les rendements sont plus élevés, de sorte que l’histoire nous conforte dans l’idée que nous commençons la nouvelle année dans une meilleure position qu’en 2022.

Dans les présentes Perspectives 2023 de la Fixed Income Boutique, les responsables de l’équipe révèlent la manière dont ils entendent trouver des opportunités au cours de la difficile période qui se profile. Un revirement s’opère pour les titres obligataires des marchés émergents, indique Luc D’hooge, Head of Emerging Markets Fixed Income, qui a repéré de multiples signes de reprise suggérant que cette année pourrait être plus positive pour cette classe d’actifs. Après une année difficile marquée par une forte volatilité, les valorisations ne sont désormais plus en phase avec les fondamentaux, ce qui a pour effet d’offrir un certain nombre d’opportunités aux gestionnaires actifs.

Mondher Bettaieb-Loriot, Head of Corporate Credit, estime ainsi que les banques centrales devraient faire preuve d’une agressivité moindre cette année, ce qui est de bon augure pour faire main basse sur les coupons intéressants aujourd’hui disponibles et assurer les revenus d’investissement pour les années à venir.

Je suis sûr que vous trouverez nos conclusions utiles lorsque vous positionnerez vos portefeuilles pour la nouvelle année. Permettez-moi, au nom de toute la Fixed Income Boutique, de vous souhaiter une année 2023 prospère.

Pour en savoir plus, cliquez ICI.

Pour accéder au site, cliquez ICI.