La faillite et le vacillement de quelques banques régionales US ces derniers mois sont le résultat involontaire de l’un des cycles de resserrement monétaire les plus agressifs de l’histoire récente. Cela se traduira notamment par un nouveau durcissement des conditions financières et un risque accru d’atterrissage brutal. Avec les difficultés à venir, les entreprises de qualité, dont la rentabilité dépend moins de facteurs macroéconomiques, pourront offrir une certaine résilience aux investisseurs.

Grant Bughman, Client Portfolio Manager

Grant Bughman, Client Portfolio Manager

Les problèmes croisés auxquels les banques font face aujourd’hui découlent de la forte hausse des taux d’intérêt cette année, alors que la Fed continuait de lutter contre une inflation toujours élevée. Problème de confiance, dû à l’asymétrie de duration entre les actifs et les passifs des banques, qui a causé des ruées sur les prêteurs les plus exposés. Dans un monde où l’on peut transférer ses dépôts d’un clic sur l’écran, la confiance qui repose sur le système bancaire à réserves fractionnaires peut se briser plus vite que par le passé. Cette confiance, bien que non totalement rétablie, a été restaurée grâce aux mesures des régulateurs qui assurent les dépôts supérieurs au plafond FDIC de 250 000 USD et fournissent des liquidités aux banques confrontées à des retraits de dépôts. Si la confiance reste vacillante, le gouvernement pourrait adopter une politique plus agressive, p. ex. en garantissant tous les dépôts du système bancaire. Cela permettrait de contrôler efficacement toute panique, même s’il s’agit d’un dernier recours non dénué d’aléas moraux.

Les données hebdomadaires sur les dépôts n’ont pas permis de dégager un schéma clair de flux depuis le pic de la crise en mars. Lors de la faillite de la Silicon Valley Bank, il y a eu un déplacement des dépôts des petites banques vers les grandes. Cela s’est un peu calmé et les flux ont été irréguliers depuis cette période, ce qui pourrait indiquer un retour vers une accalmie.

L’asymétrie de la duration entre les actifs et les passifs des institutions est au cœur de la dernière crise bancaire aux USA. Les actifs des banques en faillite étaient surtout des obligations et des prêts à taux fixe, dont la valeur baissait quand les taux augmentaient. Du point de vue comptable, la reconnaissance de ces pertes varie selon la catégorie dans laquelle elles sont placées. Outre la reconnaissance comptable, l’impact de la valeur de marché sur la valeur des actifs à taux fixe a été significatif, annihilant de fait les fonds propres de nombreuses institutions financières. Mais tant que les banques ne sont pas obligées de vendre, les pertes non réalisées dues à la hausse des taux pourraient s’inverser. Tant que les banques peuvent conserver leurs dépôts, les pertes sur les actifs ne seront pas réalisées. De plus, la valeur des dépôts des banques s’est accrue au fur et à mesure que les taux augmentaient. Tous les dépôts n’étant pas placés sur des comptes à rendement élevé (de nombreux soldes sont transactionnels, p. ex les comptes chèques pour la trésorerie des entreprises), les banques pourraient dégager un spread suffisant pour compenser les pertes sur papier.

Conditions de prêt plus strictes

Outre le problème de confiance, il y a aussi les problèmes du crédit. Les défauts de paiement potentiels ou les dévaluations des prêts à l’immobilier commercial ne se résorbent pas avec le temps. Au contraire, les bénéfices des banques seraient affectés par ces pertes sur des trimestres ce qui aggraverait le durcissement des conditions financières dû à leur réticence à prendre des risques. Si elles ont un impact sur les bénéfices des banques, il est peu probable que les pertes soient importantes au point de constituer un problème systémique, mais impossible d’en être tout à fait certain. Les conséquences économiques importent aussi, avec une hausse du risque de récession dû au durcissement des conditions de prêts.

La croissance du crédit privé ces dix dernières années a notamment privé le système bancaire de la plupart des activités de prêt à risque au profit d’investisseurs de ces stratégies, tels que les régimes de retraite, qui ont augmenté leur exposition à ces actifs alternatifs. La plupart des prêts émis ces dernières années étaient assortis de taux variables, qui commencent maintenant à être revus à la hausse. Les entreprises endettées sont en général de moindre qualité, ce qui remet en question leur capacité à rembourser dans un contexte de taux plus élevés avec une économie qui se contracte. Les pertes potentielles ne pèseraient pas sur les banques puisque les pools d’actifs sont détenus hors du système bancaire traditionnel. Mais les banques prêtent souvent aux petites entreprises à des taux variables et des taux plus élevés exerceraient donc une pression plus forte sur ces entreprises. Enfin, le spread que les prêteurs exigent pour les dettes très risquées pourrait aussi s’élargir, exacerbant le resserrement du crédit.

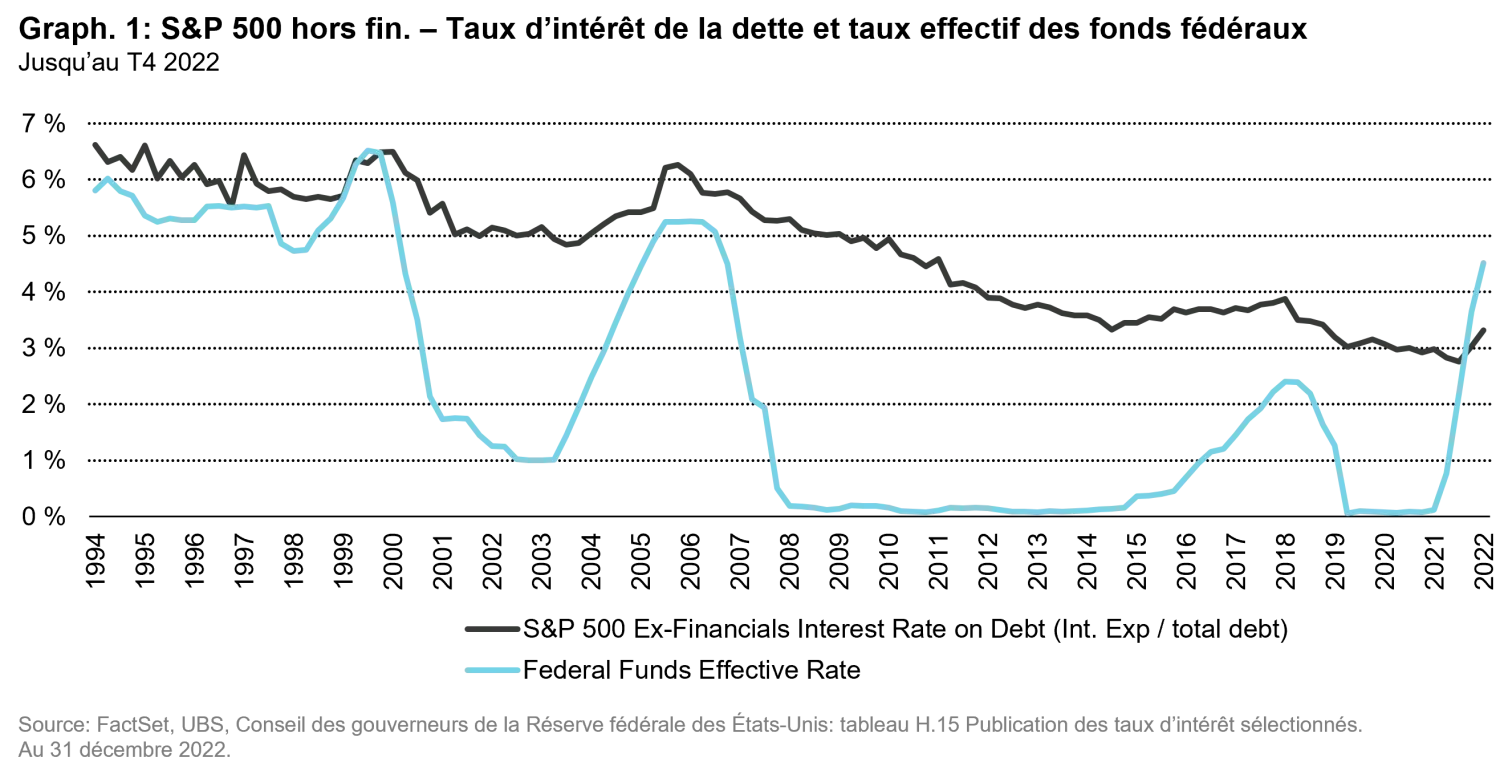

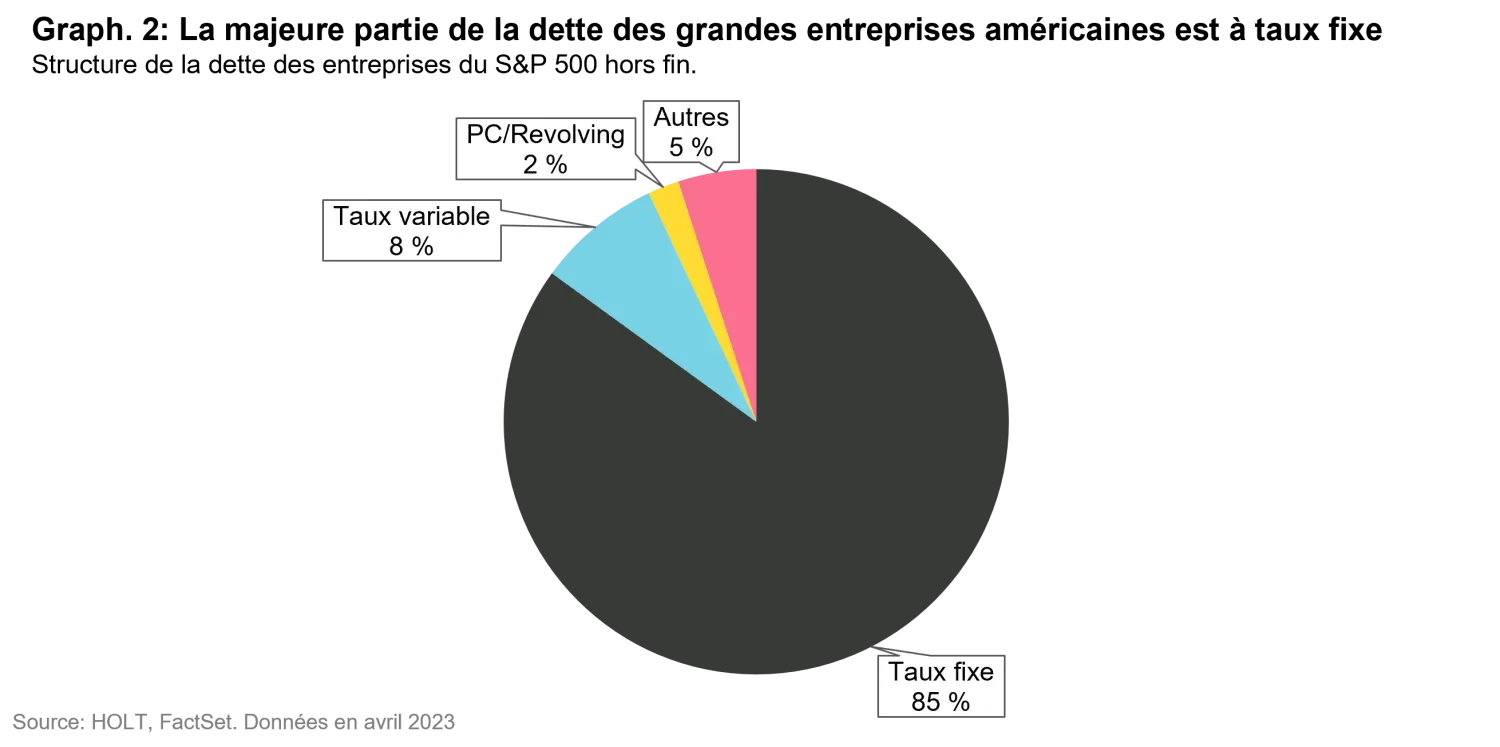

Les hausses de taux n’ont pas le même effet sur les sociétés cotées en bourse à grande capitalisation de l’indice S&P 500 que sur les emprunteurs plus petits ou de moindre qualité. En effet, beaucoup de prêts sont accordés sur le marché obligataire où les rendements sont en général fixés au moment de l’émission. Pour les entreprises s’étant endettées pour racheter des actions ou financer des acquisitions, le coût de la dette n’augmente pas de façon spectaculaire sur un an, en raison de l’échéance plus longue et des taux d’intérêt fixes. Mais les entreprises qui ont trop compté sur les taux bas de ces dix dernières années pour financer leur croissance se trouveront dans une situation plus délicate, le coût du capital étant nettement plus élevé que ce à quoi elles étaient habituées.

Dans cet article, nous montrons pourquoi c’est le bon moment pour investir dans des entreprises de qualité non soumises aux effets de levier, ayant des bénéfices plus résilients en temps d’économie faible. Les portefeuilles Vontobel US et Global Equity ne sont pas exposés aux banques. Notre philosophie et notre processus d’investissement nous amènent à éviter le secteur bancaire depuis un certain temps, car la croissance des bénéfices y est souvent inférieure à ce que l’on peut trouver ailleurs, sans compter les risques évidents du secteur. Concentrés avant tout sur le bottom-up, notre style d’investissement est adapté au contexte macro actuel et nous restons sur notre objectif de surperformer sur un cycle de marché complet avec moins de risques pour nos clients.

Par Grant Bughman, Client Portfolio Manager

Pour accéder au site, cliquez ICI.