En bref

-

Les obligations en monnaie locale ont été les plus performantes des titres obligataires cette année, avec un rendement total de 7,8 %.

-

Nous sommes toujours plus confiants sur le fait que la décennie de sous-performance des monnaies locales des marchés émergents est terminée.

-

À mesure que les étoiles s’alignent pour les obligations des marchés émergents en monnaie locale, rester sur la touche n’est peut-être plus judicieux.

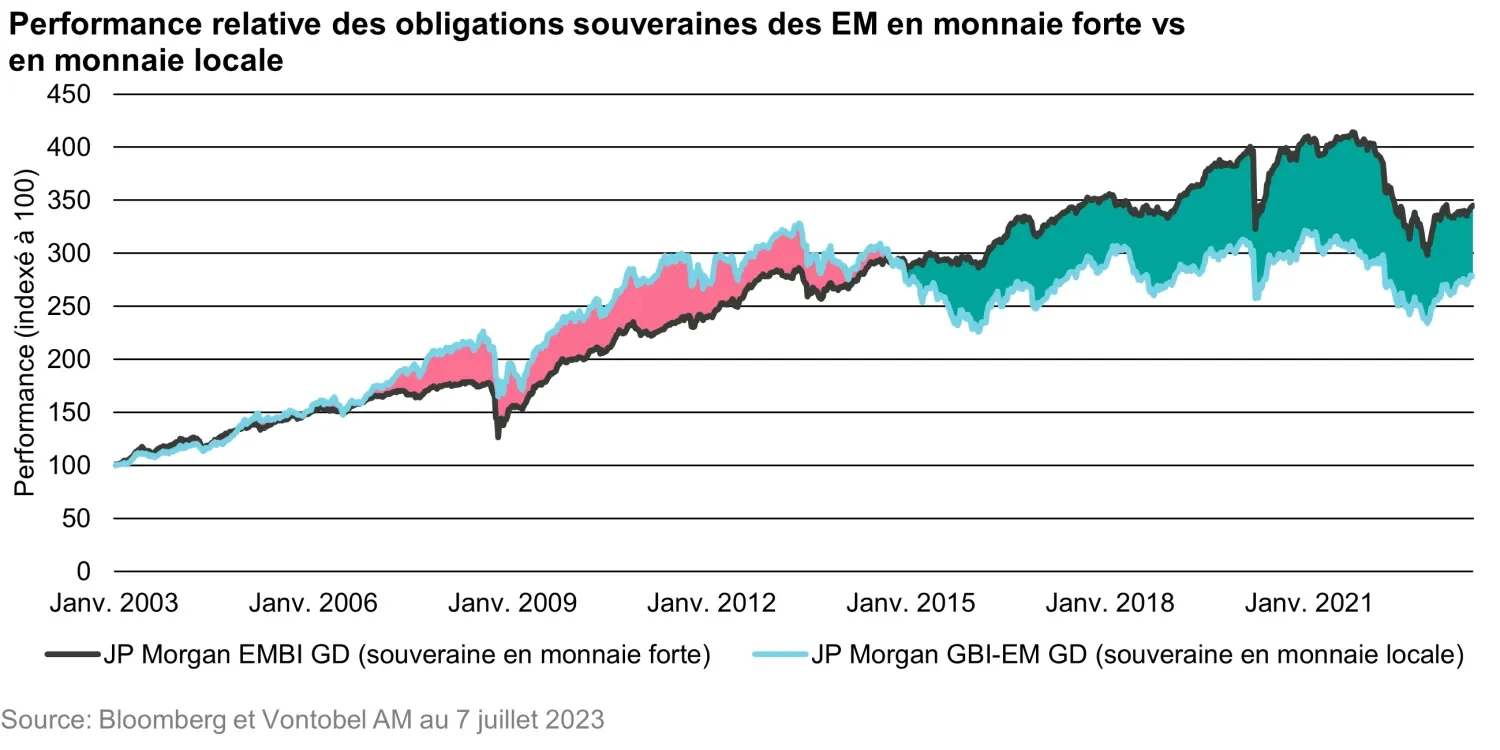

Après une décennie tumultueuse, les planètes semblent à nouveau s’aligner pour les obligations des marchés émergents en monnaie locale. Le rendement total de 7,8 % de l’indice JP Morgan Government Bond Index-Emerging Markets Broad Diversified au premier semestre 2023 en fait le plus performant des titres obligataires depuis le début d’année et de bonnes raisons font penser que ce n’est pas que de la chance.

L’indice n’a pas été au centre de l’attention depuis longtemps, ce qui explique que de nombreux investisseurs ne l’aient pas remarqué. Mais on ne peut pas dire que cela soit venu de nulle part. Il y a un an, nous publions raisons pour lesquelles la dette en monnaie locale des marchés émergents pourrait être le phénix des titres obligataires, et c’est toujours d’actualité.

Vu les valorisations attrayantes, les changes intéressants et la baisse de l’inflation, la classe d’actifs a surmonté ses difficultés de 2022, année de l’effondrement le plus important de ces deux dernières décennies. En outre, nous estimons être désormais à la fin de vents contraires importants et de long terme qui ont freiné les obligations des marchés émergents en monnaie locale pendant près d’une décennie.

Pourquoi les obligations en monnaie locale retrouvent-elles le sourire?

L’inflation des marchés développés a atteint l’an passé des sommets inégalés depuis quarante ans, sous l’effet de plusieurs facteurs, dont la guerre en Ukraine, les perturbations de la chaîne d’approvisionnement liées à la pandémie, les frictions géopolitiques et une consommation forte dans un marché du travail dynamique.

Les relèvements opérés par les banques centrales ont causé un resserrement des conditions financières dans les pays développés et en développement. Les pays émergents ont connu une situation identique et, étant plus sensibles à la volatilité des prix des denrées alimentaires et de l’énergie, ils ont rehaussé leurs prix plus tôt et, souvent, plus rapidement.

Cependant, l’impact négatif de certains des chocs d’approvisionnement en 2022 s’est estompé depuis un certain temps. La plupart des pays ont dépassé le pic d’inflation et les banques centrales se préparent à assouplir leurs politiques monétaires ou ont déjà commencé à le faire.

Ce revirement positif, associé à une émission d’obligations plutôt faible, devrait tirer les rendements des marchés émergents vers le bas. Les banques centrales des marchés émergents disposent d’une plus grande marge de manœuvre à la baisse, étant donné que leurs actions sont devenues plus agressives plus tôt.

Et si ni la Fed ni la Banque centrale européenne n’ont encore mis fin à leurs hausses, des mesures agressives inattendues sont bien moins probables à l’avenir, au vu des signes de désinflation, du ralentissement de la croissance économique et du resserrement des conditions financières non dû à la politique monétaire. De ce fait, la probabilité des situations de risk-off, telles que celles observées ces derniers mois, est aujourd’hui nettement plus faible.

Aussi dans l’idée d’un alignement planétaire favorable, le fait que les principales économies émergentes ont réduit leurs vulnérabilités ces dernières années, avec des comptes courants bien plus sains, de meilleures conditions commerciales et une dépendance moindre au financement extérieur, comparé à la décennie précédente.

Enfin, les anticipations indiquent quasi unanimement que le différentiel de croissance entre les pays émergents et les pays développés se creusera dans les années à venir. Le parallèle entre le ralentissement des économies US et UE et l’accélération des économies émergentes devrait se traduire par une hausse du différentiel de croissance pour un plus grand nombre de marchés émergents.

La diminution partielle des risques par la Chine en faveur d’autres économies émergentes entraîne une plus grande dispersion que par le passé de la croissance des marchés émergents, essentiellement tirée par la Chine. Les taux de change généraux des marchés émergents ne peuvent qu’en profiter.

Quiconque fut actif sur les marchés ces dix dernières années reconnaîtra que la «croissance différentielle accrue» a depuis toujours justifié l’investissement dans les actifs émergents en monnaie locale, avant d’être déçu par les rendements par la suite. Pourquoi tant de temps sans résultat?

Alignement des planètes après dix ans de sous-performance

L’examen attentif du positionnement actuel des portefeuilles institutionnels montre que les montants investis dans les actifs des marchés émergents en monnaie locale ont diminué de façon drastique. Les investisseurs cross-over sont quasi absents, et les investisseurs spécialisés n’ont qu’une fraction de ce qu’ils détenaient en 2013.

À l’origine de la baisse persistante des actifs sous gestion dans cette classe d’actifs: la performance absolue décevante des obligations en monnaie locale ces deux dernières années et, probablement, la sous-performance relative par rapport aux monnaies fortes des marchés émergents. Nous sortons de près d’une décennie de sous-performance, ce qui soulève la question suivante: «Cela va-t-il continuer?».

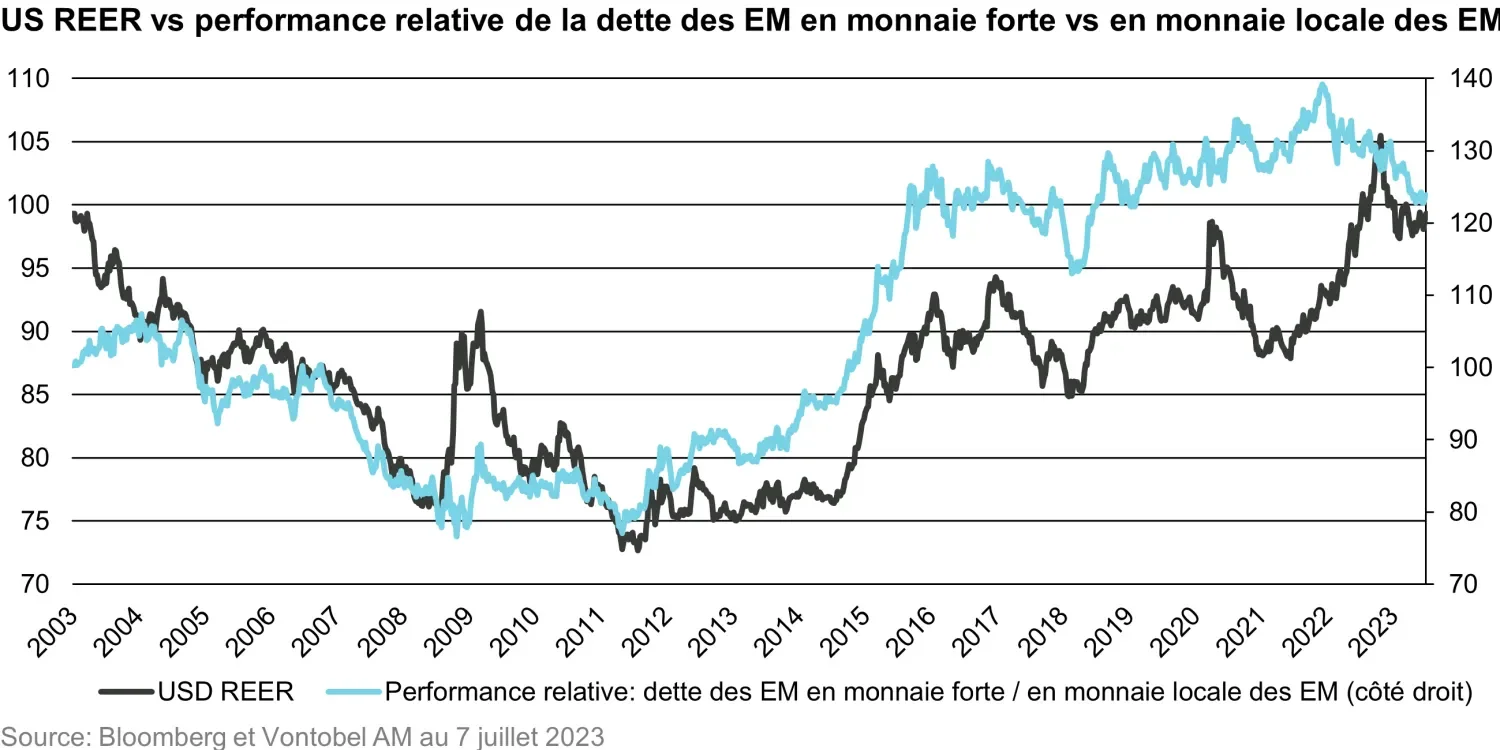

Pour y répondre, nous devons examiner les principaux facteurs à l’origine de la surperformance de la dette en monnaie forte des marchés émergents, qui s’aligne parfaitement sur les fluctuations du taux de change effectif réel (REER) du dollar US. Pourquoi regarder le REER? Parce qu’il donne une idée plus précise de la force globale d’une monnaie que les taux de change bilatéraux, comme celui entre l’euro et le dollar US.

Les performances historiques du REER en dollars US sur 20 ans révèlent deux voire trois régimes: une faiblesse générale de 2003 à 2011, une période favorable de la mi-2011 à octobre 2022, et la probabilité croissante que l’année dernière soit considérée comme un tournant majeur qui déclencherait le troisième régime.

Un schéma très similaire peut être observé dans la performance relative de la monnaie forte et de la monnaie locale: la surperformance relative des locales a atteint son pic en 2011, puis ce fut le cas des fortes, et à nouveau des locales à la fin 2021, juste avant que le REER du dollar US n’atteigne son point culminant.

L’assouplissement quantitatif (AQ) des économies développées durant les années 2010 est un second facteur de long terme expliquant la sous-performance des obligations des marchés émergents en monnaie locale. L’AQ est comme un soleil brillant qui réchauffe toutes les classes d’actifs: plus vous êtes proche du soleil, plus vous sentez sa chaleur. Ainsi, si la plus forte chaleur plus est pour les actifs des marchés développés achetés par les banques centrales, les monnaies fortes des marchés émergents – intrinsèquement une classe d’actifs en dollars US – seraient plus proches du soleil que les monnaies locales des marchés émergents.

Ces deux grands vents contraires ne devraient pas persister.

L’assouplissement quantitatif des marchés développés semble exclu dans un avenir prévisible. Même la Banque du Japon, qui a dû faire face à une inflation cumulée quasi nulle sur les deux décennies jusqu’en 2017, devrait mettre fin à l’assouplissement quantitatif dans les 12 prochains mois. Un contexte d’inflation différent et les répercussions politiques de l’augmentation des inégalités ont pesé sur les avantages parfois discutables de l’expansion des bilans.

Si le AQ fera toujours partie de la panoplie des banques centrales, l’expansion généralisée des liquidités semble appartenir au passé. Quant au dollar, comme toujours, il est difficile d’être aussi catégorique, mais la probabilité que la tendance haussière se prolonge au-delà du pic d’octobre 2022 semble assez faible.

Avec ces deux facteurs principaux clairement en retrait, nous sommes toujours plus confiants sur le fait que la décennie de sous-performance des monnaies locales des marchés émergents est terminée.

Des prévisions pour les obligations en monnaie locale en 2023?

Impossible de prédire le moment exact où les banques centrales des marchés émergents réagiront à une inflation plus modérée, où la Fed cessera ses hausses de taux et où le sentiment deviendra plus positif à l’égard des actifs à risque.

Mais, on peut s’attendre à ce que cela se produise à un moment ou à un autre en 2023, et ce dans un contexte où les vents contraires à long terme s’estompent et de faible positionnement de cette classe d’actifs.

Rester sur la touche était peut-être la bonne stratégie en 2022, mais s’est avérée être une moins bonne décision depuis le début d’année. Et à mesure que les planètes s’alignent pour les obligations des marchés émergents en monnaie locale, ce n’est peut-être plus judicieux.

Investir dans les obligations en monnaie locale avec Vontobel

L’offre de Vontobel en monnaie locale des marchés émergents est une approche unique qui allie durabilité et mesures de performance à long terme. Ceci correspond à notre opinion établie selon laquelle le choix de la durabilité, dans un cadre environnemental, social et de gouvernance bien gérée, ne doit pas se faire au détriment de la performance. Notre stratégie, plus largement diversifiée que l’indice de référence et que nos pairs, améliore notre proposition globale de valeur.

Important : les déclarations prospectives sur les événements futurs ou des performances financières à venir de pays, marchés et/ou investissements, sont toutes basées sur une variété d’estimations et d’hypothèses et ne sont pas garanties. Les résultats réels peuvent différer de manière significative. Ni l’allocation d’actifs ni la diversification ne garantissent un profit ou ne protègent contre des pertes sur des marchés en déclin. Les indices ne sont pas gérés. Aucuns frais ni aucune dépense ne sont pris en compte et il n’est pas possible d’investir directement dans un indice.

L’investissement environnemental, social et de gouvernance («ESG») et les critères utilisés peuvent être subjectifs par nature. Les considérations évaluées dans le cadre des processus ESG peuvent varier en fonction des différents types d’investissements et d’émetteurs, et les facteurs ne sont pas forcément tous identifiés ou pris en compte pour tous les investissements. Les informations utilisées pour évaluer les composantes ESG peuvent varier selon les fournisseurs et les émetteurs, car les critères ESG ne constituent pas une caractéristique uniformément définie. L’investissement ESG peut conduire à renoncer à saisir des opportunités de marché que d’autres stratégies ne reposant pas sur de tels critères pourraient permettre d’identifier.

Par Carl Vermassen, Portfolio Manager

Pour retrouver la deuxième édition de l'enquête sur les investisseurs mondiaux, menée auprès de plus de 200 décideurs en matière d’investissement en Europe, en Amérique et en Asie-Pacifique,

cliquez ICI : Are EM bonds about to shine ? And are investors ready ?

Pour accéder au site, cliquez ICI.