L’économie des États-Unis, tirée par la résilience de la consommation, a été le principal moteur de croissance de l’économie mondiale au lendemain de la pandémie, et tout porte à croire que cette tendance se poursuivra tout au long de 2024, affirme l’investisseur multi-actifs Colin Graham.

-

La croissance des salaires réels a soutenu une consommation dynamique

-

Seule une minorité de consommateurs ressent les effets de la hausse des taux d’intérêt

-

Les largesses budgétaires ont de bonnes chances d’être maintenues tout au long du cycle électoral

La période post-Covid est caractérisée par une divergence entre l’économie américaine et celle du reste du monde, l’Europe ayant échappé de peu à la récession et la Chine ayant été aux prises avec l’éclatement d’une bulle immobilière, alors que les États-Unis ont enregistré une croissance du PIB supérieure au taux tendanciel.

« Le moteur de cette croissance a été la résilience de la consommation aux États-Unis, portée par des dépenses prodigues de la part du gouvernement et un manque de sensibilité à la hausse des taux d’intérêt », explique Colin Graham, responsable des Stratégies multi-actifs chez Robeco.

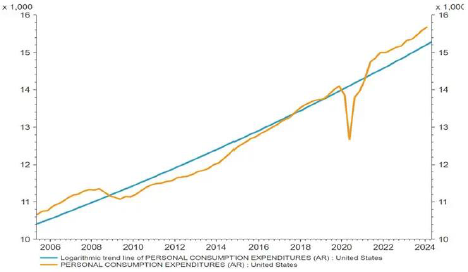

Graphique 1 : Les dépenses réelles des consommateurs sont restées supérieures à la tendance pré-Covid

Source : LSEG Datastream, Robeco

Source : LSEG Datastream, Robeco

« À première vue, cette situation s’explique en partie par les politiques de confinement, les États-Unis ayant mis de l’argent dans la poche des consommateurs alors que ceux des autres pays ont aidé financièrement les entreprises ou n’ont pas donné d’argent du tout. »

Les taux d’intérêt ne font ni chaud ni froid à de nombreux consommateurs

La deuxième raison qui explique la résilience de la consommation tient au fait que le marché hypothécaire aux États-Unis pratique essentiellement des taux fixes pour les ménages. Les taux ultra-bas ont ainsi permis aux consommateurs américains de « fixer un horizon de remboursement » de leur dette, en verrouillant des taux de 3 % sur 30 ans il y a encore trois ans. Le taux hypothécaire à 30 ans, qui s’est récemment établi à 7,55 %1, n’a donc aucune incidence sur les consommateurs, sauf s’ils sont des primo-accédants ou s’ils doivent déménager.

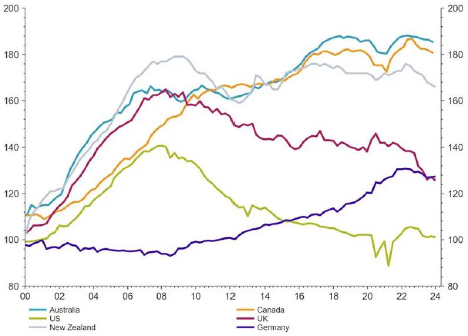

« En conséquence, les consommateurs américains continuent de tirer profit du désendettement qui a suivi la crise financière mondiale (Graphique 2) tout en assurant facilement leur service de la dette », explique Colin Graham.

Graphique 2 : Dette des ménages en % du revenu disponible

Source : LSEG Datastream, Robeco

Source : LSEG Datastream, Robeco

Le revenu réel est en croissance

Les données sous-jacentes indiquent que la consommation bénéficie d’un soutien solide. Tout d’abord, grâce à la forte croissance du revenu disponible, qui est supérieure à l’inflation, le consommateur américain médian connaît toujours une croissance de son salaire réel. Son pouvoir d’achat augmente, ce qui lui permet de maintenir son niveau de consommation malgré la hausse des prix.

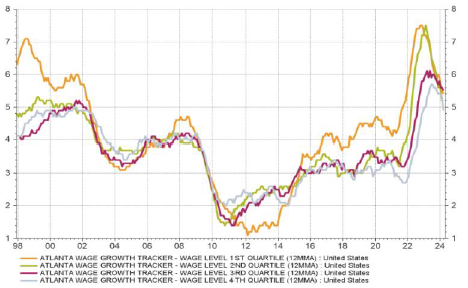

Graphique 3 : La croissance des salaires reste élevée

Source : LSEG Datastream, Robeco

Source : LSEG Datastream, Robeco

Deuxièmement, la confiance des consommateurs aux États-Unis reste relativement élevée et généralisée, ce qui encourage les dépenses. « Dans un environnement inflationniste, il est judicieux de dépenser aujourd’hui car demain, les biens et les services seront plus chers. »

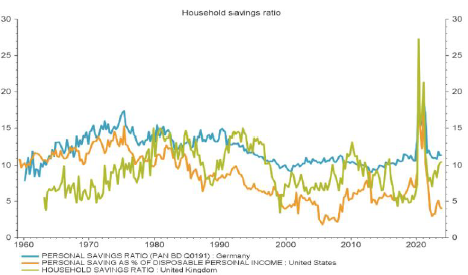

Graphique 4 : Le taux d’épargne aux États-Unis frôle de nouveau ses plus bas niveaux

Troisièmement, les confinements et les restrictions imposés par la pandémie de Covid-19 ont eu pour corollaire de favoriser la consommation de biens au détriment de celle des services. Les consommateurs ont été contraints de se tourner vers Internet pour faire leurs achats visant à améliorer leur « vie à la maison », et cette tendance ne s’est pas inversée. En effet, le taux de pénétration du commerce en ligne reste supérieur d’environ 30 % aux niveaux pré-Covid, même si certains fabricants d’équipements de sport ne sont pas de cet avis. Cette dynamique a eu pour effet durable d’accroître la fidélité des consommateurs aux marques ultra-luxueuses et à réduire leur fidélité aux marques en général, ainsi qu’à rendre ceux-ci plus enclins à faire leurs achats parmi un éventail plus large de magasins de détail et à s’intéresser à des produits affichant des fourchettes de prix et de qualité plus larges.

« De plus, une fois les confinements levés, les États-Unis ont connu une explosion des dépenses de rattrapage dans les domaines des voyages et des services, qui s’est poursuivie grâce à la hausse des salaires et à la moindre propension des consommateurs américains à mettre de côté les aides financières et les salaires comparé à leurs homologues européens ou chinois. »

Les services sont la principale composante du PIB des États-Unis, d’où leur importance pour l’économie dans son ensemble et leur contribution à l’exceptionnalisme économique du pays.

Enfin, les différentes mesures de soutien du gouvernement, telles que les chèques de relance et les allocations de chômage, ont rempli une fonction d’amortisseur pour les consommateurs américains, leur permettant de maintenir leur niveau de dépenses même pendant les périodes d’incertitude économique. Comme nous l’avons mentionné plus haut, ces mesures n’ont pas été déployées ailleurs dans le monde.

À quels niveaux les dépenses de consommation pourraient-elles montrer des signes de faiblesse ?

Il serait malvenu de ne pas mentionner les endroits où les dépenses de consommation pourraient prendre du plomb dans l’aile. Tout d’abord, les dépenses publiques pourraient diminuer, bien que cela soit peu probable étant donné que Joe Biden cherche à amadouer les électeurs pour qu’ils votent en sa faveur lors de l’élection présidentielle de novembre. Deuxièmement, l’impact des décalages longs et variables au niveau des politiques monétaires commencent à se faire sentir et à alourdir la charge du service de la dette d’un plus grand nombre de consommateurs, ce qui entame leur revenu disponible.

Qui plus est, le service de la dette publique par le département du Trésor américain entrave l’expansion fiscale (principal point d’appui des dépenses de consommation), c’est pourquoi le refinancement dans un contexte de politique de la Fed caractérisée par des taux plus élevés pendant plus longtemps reste un sujet de préoccupation pour tous.

Enfin, d’aucuns craignent, entre autres, un fléchissement des indicateurs du marché du travail

« La récente baisse des taux de démission donne à penser que la prime salariale découlant du changement d’employeur a été réduite ou supprimée, ce qui signifie que la sécurité de l’emploi actuel est un facteur de plus en plus important aux yeux des ménages américains », explique Colin Graham.

L’investisseur s’attend également à un éventuel « déstockage » de la main-d’œuvre après la situation de rétention post-Covid, car les petites et moyennes entreprises réévaluent leurs coûts et licencient des travailleurs. Une telle tendance aura pour effet d’inverser la vapeur de l’exceptionnalisme de la consommation américaine, car la croissance des salaires ralentirait plus rapidement si le taux de chômage américain passait au-dessus de la barre des 5 %.

« Globalement, les dépenses de consommation aux États-Unis semblent bénéficier d’un soutien solide en 2024 et avant l’élection présidentielle, ce qui explique la réticence actuelle de la Fed à donner du mou à sa politique monétaire. »

Par Colin Graham Head of Multi-Asset Strategies

Note de bas de page

1. Tiré de bankrate.com, 30 avril 2024

Pour accéder au site, cliquez ICI.

À propos de Robeco

Robeco est un spécialiste international de la gestion d'actifs. L'entreprise fondée en 1929 est basée à Rotterdam, aux Pays-Bas, et compte 16 bureaux dans le monde entier. Leader mondial de l'investissement durable depuis 1995, son intégration de recherches durables, fondamentales et quantitatives lui permet d'offrir aux investisseurs institutionnels et privés une vaste gamme de stratégies d'investissement actives couvrant un large éventail de classes d'actifs. Au 31 décembre 2022, Robeco avait 171 milliards d’euros d'actifs sous gestion, dont 168 milliards intégrant les critères ESG. Robeco est une filiale d'ORIX Corporation Europe N.V. Pour plus d'informations

Important Information

Robeco Institutional Asset Management B.V. has a license as manager of Undertakings for Collective Investment in Transferable Securities (UCITS) and Alternative Investment Funds (AIFs) (“Fund(s)”) from the Netherlands Authority for the Financial Markets in Amsterdam. This marketing document is intended solely for professional investors, defined as investors qualifying as professional clients, who have requested to be treated as professional clients or are authorized to receive such information under any applicable laws. Robeco Institutional Asset Management B.V. and/or its related, affiliated and subsidiary companies, (“Robeco”), will not be liable for any damages arising out of the use of this document. Users of this information who provide investment services in the European Union have their own responsibility to assess whether they are allowed to receive the information in accordance with MiFID II regulations. To the extent this information qualifies as a reasonable and appropriate minor non-monetary benefit under MiFID II, users that provide investment services in the European Union are responsible for complying with applicable recordkeeping and disclosure requirements. The content of this document is based upon sources of information believed to be reliable and comes without warranties of any kind. Without further explanation this document cannot be considered complete. Any opinions, estimates or forecasts may be changed at any time without prior warning. If in doubt, please seek independent advice. This document is intended to provide the professional investor with general information about Robeco’s specific capabilities but has not been prepared by Robeco as investment research and does not constitute an investment recommendation or advice to buy or sell certain securities or investment products or to adopt any investment strategy or legal, accounting or tax advice. All rights relating to the information in this document are and will remain the property of Robeco. This material may not be copied or shared with the public. No part of this document may be reproduced or published in any form or by any means without Robeco's prior written permission. Investment involves risks. Before investing, please note the initial capital is not guaranteed. Investors should ensure they fully understand the risk associated with any Robeco product or service offered in their country of domicile. Investors should also consider their own investment objective and risk tolerance level. Historical returns are provided for illustrative purposes only. The price of units may go down as well as up and past performance is no guarantee of future results. If the currency in which the past performance is displayed differs from the currency of the country in which you reside, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. The performance data do not take account of the commissions and costs incurred when trading securities in client portfolios or for the issue and redemption of units. Unless otherwise stated, the prices used for the performance figures of the Luxembourg-based Funds are the end-of-month transaction prices net of fees up to 4 August 2010. From 4 August 2010, the transaction prices net of fees will be those of the first business day of the month. Return figures versus the benchmark show the investment management result before management and/or performance fees; the Fund returns are with dividends reinvested and based on net asset values with prices and exchange rates as at the valuation moment of the benchmark. Please refer to the prospectus of the Funds for further details. Performance is quoted net of investment management fees. The ongoing charges mentioned in this document are the ones stated in the Fund's latest annual report at closing date of the last calendar year. This document is not directed to or intended for distribution to or for use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, document, availability or use would be contrary to law or regulation or which would subject any Fund or Robeco Institutional Asset Management B.V. to any registration or licensing requirement within such jurisdiction. Any decision to subscribe for interests in a Fund offered in a particular jurisdiction must be made solely on the basis of information contained in the prospectus, which information may be different from the information contained in this document. Prospective applicants for shares should inform themselves as to legal requirements which may also apply and any applicable exchange control regulations and taxes in the countries of their respective citizenship, residence or domicile. The Fund information, if any, contained in this document is qualified in its entirety by reference to the prospectus, and this document should, at all times, be read in conjunction with the prospectus. Detailed information on the Fund and associated risks is contained in the prospectus. The prospectus and the Key Investor Information Document for the Robeco Funds can all be obtained free of charge from Robeco’s websites.