En bref :

-

Les spreads des marchés émergents (EM) se sont comprimés malgré d’importantes sorties. Nous pensons que le potentiel augmentera avec la reprise des entrées dans la classe d’actifs, ce qui, à notre avis, se produira tôt ou tard.

-

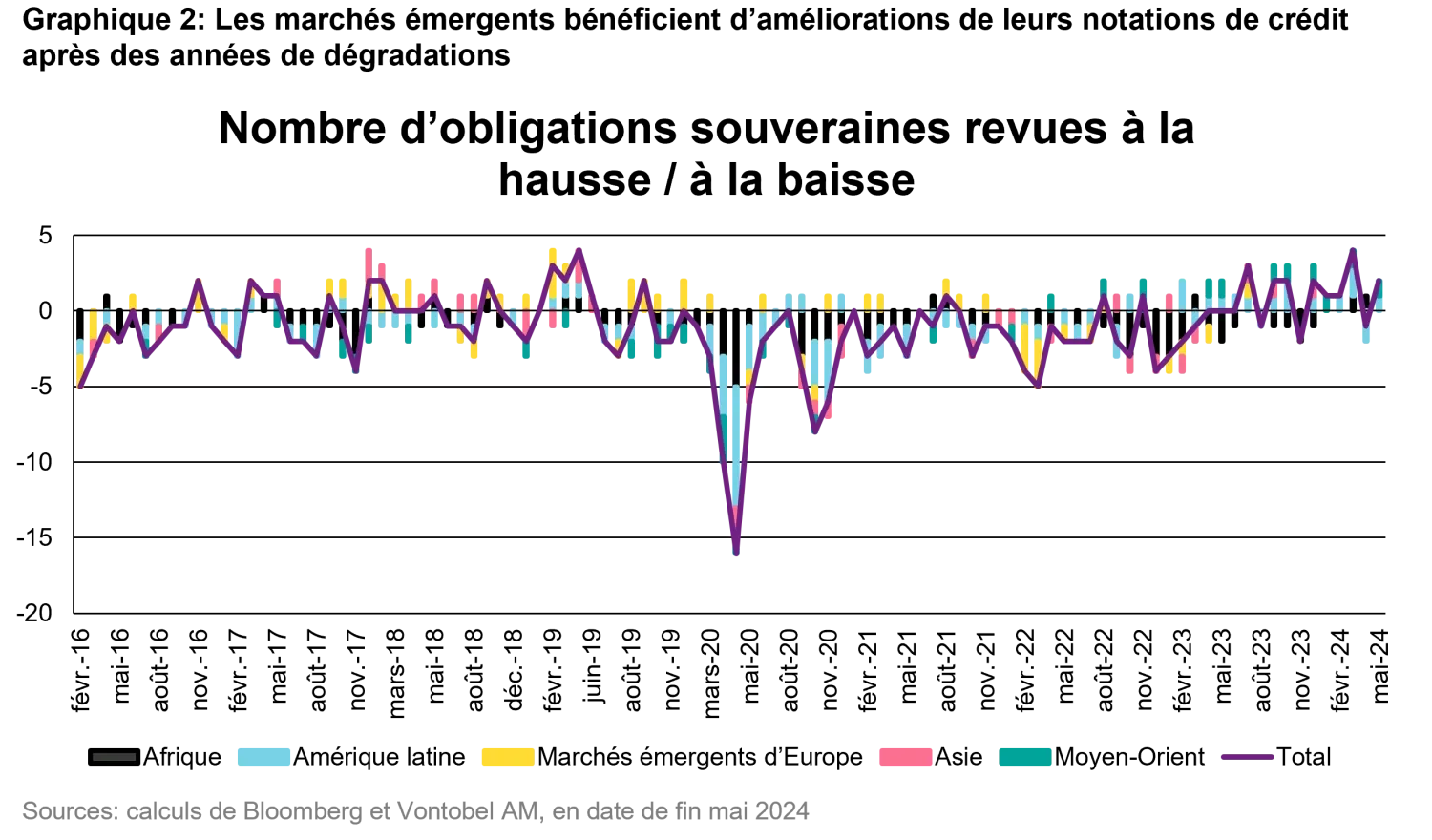

La diminution des risques justifie la réduction des primes de risque. Plusieurs pays mettent en œuvre des réformes économiques positives et le resserrement des spreads a permis aux émetteurs à haut rendement de réaccéder aux marchés, entraînant une forte diminution des risques de défaut. La tendance à la dégradation des notations de crédit semble révolue et une tendance aux révisions à la hausse pourrait être sur le point de débuter.

-

Les comparaisons avec le haut rendement US (HY) surestiment le risque des marchés émergents. Les marchés émergents offrent une plus grande diversification ainsi que des sociétés moins endettées dans les mêmes catégories de notation et comportent de 50 à 60 % d’émetteurs Investment Grade.

Carlos de Sousa, Portfolio Manager, Analyst

Carlos de Sousa, Portfolio Manager, Analyst

L’amélioration des fondamentaux et le rythme des réformes expliquent le resserrement des spreads

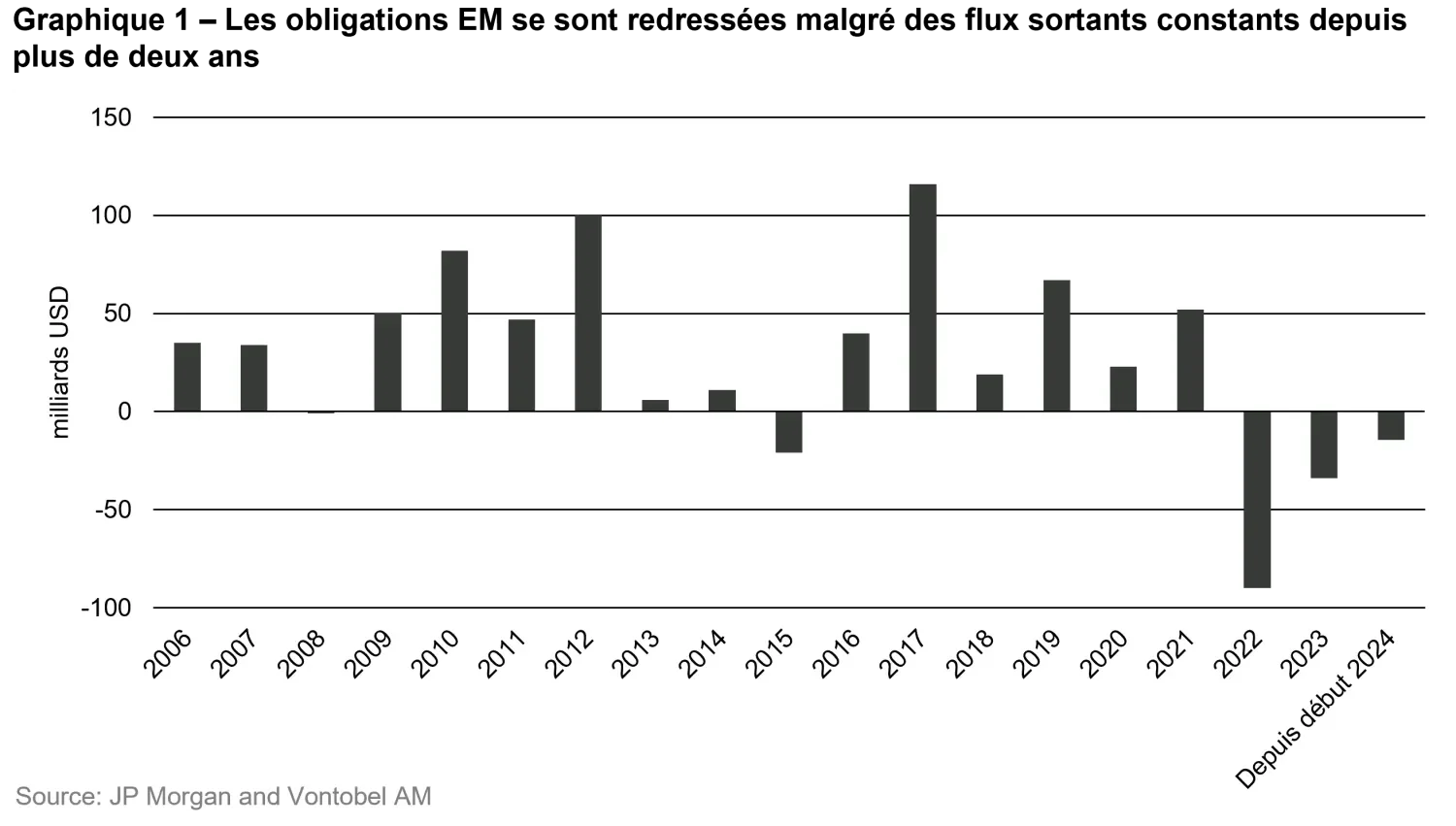

Après un excellent début d’année dans le secteur obligataire, les investisseurs devraient fortement envisager les marchés émergents. Les obligations en monnaies fortes des marchés émergents ont débuté l’année sur les chapeaux de roues, générant des rendements positifs depuis le début de l’année, malgré la hausse des rendements des bons du Trésor américain.1 Les obligations souveraines (JP Morgan EMBIG Div) et d’entreprises (JP Morgan CEMBI BD) ont généré un rendement total respectif d’environ 2,7 % et 3,9 %, qui se distingue du rendement négatif de –2,1 % pour les titres obligataires agrégés mondiaux (JP Morgan GABI, ou –2,6 % pour l’indice obligataire agrégé mondial Blomberg Barclays). Cette performance est remarquable compte tenu des sorties continues que subissent les obligations des marchés émergents (voir le graphique 1).

Pourquoi les spreads des marchés émergents se sont-ils resserrés malgré des flux sortants constants?

Les spreads des marchés émergents ont reculé en même temps que les spreads de crédit des marchés développés (DM). Les spreads des obligations souveraines des marchés émergents s’établissent à 348 pb, contre environ 447 pb il y a un an (hors obligations vénézueliennes en défaut, qui faussent le tableau), tandis que les spreads des obligations d’entreprises des marchés émergents se situent à environ 225 pb, contre environ 319 pb il y a un an.

Il est important d’analyser les données techniques en jeu. Tout d’abord, les données des flux des marchés émergents ne tiennent généralement pas compte des investisseurs cross-over et l’augmentation de leur allocation aux marchés émergents ne se reflète pas dans les chiffres. Lorsque des fonds qui ne sont pas dédiés aux marchés émergents vendent des crédits des marchés développés pour acheter directement des obligations des marchés émergents, au lieu de les allouer à un fonds dédié aux marchés émergents, la demande en marchés émergents augmente et les spreads se resserrent. De plus, malgré un marché primaire dynamique, les nouvelles émissions nettes (nettes d’amortissements, de coupons, de rachats / d’appels) ont été relativement faibles pour les obligations souveraines des marchés émergents et franchement négatives pour les obligations d’entreprises des marchés émergents, les rachats et coupons ayant été supérieurs aux émissions brutes (JP Morgan, juin 2024). Le fort recul de la présence des entreprises chinoises sur le marché primaire contribue à exacerber le déséquilibre entre l’offre et la demande. Ces deux facteurs ont considérablement contribué à la tendance au resserrement sur les marchés émergents.

Alors que les rendements des bons du Trésor américain se sont inscrits à la hausse sur une très grande partie de l’année, contribuant à la vigueur du dollar et en dépit de la persistance des sorties, la classe d’actifs a défié les prévisions les plus pessimistes et a généré des performances positives. L’amélioration des perspectives économiques mondiales, associée à celle des fondamentaux des marchés émergents et à la dynamique des réformes, a fait décoller la performance des obligations en monnaies fortes des marchés émergents, malgré les défis qui se posent à l’échelle mondiale.

Les actifs à risque mondiaux ont rebondi sur fond de diminution du risque d’une récession mondiale, gonflant les bénéfices des entreprises Les spreads des obligations des marchés émergents se sont également resserrés parallèlement au rebond des actions mondiales. La résilience de l’économie américaine a notamment donné un coup de pouce aux émetteurs sud-américains en raison des liens étroits tissés par le commerce, les investissements, les transferts de fonds et les déplacements. Les exportateurs de matières premières ont également bénéficié directement par le biais de l’augmentation des prix (à la hausse de 7,9 % depuis le début de l’année). La hausse de la valorisation des actions contribue également à améliorer la valeur relative de la dette des marchés émergents.

Il est en outre essentiel de noter que les obligations à haut rendement (HY) ont été le principal moteur des performances positives sur le marché obligataire et surperforment les obligations Investment Grade (IG) depuis la mi-juillet 2022. Au cours des douze derniers mois, les obligations d’entreprises et souveraines HY des marchés émergents en particulier ont généré des bénéfices de plus de 17,4 % et 13,4 % respectivement, par rapport à seulement 3,4 % et 6,6 % pour les obligations IG. Une sensibilité aux taux d’intérêt plus faible et des risques de défaut à la baisse en raison de la réouverture des marchés ont contribué à la surperformance des obligations souveraines HY.

Raisons pour lesquelles les investisseurs devraient envisager une diversification par le biais des marchés émergents:

1. La compression des spreads est survenue en période de sorties

Nous considérons que le potentiel d’une compression supplémentaire à la reprise des entrées est important. Ensuite, la diminution des risques justifie la réduction des primes de risque (voir ci-dessous). Enfin, les comparaisons avec le haut rendement US surestiment le risque des marchés émergents. Nous considérons qu’il existe un potentiel de réduction des risques par le biais de la diversification. Les marchés émergents se composent en effet d’environ 80 pays, avec près de 60 et 50 % d’émetteurs IG respectivement pour les obligations d’entreprises et souveraines, ce qui réduit considérablement les risques de chocs spécifiques au pays ou au secteur. Sans oublier que les obligations d’entreprises et souveraines des marchés émergents sont moins associées à un effet de levier, et ce, même à l’intérieur du même compartiment de notation.

2. Nous observons également une tendance à l’amélioration des notations de crédit des marchés émergents, consécutive aux dégradations intervenues pendant la pandémie

Les émetteurs des marchés émergents, notamment d’obligations souveraines HY qui ont perdu l’accès au marché en 2022/2023, ont concentré leurs efforts sur la mise en œuvre de réformes économiques orthodoxes, qui ont souvent été accompagnées d’un soutien multilatéral et bilatéral. Des exemples de ces réformes sont visibles dans différentes régions. En Turquie, une équipe d’économie orthodoxe a été nommée après la récente réélection du président Erdogan, incitant S&P et Fitch à rehausser la notation du pays à B+. En Amérique latine, l’Argentine a élu un gouvernement favorable aux marchés, entraînant cinq mois consécutifs d’excédent fiscal, du jamais vu depuis 16 ans. Les entreprises de ces juridictions sont ainsi parvenues à réaccéder aux marchés. En Afrique, plusieurs pays, notamment la Côte d’Ivoire et le Bénin, ont pu obtenir du FMI de nouveaux programmes, qui ont permis à la Côte d’Ivoire de bénéficier d’une amélioration de sa notation Moody à Ba2 et au Bénin de sa notation S&P à BB−.

3. Après leur augmentation dans le sillage de la pandémie, les taux de défaut des marchés émergents ont reculé et devraient poursuivre leur baisse

Contrastant avec la remontée progressive attendue des taux de défaillance des marchés développés. Depuis la pandémie, les cycles de défaut des marchés émergents et des marchés développés ont divergé et progressent à nouveau dans des directions opposées. Dans les marchés émergents, de nombreux émetteurs associés à des fondamentaux faibles ont déjà fait défaut au cours des quatre dernières années. Certaines obligations souveraines, telles que celles de l’Égypte et du Pakistan, ont reçu un soutien financier considérable de partenaires bilatéraux et multilatéraux, ce qui leur a permis d’affronter des situations difficiles. Les émetteurs d’obligations d’entreprises, notamment ceux qui résident dans des grands pays tels que le Brésil ou l’Indonésie, ont trouvé des sources de financement alternatives à l’échelle nationale. En 2024, la plupart des émetteurs à haut rendement ont pu réaccéder aux marchés, ce qui a réduit considérablement les risques de défaut. JP Morgan anticipe une diminution de 8,7 % en 2023 à moins de 4 % en 2024 des taux de défaut des obligations d’entreprises à haut rendement des marchés émergents. Entre-temps, JP Morgan prévoit une augmentation progressive des taux de défaut des obligations d’entreprises à haut rendement américaines de 2 % en 2024 à 3 % en 2025 et à 4 % pour les crédits à effet de levier. En fait, les marchés développés ont connu en mai 2024 la troisième plus forte activité d'échange de biens en difficulté jamais enregistrée.

Pour consulter l'article dans son intégralité, cliquez ICI.

Par Carlos de Sousa, Portfolio Manager, Analyst

Pour accéder au site, cliquez ICI.

Cette communication commerciale ne constitue pas une offre, une incitation ou une recommandation d’achat ou de vente d’actions/de parts d’un fonds ou de tout autre instrument d’investissement en vue d’effectuer toute transaction ou de conclure tout acte juridique de quelque nature que ce soit, mais sert uniquement à des fins d’information. Les souscriptions aux parts d’un fonds de placement ne devraient être effectuées que sur la base du prospectus de vente, des informations clés pour l’investisseur, de ses documents constitutifs et du dernier rapport annuel et semestriel du fonds, ainsi que sur l’avis d’un spécialiste indépendant en finances, droit, comptabilité et impôts. La performance historique ne saurait préjuger des résultats actuels ou futurs. Les performances ne prennent pas en compte les commissions et les frais prélevés lors de l’émission ou du rachat des parts. Le rendement d’un investissement peut augmenter ou diminuer, par exemple en fonction des fluctuations monétaires. La valeur du capital investi dans un fonds peut augmenter ou diminuer et il n’y a aucune garantie de remboursement de l’intégralité ou d’une partie du capital investi. Bien que Vontobel soit d’avis que les informations figurant sur ce site s’appuient sur des sources fiables, Vontobel décline toute responsabilité quant à la qualité, l’exactitude, l’actualité et l’exhaustivité desdites informations. Pour des informations complémentaires concernant les conditions d’accès à ce site et relative aux fonds d’investissements, veuillez vous référer aux informations légales spécifiques ici .