Dans le labyrinthe qu’est la structure du capital des banques, où se trouvent les opportunités d’investissement ?

Des régimes réglementaires contradictoires ou en concurrence des deux côtés de l'Atlantique, un environnement de taux changeant avec des politiques monétaires en voie d'assouplissement, et de la consolidation : telles sont les nouvelles tendances à surveiller dans le secteur bancaire européen à l'approche de 2025. Soyez sélectifs et surveillez les émissions.

Les trois défis de 2025 : Bâle IV, les taux et les risques de décarbonation

Le paysage bancaire est un kaléidoscope dont de nombreuses pièces sont en mouvement : débats réglementaires, bénéfices sous pression… Néanmoins, la bonne nouvelle est que les banques prennent peu à peu conscience du risque lié à l'exposition au carbone. Comme les fondamentaux des banques sont encore sains et que leurs actions ont déjà connu un belle progression boursière, il reste quelques opportunités dans la partie inférieure de la structure de la dette.

Bâle IV, ou pas Bâle IV ?

Tout d'abord, la récente élection de Donald Trump peut susciter un certain espoir de déréglementation, en particulier aux États-Unis. (La notion d’ « espoir » dépend bien sûr de votre point de vue sur le profit à court terme vs. le risque à moyen terme). Cela pourrait pousser d'autres régulateurs européens à reconsidérer leurs structures pour préserver la compétitivité dans leur zone. Des discussions sont déjà en cours sur la simplification des prospectus d'introduction en bourse au Royaume-Uni.

L'éléphant dans la pièce, la mise en œuvre de Bâle IV, doit débuter en 2025 pour être pleinement en place d'ici 2033. Si les États-Unis décidaient de ne pas adopter ces réglementations dans leur totalité, les banques américaines d'importance systémique mondiale échapperaient à la charge supplémentaire de 9 % pesant sur leurs actifs pondérés des risques, et seraient libres de distribuer davantage de capital à leurs actionnaires. Un autre assouplissement potentiel de la réglementation, la réforme de la revue fondamentale du portefeuille de négociation (« FRTB »), pourrait accroître l'avantage concurrentiel des banques d'affaires et d'investissement européennes.

Il reste à voir jusqu'où les régulateurs sont prêts à alléger la réglementation, moins de deux ans après la crise des banques régionales américaines qui a déclenché la chute du Credit Suisse. Nous pensons que la BCE maintiendra une position stricte, ce qui créera des conditions de concurrence non équitables pour les banques d’investissement européennes.

Des baisses de taux ?

Le principal défi de l'investissement dans les banques à l'horizon 2025 est le cycle des taux : la BCE s'engage sur un chemin de baisses de taux pour se rapprocher des 2 % d’ici fin 2025, notamment après la publication des indices PMI de novembre. Nous estimons que chaque baisse de taux de 50 points de base pourrait réduire les revenus d'intérêts nets de 3 %, et les bénéfices nets de 5 %, pour le secteur bancaire européen. Alors que les anticipations du marché sont en baisse sur les taux, certains managements affichent des objectifs de moins en moins réalistes, comme l'a récemment souligné Andrea Orcel, PDG d'Unicredit.1

ESG – Des objectifs de décarbonation pour les banques ?

L'un des risques les plus urgents et les plus importants, à court et à long terme, se trouve dans les objectifs de décarbonation des banques. Une analyse détaillée de la Net Zero Banking Alliance (NZBA), fondée par les Nations Unies, a montré que la plupart des trente plus grandes banques affichent actuellement des objectifs de décarbonation non pertinents, qui ne permettront probablement pas d'atteindre les réductions d'émissions rapides dont l'économie a besoin ; il faut les repenser.

Plus précisément, les objectifs actuels basés sur les émissions financées (par les prêts) et les émissions facilitées (par les activités des marchés de capitaux) sont basés sur des ratios et non sur des plafonds. Prenons l'exemple d'une banque américaine dont l'objectif en matière d'intensité énergétique couvre le pétrole, le gaz et les énergies propres. Elle peut atteindre cet objectif en augmentant son financement des énergies propres, sans réduire son financement du pétrole et du gaz.

Si les banques sont en retard en matière de décarbonation, elles s'attaquent néanmoins lentement au problème. Depuis son lancement en avril 2021, le nombre de banques membres de la Net Zero Banking Alliance a plus que triplé, passant de 43 à 144. Lorsqu'une banque rejoint la NZBA, elle s'engage de manière indépendante et volontaire (sans obligation réglementaire) à faire évoluer ses activités de financement pour s'aligner sur des trajectoires net zéro d'ici 2050 au plus tard, et à fixer des objectifs sectoriels intermédiaires pour 2030 ou plus tôt afin de permettre cet alignement. Cet intérêt croissant des banques pour adhérer à l'Alliance témoigne du fait qu’elles considèrent la transition vers l'abandon du financement des combustibles fossiles comme un objectif concret2.

En fixant des objectifs de financement vert pour 2030 et en publiant des plans de transition, les banques placent davantage les investissements durables au cœur de leur stratégie. Nous pensons qu’elles vont réduire leur exposition aux industries fortement émettrices et augmenter encore leur financement d’activités vertes.

Les quelques banques qui pourraient quitter l'Alliance en 2025 le feront probablement parce qu'elles n'auront pas atteint les objectifs fixés par le groupe, et non en raison de pressions politiques. S'il est possible que le « greenhushing » se poursuive aux États-Unis, les banques qui sont conscientes du risque ne changeront pas leur stratégie simplement à cause de la nouvelle administration.

Identifier la partie intéressante de la structure du capital bancaire pour 2025

L’environnement réglementaire et macroéconomique ainsi que les objectifs de décarbonation peuvent certes soulever des questions. Néanmoins, les fondamentaux des banques sont sains, avec des niveaux de rentabilité historiquement élevés, des ratios de solvabilité en amélioration, une gestion rigoureuse de la qualité de leur portefeuille de crédits, et une forte liquidité. De plus, les banques intègrent enfin des investissements plus durables au cœur de leur stratégie. Si la dernière saison de résultats a été de bonne facture, l'accent est désormais mis sur la croissance, les revenus de commissions et la consolidation.

Dans ce scénario, quelles sont les opportunités dans la structure du capital ?

Actions : Où en sont les valorisations ?

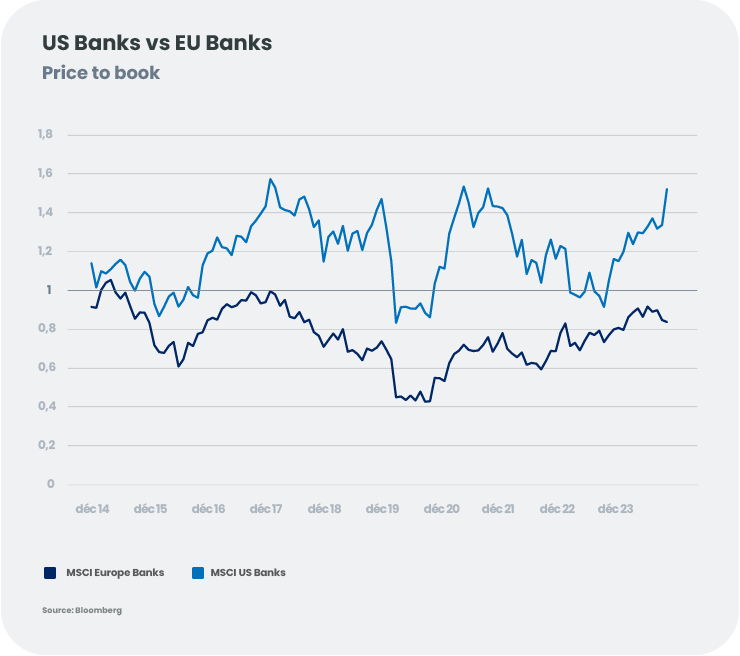

Les cours ont déjà fortement progressé, les actions des banques européennes ayant de nouveau réalisé un beau parcours boursier en 2024 (comme l'indiquent les ratios cours/valeur comptable dans le graphique). Le cycle des taux est susceptible d'entraver la dynamique des bénéfices et, bien que la qualité du crédit reste élevée, elle pourrait se détériorer rapidement dans le cas d’un ralentissement de l'économie compte tenu du caractère cyclique et de l'effet de levier du secteur bancaire.

Sur une note positive, la tendance est à la consolidation. Au cours des derniers mois, BBVA a lancé une offre sur Banco Sabadell en Espagne, Unicredit a pris une participation de 20 % dans Commerzbank et BPM une participation de 9 % dans Banca dei Monte Paschi di Sienna. Unicredit (encore) a finalement lancé une offre sur BPM, tandis qu'Eurobank rachète les participations minoritaires dans Hellenic Bank of Cyprus. Cela devrait bénéficier aux investisseurs en imposant une plus grande discipline aux équipes dirigeantes - en matière de fixation des prix, d'efficacité et d'allocation des capitaux. Cependant, l'Europe reste un marché fragmenté et la consolidation transfrontalière est freinée par l'absence d'un marché bancaire commun et par des résistances politiques nationales.

En outre, le secteur pourrait connaître des épisodes de volatilité. Les turbulences politiques et économiques dans certains pays pourraient provoquer le retour d'une interdépendance entre banques et États souverains, les pays périphériques tels que l'Espagne ou l'Italie étant potentiellement mieux placés que les pays « core » comme la France ou l'Allemagne.

Dette bancaire : Senior ou subordonnée ?

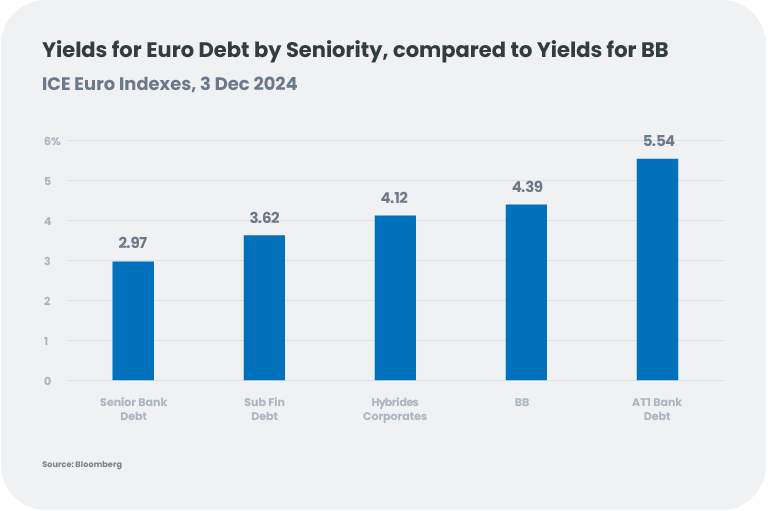

Les valorisations étant comprimées sur la dette bancaire, la performance est plus susceptible de provenir du portage que du resserrement des spreads, et ce dans l’ensemble de la structure du capital. Mais la dette subordonnée bancaire (« Additional Tier 1 » et, dans une moindre mesure, Tier 2) peut sélectivement offrir des rendements intéressants, non seulement en comparaison avec la dette senior, mais aussi avec d'autres actifs plus risqués tels que les obligations BB à haut rendement et les obligations hybrides d’entreprises.

Sélectionner les bonnes émissions

Nous pensons qu’il est possible de trouver quelques opportunités sélectives dans la partie inférieure de la structure du capital de la dette, qui offre des ratios de fonds propres sains et des actifs de bonne qualité. Les AT1 et Tier 2 ont un rendement proche du High Yield BB mais sont émis par des banques de notation moyenne A. Compte tenu des ratios de solvabilité actuels, les banques sont effectivement loin du point de non-viabilité qui déclencherait un risque d'absorption et des potentielles modifications des coupons. Les bons antécédents en matière de remboursements anticipés sur les AT1 et de gestion du passif nous confortent dans l'idée que les banques continueront les remboursements, mais la sélection des émetteurs reste cruciale. Nous maintenons notre préférence pour les champions nationaux et, plus largement, pour les émetteurs de qualité supérieure.

1 Commentaire lors d’une conférence téléphonique sur l'acquisition de BPM, le 25 novembre 2024.

2 Ces objectifs intermédiaires devraient couvrir tout ou partie des neuf secteurs à forte intensité carbone.

Ce document est fourni uniquement à des fins d’information et d’éducation et peut contenir l’opinion de Candriam ainsi que des informations exclusives. Les opinions, analyses et points de vue exprimés dans ce document sont fournis à titre d’information uniquement. Ils ne constituent en aucun cas une offre d’achat ou de vente d’instruments financiers, ni une recommandation d’investissement, ni une confirmation d’une quelconque transaction.

Bien que Candriam sélectionne soigneusement les données et les sources utilisées, des erreurs ou omissions ne peuvent être exclues a priori. Candriam ne saurait être tenue responsable des dommages directs ou indirects résultant de l’utilisation de ce document. Les droits de propriété intellectuelle de Candriam doivent être respectés à tout moment et le contenu de ce document ne peut être reproduit sans autorisation écrite préalable.

Le présent document ne constitue pas une recherche en investissements au sens de l’article 36, paragraphe 1, du règlement délégué (UE) 2017/565 de la Commission. Candriam souligne que ces informations n’ont pas été préparées conformément aux dispositions légales prônant la recherche indépendante en investissements et qu’elle n’est soumise à aucune restriction interdisant l’exécution de transactions avant la diffusion de la recherche en investissements.

Le présent document n’a pas vocation à promouvoir et/ou offrir et/ou vendre un quelconque produit ou service. Le document n'est pas non plus destiné à solliciter une demande de prestation de services.

Pour accéder au site, cliquez ICI.

À propos de Candriam

Candriam, qui signifie "Conviction AND Responsibility In Asset Management", est un gestionnaire d’actifs mondial multi-spécialiste. Pionnier et leader dans le domaine des investissements durables depuis 1996, Candriam gère environ 145 milliards d’euros d’actifs et s’appuie sur une équipe de plus de 600 professionnels. La société dispose de centres de gestion à Luxembourg, Bruxelles, Paris et Londres et ses responsables de clientèle couvrent plus de 20 pays dans toute l'Europe continentale, au Royaume-Uni, aux États-Unis et au Moyen-Orient. Candriam propose des solutions d'investissement dans plusieurs domaines clés : obligations, actions, gestion alternative et stratégies d’allocation d'actifs, avec une gamme large et innovante de stratégies ESG couvrant toutes ces classes d'actifs.

Candriam est une société du groupe New York Life Investments. New York Life Investments se classe parmi les principaux gestionnaires d’actifs mondiaux.