L'équipe Franklin Templeton Emerging Markets Equity rapelle régulièrement l’incroyable évolution des marchés émergents au cours des décennies, que de nombreux investisseurs ne réalisent peut-être pas. Aujourd’hui, les économies émergentes comptent de nombreuses entreprises de pointe qui sont des leaders dans leur secteur. De plus, de nombreux pays ont tiré de précieuses leçons des périodes de crise précédentes qui les ont aidés à faire face à la pandémie actuelle de coronavirus. La Corée du Sud en est un exemple.

L'équipe Franklin Templeton est implantée au cœur des marchés émergents. En étant sur le terrain dans 15 pays, l'équipe voit directement la transformation qui a eu lieu au cours des deux dernières décennies — une évolution qui, dans certains domaines, s’accélère même avec la crise sanitaire. Cette nouvelle réalité des marchés émergents se caractérise par une résilience institutionnelle accrue, une meilleure diversification économique et l’émergence d’entreprises de premier plan sur les marchés émergents . Dans de nombreux cas, ces sociétés émergentes dépassent leurs homologues des marchés développés grâce à de nouveaux modèles d’entreprise, souvent facilités par une infrastructure et une propriété intellectuelle supérieures.

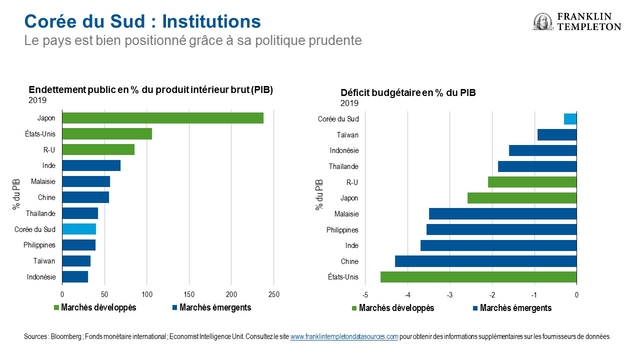

L'équipe Franklin Templeton est implantée au cœur des marchés émergents. En étant sur le terrain dans 15 pays, l'équipe voit directement la transformation qui a eu lieu au cours des deux dernières décennies — une évolution qui, dans certains domaines, s’accélère même avec la crise sanitaire. Cette nouvelle réalité des marchés émergents se caractérise par une résilience institutionnelle accrue, une meilleure diversification économique et l’émergence d’entreprises de premier plan sur les marchés émergents . Dans de nombreux cas, ces sociétés émergentes dépassent leurs homologues des marchés développés grâce à de nouveaux modèles d’entreprise, souvent facilités par une infrastructure et une propriété intellectuelle supérieures.Le pays a tiré les leçons des précédentes crises sanitaires régionales, et son économie et son système de santé étaient donc préparés pour celle-ci. Pendant de nombreuses années, la Corée du Sud a mené une politique économique prudente, ce qui s’est traduit par une faible dette publique. Aspect fondamental, elle est entrée dans la crise avec un déficit budgétaire négligeable de 0,3 % l’année dernière, soit une petite fraction de l’endettement des marchés les plus développés.

Diversification économique

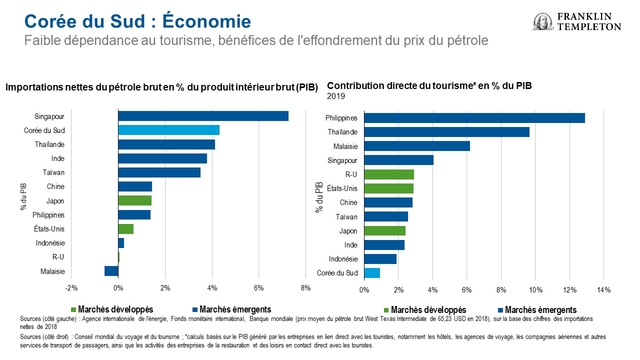

En termes d’économie générale, la Corée du Sud n’a pas eu la chance de disposer de vastes ressources naturelles — au contraire, ses importations de pétrole sont parmi les plus élevées d’Asie en pourcentage du produit intérieur brut. Et malgré la grande beauté naturelle et la richesse de sa culture, le tourisme n’a jamais été au cœur de l’économie.

Les résultats sont doubles. À court terme, le pays a bénéficié de manière disproportionnée de l’effondrement des prix du pétrole, tout en constatant que l’effondrement des voyages internationaux a eu peu d’impact économique. Mais surtout, sur le long terme, la Corée a investi dans sa population, dans la recherche et le développement, et est devenue une économie ouverte — c’est une puissance d’exportation.

Entreprises internationales

En outre, un certain nombre d’exportateurs sud-coréens sont d’importance mondiale, fournissant du matériel qui permet à l’économie moderne de fonctionner. Les principaux fabricants mondiaux de semi-conducteurs et de batteries profitent des tendances durables à l’augmentation de la puissance de calcul et de la mobilité verte, dont certaines s’accélèrent en raison de la pandémie. Comme l’augmentation massive de la demande de cloud computing (et donc de centres de données) stimulée par le travail à domicile et la vidéoconférence. Ou encore la hausse potentielle des ventes de vélos électriques et de voitures (dont une proportion croissante est électrique), les gens cherchant à éviter les transports publics bondés.

Les avantages de la Corée du Sud en matière d’innovation et de propriété intellectuelle sont également évidents dans le secteur des soins de santé, allant des kits de dépistage des virus aux produits biologiques, qui ont sans aucun doute été d’un grand soutien durant cette crise. Le secteur de l’internet du pays a également prospéré dans un contexte de distanciation sociale.

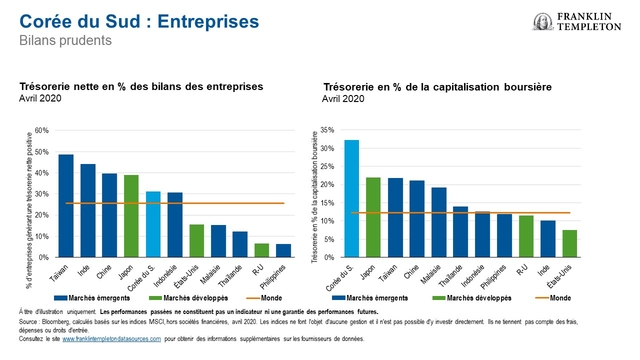

La prudence budgétaire de la Corée du Sud se retrouve également au niveau des entreprises ; la proportion de sociétés non financières affichant une trésorerie nette positive est considérablement supérieure à la moyenne mondiale (et plus du double de celle des États-Unis).1 Vu sous un autre angle, les avoirs en espèces en pourcentage de la capitalisation boursière totale sont parmi les plus élevés au monde. Les bilans autrefois considérés comme inefficaces semblent suffisamment prudents alors que les entreprises du monde entier cherchent à être renflouées par les gouvernements.

Certes, la gouvernance d’entreprise a longtemps constitué un défi majeur pour l’investissement en Corée du Sud ; des structures de holding chaebol complexes, des rendements médiocres pour les actionnaires et le problème plus flagrant de la corruption expliquent la décote appliquée à de nombreuses entreprises coréennes. Toutefois, il s’agit d’un domaine en pleine évolution, un code de gouvernance d’entreprise devenant obligatoire pour les grandes entreprises (celles qui figurent dans l’indice KOSPI) en 2019. Divers exemples d’engagement auprès d’entreprises commencent à donner des résultats concrets, comme en témoignent l’amélioration du rendement pour les actionnaires, les excuses publiques et les restructurations.

En bref, la Corée du Sud illustre bon nombre des tendances que nous observons de plus en plus sur les marchés émergents — un environnement qui facilite une croissance supérieure des bénéfices des entreprises durables compétitives au niveau mondial.

Chetan Sehgal, CFA, Senior Managing Director, Director of Portfolio Management, Franklin Templeton Emerging Markets Equity

Andrew Ness, ASIP, Portfolio Manager, Franklin Templeton Emerging Markets Equity

1. Source : Bloomberg, calculs basés sur les indices MSCI. Hors sociétés financières, avril 2020. Les indices ne font l’objet d’aucune gestion et il n’est pas possible d’y investir directement. Ils ne tiennent pas compte des frais, dépenses ou droits d’entrée. Voir www.franklintempletondatasources.com pour des informations supplémentaires sur le fournisseur de données.

Mentions légales importantes

Ces documents sont fournis uniquement dans l'intérêt général et ne sauraient constituer un conseil d'investissement individuel, une recommandation ou une incitation à acheter, vendre ou détenir un titre ou à adopter une stratégie d'investissement particulière. Il ne constitue pas un conseil d'ordre juridique ou fiscal.

Les opinions exprimées sont celles des gérants mentionnés et les commentaires, opinions et analyses sont valables à la date de la publication (ou pour certains cas précis à une autre date donnée) et peuvent être modifiés sans préavis. Les informations contenues dans ce document ne constituent pas une analyse complète des événements survenant dans les divers pays, régions ou marchés.

Les données de tierces parties peuvent avoir été utilisées dans la préparation de ce document et Franklin Templeton Investments (« FTI ») n'a pas vérifié, validé ni audité de manière indépendante ces données. FTI décline toute responsabilité en cas de perte due à l’utilisation de ces informations, et la pertinence des commentaires, des opinions et des analyses contenus dans ce document est laissée à la seule appréciation de l’utilisateur.

Les produits, services et informations peuvent ne pas être disponibles dans toutes les juridictions et sont fournis en dehors des États-Unis par d'autres sociétés affiliées de FTI et/ou leurs distributeurs, dans la mesure où la réglementation/législation locale l'autorise. Veuillez consulter votre conseiller financier ou votre interlocuteur de Franklin Templeton Institutional pour toute information supplémentaire sur la disponibilité des produits et services dans votre juridiction.

Publié aux États-Unis par Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, Californie 94403- 1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. est le principal distributeur des produits enregistrés aux États-Unis de Franklin Templeton Investments, qui ne sont pas assurés par la FDIC, peuvent perdre de la valeur, ne sont pas garantis par la banque et sont disponibles uniquement dans les juridictions dans lesquelles est permise une offre ou une sollicitation d'achat ou de vente de ces produits, en vertu des lois et règlements applicables.

CFA® et Chartered Financial Analyst® sont des marques déposées de CFA Institute.

Quels sont les risques ?

Tout investissement comporte des risques, notamment celui de ne pas récupérer le capital investi. La valeur des investissements peut fluctuer à la baisse comme à la hausse et les investisseurs ne sont pas assurés de récupérer la totalité de leur mise initiale. Les prix des actions peuvent fluctuer, parfois de manière rapide et brusque, en raison de facteurs propres à des sociétés, industries ou secteurs spécifiques ou du marché dans son ensemble. Les investissements dans des titres étrangers comportent des risques spécifiques, comme les fluctuations de change, l’instabilité économique et l’évolution de la situation politique. Investir sur les marchés émergents, y compris dans la sous-catégorie des marchés frontières, implique des risques accrus concernant ces mêmes facteurs, lesquels s’ajoutent aux risques liés à leur plus petite taille, à leur liquidité inférieure et à l’absence de cadre juridique, politique, commercial et social établi pour soutenir les marchés de valeurs mobilières.

Pour accéder au site, cliquez ICI.