Les élections soulèvent de nombreuses questions. À chaque automne d’une année bissextile, la fièvre électorale s'empare des États-Unis à l’occasion du scrutin présidentiel, chacun y allant de son pronostic quant à ses implications potentielles. Le positionnement des deux partis politiques rend l'issue du scrutin présidentiel particulièrement serrée, d'autant plus compte tenu des spécificités du calcul du Collège électoral.

Dans la mesure où les primaires poussent généralement les candidats vers les franges les plus extrêmes de leur parti, les programmes proposent des choix radicalement différents. Par ailleurs, le pouvoir fédéral dépend du contrôle exercé à la fois sur la Maison-Blanche et sur le Capitole, ce qui donne de l’importance aux multiples campagnes aux échelons inférieurs. La combinaison de petits écarts dans les sondages, de différences marquées au niveau des programmes annoncés et de l’effet amplificateur des élections du Congrès complique encore l’établissement de perspectives économiques et d’une stratégie d’investissement.

Le présent article dresse un cadre facilitant la compréhension des conséquences politiques des résultats aux élections, soulignant les gouffres et les similarités surprenantes entre les deux candidats. Ce cadre aide à comprendre pourquoi le ton est à l’heure actuelle beaucoup plus élevé sur les chaînes d’informations politiques que sur leurs équivalentes commerciales.

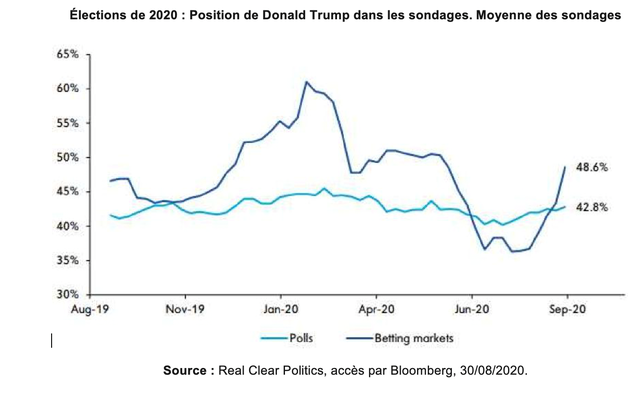

À la date du présent article, le président Donald Trump est nettement à la traîne dans les sondages, un agrégateur ne lui accordant que 43% des voix. De même, les sondages en ligne misent fortement sur une « vague bleue » à la suite de laquelle les démocrates remporteraient la Maison-Blanche et reprendraient le Sénat. Cependant, les parieurs sont désormais plus nombreux à estimer que Donald Trump va remporter les élections, à presque un contre un. Autre mise en garde évidente : il y a quatre ans, le candidat Donald Trump était encore plus bas dans les sondages et nombreux étaient ceux qui pariaient sur une majorité démocrate plus importante. Les sondages et les experts s'étaient déjà aussi lourdement trompés lors du référendum sur le Brexit cinq mois plus tôt.

Revenons en 2016

L’année 2016 est riche d’enseignements. Premièrement, il est parfois plus clair de dire que des élections ont été perdues par un parti plutôt que gagnées par un autre. Au Royaume-Uni, la campagne de soutien au maintien du pays dans l’UE (« Remain ») a mal défini le rôle joué par l’Union européenne et, aux États-Unis, Hilary Clinton n’a pas réussi à nouer un lien avec l’électorat démocrate.

Deuxièmement, prendre le pouls du public, une activité délicate dans le meilleur des cas, est désormais particulièrement hasardeux. En effet, les réseaux sociaux amplifient les messages, polarisent les opinions et minent le rôle joué par les leaders d’opinion traditionnels. Par exemple, vous pouvez être sûrs qu’une majorité des journaux américains va appeler à voter pour Joe Biden. Soyez également assurés que cela ne va avoir aucun effet sur les supporters de Trump.

Troisièmement, les sondages sont de moins en moins pertinents, d’où nos deux surprises concernant les scrutins au Royaume-Uni et aux États-Unis.

Le quatrième enseignement que nous avons tiré de l’année 2016 concerne son retentissement : prédire la gouvernance qui va s’établir après les élections est tout aussi important que prédire les résultats de ces mêmes élections. En effet, la Première ministre Theresa May a échoué à tirer profit de la victoire écrasante du Brexit et le gouvernement américain, composé de fervents républicains, n’a pu se prévaloir que d’un nombre limité de succès législatifs au cours des deux premières années du mandat de Trump. En résumé, il est difficile de deviner qui remportera une élection nationale et encore plus de prédire comment le vainqueur va s’en sortir. Cette dernière conclusion explique probablement pourquoi les investisseurs ne manifestent pour la plupart aucune émotion alors que la présidentielle approche, car ils perçoivent le dysfonctionnement du système politique américain comme l’une de ses caractéristiques et non comme une anomalie.

Anticipons jusque 2021 et après

Les scénarios potentiels concernant es mesures prises au cours de la prochaine administration présidentielle devraient être évalués en fonction de leur teneur et de leur facilité d’exécution.

Les ailes gauche et droite tablent sur une large victoire dans laquelle un seul parti tiendra les ficelles du pouvoir. Cette situation facilite la réalisation des mesures législatives, le compromis étant nécessaire au sein d’un groupe parlementaire. Cela dit, les deux premières années de l'administration Trump ont montré qu'il est parfois aussi difficile de résoudre les clivages au sein d'un parti qu'entre les partis. Après une « vague bleue », Nancy Pelosi, la présidente de la Chambre des représentants, trouvera peut-être tout aussi difficile de rassembler les éléments progressistes de son parti que son prédécesseur Paul Ryan avec ses collègues du Tea Party.

Si le Congrès est divisé, cela signifie que le résultat de l’élection était serré et que le contrôle actuel des chambres ne va pas basculer. Dans ce cas, le président Joe Biden devra faire face à un Sénat républicain ou le président Donald Trump devra affronter une Chambre démocrate.

Les diverses implications sont les suivantes :

- Le président, quel qu’il soit, ne pourra probablement pas prendre d’initiatives législatives majeures, car un parti peut toujours bloquer l’autre.

- En tant que président, Joe Biden sera plus gêné par un gouvernement divisé parce que toutes les propositions (la partie centrale du tableau) devront passer devant un Sénat hostile, ce qui va placer le choix des candidats au centre. En revanche, Donald Trump gardera une marge de manœuvre plus grande pour réformer le système judiciaire.

Chaque président aura recours aux mesures exécutives (éléments situés principalement en bas du tableau) pour atteindre ses objectifs, notamment s’il ne parvient pas à un compromis législatif. Gardez à l’esprit que les lignes correspondent à des catégories globales. Si les deux partis conviennent que des dépenses supplémentaires seront nécessaires pour remettre sur pied les infrastructures vétustes du pays, les démocrates sont plus susceptibles de cibler les zones côtières avec un saupoudrage de mesures écologiques. De plus, un package fiscal combinera probablement plusieurs lignes. Par exemple, les plans de dépenses massifs de l’administration Biden seront associés à des hausses des taux d'imposition marginaux pour les ménages à revenus élevés, aboutissant à un creusement du déficit.

Joe Biden et Donald Trump ont une vision très différente de la manière dont l’administration gère un gouvernement fédéral. En revanche, la capacité de l’un et de l’autre à mettre en œuvre leur vision suscite le scepticisme.

Quelques similarités

Les quatre similarités entre les deux candidats sont tout aussi riches d’informations.

Premièrement, l’économie américaine aura besoin de temps pour se remettre de la forte contraction qu’elle a subie au cours du premier semestre 2020. Selon nos prévisions, le PIB réel des États-Unis ne renouera pas avec son niveau de fin 2019 avant 2023. D’ici là, beaucoup de ménages et d’entreprises seront probablement dans une situation difficile. Dans cet environnement, les responsables politiques, et surtout ceux qui viendront d’être élus, devraient être réticents à diminuer les mesures de relance budgétaire. Cette contrainte macroéconomique signifie que les hausses d’impôt sur les hauts revenus souhaitées par les démocrates seront peut-être mises en place progressivement ou délayées par des réductions pour les ménages à faibles revenus, adoucies par des exemptions (par exemple en relevant le plafond de déductibilité des impôts sur le revenu au niveau local et des États) et des projets de dépenses.

Deuxièmement, l’ère Volcker-Greenspan marquée par une faible inflation, un bilan réduit de la Réserve fédérale (Fed) et la prise en compte exclusive du taux d’intérêt comme instrument opérationnel de la politique monétaire touche à sa fin. Les deux présidents apprécieraient la récente posture non équivoque adoptée par Jerome Powell, le président de la Fed, le chômage n’étant jamais assez bas et les prévisions d’inflation étant censées dépasser les objectifs. Reste à savoir si Jerome Powell sera toujours aux commandes de la Fed après 2022. En effet, il a renforcé par précaution ses liens avec le Congrès, améliorant ses chances d’occuper un poste dans les colonnes centrales du tableau. Pour ce qui est des ailes du tableau ci-dessus, les deux candidats voudront probablement quelqu’un plus en phase avec leurs propres intérêts.

Troisièmement, le président Donald Trump a ouvert le dossier des relations commerciales avec la Chine, suscitant des inquiétudes sur la protection de la propriété intellectuelle, la sécurité nationale et l’accès au marché. Xi Jinping, le président à vie de la Chine, a pour sa part soulevé l’indignation des deux partis en ce qui concerne les droits de l’homme, le contrôle de la mer de Chine méridionale et le statut de Hong Kong. Aucun des deux leaders ne pourra refermer ce dossier non résolu l’an prochain. Cependant, le style a son importance. Joe Biden est un défenseur du multilatéralisme traditionnel. S’il est élu, son administration s’efforcera de rétablir des partenariats afin de résoudre ces questions et d’annuler les restrictions commerciales qui suivent une interprétation élargie des règles de l’Organisation mondiale du commerce.

Quatrièmement, aucun ne devrait s’inquiéter du niveau de la dette fédérale, ce qui leur permettra de mettre en application leurs ambitions élevées en matière de dépenses et d’impôts. La Fed est à leur côté et, en dépit des perturbations manifestes de notre gestion du budget, les bons du Trésor américains sont toujours considérés comme des valeurs refuges. Par conséquent, les prévisions de taux d’intérêt bas à long terme devraient empêcher le fardeau fiscal de la dette de s’envoler. Néanmoins, la dette publique brute devrait atteindre de nouveaux sommets par rapport au PIB nominal et être détenue en grande partie par des investisseurs étrangers et des institutions officielles. Une telle situation présente une multitude de risques et de vulnérabilités sur le long terme, mais ne va pas inquiéter le monde politique à court terme. Tôt ou tard, l’accumulation de ces postures à court terme successives va atteindre un point de rupture, mais ce sera sûrement sous une autre présidence.

Conclusion

La rhétorique politique déjà très animée devrait encore s’enflammer à mesure que l’élection approche, mais ces altercations concernent les ailes du tableau. Une situation qui semble laisser les investisseurs indifférents. Les marchés d’actions sont orientés à la hausse, les spreads de risque de crédit étroits et la volatilité implicite pas particulièrement élevée. Pourquoi cette attitude ? Ils pensent certainement que l’administration américaine restera dysfonctionnelle et trouvera un terrain d’entente si les circonstances macroéconomiques l’exigent. En outre, le président de la Fed a le soutien de tous.

Le risque est que ces circonstances pourraient changer si les événements font passer la probabilité de consensus des colonnes du milieu vers l’une des ailes du tableau.

Par Vincent Reinhart, chef économiste et stratégiste macroéconomie chez Mellon

Pour accéder au site de BNY Mellon, cliquez ICI.