Nous sommes aujourd’hui à moins d’une décennie de l’échéance que se sont fixées de nombreuses entreprises pour atteindre la neutralité carbone d’ici 2030. De même, l’échéance de 2050 arrêtée par de nombreux pays pour y parvenir se profile à l’horizon. Pour atteindre ces objectifs, des progrès considérables devront être accomplis. Mais comment ?

Directement dans le réservoir

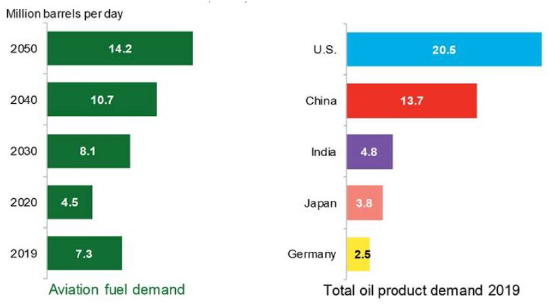

Taille du marché et pénétration

Des mandats

Opportunités pour les investisseurs

1 BP, Statistical review of world energy (Revue statistique de l’énergie mondiale), juin 2020

2 BloombergNEF, 2020

3 BloombergNEF, 2020

4 Aucune référence à une entreprise spécifique ne saurait être considérée comme une recommandation

5 https://www.neste.com/about-neste/who-we-are/business#9507dabd

6 IATA, 2021

7 IATA, 2021

8 Forum économique mondial, 2021

9 Présentation de la direction de Neste, février 2021

10 Exane BNP Paribas, Global Airlines: Sustainable Change, 13 mai 2021

11 https://biofuels-news.com/news/neste-and-all-nippon-airways-collaborate-on-first-supply-of-sustainable-aviation-fuel-in-asia/ 26 octobre 2020

12 Conférence mondiale sur la durabilité de l’ISCC, février 2021

13 https://www.ainonline.com/aviation-news/business-aviation/2020-03-06/dutch-government-targets-saf-blending-mandate-2023 6 mars 2020

14 Exane BNP Paribas, Global Airlines: Sustainable Change, 13 mai 2021

15 https://www.reuters.com/article/us-usa-energy-aviation-idUSKBN2AJ0LH 19 février 2021

16 Analyse Columbia Threadneedle, 2021

17 https://sdgs.un.org/goals

Pour accéder au site, cliquez ICI.

Informations importantes

Document exclusivement réservé aux clients professionnels et/ou investisseurs équivalents dans votre pays (non destiné aux particuliers) Il s’agit d’un document publicitaire. Le présent document est uniquement destiné à des fins d’information et ne saurait être considéré comme représentatif d’un quelconque investissement. Il ne saurait être considéré comme une offre ou une sollicitation en vue de l’achat ou de la vente de titres quelconques ou autres instruments financiers, ou de la fourniture de conseils ou de services d’investissement. Investir comporte des risques, y compris le risque de perte du principal. Votre capital est exposé à des risques. Le risque de marché peut affecter un émetteur, un secteur de l’économie ou une industrie en particulier ou le marché dans son ensemble. La valeur des investissements n’est pas garantie. Il se peut dès lors que l’investisseur ne récupère pas sa mise de départ. Les investissements internationaux impliquent certains risques et une certaine volatilité en raison des fluctuations éventuelles sur le plan politique, économique ou des changes et des normes financières et comptables différentes. Les titres mentionnés dans le présent document sont présentés exclusivement à des fins d’illustration, ils sont susceptibles de changer et ne doivent pas être interprétés comme une recommandation d’achat ou de vente. Les titres mentionnés peuvent générer ou non un rendement. Les opinions exprimées le sont à la date indiquée. Elles peuvent varier en fonction de l’évolution du marché ou d’autres conditions et peuvent différer des opinions exprimées par d’autres associés ou sociétés affiliées de Columbia Threadneedle Investments (Columbia Threadneedle). Les investissements réels ou les décisions d’investissement de Columbia Threadneedle et de ses sociétés affiliées, que ce soit pour leur propre compte ou pour le compte de clients, ne reflètent pas nécessairement les opinions exprimées. Ces informations ne sont pas destinées à fournir des conseils en investissement et ne tiennent pas compte de la situation particulière des investisseurs. Les décisions d’investissement doivent toujours être prises en fonction des besoins financiers, des objectifs, des fins, de l’horizon temporel et de la tolérance au risque spécifiques de l’investisseur. Les classes d’actifs décrites peuvent ne pas convenir à tous les investisseurs. Les performances passées ne préjugent aucunement des résultats futurs et aucune prévision ne saurait être considérée comme une garantie. Les informations et opinions fournies par des tiers ont été obtenues auprès de sources jugées fiables mais aucune garantie n’est donnée quant à leur exactitude et à leur exhaustivité. Le présent document et son contenu n’ont pas été vérifiés par une quelconque autorité de tutelle.