L’année 2022 a connu un démarrage particulièrement volatile et il y a fort à parier que les marchés seront encore malmenés cette année. Alors que l’éventualité d’une récession plane sur plusieurs pays, les banques centrales s’engagent actuellement dans un cycle de resserrement de leur politique monétaire visant à tuer la vague d’inflation élevée à laquelle elles sont confrontées.

En bref

En bref

• Confrontés à une inflation en forte hausse, à de faibles taux d’intérêt désormais en rapide augmentation et à un ralentissement de la croissance économique, les investisseurs manœuvrent aujourd’hui dans un environnement particulièrement volatile.

• Le marché des transactions « value » semble s’essouffler. Les actions de nombreux acteurs de la construction, de l’ingénierie, de la construction automobile et de l’activité financière ont commencé à sous-performer le marché général.

• Le mouvement de balancier pourrait revenir se caler sur les valeurs Quality Growth et mettre notamment l’accent sur les sociétés présentant des marges élevées, disposant d’un véritable pouvoir de fixation de leurs prix, et présentant un faible niveau d’endettement doublé de bénéfices constants.

La hausse des taux d’intérêt constitue une gageure pour les entreprises à forte croissance et à forte valorisation, car si leurs promesses sont enthousiasmantes pour l’avenir, elles ne réalisent, pour l’heure, que peu de bénéfices. Dans un environnement de taux d’intérêt ultra bas et de relance budgétaire substantielle, ces sociétés se sont relativement bien comportées au cours de la dernière décennie. Mais l’inflation connaît maintenant une véritable explosion, et cette époque est révolue.

Les économistes se rendent compte que les scénarios optimistes de croissance régulière qu’ils ont établis pour 2022-23 posent des questions de plus en plus délicates, de sorte que les prévisions de croissance mondiale sont revues à la baisse. En avril dernier, le FMI a ainsi réduit ses prévisions de PIB mondial à 3,6 % pour 2022, soit 0,8 % de moins que trois mois auparavant et 1,3 % de moins qu’il y a six mois.

Face à un scénario de croissance lente et d’inflation élevée, il convient que les investisseurs fassent preuve de prudence

Ces dernières années, les investisseurs ont, d’une manière générale, fait l’impasse sur les sociétés de qualité et les sociétés affichant une croissance de qualité pour leur préférer d’autres styles. Il nous a ainsi, dans un premier temps, été donné d’observer une véritable ruée sur les stratégies de croissance dynamique, lorsque les taux d’intérêt ont été abaissés à zéro au printemps 2020, et que la récession induite par les mesures de confinement a rapidement pris fin. Partant du principe que l’argent était gratuit et que l’actualisation des bénéfices futurs était un jeu d’enfant, les investisseurs ont ainsi attribué des valorisations vertigineuses à des sociétés dont les bénéfices étaient faibles voire inexistants. Cet épisode a été suivi, en 2021, de la séquence de la «grande rotation», qui a vu les investisseurs délaisser la croissance au profit de stratégies « value ». Estimant qu’une fenêtre s’ouvrait qui permettait aux sociétés cycliques (y compris l’énergie et les matériaux), aux groupes industriels et aux établissements financiers de réaliser des bénéfices plus élevés, les investisseurs ont alors fait monter les cours des actions dans ces secteurs.

On assiste aujourd’hui à un renversement de tendance pour bon nombre de ces sociétés « value ». Que l’on en impute la faute à l’inflation, à la résurgence de la COVID-19 en Chine ou à l’action de Vladimir Poutine, le fait est que le monde est désormais un endroit moins sûr, voire plus effrayant lorsqu’il s’agit de réaliser des investissements. À l’exception notables des secteurs de l’énergie et des matériaux, le marché des transactions « value » semble s’essouffler. Il n’est à cet égard pas surprenant que, avec la hausse des taux et le ralentissement économique, les actions de nombreux acteurs de la construction, de l’ingénierie, de la construction automobile et de l’activité financière aient commencé à sous-performer le marché général: les investisseurs craignent, en effet, que la croissance ne ralentisse.

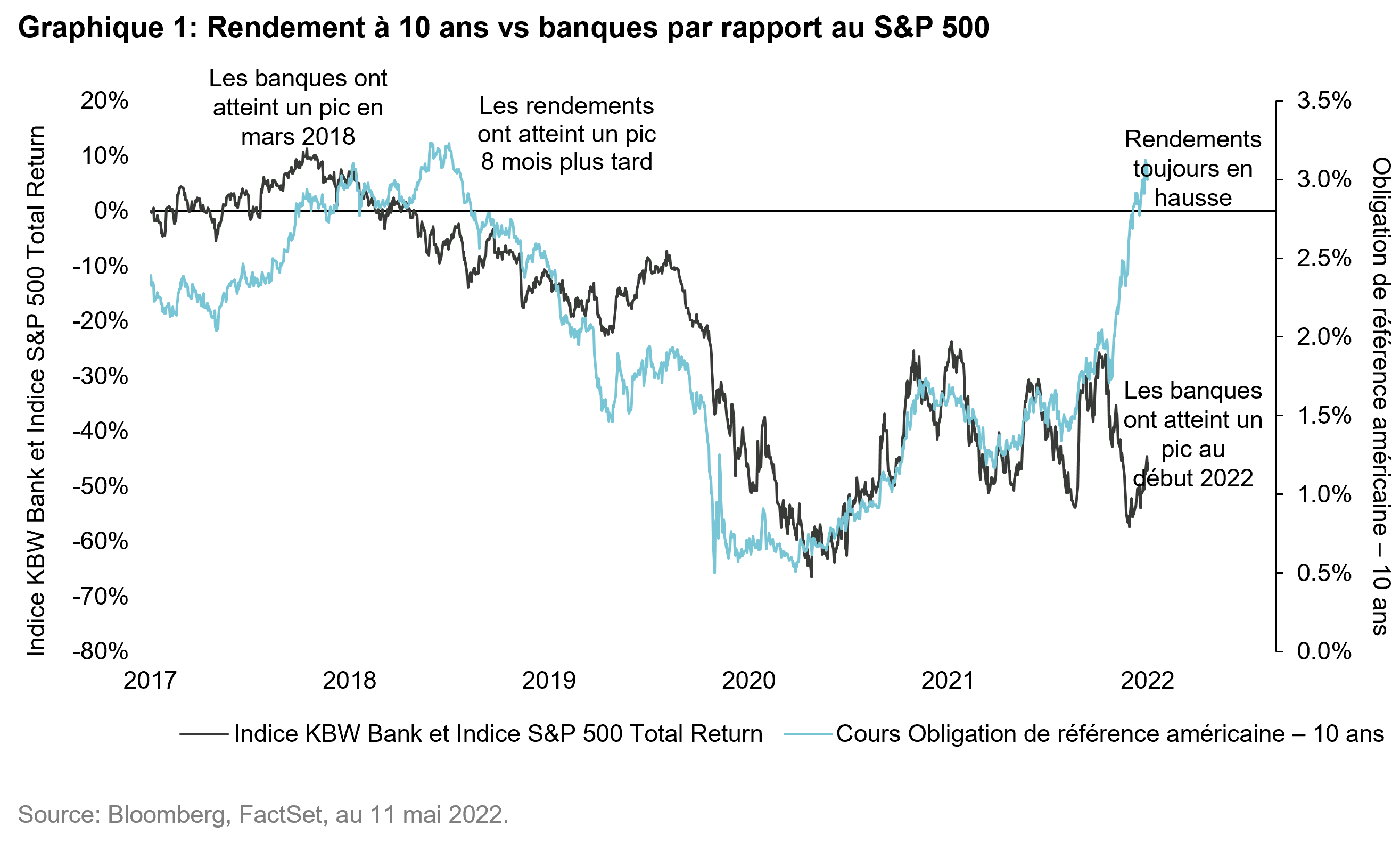

Les banques américaines, par exemple, sont actuellement confrontées à un doublement des taux hypothécaires sur les 18 derniers mois: ceux-ci s’établissaient ainsi à près de 5,1 % à la fin du mois d’avril, ce qui a pour effet d’entraîner une baisse de la croissance des prêts accordés dans le secteur du logement. La volatilité des marchés et la hausse des taux d’intérêt a, par ailleurs, donné lieu à un ralentissement des activités de banque d’investissement. Comme Balthazar en son temps, les banques voient l’écriture apparaître sur le mur et augmentent leurs réserves de crédit en prévision des périodes difficiles qui semblent s’annoncer. Les investisseurs soupèsent désormais les facteurs qui font pression sur les banques, ils observent les taux d’intérêt plus élevés et la baisse concomitante des prévisions de croissance, et considèrent qu’il ne s’agit pas là d’un bon scénario pour les actions bancaires. Après avoir atteint un pic en janvier-février de cette année, les actions bancaires ont ainsi récemment enregistré une forte baisse. Ces évolutions ont souvent tendance à précéder un mouvement de baisse des taux d’intérêt, or, la dernière fois que les actions bancaires avaient connu un pic en 2018, les taux d’intérêt avaient, eux, poursuivi leur augmentation pendant 8 mois (Graphique 1).

Les derniers secteurs à résister dans l’espace des titres « value » sont ceux de l’énergie et des matériaux. Mais les prix des matières premières ne sauraient constituer un pari à sens unique et la production ne pourra qu’augmenter aux États-Unis, au Canada et dans les pays de l’OPEP si les prix du pétrole restent élevés. Le vieil adage en vigueur selon lequel «le remède aux prix élevés de l’énergie réside dans des prix élevés de l’énergie» finira par s’appliquer, ce qui aura pour effet de réduire les prix du pétrole et du gaz, et, par là même, les valorisations des sociétés énergétiques. Les matériaux constituent un groupe diversifié au sein duquel certains métaux/minéraux sensibles à l’économie peuvent se trouver fortement impactés, tandis que d’autres fournissant le secteur du nucléaire ou celui des véhicules électriques (VE) peuvent s’en sortir relativement bien. À moyen et long terme, cependant, les matières premières demeurent des valeurs cycliques, de sorte que leur prix devrait finir par baisser, car l’offre est supérieure à la demande.

Quelles allures ces montagnes russes de l’investissement vont-elles prendre pour les investisseurs en actions misant sur le long terme ?

Comme à la fin d’une longue soirée de réjouissances, alors que décline l’éclat des sociétés de croissance « momentum » et des sociétés « value », seuls les abstinents – les investisseurs Quality Growth – nous semblent toujours à la fête. Ce sont eux, en effet, qui investissent dans des sociétés capables d’enregistrer une croissance régulière de leurs bénéfices et de dégager des marges d’exploitation élevées grâce aux fossés économiques dont s’entourent leurs activités. Ils peuvent effectivement détenir des sociétés ayant le pouvoir d’augmenter leurs prix en période d’inflation. Leurs sociétés affichent des niveaux d’endettement relativement faibles et peuvent donc plus facilement résister à des hausses de taux d’intérêt. Il est probable que les PDG de leurs sociétés ne se fendront que de commentaires relativement bénins quant aux perspectives commerciales actuelles et futures de leurs activités. Nous pensons donc qu’ils devraient passer des nuits relativement calmes.

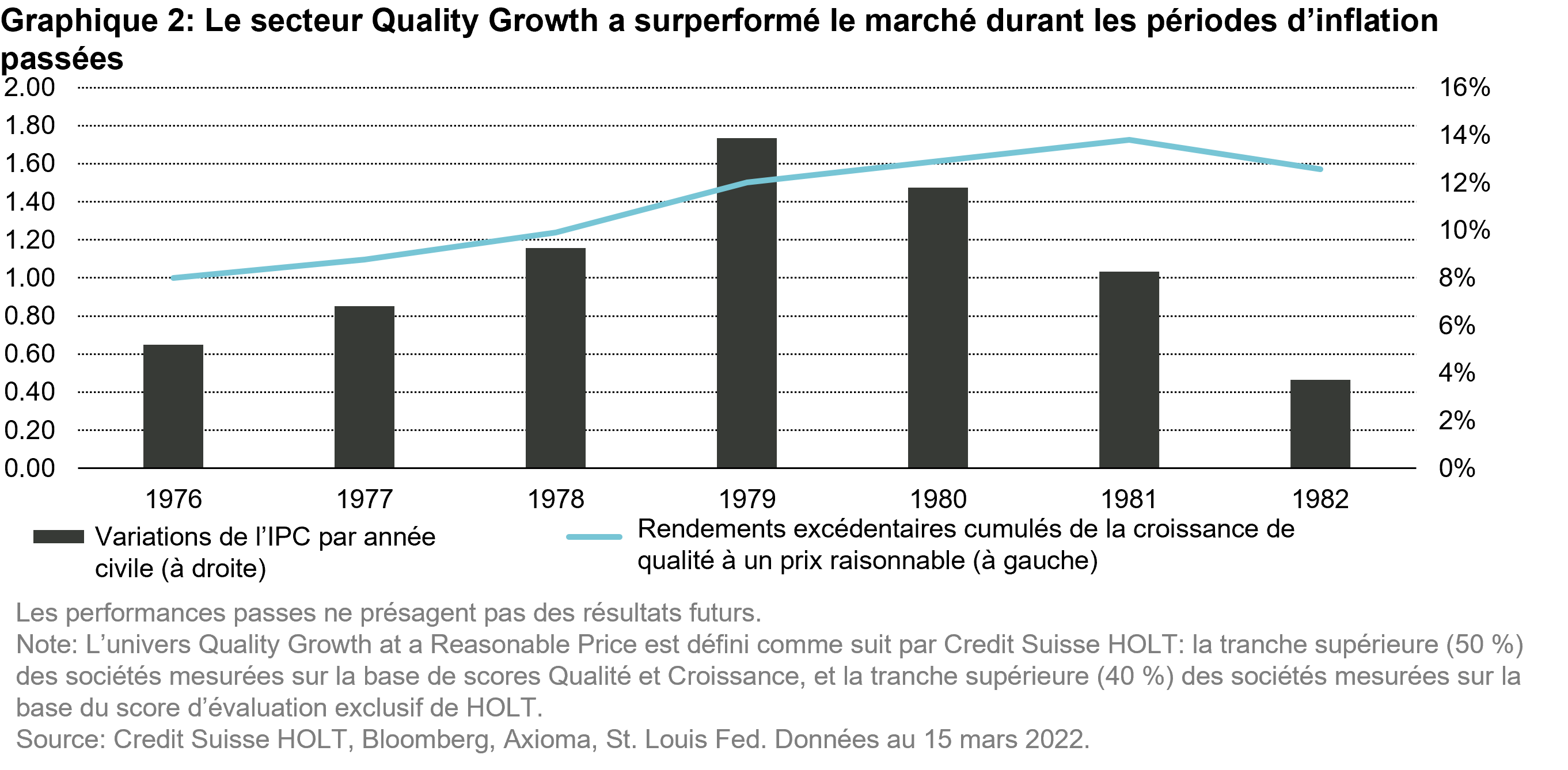

Source traditionnelle de titres de qualité élevée et de croissance fiable, le secteur de la consommation non cyclique a commencé à publier ses résultats trimestriels au mois d’avril. Nestlé, Procter & Gamble et Heineken ont annoncé qu’ils avaient chacun augmenté leurs prix d’environ 5 %. Les sociétés de qualité sont parfaitement en mesure d’augmenter leurs prix pour protéger leurs marges bénéficiaires. On comprend, dans ces conditions, que les investisseurs puissent récompenser ces sociétés en achetant leurs actions en période d’inflation, ainsi que cela s’était produit à la fin des années 1970, lorsque l’inflation faisait rage.

Confrontés à une inflation en forte hausse et à de faibles taux d’intérêt désormais en rapide augmentation, nous entrons désormais dans une nouvelle phase, dans laquelle le mouvement de balancier pourrait revenir se caler sur les valeurs Quality Growth, et mettre notamment l’accent sur les sociétés présentant des marges élevées, disposant d’un véritable pouvoir de fixation de leurs prix, et présentant un faible niveau d’endettement doublé de bénéfices constants. Selon nous, ce sont ces tortues qui finiront par l’emporter dans la longue course qui s’engage pour battre le marché global.

Par Douglas Bennett, Client Portfolio Manager

Pour accéder au Point de Vue complet (en anglais), cliquez ICI.

Pour accéder au site, cliquez ICI.

Cette communication commerciale ne constitue pas une offre, une incitation ou une recommandation d’achat ou de vente d’actions/de parts d’un fonds ou de tout autre instrument d’investissement en vue d’effectuer toute transaction ou de conclure tout acte juridique de quelque nature que ce soit, mais sert uniquement à des fins d’information. Les souscriptions aux parts d’un fonds de placement ne devraient être effectuées que sur la base du prospectus de vente, des informations clés pour l’investisseur, de ses documents constitutifs et du dernier rapport annuel et semestriel du fonds, ainsi que sur l’avis d’un spécialiste indépendant en finances, droit, comptabilité et impôts. La performance historique ne saurait préjuger des résultats actuels ou futurs. Les performances ne prennent pas en compte les commissions et les frais prélevés lors de l’émission ou du rachat des parts. Le rendement d’un investissement peut augmenter ou diminuer, par exemple en fonction des fluctuations monétaires. La valeur du capital investi dans un fonds peut augmenter ou diminuer et il n’y a aucune garantie de remboursement de l’intégralité ou d’une partie du capital investi. Bien que Vontobel soit d’avis que les informations figurant sur ce site s’appuient sur des sources fiables, Vontobel décline toute responsabilité quant à la qualité, l’exactitude, l’actualité et l’exhaustivité desdites informations. Pour des informations complémentaires concernant les conditions d’accès à ce site et relative aux fonds d’investissements, veuillez vous référer aux informations légales spécifiques ici .