L’analyse ESG conserve-t-elle tout son sens dans la gestion ? Lorsque l’on cherche à répondre à cette question, une analyse objective de la situation à mi-2024 invite – au minimum - à une certaine introspection.

Richard PANDEVANT, Responsable ESG

Richard PANDEVANT, Responsable ESG-

Les trajectoires Environnementales deviennent difficilement soutenables, certaines promesses initiales semblaient déjà hasardeuses ; la guerre en Ukraine n’a rien arrangé. Notre foi dans la multiplication des courbes « en J » sur des phénomènes physiques, énergétiques et industriels (sujets par nature à une forte inertie) n’est pas infinie. Le moment approche donc où des émetteurs (et des Etats, ce qui nous concerne moins directement en tant qu’investisseurs en actions) devront admettre qu’ils n’atteindront pas ces objectifs initiaux. La façon dont cela sera communiqué par chacun sera probablement riche en enseignements, notamment sur la qualité et la transparence des managements. L’important sera de continuer pour chacun à faire des efforts concrets d’amélioration, même si la « communication verte » finit par devenir moins centrale.

-

Le ban de tous les types d’armements – sans distinction - ne semble pas forcément compatible avec la défense de la démocratie. L’exclusion des armes controversées ne fait pas débat. Rien ne justifie jamais de faire subir aux populations civiles des dommages disproportionnés et pouvant durer des décennies. A l’inverse, l’actualité nous rappelle ce que l’Histoire nous avait normalement déjà tragiquement appris : la détention d’armes classiques – à visées militaires - détenues par des pays non-expansionnistes, peut dissuader ces derniers, éviter ou abréger des conflits, et au total épargner des vies humaines.

-

La quasi-totalité des ressources (brutes ou transformées) indispensables à la transition énergétique sont entre les mains de la Chine. Or, un enseignement majeur de ces dernières années est le cheminement depuis le « purement Environnemental » au dilemme « Environnemental mais pas à n’importe quel prix Social » puis au trilemme « Sécurité d’approvisionnement – coût Social – impact Environnemental ».

-

L’agenda politico-judiciaire aux Etats-Unis ouvre des incertitudes immenses. Aggravées par l’année électorale en cours, les tensions prennent des proportions jamais vues entre les tenants de l’ESG (souvent déjà rebaptisé « Transition & Responsible Investment ») et ceux qui considèrent que cela entrave la liberté, va à l’encontre des intérêts financiers des investisseurs et des entreprises, voire des intérêts des Etats-Unis tout court.

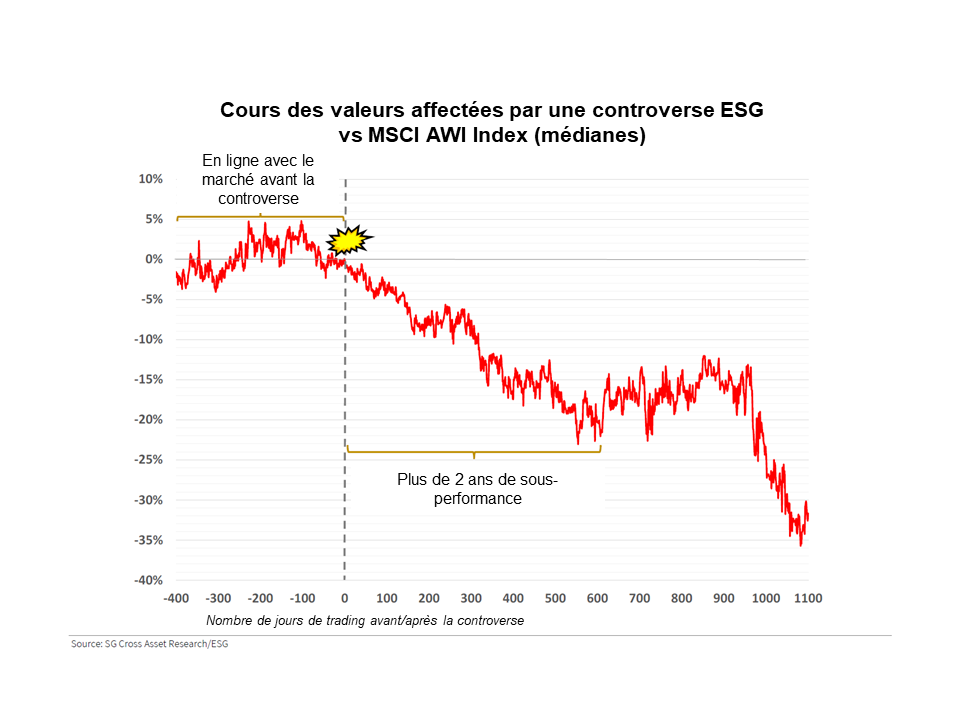

Dans ce tumulte, il est au contraire réconfortant que la validité des controverses ESG - en tant qu’élément d’analyse fondamentale d’une entreprise agissant efficacement sur les cours de bourse - se vérifie presque chaque semaine. A condition de se reposer sur sa propre analyse et sa propre connaissance approfondie des entreprises et de leur management, se mettre en situation de les anticiper (autant que possible) ou de les gérer au mieux (lorsqu’elles surviennent) peut être une boussole robuste, recouvrant en réalité tous les thèmes de l’investissement responsable.

Effet sur les cours de bourse

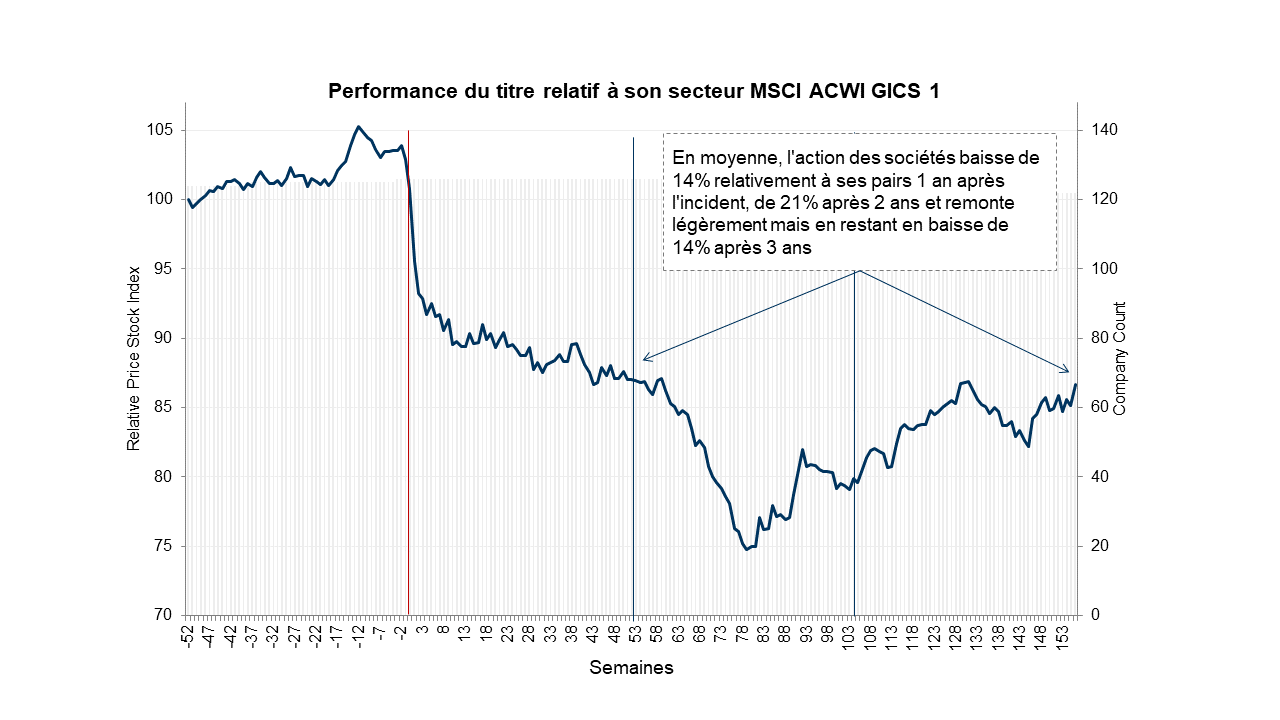

En moyenne, et même si les résultats des études à ce sujet diffèrent, il est désormais avéré et documenté – chiffres à l’appui - que le passage par une controverse sévère pour une entreprise se traduit par :

-

Une sous-performance boursière plus ou moins marquée dans les mois suivants,

-

La mise en « liste grise » plus ou moins excluante en pratique selon le type et la gravité de la controverse pour une durée que nous estimons en moyenne entre 18 mois et 2 ans, en fonction de la façon dont le management de l’entreprise réagit efficacement à la controverse. Nous entendons par là que certaines gestions excluront de facto le titre au moins pour une période de probation et que pour d’autres gestions, le titre sera jugé moins « fréquentable », se voyant appliquer de facto une décote plus ou moins durable.

Plusieurs facteurs influent sur la magnitude et l’impact de la baisse du cours de l’action concernée :

-

La sévérité de la controverse. Assez logiquement, plus la controverse est sévère, plus l'impact sur la performance du cours des actions est négatif.

-

Le secteur dans lequel évolue la société. Les valeurs du secteur de la santé sont particulièrement volatiles en cas de controverses, tandis que les valeurs du secteur de la consommation de base restent relativement immunisées.

-

La confiance envers le management de la société existant préalablement au déclenchement de la controverse.

Tous les types de controverses ne se valent pas

Dans le détail, le type de controverses et les sujets sur lesquels elles portent influent grandement sur l’effet plus ou moins fort que cela peut avoir sur les cours de bourse.

Sans surprise, les controverses portant sur des soupçons de malversations comptables sont celles qui impactent le plus sévèrement le cours de bourse des sociétés touchées, avec une sous-performance moyenne de plus de 50% à un an. Cela s’explique par le fait que dans un certain nombre de cas (minoritaires toutefois), la controverse est en fait le commencement de la mise au grand jour d’une véritable fraude comptable, qui peut entraîner la disparition pure et simple de l’émetteur.

A l’inverse, de façon contre-intuitive, les sociétés sujettes à une controverse sur le thème de la cybersécurité et de la protection des données connaissent en moyenne une légère surperformance dans les une à trois années qui suivent. Cela est en réalité un phénomène sectoriel spécifique : dans le domaine du digital et du marketing numérique, l’excès d’agressivité commerciale s’avère très payant, faisant plus que compenser le coût des controverses. En revanche, le résultat est différent si le même type de controverse touche une compagnie d’assurance, une banque ou une société de distribution grand public.

La revanche du « S » et du « G », où quand la confiance est rompue…

On voit fréquemment évidemment des controverses malheureusement liées à des pratiques environnementales (« E ») contestables. Des exemples récents sur la pollution de l’eau, la pollution de l’air, la pollution des sols, les polluants éternels montrent clairement que des comportements imprévoyants ou – pire encore – malveillants dans ces domaines sont inacceptables.

Toutefois, nous notons surtout que les controverses fonctionnent souvent comme un révélateur de manquements graves en matière sociale/sociétale (relation avec les employés, relation avec les communautés locales, …) ou de gouvernance (défaut grave notamment dans la prévention des risques de corruption. Dans de nombreux cas de controverses, certains signaux faibles étaient disponibles des mois, voire des années avant le déclenchement public. Cela est d’autant plus intéressant que ce type de controverse est par nature à même d’amener à de très fortes amendes et condamnations, voire à des pertes d’autorisation d'exploitation.

Nous notons enfin que, récemment, certaines des attaques de short sellers se sont portés contre des entreprises qui avaient déjà été fragilisées par une controverse ESG quelques mois auparavant, devenant ainsi une cible idéale pour ces attaques spéculatives, après la rupture de confiance entre le management et les intervenants de marché, ou – a minima – le doute déjà instillé.

Comment renforcer l’analyse & la gestion ?

Face à ces enjeux, plusieurs engagements se dégagent.

Premièrement, si parmi la multitude de données des agences de notations extra-financières, toutes ne sont pas toujours extrêmement pertinentes, celles qui dénotent des manquements graves sur des pratiques sensibles (respect de l’environnement, santé et sécurité des salariés et des clients, prévention de la corruption notamment) doivent être prises extrêmement au sérieux.

Cela est d’autant plus important que ces signaux sont disponibles parfois très longtemps avant la dégradation de note de controverses, qui intervient bien souvent « après la bataille ».

Plus important encore, l’interprétation des controverses naissantes ou des données préalables ne peut se faire efficacement de manière automatique. La connaissance profonde des entreprises et de leur management permet de réagir avec flexibilité et finesse. Pour des signaux en apparence identiques, la meilleure réaction ne sera pas forcément la même dans tous les cas.

Chez Exane Asset Management, nous avons mis en place des procédures d’anticipation et de détection des controverses, ainsi que de réaction en cas de controverse avérée. Dans ce cas, l’expertise du gérant sectoriel en charge de la valeur est systématiquement sollicitée et une décision collégiale est prise entre le spécialiste, les analystes ESG et la direction de la gestion. Grâce à cela, même si certains cas graves conduisent à une exclusion systématique, dans la plupart des cas, nous conservons une marge de manœuvre pour gérer chaque situation au mieux des intérêts des porteurs de fonds.

Pour accéder au site, cliquez ICI.