L’économie a survécu à la Covid, cependant qu’en est-il des populations qui ont survécu mais sont maintenant privées de nourriture, de soins de santé, de financement ou d’éducation ? Les rapports du Programme alimentaire mondial des Nations unies et d’autres organisations mondiales indiquent que leur situation vient d’empirer considérablement.

Dans son best-seller pré-Covid, « Factfulness » (« factualité »)1, le médecin et statisticien suédois Hans Rosling avait envoyé un message d’espoir selon lequel l’humanité s’améliore lentement mais sûrement. Cependant, le risque majeur qu’il voyait dans la lente progression vers une baisse globale des taux de natalité, une meilleure éducation et des soins de santé efficaces était une pandémie mondiale ; nous y voilà.

Comment les investisseurs peuvent-ils contribuer à la résolution de ces problèmes ? Privilégier les entreprises contribuant au changement environnemental et social peut nous aider à améliorer des vies humaines. Quels sont donc les défis ?

-

Plus de personnes souffrent de la faim

Selon le Programme alimentaire mondial (PAM)2, la pandémie a aggravé le problème mondial de la faim. La vie et les moyens de subsistance de 265 millions de personnes dans les pays à faible et moyen revenu sont menacés à cause de la Covid, contre 135 millions avant la crise sanitaire, a précisé l’Organisation des Nations unies. En outre, la Banque mondiale a constaté que les prix mondiaux des denrées alimentaires ont augmenté de 38 % depuis janvier 2020. Elle a averti qu’un nombre croissant de ménages devraient réduire la qualité et la quantité de leur alimentation.3 Des organisations non gouvernementales telles qu’Oxfam ont émis des avertissements similaires, préconisant des mesures.4

-

Les perspectives d’éducation s’aggravent

La fermeture d’écoles à cause de la Covid-19 a annulé des années de progrès en matière d’éducation. Avant la pandémie, le nombre estimé d’enfants ne pouvant pas être scolarisés d’ici 2030 s’élevait à plus de 200 millions, a déclaré l’ONU dans un rapport.5 L’enseignement à distance reste hors de portée pour 500 millions d’élèves, essentiellement dans les pays les plus pauvres, et les perspectives de réouverture des écoles restent incertaines dans de nombreuses régions en raison de la progression inégale des vaccinations.

-

Augmentation du travail des enfants

Le nombre d’enfants utilisés comme travailleurs peu coûteux a diminué de 100 millions, passant de 246 millions en 2000 à 152 millions en 2016, mais la pandémie et les effets secondaires tels que les fermetures d’écoles ont aggravé la situation. Le nombre d’enfants effectuant un travail manuel et souvent dangereux est le plus élevé en Afrique (72 millions), la plupart d’entre eux travaillant dans l’agriculture et l’élevage de bétail.6

-

Des systèmes de santé ravagés

La pandémie a ravagé les systèmes de santé et les économies des pays du monde entier, mais a mis à nu les différences de disponibilité des services de santé entre l’hémisphère nord et l’hémisphère sud, selon une étude publiée dans la revue scientifique Nature.7 Le journal a relevé les taux d’infection et de mortalité disproportionnellement élevés chez les personnes issues de milieux ethniques noirs et minoritaires au Royaume-Uni et parmi les Afro-Américains.

-

Les inégalités à nouveau en hausse

Selon un rapport sur le développement durable publié par une agence des Nations unies, l’inégalité des revenus a fortement augmenté depuis 1980, en dépit de certains progrès dans les parties les plus faibles de la répartition des revenus de la population mondiale.8 Si la moitié la plus pauvre de la population mondiale a vu ses revenus augmenter sensiblement (principalement en raison de la forte croissance en Asie), elle n’a reçu qu’une part de 12 % des bénéfices mondiaux, contre 27 % pour les 1 % les plus riches. Aux États-Unis, par exemple, alors que la productivité des travailleurs a doublé depuis les années 1980, la quasi-totalité des bénéfices a profité aux dirigeants, aux propriétaires et aux investisseurs.

Des « piliers » d’impact avec un angle social

Tels sont quelques-uns des défis auxquels nous sommes confrontés aujourd’hui. Mais si nous croyons que les investisseurs peuvent améliorer finalement la vie des gens, que devons-nous montrer pour étayer cette affirmation ? Et n’oublions pas que les investisseurs d’impact veulent voir exactement quels avantages environnementaux et sociaux leur investissement apporte.

Examinons notre stratégie Global Impact Equities reposant en partie sur notre stratégie de longue date en matière de technologies propres mais davantage axée sur le changement social. Nous expliquons la logique d’investissement des Global Impact Equities par les piliers dits d’impact ou ce que nous pensons être les domaines les plus prometteurs où les entreprises innovantes peuvent faire la différence, à savoir viser le bien commun par une activité rentable. Pour tracer et mesurer les progrès, nous avons défini des indicateurs clés de performance (ICP) pour chacun d’entre eux.

-

Alimentation et agriculture durables

Même s’il y a suffisamment de nourriture pour alimenter tous les peuples de la planète, des millions de personnes souffrent encore de la faim. Des pratiques agricoles résilientes, un accès facile aux technologies et aux marchés ainsi que la réduction des déchets alimentaires pourraient apporter la solution. Pour garantir la sécurité alimentaire tout en réduisant les dommages environnementaux et sociaux, nous devons soutenir l’agriculture écologique et équitable, l’irrigation et la fertilisation efficaces, le conditionnement sécurisé et hygiénique et l’efficacité de la logistique. Les indicateurs clés de performance permettant de mesurer les progrès réalisés par l’action des entreprises sont, par exemple, la quantité de déchets alimentaires évités ou la préservation de la biodiversité.

-

Une bonne santé et le bien-être

Pour parvenir à une couverture sanitaire universelle, l’accès de tous à des médicaments et vaccins sûrs et efficaces est essentiel. Cela suppose de soutenir la recherche et le développement ainsi que l’amélioration des infrastructures sanitaires. Les technologies innovantes en matière de santé et l’automatisation peuvent diminuer les coûts. Parmi les ICP permettant de mesurer les progrès accomplis figure une mesure de suivi de l’accès aux soins de santé et à l’assainissement.

-

L’égalité des chances

Les taux d’alphabétisation ont connu une augmentation spectaculaire. Mais de grandes disparités subsistent, car les enfants des plus pauvres ménages et ceux qui vivent dans les zones rurales des pays en développement sont moins susceptibles d’être scolarisés. Assurer une éducation inclusive et de bonne qualité est l’un des moyens les plus efficaces d’améliorer les opportunités. Une fois éduquées, les populations peuvent stimuler le développement économique et vivre en meilleure santé et plus longtemps. Parmi les ICP permettant de mesurer les progrès accomplis figurent la prestation de services d’éducation aux minorités ou aux étudiants à faibles revenus et l’accès à des services financiers.

-

Consommation responsable

La croissance économique conjuguée au développement durable requiert une réduction de notre empreinte environnementale. L’un des moyens d’y parvenir est de sélectionner soigneusement ce que nous consommons. Ce changement est déjà amorcé, à l’heure où les consommateurs se tournent vers des marques respectueuses de l’environnement et adoptent l’idée d’une économie circulaire. Les entreprises présentant des caractéristiques de durabilité élevées bénéficieront à terme de la tendance à une production plus respectueuse de l’environnement et de la société ou à l’extraction socialement responsable des ressources naturelles. Parmi les ICP visant à suivre les progrès accomplis figurent des mesures pour la promotion d’une économie circulaire et l’empreinte environnementale des chaînes d’approvisionnement.

Découvrez d’autres moyens de créer un impact avec vos investissements:

Six piliers pour des investissements à impact positif

Votre argent compte – créer un impact grâce aux marchés boursiers

Opportunités de marché – besoin de financement par le secteur privé

Les efforts déployés pour atteindre ces objectifs mondiaux seront colossaux, mais ils devraient également accroître les opportunités de marché dans les secteurs de l’alimentation et de l’agriculture ou de la santé, puis créer des millions d’emplois supplémentaires. La réalisation de ces objectifs ambitieux nécessitera des capitaux émanant à la fois d’acteurs publics et privés, car les gouvernements ne sont pas en mesure de régler cette note à eux seuls.

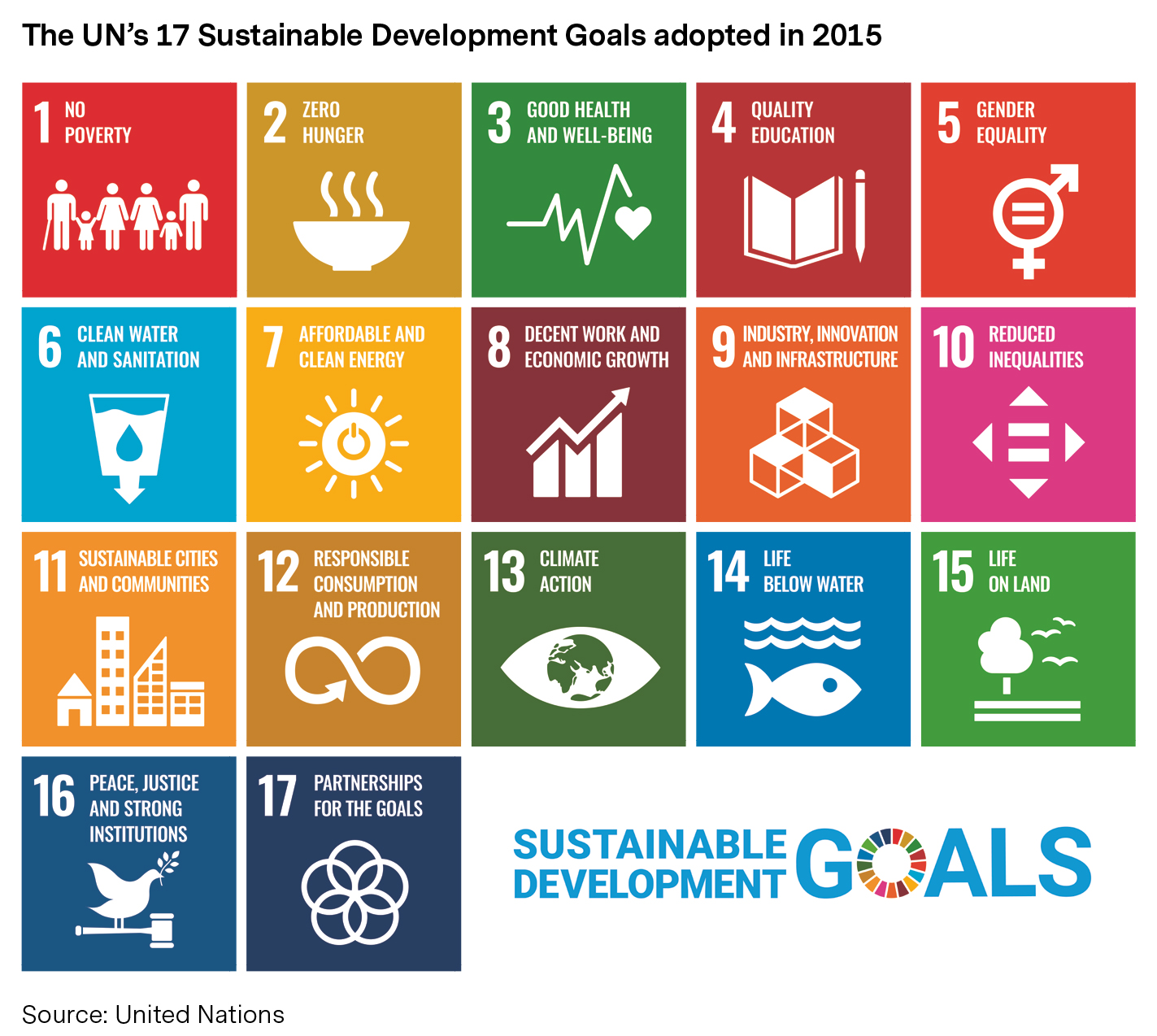

Comme toujours, les entreprises innovantes seront au cœur du changement environnemental et sociétal. Notre processus d’investissement comprend une évaluation permettant de déterminer si les activités de l’entreprise sont conformes à nos propres piliers d’impact, si elles soutiennent au moins un des objectifs de développement durable (ODD, voir ci-dessous) des Nations unies et comment elles contribuent aux indicateurs clés de performance que nous mesurons.

Ainsi, en identifiant les « bonnes » entreprises, nous pensons pouvoir apporter une contribution modeste à un monde meilleur. Et nous espérons que vous conviendrez que cela constitue un petit pas dans la bonne direction.

1. Factfulness, Flatiron Books, New York 2018

2. « Risque de pandémie de la faim, car le coronavirus devrait presque doubler la famine d’ici fin 2020 », PAM, le 16 avril 2020. https://www.wfp.org/stories/risk-hunger-pandemic-coronavirus-set-almost-double-acute-hunger-end-2020

« Sécurité alimentaire et Covid-19 », 21 mai 2021. “Food security and Covid-19”, May 21, 2021. https://www.worldbank.org/en/topic/agriculture/brief/food-security-and-covid-19

4. « Le monde au bord d’une nouvelle pandémie : le coronavirus menace de famine des millions de personnes », Oxfam International, 2021. https://www.oxfam.org/en/world-brink-hunger-pandemic-coronavirus-threatens-push-millions-starvation

5. https://unstats.un.org/sdgs/report/2020/Goal-04/

6. « 2021 : Année internationale de l’élimination du travail des enfants », Organisation internationale du Travail, 15 janvier 2021 https://www.ilo.org/tokyo/information/pr/WCMS_766351/lang--en/index.htm « Le travail des enfants a baissé de 38 % ces dix dernières années, mais la Covid a aggravé la situation : OIT », Business Standard, 16 janvier 2021 https://www.business-standard.com/article/current-affairs/child-labour-fell-38-in-last-decade-but-covid-worsened-situation-ilo-121011600285_1.html

7. « la pandémie de covid-19 souligne la nécessité d’un programme de santé mondial axé sur l’équité », Nature, 18 janvier 2021 https://www.nature.com/articles/s41599-020-00700-x 8 .

8. « L’avenir, c’est maintenant – la science au service du développement durable », rapport mondial des Nations unies sur le développement durable 2019. https://sdgs.un.org/sites/default/files/2020-07/24797GSDR_report_2019.pdf

Pour accéder au site, cliquez ICI.