Ali Dibadj, PDG, et Matt Peron, Responsable mondial du pôle Solutions, expliquent pourquoi un coût du capital plus élevé et une vague d’innovation sont susceptibles de créer des opportunités, et ainsi permettre aux investisseurs capables de se montrer sélectifs de faire la différence entre les entreprises bien positionnées et celles qui n’apprécient pas l’ampleur de ce changement radical.

Matt Peron, Responsable mondial du pôle Solutions et Ali Dibadj, PDG

Matt Peron, Responsable mondial du pôle Solutions et Ali Dibadj, PDG

Le terme changement de régime sur les marchés d’investissement est généralement associé au retour de l’inflation et des taux d’intérêt aux niveaux d’avant la crise financière mondiale. Cependant, nous pensons que le terme s’applique également à la façon dont il faut investir. Un coût du capital plus élevé modifie la recherche de performance de la part des entreprises et des investisseurs. Cela met notamment l’accent sur la sélectivité et une approche active de l’investissement.

L’ère des taux d’intérêt ultra-bas a faussé les processus d’allocation du capital. Comme nous l’avons étudié dans nos perspectives 2024, S'adapter au changement : trois moteurs pour établir un positionnement en matière d’investissement à long terme, qu’une organisation possède un bon ou un mauvais modèle économique n’était presque pas pertinent ; un faible coût du capital était facilement accessible pour soutenir même les entreprises les moins viables. Le retour des taux d’intérêt plus élevés a radicalement changé le paysage pour les entreprises, les financements étant désormais beaucoup plus difficiles à trouver et les investisseurs plus exigeants quant à leur allocation de capitaux.

Bien que nous nous attendions à ce que les taux d’intérêt baissent par rapport à leurs plus hauts actuels, la nouvelle normalité semble les établir à des niveaux plus élevés que celui inhabituellement bas antérieur à la pandémie. Cela obligera les entreprises à faire plus d'efforts pour attirer les capitaux des investisseurs et, avec des exigences plus strictes, certaines entreprises réussiront mieux que d’autres. En effet, de nombreuses entreprises vont échouer. Par conséquent, les investisseurs doivent adopter une approche plus rigoureuse de la sélection de titres, ce qui accroît l’importance d’une connaissance approfondie du secteur.

Des exigences plus élevées pour les entreprises favorise la gestion active

L’ère des taux bas a également coïncidé avec la croissance des stratégies d’investissement passives conçues pour suivre le marché. Les fonds qui reproduisent fidèlement l’indice de référence ont un rôle à jouer pour atteindre certains objectifs d’investissement. Pourtant, dans un environnement marqué par un coût du capital plus élevé, nous pensons qu’une approche active de la sélection de titres est mieux adaptée pour faire la distinction entre les gagnants et les perdants et pour générer des rendements exceptionnels.

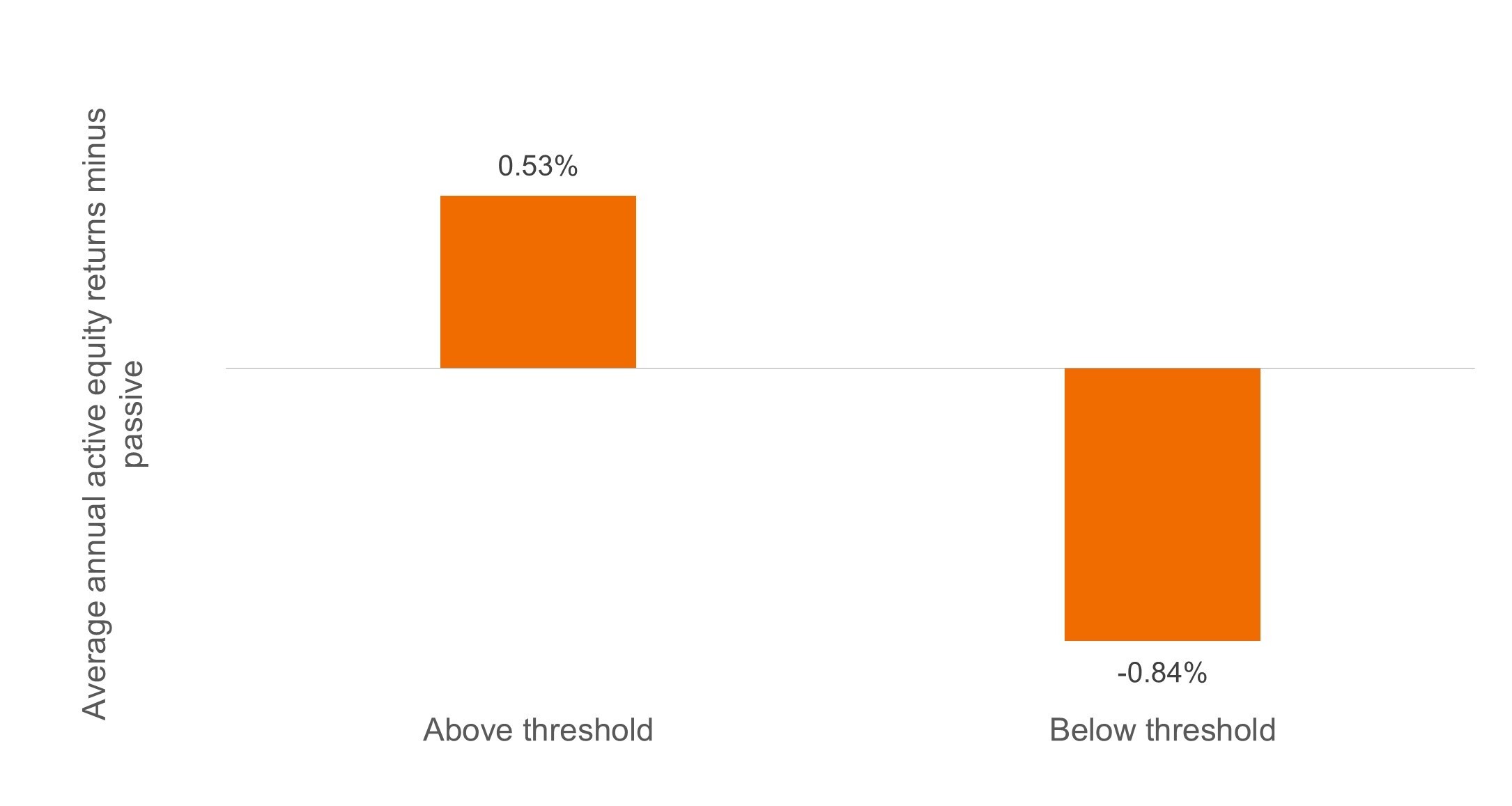

Cela se confirme lorsque l’on compare les performances des gestions actives et passives des actions américaines dans différents contextes de taux. D’après les données remontant à 1990, le fonds passif moyen a surperformé le fonds actif moyen lorsque le rendement des bons du Trésor US à 10 ans était inférieur ou égal à 3,50 %. Cependant, lorsque ce rendement est supérieur à 3,50 %, comme nous le prévoyons dans un avenir prévisible, le fonds moyen dédié aux actions américaines a toujours surperformé. Bien sûr, ces chiffres sont basés sur les fonds actif et passif moyens, et des gérants actifs possédant des compétences éprouvées en matière de recherche et de solides historiques de performance ambitionneraient de faire mieux.

La gestion active a surperformé la gestion passive sur le segment des actions américaines lorsque le rendement des bons du Trésor à 10 ans était supérieur à 3,50 %

Source : Bloomberg, Morningstar, Janus Henderson Investors, à fin avril 2024. Données depuis le 31 décembre 1989, moyennes non pondérées par la capitalisation boursière.

Source : Bloomberg, Morningstar, Janus Henderson Investors, à fin avril 2024. Données depuis le 31 décembre 1989, moyennes non pondérées par la capitalisation boursière.

Le fossé de l’innovation – se creuse

Ce n’est pas seulement le coût plus élevé du capital qui nous incite à penser que les investisseurs menant des recherches approfondies seront récompensés dans les années à venir. L’ampleur des changements qui se produisent dans l’économie creuse le fossé potentiel entre les gagnants à long terme et les entreprises les plus exposées au risque d’être mises à l'écart. Pendant des années, ce fossé a été visible dans le secteur de la technologie, alors que des nouveaux arrivants innovants ont créé des secteurs entièrement nouveaux ou ont remplacé des acteurs existants trop lents à réagir.

Cette destruction créatrice s’est déjà répandue dans d’autres secteurs, et les progrès rapides de l’intelligence artificielle (IA) et d’autres nouvelles technologies vont probablement creuser ce fossé. C’est particulièrement évident dans le domaine de la santé, où les groupes pharmaceutiques et biotechnologiques créent de nouvelles classes de thérapies inédites à un rythme croissant.

Comme pour les autres vagues d’innovation, toutes les entreprises n’adopteront pas une stratégie efficace. Celles qui ne le font pas risquent de perdre des parts de marché ou rebuteront les investisseurs par leur incapacité à augmenter leurs bénéfices aussi rapidement que leurs concurrentes en constante évolution. À titre d’exemple, les grandes capitalisations américaines qui se sont engagées à financer la recherche et le développement (R&D) pour favoriser l’innovation ont surperformé celles qui ne l’ont pas fait (voir le graphique ci-dessous). Du point de vue de l’investissement, nous pensons qu’une compréhension approfondie des forces structurelles en jeu, combinée à la recherche d’experts sur la stratégie de l’entreprise, sera essentielle pour s'adapter au changement et générer de la surperformance.

L’innovation est importante : les avantages de la recherche et du développement sur la performance des actions américaines

La surperformance du ratio stock de R&D/VE du quintile supérieur s’inscrit dans la continuité d’une tendance vieille de plusieurs décennies, tandis que la surperformance du ratio R&D/chiffre d'affaires reflète les investissements massifs plus récents dans la digitalisation de l’économie mondiale.

Source : Empirical Research Partners, avril 2022. Valeurs de grande capitalisation, performance par rapport aux quintiles supérieur et inférieur de certains facteurs. Données mensuelles équipondérées cumulées en périodes annuelles. Période de dix ans prenant fin mi-avril 2022. Le ratio stock de R&D/VE correspond au stock capitalisé des dépenses de R&D, accumulé sur des périodes de trois à huit ans selon le secteur, par rapport à la valeur d’entreprise.

Source : Empirical Research Partners, avril 2022. Valeurs de grande capitalisation, performance par rapport aux quintiles supérieur et inférieur de certains facteurs. Données mensuelles équipondérées cumulées en périodes annuelles. Période de dix ans prenant fin mi-avril 2022. Le ratio stock de R&D/VE correspond au stock capitalisé des dépenses de R&D, accumulé sur des périodes de trois à huit ans selon le secteur, par rapport à la valeur d’entreprise.

Rester souple sur les marchés

Les périodes de transition et les perturbations rapides obligent les investisseurs à rester vigilants. À mesure que les répercussions de la hausse du coût du capital et de l’innovation se font sentir, nous nous attendons à une plus grande dispersion de la performance des actions. Les valeurs de croissance devront « mériter » leur multiple. Autrement dit, sans le soutien d'un faible taux d’escompte envers les valorisations, elles devront prouver qu’elles peuvent augmenter leurs bénéfices plus rapidement que le marché sur une période prolongée.

Les entreprises qui dépendent des marchés de la dette pour se financer reconnaissent que les investisseurs ont désormais d'autres possibilités. Elles ne pourront plus compter sur une forte demande du marché lorsqu'elles devront renouveler leur dette arrivant à échéance. Elles devront plutôt démontrer leur capacité à générer suffisamment de liquidités pour couvrir leurs obligations et, dans les cas où un financement par emprunt sera nécessaire, avoir la rigueur nécessaire pour gérer judicieusement leur bilan. Il vaudra ainsi mieux éviter celles qui ne le pourront pas car, sans le soutien d’investisseurs en quête de rendement, leur solvabilité et leur position dans l’indice de référence pondéré en fonction de la capitalisation boursière sont menacées.

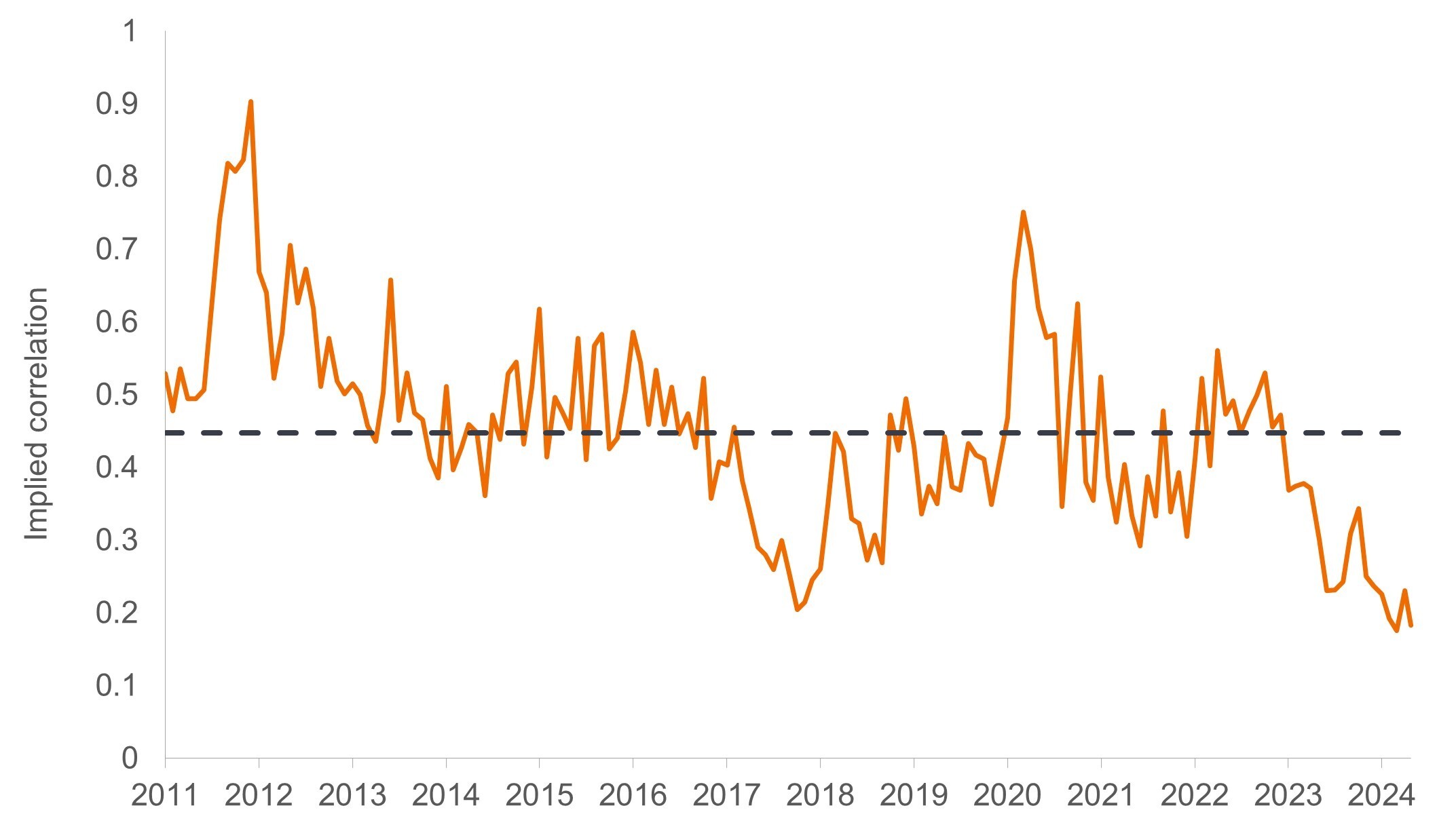

Le processus de distinction entre les gagnants et les perdants a déjà commencé. Après une longue période d’évolution quasi ininterrompue des marchés financiers – souvent en réaction à des données macroéconomiques – des facteurs spécifiques guident de plus en plus la performance des titres individuels. Sur les marchés actions, les corrélations entre les 100 principales valeurs de l’indice S&P 500 sont au plus bas – et il n’est pas surprenant que la baisse ait été catalysée par la réinitialisation des taux.

Séparer le bon grain de l’ivraie : corrélations au sein de l’indice S&P 500

Les corrélations entre les principales composantes de l'indice S&P 500 ont chuté précipitamment, dans un contexte où les investisseurs cherchent à identifier les modèles économiques les mieux adaptés à une ère définie par une hausse du coût du capital et de l’innovation.

Source : Bloomberg, Janus Henderson Investors, à fin mai 2024.

Source : Bloomberg, Janus Henderson Investors, à fin mai 2024.

La recherche réaffirme son rôle

Les marchés financiers ont survécu – et dans certains cas ont prospéré – durant la période de taux bas. En revanche, une multitude de distorsions a interféré avec les prix du marché, ce qui a finalement affecté le comportement des investisseurs. La politique accommodante et la quête de rendement ont donné lieu à des vagues successives d’évolutions macroéconomiques et de facteurs de style qui ont influencé la performance de classes d’actifs entières. De nombreux investisseurs se sont familiarisés avec les stratégies top-down, de momentum et passives. À l’avenir, nous pensons que de telles stratégies seront confrontées à des difficultés, car les entreprises visionnaires et les entreprises émergentes suiveuses connaîtront des fortunes diverses du fait de la hausse du coût du capital et de l'innovation rapide.

L'importance de faire la distinction entre ces deux profils en tirant parti de la recherche fondamentale et de l’expertise sectorielle devrait permettre aux experts de l'investissement de retrouver leur rôle historique en matière d’allocation productive des capitaux. Dans le processus, les investisseurs qui comprennent cet impératif et s'adaptent avec succès à ce changement de régime devraient être récompensés.

Pour accéder au site, cliquez ICI.

À propos de Janus Henderson

Le groupe Janus Henderson est un gestionnaire d’actifs mondial de premier plan qui a pour mission d’aider ses clients à définir et à atteindre des résultats financiers supérieurs grâce à une vision différenciée, à un processus d’investissement rigoureux et à un service de premier ordre.

Au 31 mars 2024, Janus Henderson gérait environ 353 milliards de dollars US d'actifs, employait plus de 2 000 personnes et possédait des bureaux dans 24 villes du monde entier. La société aide des millions de personnes dans le monde à investir ensemble dans un avenir meilleur. Janus Henderson, dont le siège est à Londres, est cotée à la Bourse de New York (NYSE).