La vigueur de l’économie américaine, qui défie les prévisions, a été l’un des principaux moteurs des marchés financiers ces derniers trimestres, mais comme les perspectives économiques divergent, nous estimons que la valeur relative des titres obligataires est meilleure en Europe aujourd’hui.

Felipe Villarroel, Partner, Portfolio Management

Felipe Villarroel, Partner, Portfolio Management

En bref :

-

Les hauts rendements et les baisses de taux attendues sont favorables aux obligations, mais l’environnement macroéconomique reste incertain et l’inflation difficile à prévoir.

-

Constituer un portefeuille en tablant sur un rebond important des emprunts d’État en raison des baisses de taux n’est probablement pas une stratégie gagnante. Nous pensons que les revenus seront la composante la plus importante des rendements totaux au cours des prochains trimestres.

-

Selon nous, l’environnement macroéconomique de l’Europe semble désormais plus favorable que celui des États-Unis pour les investisseurs en obligations, et les spreads de crédit plus importants de l’Europe pourraient offrir une meilleure valeur.

En ce qui concerne le second semestre 2024, nous pensons que les conditions de marché pour les obligations dans l’ensemble semblent favorables. Les rendements de l’ensemble de la classe d’actifs restent élevés par rapport à l’histoire récente et les banques centrales sont en passe de procéder à des baisses de taux d’intérêt attendues de longue date.

Toutefois, l’environnement macroéconomique mondial reste incertain. Le calendrier des élections est chargé au second semestre, à un moment où les niveaux d’endettement des gouvernements sont de plus en plus surveillés. Les réductions attendues des taux d’intérêt, déjà fortement limitées depuis le début de l’année, dépendent toujours de données difficiles à prévoir, et la baisse de l’inflation reste également vulnérable à une toile de fond géopolitique volatile.

À notre avis, un portefeuille diversifié est le meilleur moyen de tirer parti de cette situation et les investisseurs devront chercher les revenus les plus intéressants dans toutes les régions du monde. En termes de valeur relative, nous considérons que les marchés obligataires européens sont plus attractifs que les marchés américains.

L’Europe connaît une trajectoire plus claire vers la baisse des taux d’intérêt

La vigueur de l’économie américaine a été le thème dominant sur les marchés financiers pendant une grande partie de 2024 et 2023, avec des données toujours solides qui ont fait se resserrer les spreads des obligations d’entreprises, ont fait grimper les actions à des niveaux record et ont anéanti les espoirs de multiples baisses de taux d’intérêt de la part de la Réserve fédérale (Fed).

Toutefois, les conditions économiques des marchés développés ont récemment commencé à diverger. Après être restées à la traîne de la Fed dans leurs efforts pour maîtriser l’inflation, la Banque centrale européenne (BCE) et la Banque d’Angleterre (BoE) ont désormais pris de l’avance sur la voie des baisses de taux.

Selon nous, les perspectives d’inflation de l’Europe sont plus claires que celles des États-Unis. L’ampleur et la portée des mesures de relance budgétaire et monétaire de l’ère COVID ont été bien plus importantes aux États-Unis qu’en Europe. L’impact inflationniste de cette relance était plus difficile à démêler lorsque les chaînes d’approvisionnement perturbées jouaient également un rôle important, mais maintenant que l’offre s’est largement rétablie, il devient de plus en plus évident que la demande mettra plus de temps à rebondir aux États-Unis. Par conséquent, la BCE estime avoir une meilleure visibilité sur le retour de l’inflation à l’objectif, ce qui l’a incitée à réduire ses taux de 25 pb lors de sa réunion de juin.

La trajectoire de croissance de l’Europe est également devenue plus attrayante pour les investisseurs obligataires. L’économie de la zone euro se remet de la crise énergétique et des relèvements de taux successifs de manière résiliente. La croissance devrait s’accélérer, passant d’un peu moins de 0,5 % en 2023 à près de 1 % en 2024, et plus encore l’année suivante.

En tant qu’investisseur en obligations, une croissance trop importante n’est pas à exclure. Lorsque la croissance dépasse les anticipations pendant une période prolongée, cela entraîne généralement une inflation et force les banques centrales à augmenter les taux, ce qui entraîne des pertes de valeur de marché et une volatilité des obligations. En théorie, une croissance «supérieure au potentiel» augmente également le risque d’une contraction économique plus sévère (un «atterrissage brutal») à l’avenir. La croissance en Europe est faible mais positive et s’éloigne de la récession. Aux États-Unis, la croissance a été supérieure au potentiel pendant un certain temps et ralentit maintenant.

Soyons clairs: nous ne suggérons pas que l’environnement macroéconomique des États-Unis est mauvais. Mais nous pensons effectivement que pour les investisseurs en obligations, les conditions semblent plus favorables en Europe à ce stade.

Les spreads européens semblent plus attractifs

Les spreads des obligations d’entreprises se sont considérablement resserrés ces derniers trimestres dans le monde entier, les craintes d’un atterrissage brutal s’étant estompées. Cependant, tout comme pour les conditions macroéconomiques, des divergences sont apparues entre les zones géographiques.

Après une contraction régulière ces derniers mois, les spreads des obligations d’entreprises américaines sont désormais presque aussi minces que ceux observés depuis la crise financière mondiale; à la fin du mois de mai, les spreads des obligations Investment Grade (IG) et haut rendement (HY) s’établissaient à 88 pb et 338 pb, non loin de leurs niveaux respectifs postérieurs à 2008 de 82 pb et 316 pb atteints à la mi-20211. En d’autres termes, les investisseurs sont relativement peu payés pour détenir des risques d’entreprise plutôt que des bons du Trésor américain.

En revanche, les spreads européens ne se sont pas resserrés de manière aussi agressive. Les spreads correspondants sur les obligations IG et HY européennes s’établissaient fin mai à 108 pb et 351 pb, à une certaine distance de leurs niveaux respectifs postérieurs à 2008 de 72 pb et 235 pb atteints fin 2017 et début 22.

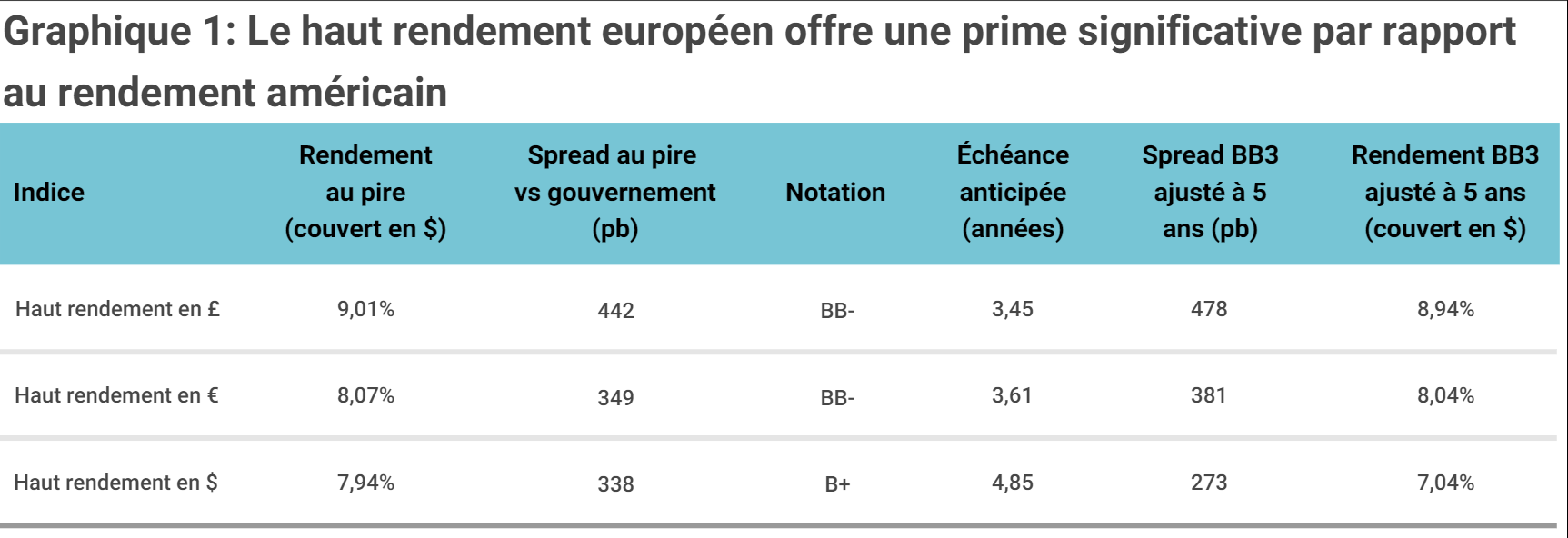

Comme le montre le graphique 1, l’opportunité de rendement des obligations européennes et américaines à haut rendement semble pratiquement identique au niveau global. Toutefois, si l’on tient compte de la duration et de la notation des indices respectifs pour établir une véritable comparaison, le haut rendement européen offre une prime significative.

Pour consulter l'article dans son intégralité, veuillez cliquer ICI.

Pour accéder au site, cliquez ICI.