En bref :

- Il est peu probable à notre avis que sous un deuxième mandat Trump, l’Inflation Reduction Act (IRA) soit détricoté.

- Les moteurs de la transition énergétique sont tenaces et indépendants des partis au pouvoir. La dynamique est forte et il serait probablement difficile de forcer un ralentissement alors que l’économie effectue sa mue en faveur des industries propres.

- Les incertitudes électorales actuelles peuvent certes s’accompagner d’une volatilité des marchés, mais des perturbations temporaires sur le marché peuvent créer des points d’entrée favorables pour des investissements à long terme dans les technologies pour l’énergie propre et la transition.

D’ici la fin de cette année électorale historique, près de la moitié de la population mondiale aura voté pour élire ses dirigeants. Dans la première économie mondiale, l'élection n'est pas encore décidée. Quelles seraient les conséquences d’un deuxième mandat de Donald Trump pour la neutralité carbone?

Aux États-Unis, le parti républicain et le parti démocrate ont des positions divergentes sur le changement climatique, la transition énergétique et les critères ESG. Au cours de son premier mandat, Trump a pris d’importantes mesures allant à l’encontre des politiques climatiques: retrait de l’Accord de Paris sur le changement climatique; rejet de la constatation par le National Climate Assessment1, que le changement climatique est provoqué par l’être humain et risque d’avoir des effets négatifs sur l’économie2; détricotage de nombreuses réglementations relatives au climat3; et tentatives de bannir les considérations ESG des régimes de retraite dans le secteur privé4. Trump a qualifié les critères ESG d’«ineptie d’extrême gauche»5 et s’est engagé à continuer à s’y opposer6.

Pour les investisseurs, cela souligne l’importance d’analyser en profondeur les réglementations et politiques. Cela peut aider à distinguer que la rhétorique et réalité politique sont cependant deux choses différentes. Alors que la campagne de Trump semble indiquer une volonté de démanteler les initiatives ESG, la réalité dresse souvent un tableau plus nuancé. Nous pensons que, passés les premiers moments, les changements radicaux seront moins nombreux que ce que l’on pourrait craindre.

D’une part, le think-tank conservateur « The Heritage Foundation » s’est engagé à promouvoir son «Projet 20257», dont l’objectif est de démanteler les politiques environnementales de Président Joe Biden, y compris l’historique Inflation Reduction Act (IRA). Alors que certains investisseurs craignent un éventuel détricotage des politiques vertes, les engagements financiers considérables d’ores et déjà pris par le gouvernement américain et le secteur privé rendent difficile le démantèlement de ces initiatives. L’IRA est une loi en vigueur et les dépenses associées se chiffrent en milliards. Le démantèlement de politiques si fermement ancrées se heurterait probablement à une opposition et des obstacles logistiques considérables.

Nous pensons que l’IRA de Biden restera intacte. De nombreux États républicains notamment ont bénéficié des investissements ESG. Le Texas se place au premier rang des États pour la production d’énergie propre d’après l’Environment Texas Research & Policy Center8, ce qui prouve que les avantages économiques des énergies renouvelables peuvent être transpartisans.

Les trois quarts environ des investissements promis dans la production d’énergie propre depuis l’adoption de l’IRA sont destinés à des États dirigés par des gouverneurs républicains, d’après une note d’analystes de JP Morgan datée du 7 mai 20249. En fait, les analystes de JP Morgan soulignent que les États républicains donnent l’exemple en ce qui concerne la mise en œuvre de l’énergie propre et reçoivent 80 % de l’ensemble des financements, la Géorgie, le Texas et l’Oklahoma étant les premiers bénéficiaires. En 2023, le Texas, suivi de la Floride, est l’État qui a enregistré le plus grand nombre de nouvelles installations photovoltaïques, dépassant la Californie pour la deuxième fois au cours de trois dernières années, d’après la note. Le Texas, l’Oklahoma et l’Iowa occupent les trois premières places en matière d’installations éoliennes.

Une autre raison qui nous incite à penser que Trump n’apportera pas de modifications à l’IRA est le fait qu’une grande partie des subventions prévues par l’IRA se présente sous la forme de crédits d’impôt (non plafonnés, dans de nombreux cas). Un démantèlement s’accompagnerait donc d’une augmentation d’impôts, ce que les Républicains évitent généralement de faire.

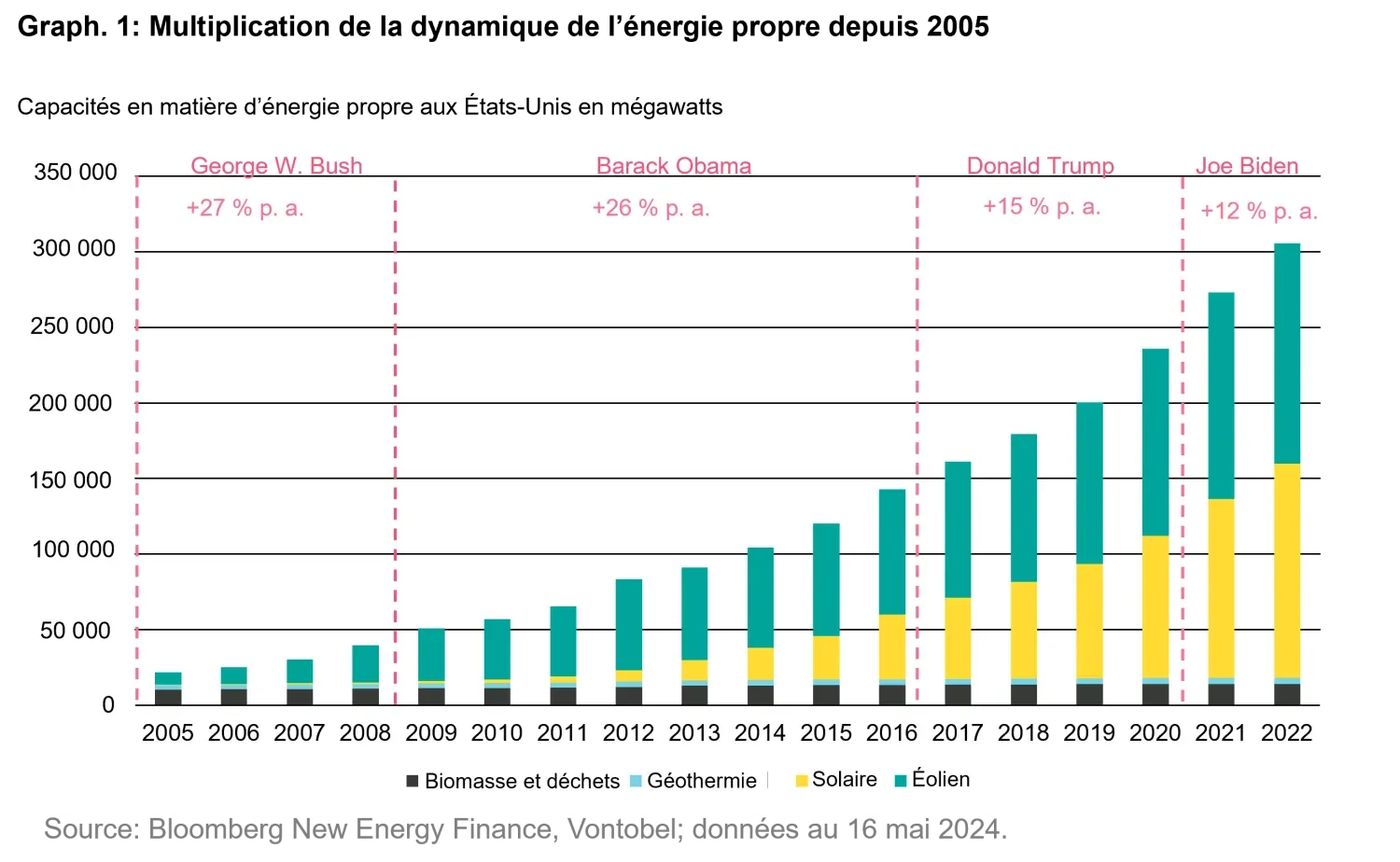

En outre, l’histoire montre que les moteurs forts de la transition énergétique se maintiennent, quel que soit le parti au pouvoir. Les capacités en matière d’énergie propre ont augmenté aux États-Unis aussi bien sous les gouvernements républicains que démocrates, avec des taux de croissance légèrement plus élevés sous Trump que sous Biden (voir le graphique 1). Ces constatations suggèrent que ce sont les forces du marché et les progrès technologiques, plutôt que les agendas politiques, qui favorisent l’adoption de l’énergie propre.

Les facteurs favorisant l’électrification, l’approvisionnement en énergie propre et l’efficacité énergétique s’imposeront probablement sur le long terme même en dehors de tout soutien politique et de subventions. Et les technologies liées à l’énergie renouvelable, les solutions de construction et les véhicules électriques sont d’ores et déjà compétitives. Au cours des dix dernières années, le coût de l’énergie issue de sources solaires et éoliennes onshore a chuté respectivement de plus de 80 % et de près de 70 %10, faisant de ces sources des options viables, quelle que soit la politique appliquée à l’échelle fédérale. L’énergie solaire devrait même devenir la principale source d’électricité mondiale à la place des combustibles fossiles d’ici 2050, d’après une étude publiée dans Nature Communications en octobre 2023, qui évoque un «point de basculement irréversible».11

En effet, le système énergétique présente des signes de changement exponentiel, dont les énergies renouvelables, l’électrification et l’efficacité énergétique seraient les principaux moteurs, d’après une note d’analystes de Jefferies datée du 13 juin 202412. Les installations photovoltaïques totales ont doublé dix fois depuis les années 1970, et celles éoliennes ont doublé six fois au cours des vingt dernières années, d’après la note, qui ajoute qu’à chaque doublement du déploiement, les coûts des technologies propres ont diminué d’environ 20 %, avec une chute des prix de près de 80 % rien qu’au cours de l’actuelle décennie. À notre avis, ce virage économique offre des vents arrière structurels pour les entreprises qui proposent des solutions environnementales évolutives.

Les incertitudes électorales actuelles peuvent certes s’accompagner d’une volatilité des marchés, mais aussi d’opportunités d’investissement. Des perturbations temporaires sur le marché peuvent créer des points d’entrée favorables pour des investissements à long terme dans les technologies pour l’énergie propre et la transition. Nous sommes de l’avis que la croissance et la progression des infrastructures destinées aux énergies renouvelables devraient se poursuivre, indépendamment des résultats électoraux. Nous pensons que les avantages économiques des énergies renouvelables, tels que des coûts d’exploitation moindres et les progrès technologiques engendrés, sont considérables. Il est donc à notre avis difficile qu’un gouvernement quel qu’il soit puisse les ignorer.

Ainsi, bien que certains investisseurs pourraient ressentir des pressions politiques accrues les incitant à réduire leurs engagements ESG, la dynamique générale en faveur d’une économie plus propre est forte. L’ancrage des politiques vertes actuelles, les investissements financiers considérables déjà effectués et la viabilité économique des technologies renouvelables permettent de supposer que la tendance en faveur des solutions à faible émission de carbone se poursuivra et rendra les conséquences d’un deuxième mandat de Trump moins dramatiques que ne le laisse présager la rhétorique.

Pascal Dudle, Head of Impact & Thematic Investing, Lead Portfolio Manager, et Matthias Fawer, Senior ESG & Impact Analyst

Pour accéder au site, cliquez ICI.