La gestion multi-actifs s’est imposée au fil du temps comme une solution « cœur » dans le monde de l’épargne financière malgré une année 2022 marquée par des turbulences extrêmes. Jean-François Fossé, Directeur de la Gestion Multi-Actifs chez Ofi Invest Asset Management, revient sur ce contexte si particulier, analyse les facteurs de résilience et les perspectives qu’offre la gestion multi-actifs aux épargnants.

Jean-François FOSSÉ, Directeur de la Gestion Multi-Actifs chez Ofi Invest AMUne inflation galopante, un resserrement monétaire de grande ampleur et une forte instabilité géopolitique combinés en 2022 ont entamé la confiance des investisseurs dans les vertus de la gestion multi-actifs dont les performances dans ce contexte se sont révélées décevantes à court terme. À l’époque, certains n’avaient pas hésité à prédire la fin d’un modèle de gestion de l’épargne collective. Une prédiction qui s’est avérée prématurée, voire erronée, car deux ans plus tard cette gestion affiche un renouveau de performances avec la normalisation des marchés et l’enrichissement des méthodes de gestion.

Jean-François FOSSÉ, Directeur de la Gestion Multi-Actifs chez Ofi Invest AMUne inflation galopante, un resserrement monétaire de grande ampleur et une forte instabilité géopolitique combinés en 2022 ont entamé la confiance des investisseurs dans les vertus de la gestion multi-actifs dont les performances dans ce contexte se sont révélées décevantes à court terme. À l’époque, certains n’avaient pas hésité à prédire la fin d’un modèle de gestion de l’épargne collective. Une prédiction qui s’est avérée prématurée, voire erronée, car deux ans plus tard cette gestion affiche un renouveau de performances avec la normalisation des marchés et l’enrichissement des méthodes de gestion.

Une année 2022 sous tension

2022 a mis à rude épreuve les stratégies de gestion dite traditionnelles. La correction simultanée des marchés actions et des marchés obligataires a remis en question les principes fondamentaux de la diversification classique, qui reposaient pour l’essentiel sur un moteur de performance actions et une forme de protection offerte par l’exposition aux obligations.

Si 2022 a été une année de remise en question pour les gérants d’actifs, elle a également représenté une opportunité pour ces gestionnaires de repenser leurs approches et de montrer leurs capacités à naviguer dans des conditions adverses.

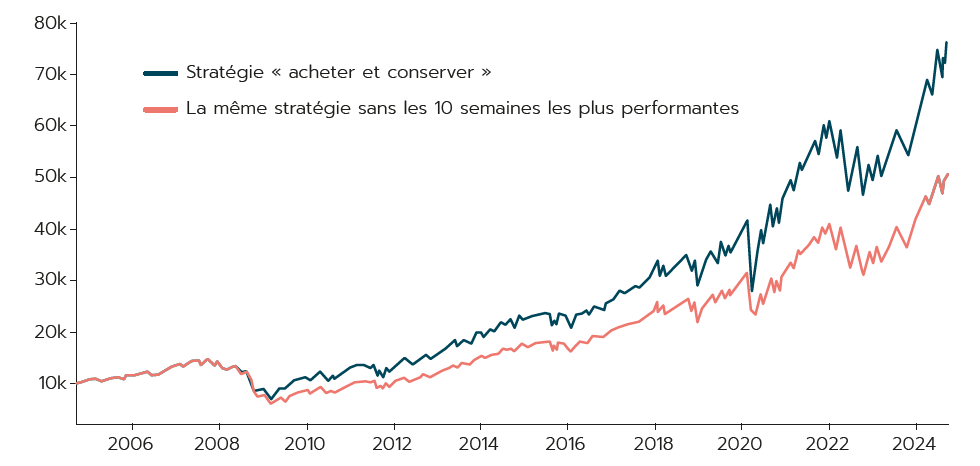

Dans un tel contexte, la tentation est grande de succomber aux sirènes du « market timing »(1) en tentant d’anticiper la direction des marchés financiers. Or ces arbitrages, s’ils sont le fruit d’un comportement émotionnel ou d’une modification du niveau d’aversion au risque, peuvent en réalité s’avérer souvent coûteux s’ils ne sont pas réalisés avec une extrême rigueur. Ils peuvent potentiellement se traduire par des pertes réalisées dans des « creux de marchés » ou, à plus long terme, par la matérialisation de coûts d’opportunité. Citons à ce titre Peter Lynch (traduit en français) : « Bien plus d’argent a été perdu par les investisseurs anticipant une correction que pendant la correction elle-même ».

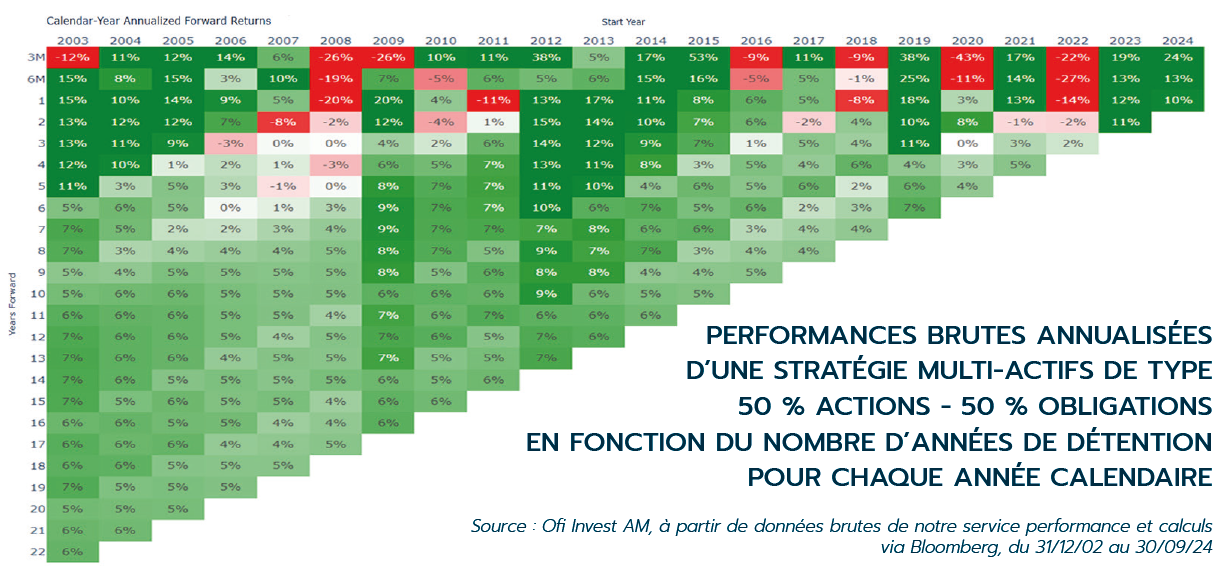

Il est donc essentiel de recontextualiser les mauvaises performances d’une année comme 2022 sur un horizon de placement adapté aux classes d’actifs et stratégies de gestion concernées, c’est-à-dire des horizons de moyen ou long terme. Une représentation visuelle permet d’en prendre conscience en observant le graphique des performances annualisées d’une stratégie multi-actifs réalisées selon la durée de placement et son année de départ. Il en résulte que peu importe l’année de démarrage, les effets du choix du point d’entrée disparaissent avec le temps pour converger vers une performance annualisée de long terme.

Deux enseignements à retenir

Le premier est l’importance d’avoir une bonne adéquation entre son horizon de placement et celui de son portefeuille d’actifs financiers.

Le deuxième est que les marchés qui peuvent être très volatils(2) à court terme, sont souvent les plus performants à long terme. Sur un horizon très court, le pire côtoie souvent le meilleur et de fait, un arbitrage mal placé peut compromette l’objectif de long terme.

ÉVOLUTION DU CAPITAL INVESTI SUR DU S&P 500 NET PENDANT 20 ANS

(septembre 2004-2024) Source : calculs Ofi invest AM - gestion Multi-actifs, à partir de données Bloomberg sur le S&P 500 Total Return, du 30/09/04 au 30/09/24, soit 20 ans

Source : calculs Ofi invest AM - gestion Multi-actifs, à partir de données Bloomberg sur le S&P 500 Total Return, du 30/09/04 au 30/09/24, soit 20 ans

La réactivité peut être utile pour s’extraire de situations délicates mais, compte tenu de la difficulté de l’exercice, elle doit faire l’objet d’une approche méthodique et rigoureuse pour ne pas pâtir de biais comportementaux.

2023-2024 : l’adaptation a permis un retour en force des fonds multi-actifs

Grâce à une gestion active et adaptative, les fonds multi-actifs ont su rebondir et surmonter cette contre-performance dès 2023. Cela a été possible grâce à une gestion active qui a capitalisé sur la reprise des actifs risqués tout en limitant les pertes dans les segments plus volatils.

Mais, en plus de la dynamique des marchés, la gestion multi-actifs a bénéficié de l’évolution de ses stratégies d'investissement au-delà de la diversification entre actions et obligations.

Chez Ofi Invest Asset Management par exemple, les fonds multi-actifs proposent un accès à un panel plus large de stratégies et de classes d’actifs que par le passé. Ces derniers offrent des moteurs de performance supplémentaires qui, au travers d’une construction de portefeuille plus sophistiquée, permettent de mieux répondre aux attentes des épargnants tel que :

-

La génération de revenus en vue d’améliorer la rémunération (valeur temps de l’argent) en exploitant plus profondément la classe d’actif crédit d’entreprises et dettes des pays émergents ;

-

La protection du capital par le recours à des dérivés visant à déformer le profil linéaire de performance en ajoutant de la convexité(3) à la baisse et/ou à la hausse des marchés ;

-

L’exposition à des thématiques, par exemple l’Intelligence artificielle et la cybersécurité aux États-Unis ou la défense en Europe ;

-

La mise à profit de rotations au sein des classes d’actifs (styles, secteurs), à l’image de notre positionnement récent sur la surperformance des moyennes valeurs contre les grandes valeurs en Europe ;

-

Une sélection active des titres, par la recherche de belles histoires de valeurs à long terme avec une approche non biaisée en termes de styles ou de secteurs pour se concentrer sur les fondamentaux des entreprises.

Malgré une année 2022 difficile (et il y en aura sûrement d’autres), le retour des fonds multi-actifs confirme le rôle central qu’ils occupent au coeur des allocations des épargnants.

L’approche « tout-en-un » qu’ils offrent constitue pour les investisseurs une réponse à la fois simple et efficace aux enjeux complexes de l’investissement pour autant que l’horizon d’investissement recommandé soit respecté.

Par Jean-François FOSSÉ, Directeur de la Gestion Multi-Actifs chez Ofi Invest AM

(1) Le « market timing » est une stratégie d’investissement qui consiste à essayer de prédire les mouvements du marché pour acheter bas et vendre haut.

(2) Volatilité : correspond au calcul des amplitudes des variations du cours d’un actif financier. Plus la volatilité est élevée, plus l’investissement sera considéré comme risqué.

(3) L'un des principaux objectifs des stratégies de convexité est de maximiser la résilience d'un portefeuille aux variations des taux d’intérêt et des conditions du marché.

INFORMATION IMPORTANTE

Cette communication publicitaire est établie par Ofi Invest Asset Management, société de gestion de portefeuille (APE 6630Z) de droit français agréée par l’Autorité des Marchés Financiers (AMF) sous l'agrément n° GP92012 – n° TVA intracommunautaire FR51384940342, Société Anonyme à Conseil d’Administration au capital de 71 957 490 euros, dont le siège social est situé au 22, rue Vernier 75017 Paris, immatriculée au Registre du Commerce et des Sociétés de Paris sous le numéro 384 940 342. Elle ne saurait être assimilée à une activité de démarchage, à une quelconque offre de valeur mobilière ou instrument financier que ce soit ou de recommandation d’en acheter ou d’en vendre. Elle contient des éléments d’information et des données chiffrées qu’Ofi Invest Asset Management considère comme fondés ou exacts au jour de leur établissement. Pour ceux de ces éléments qui proviennent de sources d’information externes, leur exactitude ne saurait être garantie. Les analyses présentées reposent sur des hypothèses et des anticipations d’Ofi Invest Asset Management, faites au moment de la rédaction de la communication qui peuvent être totalement ou partiellement non réalisées sur les marchés. Elles ne constituent pas un engagement de rentabilité et sont susceptibles d’être modifiées. La valeur d'un investissement sur les marchés peut fluctuer à la hausse comme à la baisse, et peut varier en raison des variations des taux de change. En fonction de la situation économique et des risques de marché, aucune garantie n’est donnée sur le fait que les produits ou services présentés puissent atteindre leurs objectifs d’investissement. Les performances passées ne préjugent pas des performances futures. Ofi Invest Asset Management décline toute responsabilité quant à d'éventuels dommages ou pertes résultant de l'utilisation

en tout ou partie des éléments y figurant. FA24/0356/04122025

Pour accéder au site, cliquez ICI.