La dette souveraine des marchés émergents en devises fortes (EMD) a longtemps représenté une source d’opportunités, mais l’enthousiasme des investisseurs s’est estompé ces dernières années. La tendance pourrait-elle s’inverser ?

L’année 2024 a été une autre année où les marchés émergents (ME) ont eu du mal à capter l’attention significative des investisseurs. Les flux dédiés à cette classe d’actifs sont restés limités, avec une nouvelle année de sorties nettes pour les fonds retail des marchés émergents. Et ce, malgré des écarts de crédit attractifs et des perspectives prometteuses en matière de taux d’intérêt, les marchés ayant correctement anticipé le début d’un cycle de baisse des taux par la Réserve fédérale américaine, dans un contexte de progrès du processus de désinflation.

Qu’est-ce qui a donc poussé les investisseurs à rester en retrait ces dernières années ? Les taux élevés des marchés monétaires sans risque ont certainement joué un rôle dissuasif, notamment après une période prolongée de volatilité mondiale marquée par une succession de crises : la pandémie de Covid-19, la guerre en Ukraine, les incertitudes liées à l’inflation et le risque imminent d’une crise bancaire en 2023. Les investisseurs ont ainsi privilégié la sécurité au détriment des opportunités risquées.

Une analyse plus approfondie du calendrier des flux confirme cette hypothèse, en contradiction avec les schémas habituels : les flux de capitaux ne se sont pas matérialisés en anticipation des développements positifs. Ils n’ont commencé à apparaître qu’après la première baisse des taux de la Fed et se sont révélés éphémères, influencés par les incertitudes accrues liées à l’élection présidentielle américaine.

Malgré l’absence de flux dédiés, les écarts de crédit sur les marchés émergents se sont nettement resserrés, tant pour les émetteurs souverains que pour les émetteurs d’entreprises, dans les segments investment grade (IG) et high yield (HY), avec une contraction particulièrement marquée dans ce dernier. Selon nous, cela indique fortement l’intérêt d’autres investisseurs. En effet, nous avons observé que les opportunités offertes par les marchés émergents étaient particulièrement attrayantes pour les investisseurs en crédit corporate des marchés développés (MD) tout au long de 2024. Les obligations quasi-souveraines et d’entreprises des marchés émergents ont offert une valeur relative convaincante par rapport à leurs pairs, tandis que les actifs des marchés développés semblaient de plus en plus surévalués après des années d’assouplissement quantitatif (QE), qui ont protégé un univers toujours croissant de titres des MD. Les actifs des marchés émergents, en revanche, n’ont pas bénéficié du même niveau de protection.

En 2022, les écarts de crédit pour les émetteurs de moindre qualité se sont fortement élargis, et plusieurs pays plus faibles ont perdu l’accès aux marchés obligataires internationaux, alimentant les craintes d’une flambée des défauts de crédit. Cependant, ces inquiétudes étaient largement exagérées, car la plupart des émetteurs souverains avaient des besoins de refinancement gérables ou pouvaient compter sur des prêteurs de dernier recours tels que le FMI, les institutions financières internationales (IFI) et les créanciers bilatéraux. Alors que ces craintes de défaut se sont dissipées, les investisseurs transversaux sont revenus dans les segments plus sûrs de la classe d’actifs des marchés émergents en 2024, permettant aux investisseurs spécialisés de cibler des émetteurs plus en difficulté. Début 2024, la plupart des émetteurs notés B avaient retrouvé l’accès au marché, déclenchant un rallye de soulagement.

Les réformes économiques et l’amélioration des fondamentaux justifient le resserrement des écarts de crédit. De nombreux pays HY qui avaient perdu l’accès au marché en 2022-2023 ont été contraints d’adopter des politiques plus orthodoxes, telles que des réductions de subventions et des mesures d’austérité. Parmi eux figurent la Turquie, l’Argentine, le Kenya, le Nigeria et le Pakistan. Ces réformes portent leurs fruits et sont reconnues par les agences de notation : pour la première fois depuis plus d’une décennie, les relèvements de notation ont dépassé les abaissements. Cette tendance devrait se poursuivre, comme le reflètent les perspectives de notation de crédit. Un nombre croissant d’émetteurs bénéficient désormais de perspectives positives, en particulier dans le segment high yield. Par ailleurs, alors que les MD ont vu plusieurs entreprises “zombies” survivre grâce au QE, les émetteurs les plus faibles des ME ont largement fait défaut entre 2020 et 2023. La divergence entre les cycles de défaut des ME et des MD est frappante : les défauts souverains des ME ont culminé à cinq en 2022, sont tombés à un en 2023, et aucun n’a été enregistré en 2024. Nous prévoyons que les taux de défaut resteront faibles dans les années à venir. La plupart des souverains en défaut ont achevé leurs restructurations de dette l’année dernière, laissant la classe d’actifs des marchés émergents dans une position plus saine.

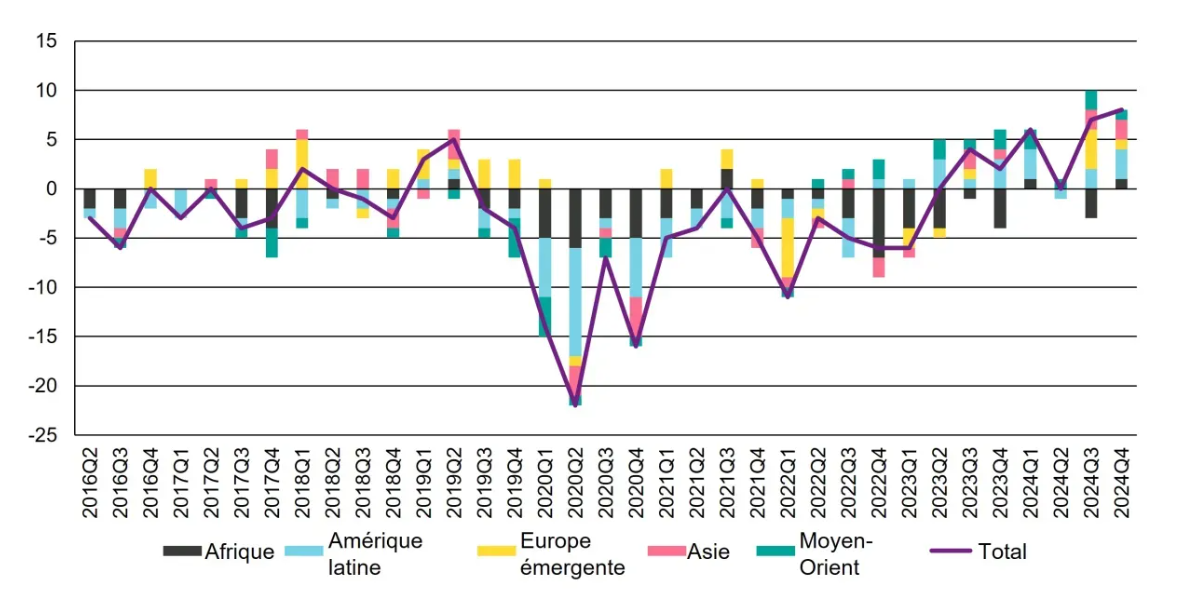

Graph. 1 : Nombre de relèvements/abaissements de la note souveraine

Source : Bloomberg, Vontobel ; données au 31 décembre 2024.

Source : Bloomberg, Vontobel ; données au 31 décembre 2024.

Avec des écarts actuellement inférieurs aux moyennes historiques, peut-on s’attendre à un retour des flux vers les marchés émergents ? Nous pensons que la valeur relative est la clé pour répondre à cette question : les écarts souverains des marchés émergents restent très attractifs par rapport à ceux des marchés développés. De plus, la baisse de volatilité observée tout au long de 2024 pourrait raviver la demande des investisseurs. Une autre évolution prometteuse est la réapparition d’une corrélation négative entre les taux directeurs et les écarts des marchés émergents, une tendance qui devrait séduire les investisseurs soucieux des risques.

Bien que la Fed ne devrait pas assouplir les conditions monétaires aussi agressivement qu’on l’avait initialement prévu, un assouplissement supplémentaire en Europe pourrait stimuler une demande accrue de la part des investisseurs européens. Au-delà du potentiel de performance brute, la capacité à générer de l’alpha est un facteur critique – et sur ce point, nous pensons que les marchés émergents offrent des opportunités significatives.

La dette des marchés émergents est une classe d’actifs hétérogène, regroupant plus de 70 pays dans l’indice JP Morgan EMBIG Diversified, chacun avec des modèles économiques et politiques différents, des cycles économiques variés, des notations distinctes, ainsi que des forces et faiblesses spécifiques. C’est aussi une classe d’actifs inefficiente, car elle ne représente généralement qu’une petite part de l’allocation stratégique des investisseurs. Malgré cela, nous avons observé une croissance des actifs sous gestion dans les ETF passifs investissant en dette des marchés émergents, ainsi que dans les investissements de non-spécialistes ou de crossover investors (comme les investisseurs en crédit corporate des MD), qui se concentrent généralement sur un segment précis du marché (noms de meilleure qualité de crédit, meilleure liquidité et couverture analytique approfondie). La présence de ces grandes communautés d’investisseurs, qui se concentrent sur les mêmes obligations de référence ou sur les mêmes segments de marché, peut peser lourdement sur les aspects techniques de certaines obligations, exacerbant ainsi les distorsions et les erreurs de valorisation, selon nous. Cela, à son tour, amplifie les opportunités pour les gestionnaires dédiés et actifs ayant des convictions fortes dans ce segment.

Tout bien considéré, nous pensons que le potentiel de génération d’alpha sur le marché obligataire des marchés émergents est considérable. L’amélioration de la liquidité au cours de l’année écoulée a encore facilité la capacité à tirer parti des inefficiences du marché, rendant les obligations des marchés émergents un choix de plus en plus attrayant pour les investisseurs à la recherche de rendements différenciés, selon nous. Le moment est peut-être venu de réinvestir sur ce marché. Que les investisseurs soient expérimentés ou qu’ils explorent les marchés émergents pour la première fois, les récompenses potentielles méritent d’être prises en compte.

Article rédigé par :

Luc D'hooge, Senior Portfolio Manager

Dario Scheurer, Portfolio Manager, Analyst

Carlos de Sousa, Strategist and Portfolio Manager

Pour accéder au site, cliquez ICI.