Il semble encore difficile pour les opérateurs de marché de se projeter clairement dans l’avenir et si les premiers mois post-traumatiques du choc de la crise avaient vu un retour rapide des actifs risqués, c’est la volatilité et le principe de « tôle ondulée » qui prime depuis plusieurs semaines, comme on l’a encore remarqué la semaine passée avec des chutes de valorisations significatives sur les actions, quelques écartements de primes de crédit sur le marché des obligations corporate, et surtout des taux souverains qui ont poursuivi leur chute, symbole le plus clair du « flight to quality » vu leur niveau actuel, déjà au plancher.

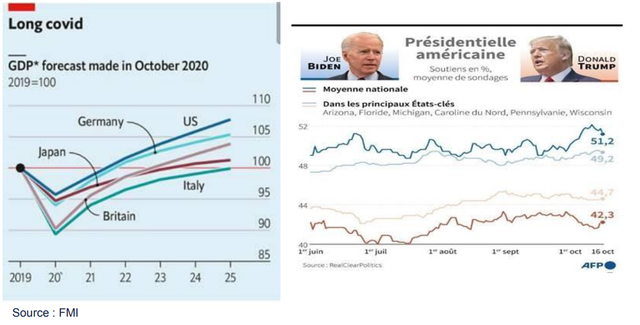

Pour les lecteurs n’observant pas les rendements tous les jours, voici un petit état des lieux des taux souverains dix ans et le résultat approximatif de cet ‘investissement’, si tant est qu’on puisse le nommer ainsi :

-

La banque centrale a déjà annoncé qu’elle était pied au plancher depuis plusieurs mois : aucune nouvelle surprise ou espérance à envisager pour le moment de ce côté. Pour la première fois, les marchés en viendraient presque à espérer que les banques centrales en viennent à réduire à nouveau leurs injections de liquidités car un retour en arrière signifierait que l’économie se rétablit, mais ce n’est actuellement pas une option…

-

Les Etats ont également déjà annoncé il y a plusieurs semaines les plans de relance les plus ambitieux en termes de montants alloués. Si certains analystes espèrent que les ratifications de ces plans, encore à la peine aujourd’hui en Eurozone à cause de tensions politiques, relanceront le marché, il n’en est, selon nous, rien du tout. L’annonce est déjà faite, les négociations sont un prérequis habituel et les marchés restent ancrés à la certitude que les plans seront globalement ratifiés, dans les jours à venir ou dans les semaines suivantes. Si les marchés financiers pensaient réellement que les plans américains ou européens puissent tomber à l’eau, ils reviendraient probablement sur leurs plus bas de mars, tant les économies sont exsangues et les perfusions nécessaires, alors que la crise sanitaire reprend de plus belle, presque plus massivement qu’au printemps et avec la certitude d’une certaine longévité, puisque les gouvernants parlent aujourd’hui de mi-2021… Tandis qu’on évoquait le T4 2020 au printemps…

-

Les corporates peinent toujours, et on les comprend, à donner des perspectives de chiffres pour les mois, voire les années à venir. C’est donc le flou total pour les analystes et, en dehors de certains secteurs, nous considérons que ceux qui s’évertuent à faire des prévisions trop précises méritent une grande défiance.

-

Les économistes, à peu près comme les épidémiologistes, peuvent, en fonction de leur propension optimiste ou pessimiste, nous donner des horizons de reprise ou de crise totalement différents… Sans doute l’un d’entre eux aura-t-il raison mais déterminer lequel revient souvent à faire le choix de ce qu’on souhaite entendre. Il est aujourd’hui à peu près évident que le monde est encore en pleine crise et que le recul n’est encore pas suffisant pour déterminer la situation du monde à son issue. La première étape pour avoir une certaine visibilité sera la fin de la crise sanitaire, ce qui n’est clairement pas le cas pour le moment.

2. Nous noterons ici un écart significatif entre le niveau des taux américains, qui ont plutôt grimpé ces dernières semaines, passant de 0.50% début août à 0.76% actuellement, et celui des pays européens en forte baisse, écart qui peut s’expliquer par :

- Le différentiel de rendement des banques centrales, la FED ayant fixé son niveau à 0.25% tandis que celui de la BCE est à 0% depuis plusieurs mois.

- Les anticipations économiques : comme à chaque crise économique majeure, le différentiel de croissance anticipé, puis réalisé, augmente entre l’Eurozone et les autres zones économiques, USA et Chine en tête. Le poids de la dette, les divergences des pays de la zone, la faiblesse politique croissante de la zone sur le plan mondial, la rigidité du système économique et social sont autant de raisons capables d’expliquer ce retard croissant de l’Eurozone. Encore une fois, hormis l’Allemagne, les prévisions de sortie de crise des pays européens semblent plus longues et plus poussives que celles des autres pays (cf graphique ci-dessous).

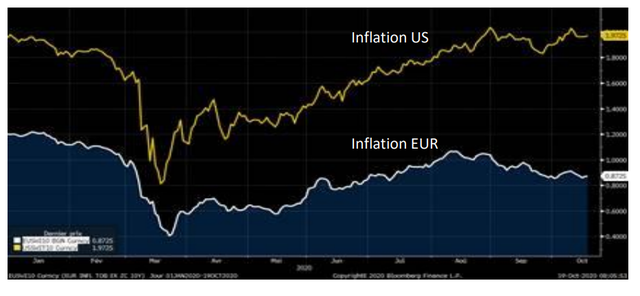

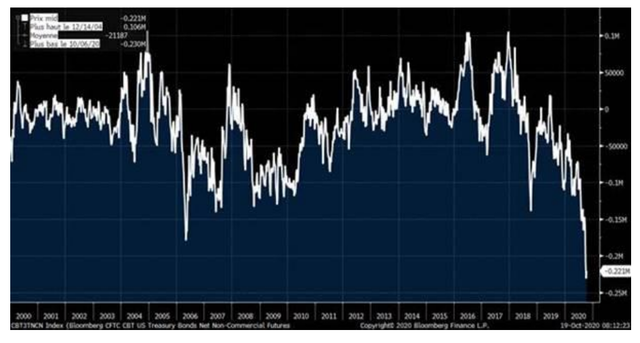

- Les anticipations politiques : alors que les élections américaines approchent, les sondages restent significativement favorables à Monsieur Biden, chantre d’une politique sociale et de relance importante, propre à tirer l’inflation comme en témoigne les deux graphes ci-dessous,

In fine, les rendements longs étant issus du taux directeur et des anticipations de croissance et d’inflation, on peut expliquer le différentiel de rendement entre les USA et l’Eurozone.

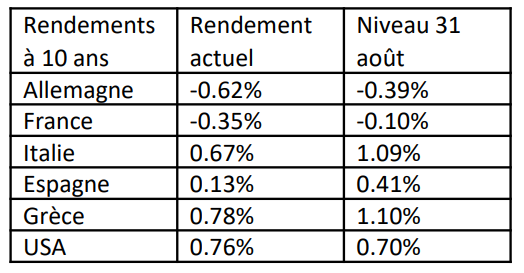

4. Reste aussi le driver du marché et on observe encore une fois que les opérateurs parient massivement depuis plusieurs semaines sur une hausse des rendements américains, comme en témoigne le graphique ci-dessous. L’objet de ce graphique est de répertorier les positions nettes spéculatives sur les contrats futures d’obligations américaines. Plus le chiffre est haut, plus les marchés souhaitent se positionner à l’achat sur les obligations d’Etat américaines, pariant sur la baisse des taux, plus il est négatif, plus les marchés « shortent » les obligations d’Etat américaines, pariant sur la hausse des taux.

On observe alors que, depuis 2000, jamais les marchés n’ont autant parié sur une hausse des taux américains, ce qui va à l’opposé de ce qu’on peut observer de notre côté de l’Atlantique, avec des investisseurs ayant massivement acheté les obligations d’Etat… Outre les explications macroéconomiques possibles évoquées ci-dessus, on peut aussi évoquer une explication psychologique, tout à fait propre au marché, que l’Europe a connu en 2015 et 2016, alors que la BCE compressait son taux directeur vers zéro. En effet, les USA ont, pour le moment, toujours vu leurs taux de rendement évoluer largement au-dessus de zéro, et surtout jamais en territoire négatif. Les opérateurs jugent donc encore impossible que le phénomène se produise et considèrent, comme les Européens en 2016 lorsqu’ils observaient le Japon, que ce phénomène ne peut se produire dans leur zone économique, ou du moins qu’à titre exceptionnel et pour une durée très courte. En 2016, les positions shorts sur le Bund s’étaient également révélées massives tant les opérateurs pensaient que les taux zéro étaient une aberration au vu de la croissance, de l’inflation ou de toutes les autres théories financières ’classiques’… Et pourtant… il les rendements sont aujourd’hui encore bien plus bas qu’ils ne l’étaient à l’époque…

Retenons aussi une notion très basique : lorsque les prises de positions sont toutes effectuées, elles peuvent être tenues quelques mois puis doivent être débouclées, ce qui provoque une tendance opposée. Généralement, il est facile d’observer que le pic de positionnement spéculatif sur un actif précède de quelques semaines le pic (pour les positions longues) ou le creux (pour les positions ‘short’) de la valorisation d’un actif. Vu les positionnements « shorts » massifs déjà engagées sur les obligations américaines, le tout pour arriver seulement autour de 0.7% de rendement sur les obligations de maturité 10 ans, ce qui reste un taux extrêmement bas en absolu, on peut imaginer la force de la tendance fondamentale à la baisse des taux (et donc à la hausse des obligations d’Etat américaines), portée par les investisseurs institutionnels et la banque centrale. La probabilité est donc relativement forte de voir les rendements américains chuter à nouveau post-élections.

Par Matthieu Bailly, Octo Asset Management

Pour accéder au site, cliquez ICI.

Ce document est exclusivement conçu à des fins d’information. Il ne constitue ni un élément contractuel, ni un conseil en investissement, ni une offre pour acheter ou vendre quelques placements spécifiques. Du fait de leur simplification, les informations contenues dans ce document sont partielles. Elles peuvent être subjectives et sont susceptibles d’être modifiées sans préavis. Toutes ces données ont été établies de bonne foi sur la base d’informations comptables ou de marché. Les données comptables n’ont pas toutes été auditées par le commissaire aux comptes. Les personnes qui viendraient à se trouver en possession de ce présent document sont invitées à la demande d’Octo Asset Management à se renseigner et à respecter toutes les lois et règlements applicables relatifs à la possession ou à la distribution de tels supports d’information.