Alors que la deuxième vague de la pandémie de coronavirus frappe l’Europe de plein fouet, la plupart des pays du vieux continent passeront le mois de novembre en confinement plus ou moins strict.

Dans un contexte marqué par le report du lancement d’un vaccin et par les querelles de dernière minute concernant le fonds de relance européen, notre décision à souspondérer les actions européennes et à protéger nos portefeuilles nous semble donc justifiée. L’élection présidentielle américaine cette semaine pourrait accoucher de nombreux scénarios différents pour les actifs risqués. Les marchés ont vacillé la semaine dernière car les investisseurs ont commencé à remettre en question l’idée d’une ‘vague bleue’ (une victoire de Joe Biden et la prise de contrôle du Congrès par les Démocrates) et sont de plus en plus nombreux à redouter une remise en question du résultat du scrutin. Dans l’attente d’une meilleure visibilité, nous pensons qu’il est trop tôt pour arrêter de sous-pondérer les actions américaines en portefeuille.

Dans le même temps, alors qu’une majorité des entreprises a publié de très bons résultats pour le troisième trimestre, les sociétés qui ont publié des chiffres moins bons que prévu ont été sanctionnées par les marchés (à l’excès, peut-être) et certaines d’entre elles ont même vu leur valeur en bourse chuter de 25%. Ces réactions disproportionnées offrent une opportunité en or aux « stock pickers », ceux qui se focalisent sur les fondamentaux de chaque titre. Nous avons également pu constater que la conjoncture incertaine a entraîné une révision des prix de certaines opérations de fusion-acquisition à des niveaux relativement attractifs.

À l’approche d’une élection américaine qui aura de vastes répercussions, et à l’heure où l’Europe se reconfine, la Chine a défini la trajectoire de sa croissance pour les années à venir. En attendant les détails, le parti communiste a dévoilé la semaine dernière un programme quinquennal pour 2021-2025 dans lequel l’auto-dépendance semble être un mot-clé. La guerre commerciale avec l’administration de Donald Trump a aiguisé la détermination du gouvernement chinois à soutenir l’économie intérieure. De la même manière, la China devra être à la pointe de de l’innovation technologique et devenir plus attrayante pour les investissements étrangers. Le parti communiste souhaite que le PIB par tête atteigne « le niveau des pays modérément développés » d’ici 2035. Si l’on prend l’Espagne ou la Corée du Sud comme base de comparaison, cela impliquerait une multiplication par trois du PIB par tête actuel en termes nominaux. Rares sont ceux qui parieraient contre la capacité de la Chine à atteindre cet objectif, et nous continuons à surpondérer les actifs chinois (renminbi, obligations et actions).

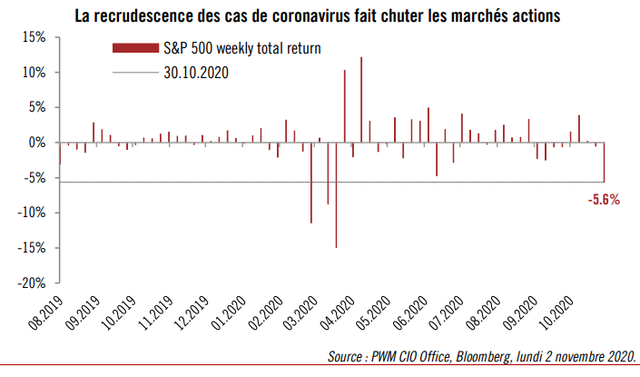

Graphique de la semaine : Les marches actions devissent

Les marchés actions mondiaux ont chuté la semaine dernière sur fond d'aggravation de la pandémie. La mise en place de restrictions plus contraignantes pour endiguer la recrudescence de l’épidémie et les nouvelles mesures de confinement ont avivé les inquiétudes des investisseurs vis-à-vis des perspectives économiques. Le S&P 500 a cédé 5,6% (en USD), effaçant ainsi sa progression du mois d’octobre. Nous n’avions pas vu de baisse hebdomadaire aussi brutale depuis la mi-mars, époque à laquelle le confinement avait été instauré pour la première fois.

Macroéconomie : La croissance repart, mais pour combien de temps ?

L’économie américaine rugit de nouveau au troisième trimestre

Les estimations préliminaires montrent que le PIB américain a progressé de 7,4% au troisième trimestre par rapport au trimestre précédent et à un taux annualisé de 33,1%, supérieur aux prévisions. Toutefois, le PIB américain au 30 septembre affichait une contraction de 3,5% par rapport à son niveau de fin 2019 et les craintes vis-à-vis de la reprise se font de plus en plus nombreuses dans un contexte marqué par la multiplication des cas de coronavirus et par l’absence d’avancées sur une nouvelle relance budgétaire. Reflétant le récent rebond de l’activité économique, les dépenses des ménages ont continué à progresser en septembre (+1,4%), tandis que le revenu des ménages a augmenté de 0,9%, à rebours de la baisse enregistrée en août.

L’Europe s’extirpe du marasme au troisième trimestre

Le PIB de la zone euro a progressé de 12,6% en rythme trimestriel au troisième trimestre, selon les premières estimations. C’est plus que ce que prévoyait le consensus et supérieur à nos prévisions. Le rebond le plus marqué a eu lieu en France. Cela étant, le PIB de la zone euro est toujours 4,3% inférieur à son niveau du quatrième trimestre 2019. Le bloc européen a connu son troisième mois consécutif de déflation en octobre, comme en atteste la baisse de 0,3% des biens de consommation en glissement annuel.

Corée du Sud : l’économie se stabilise

Bénéficiant d’une hausse des exportations technologiques et des efforts déployés pour éradiquer le covid-19, le PIB de la Corée du Sud a progressé de 1,9% au troisième trimestre en glissement trimestriel. Il s’agit de la plus forte progression trimestrielle depuis 10 ans, qui vient mettre un terme à la tendance baissière observée au premier semestre. En rythme annuel, le PIB sud-coréen s’est contracté de 1,3% au troisième trimestre, une baisse moins importante que prévu. La Banque du Japon a révisé ses prévisions de croissance pour le Japon : elle table désormais sur une contraction du PIB de -5,5% sur l’exercice se clôturant fin mars 2021, contre une prévision de -4,7% précédemment.

Marchés : Sur le fil du rasoir

Une défiance généralisée

Les marchés actions ont fini la semaine dernière dans le rouge, signant ainsi leur plus mauvaise performance mensuelle depuis mars, comme en attestent la baisse de -5,6% du S&P 5001 et la baisse de -5,3% du MSCI World2 (en USD pour les deux indices). Même certaines valeurs technologiques qui avaient le vent en poupe ont été frappées de plein fouet par le climat de défiance généralisée, dans un contexte marqué la recrudescence du coronavirus et par les incertitudes autour de l’élection présidentielle américaine. Le rebond de l’économie américaine au troisième trimestre a été plus fort que prévu, mais la forte poussée de volatilité des indices montre que les acteurs de marché se soucient davantage de ce qui les attend, ce qui est tout à fait compréhensible. L’incertitude actuelle, qui pourrait se dissiper seulement en partie si l’élection présidentielle accouche d'un résultat sans appel mardi, nous pousse à continuer à sous-pondérer les actions pour le moment. Les résultats du troisième trimestre ont été meilleurs que prévu, mais la mise en œuvre de nouvelles mesures pour lutter contre la propagation du covid-19 pourrait compromettre le redressement de nombreuses entreprises.

Les bons du Trésor résistent

À l’instar des actions, les cours des obligations se sont repliés la semaine dernière : le taux des bons du Trésor américain à 10 ans a gagné 0,85%, dans le sillage d’une hausse du taux des obligations indexées sur l’inflation (TIPS) à -0,82%. Même si le TIPS reste négatif, la conviction qu’une victoire de Joe Biden pourrait aboutir à une relance budgétaire d’une ampleur assez large pour stimuler la croissance économique explique en partie la hausse des taux réels. Beaucoup dépendra de la capacité des Démocrates à prendre le contrôle du Sénat et à remporter la présidentielle, et le cas échéant, de l’ampleur de leur victoire. Cependant, il est à noter que la hausse récente des taux du Trésor a commencé à ralentir, car même en cas de ‘vague bleue’, la Fed interviendra probablement pour limiter toute hausse des taux susceptibles d’augmenter excessivement les coûts de financement des entreprises et du gouvernement. Nous pensons que la Fed continuera à contrôler de manière implicite la courbe des taux et qu’elle déploiera une nouvelle initiative pour allonger la maturité moyenne des bons du Trésor qu’elle achète (‘Operation Twist’) via son programme d’assouplissement quantitatif.

Le dollar en hausse, l’or en baisse

Avec les marchés financiers en baisse, le dollar a joué son rôle d’actif refuge habituel la semaine dernière, progressant contre la plupart e des autres grandes devises. Néanmoins, l’indice dollar affiche toujours un niveau inférieur au sommet qu’il avait atteint juste après le choc causé par la première vague de la pandémie en mars dernier, et nous pensons que la perspective d’une aggravation du déficit budgétaire et du déficit du compte courant des ÉtatsUnis pèsera sur le cours du billet vert dans les mois à venir. A moyen terme, cela pourrait pousser à la hausse d’autres devises comme le yen et l’euro, ainsi que le renminbi (qui a effacé une partie de ses gains récents la semaine dernière). Il convient de mentionner que tout comme les actifs risqués, l’or a fini la semaine dernière en baisse. La hausse du dollar et des taux obligataires réels (liées à une révision à la baisse des prévisions d’inflation) explique en partie cette évolution. Cela étant, nous continuons à penser que l’or pourrait progresser à moyen terme à la faveur des injections massives de liquidité et de creusement de la dette publique partout dans le monde.

César Pérez Ruiz, Directeur des investissements

Pour accéder au site, cliquez ICI.