Le risque politique, une deuxième vague de Covid-19, une baisse de l’activité économique et une inflation contenue sont autant d’éléments qui pourraient déclencher une correction à court terme. A moyen terme cependant, une prime de risque actions élevée et des taux faibles s’inscriront en soutien des actions.

Après un très net rebond par rapport aux niveaux planchers de mars, les marchés d’actions semblent à présent tendus. Alors que nous vivons une deuxième vague de Covid-19, l’incertitude commence à avoir un impact sur la reprise des bénéfices. Par ailleurs, si l’élection présidentielle américaine est désormais derrière nous (quoiqu’avec une transition difficile), il est probable que le président nouvellement élu continue à faire pression sur la Chine.

Les révisions des bénéfices d’entreprises ont augmenté aux Etats-Unis mais pourraient désormais plafonner, alors qu’elles sont stables en Europe.1 Chez Columbia Threadneedle Investments, nous nous attendons pour 2021 à un redressement des bénéfices plus limité que de l’avis de beaucoup d’autres commentateurs. Le consensus semble trop élevé. Un élément indéniablement positif est le nouveau cadre de politique de la Réserve fédérale américaine, qui énonce un plan explicite pour permettre à l’inflation de dépasser l’objectif. Même si l’inflation augmente, la Fed n’y prêtera pas attention.

A terme, cela entraînera une pentification de la courbe des taux. Néanmoins, le principal facteur déterminant pour les taux d’intérêt à long terme est l’orientation des taux courts. Si les taux courts restent bloqués à des niveaux bas pendant les quatre à cinq prochaines années, comment les taux longs pourraient-ils grimper ?

De nouvelles restrictions liées au Covid-19, alliées à une diminution des mesures de soutien budgétaire, pèseront sur les économies. Au moment d’écrire ces lignes, le programme fédéral américain d’aide d’urgence au chômage a expiré et aucun nouveau train de mesures budgétaires n’a encore été convenu. Des retards dans l’adoption de ces mesures de relance combinés à une correction des valeurs technologiques américaines ont accru le risque à court terme sur les marchés, même si l’actualité concernant la mise au point de vaccins est un facteur largement positif. Les mesures de relance monétaire à court terme, mesurées à l’aune des flux de crédit à six mois, ont atteint un niveau record au cours de l’été, mais la tendance s’inverse désormais. Aux Etats-Unis et en Chine, ces flux ont culminé à 700 milliards USD et 800 milliards USD respectivement en mai. Dans la zone euro, ils ont atteint un sommet de plus de 1.000 milliards USD en juillet. Le total de ces flux était encore plus important que lors de la crise financière mondiale. Récemment, les flux de crédit à six mois ont chuté à environ 200 milliards USD tant aux Etats-Unis qu’en Chine.2 Nous n’avons pas encore les derniers chiffres pour l’Europe, mais le constat devrait être similaire. Dans ce contexte, les mesures de relance budgétaire sont appelées à jouer un rôle plus important.

Surveiller la prime de risque actions

Au-delà du très court terme, il n’existe aucune alternative aux actions vu le niveau élevé persistant de la prime de risque actions au niveau mondial, à savoir l’écart entre le rendement des bénéfices des actions et le rendement réel des obligations d’Etat. Le rendement du dividende pour l’indice S&P 500 est actuellement de 1,6%, un niveau inférieur à sa moyenne à long terme de 4,3%, mais largement supérieur au rendement de 0,7% des bons du Trésor américain à 10 ans. Si les dividendes versés devaient se maintenir aux niveaux actuels sur les 10 prochaines années, le S&P 500 devrait baisser de 9% pour égaler la performance des bons du Trésor à 10 ans. Avec une inflation approchant les 2% sur la même période de 10 ans, le S&P 500 devrait chuter de 25% pour arriver au niveau des bons du Trésor à 10 ans.3

Le scénario est encore plus impressionnant en dehors des Etats-Unis : les actions de la zone euro devraient reculer de 30% en termes réels et les actions britanniques de 50% pour égaler la performance des obligations.4 Aucun de ces scénarios n’est vraisemblable. Alors que le rendement des bénéfices aux Etats-Unis est bien inférieur à la moyenne, la prime de risque actions reste élevée car les rendements obligataires réels pointent de loin en territoire négatif.

La prime de risque actions se maintient en effet proche de son niveau de mars, tandis que les cours des actions ont atteint leurs planchers. Bien que les cours des actions aient rebondi et que les rendements du dividende aient chuté, la baisse des rendements obligataires réels s’est avérée similaire. Si le marché a intégré dans les cours la baisse temporaire des bénéfices des entreprises dans le sillage du Covid-19, lesquels finiront par rebondir, il a également intégré la baisse de 94 pb du rendement des obligations sans risque à 30 ans depuis le début de l’année.5

Si l’effet des bénéfices est temporaire, l’effet du taux d’actualisation est pour sa part permanent. Ainsi, en dépit des inquiétudes à court terme, les cours des actions devraient en réalité être plus élevés.

Par ailleurs, la politique monétaire est exceptionnellement accommodante. La Fed a promis de maintenir les taux inchangés jusqu’à ce que l’économie ait atteint le « plein emploi » et que l’inflation soit « en bonne voie pour dépasser légèrement 2% pendant un certain temps ». Une majorité des membres du Federal Open Market Committee ne s’attend pas à une modification des taux avant au moins fin 2023. Si une augmentation des rendements obligataires est peu probable dans les prochaines années en l’absence d’inflation, il est tout aussi improbable qu’ils continuent de chuter étant donné qu’ils sont déjà très bas. La prime de risque actions est suffisamment élevée pour que les actions puissent encore grimper, même si les rendements obligataires venaient à augmenter légèrement.

Croissance vs valeur

Cette période prolongée de faibles taux d’intérêt présente certaines similitudes avec l’époque des « Nifty Fifty » dans les années 1960 et 1970, alors que la performance du marché actions américain était dictée par 50 valeurs de croissance de qualité.

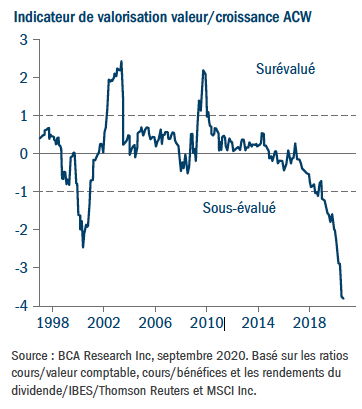

Quoi qu’il en soit, si les rendements obligataires ne font que se stabiliser au lieu de progresser, cela pourrait lever un obstacle majeur pour les banques. Par rapport aux titres de croissance, les valeurs décotées sont aujourd’hui moins chères qu’à tout autre moment de l’histoire – même à l’apogée de la bulle Internet en 2000 (Figure 1).6 Mais ils ont besoin d’un catalyseur pour engranger un rebond. Un nouvel accord budgétaire et un vaccin efficace, entièrement approuvé et rapidement distribué, pourraient jouer ce rôle, mais dans un cas comme dans l’autre, ce n’est pas encore chose faite. Plusieurs vaccins candidats sont en phase III d’essais cliniques, et trois d’entre eux semblent efficaces à ce stade, mais la validation finale, la production et la distribution mondiale prendront encore un certain temps.

Figure 1 : Les valeurs décotées extrêmement bon marché par rapport aux titres de croissance

Les valeurs décotées ont tendance à surperformer par rapport aux titres de croissance lorsque le dollar américain faiblit et que la croissance mondiale prend de la vitesse. Les titres de croissance se sont bien comportés à la fin des années 1990, lorsque le dollar était fort, tandis que les valeurs décotées ont affiché de meilleurs résultats entre 2001 et 2007, lorsque le dollar était faible. Si le dollar faiblit dans les prochains mois, cela pourrait venir soutenir ces valeurs décotées actuellement en plein marasme.

"Par rapport aux titres de croissance, les valeurs décotées sont aujourd’hui moins chères qu’à tout autre moment de l’histoire – même à l’apogée de la bulle Internet en 2000."

Soutien aux actifs risqués

La présidentielle américaine étant désormais derrière nous, les vaccins devraient accélérer la reprise. Il est peu probable que les actuelles politiques de soutien changent, car les autorités veulent faire tourner l’économie à plein régime pour soutenir la reprise, ce qui entraînera les actions à la hausse. Jusqu’ici, il y a eu beaucoup d’incertitude sur la croissance à long terme, ce qui a contrebalancé les effets positifs des baisses de taux d’intérêt. Cela faisait aussi écho aux risques déflationnistes extrêmes et aux craintes quant à l’avenir de l’UE et de l’euro.

Maintenant que nous sommes au début d’un nouveau cycle, avec une croissance modérée mais une faible inflation et des taux d’intérêt bas, les politiques de soutien devraient contribuer à réduire le risque d’une nouvelle récession.

Le retour d’une politique de taux d’intérêt zéro soutiendra les actifs risqués dans un avenir proche. A court terme cependant, l’augmentation actuelle des cas de contamination au Covid-19, le maintien des mesures de confinement, la baisse de l’activité économique et les anticipations d’inflation contenue (autrement dit des taux réels plus élevés) pourraient provoquer une nouvelle correction des actions.

Pour accéder au site, cliquez ICI.