Les randonneurs expérimentés savent bien qu’une descente peut être plus difficile qu’une ascension. Heureusement, un bon équipement peut vous aider à surmonter les obstacles que vous pourrez rencontrer. Quel matériel devez-vous acheter et que faut-il laisser en rayon ?

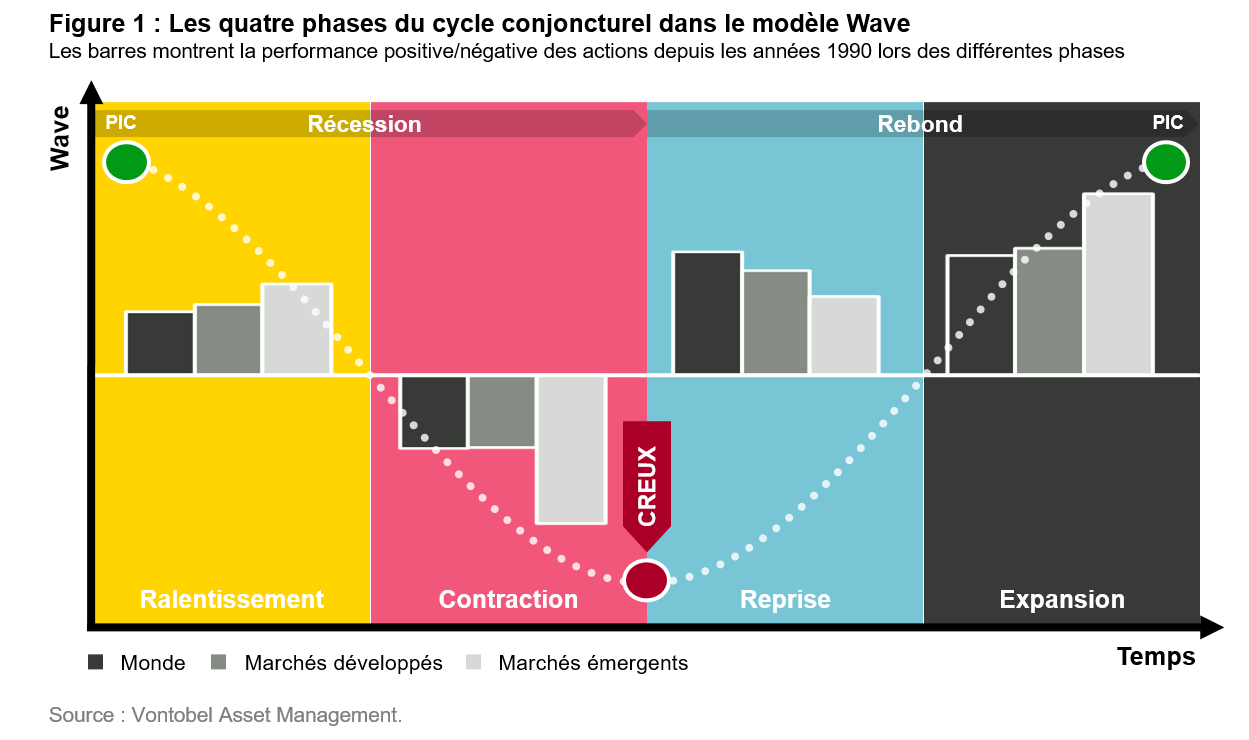

Avant de choisir la marque des bâtons ou des chaussures de marche que vous voulez acheter – ou, pour les investisseurs qui se concentrent sur les marchés émergents (ME), un titre spécifique qui rendra votre évolution plus sûre – commençons par jeter un œil au parcours sur le GPS. Il semble évident que nous avons bien laissé derrière nous le sommet du « Pic de la Croissance », sans l’ombre d’un doute pour les économies émergentes, mais c’est également de plus en plus clair dans les marchés développés. C’est ce que suggère notre modèle du cycle conjoncturel « Wave » (voir Figure 1) et c’est une information cruciale pour les investisseurs qui suivent une approche macroéconomique top-down.1 Une fois votre position repérée sur la carte, vous pouvez commencer à scruter le paysage en quête d’opportunités (ou de zones de danger) à l’aide de vos jumelles spécifiques aux pays, aux secteurs et même aux thèmes.

Avant de choisir la marque des bâtons ou des chaussures de marche que vous voulez acheter – ou, pour les investisseurs qui se concentrent sur les marchés émergents (ME), un titre spécifique qui rendra votre évolution plus sûre – commençons par jeter un œil au parcours sur le GPS. Il semble évident que nous avons bien laissé derrière nous le sommet du « Pic de la Croissance », sans l’ombre d’un doute pour les économies émergentes, mais c’est également de plus en plus clair dans les marchés développés. C’est ce que suggère notre modèle du cycle conjoncturel « Wave » (voir Figure 1) et c’est une information cruciale pour les investisseurs qui suivent une approche macroéconomique top-down.1 Une fois votre position repérée sur la carte, vous pouvez commencer à scruter le paysage en quête d’opportunités (ou de zones de danger) à l’aide de vos jumelles spécifiques aux pays, aux secteurs et même aux thèmes.

Mais commençons par le commencement. Les cycles conjoncturels démarrent par une reprise économique, généralement suivie d’une expansion de moins en moins soutenable, qui déclenche de l’inflation et pousse les banques centrales et les gouvernements à déployer des politiques « restrictives » anticycliques, comme des hausses de taux. Avec ces politiques, la reprise économique est étouffée et la croissance et l’inflation atteignent un pic. A ce stade, l’économie commence à ralentir avant de se contracter, ce qui coïncide souvent avec une récession. C’est habituellement à ce moment-là que les banques centrales et les gouvernements changent de braquet et soutiennent l’économie par des politiques « expansionnistes » comme des baisses d’impôts. Une autre reprise se déclenche alors et le cycle conjoncturel recommence.

Voilà pour la théorie. Dans la pratique, les choses sont plus compliquées et il n’est pas rare que les cycles conjoncturels s’éloignent de ces schémas, comme on a pu l’observer pendant la pandémie, par exemple. Les mesures de confinement drastiques prises au début de 2020, qui ont précipité l’économie mondiale dans la pire crise depuis la Grande Dépression du siècle dernier, ont laissé place à une reprise économique tout aussi spectaculaire.

Jusqu’où le cycle conjoncturel va-t-il nous conduire ?

C’est généralement le milieu d’une période de ralentissement économique qui constitue un environnement favorable aux classes d’actifs cycliques.2 Mais est-il possible que nous approchions déjà de la phase suivante du cycle conjoncturel ? Pour mieux appréhender les choses et pour identifier les gagnants et les perdants potentiels, vous devez, en tant qu’investisseur, formuler des hypothèses sur l’évolution de la situation. A ce stade, il est fondamental d’évaluer et d’anticiper les mesures prises par les gouvernements et les banques centrales, qui font ou défont l’économie. Notre modèle du cycle conjoncturel a pour l’instant bien fonctionné cette année, et a annoncé la transition entre expansion et ralentissement avant qu’elle se produise. Actuellement, selon le modèle Wave, l’économie mondiale a 67% de chances de poursuivre son ralentissement à court terme.

La dette des ME en devise forte au centre de toutes les attentions

Ce scénario soutient une stratégie en actions axée sur les valeurs cycliques, mais bien calibrée. N’oublions pas que plus nous avançons dans le ralentissement, plus le risque de chuter dans la contraction est grand. C’est pourquoi les actions défensives qui versent des dividendes, que l’on trouve généralement dans des marchés comme la Suisse, sont de plus en plus séduisantes. En raison de leur nature défensive, elles ont des chances de surperformer en cas de passage à un scénario de contraction plus sombre, mais elles pourraient également bénéficier d’un rebond des marchés actions en cas de retour de la croissance. L’avantage de la continuité des rendements du dividende (versement de dividendes par rapport au cours de l’action d’une société) sur les rendements obligataires est un autre argument en faveur des stratégies axées sur les dividendes.

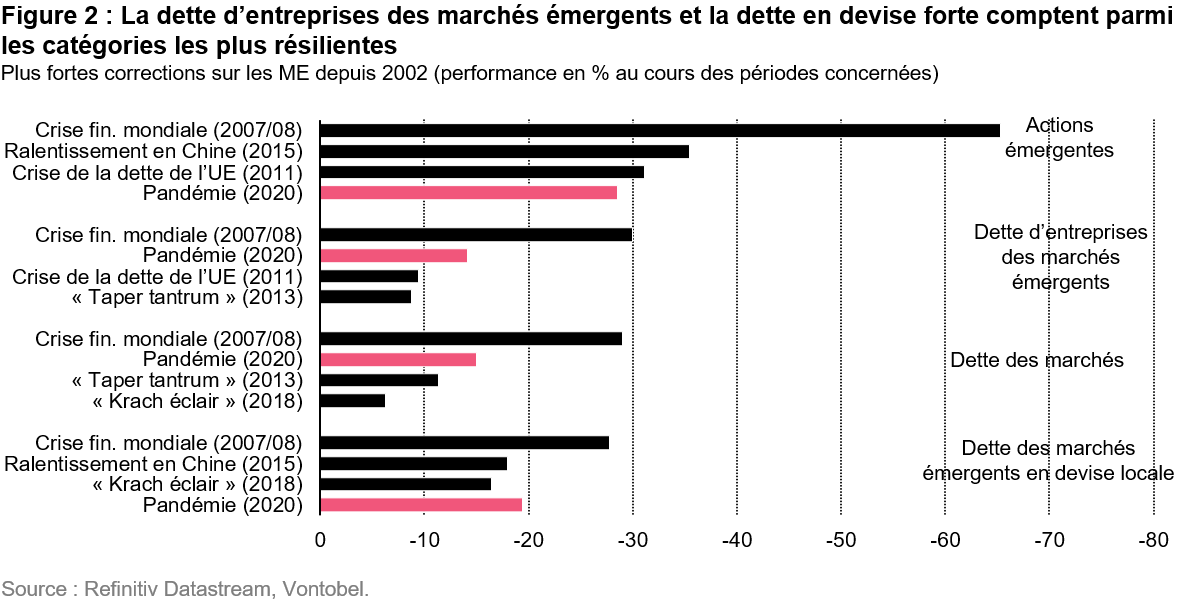

En règle générale, l’attrait des actifs défensifs est tout particulièrement évident dans les marchés émergents, où le risque d’entrer dans une phase de contraction est nettement plus élevé que pour les économies développées. Nous privilégions donc la dette libellée en devise forte dans cette région. Selon notre analyse, la dette des marchés émergents en devise forte affiche généralement des performances légèrement positives, même pendant les périodes de contraction économique. En outre, les pertes extrêmes – les plus grosses chutes mesurées à partir de la différence entre les points hauts et bas – ont été inférieures à celles d’autres classes d’actifs (Figure 2).

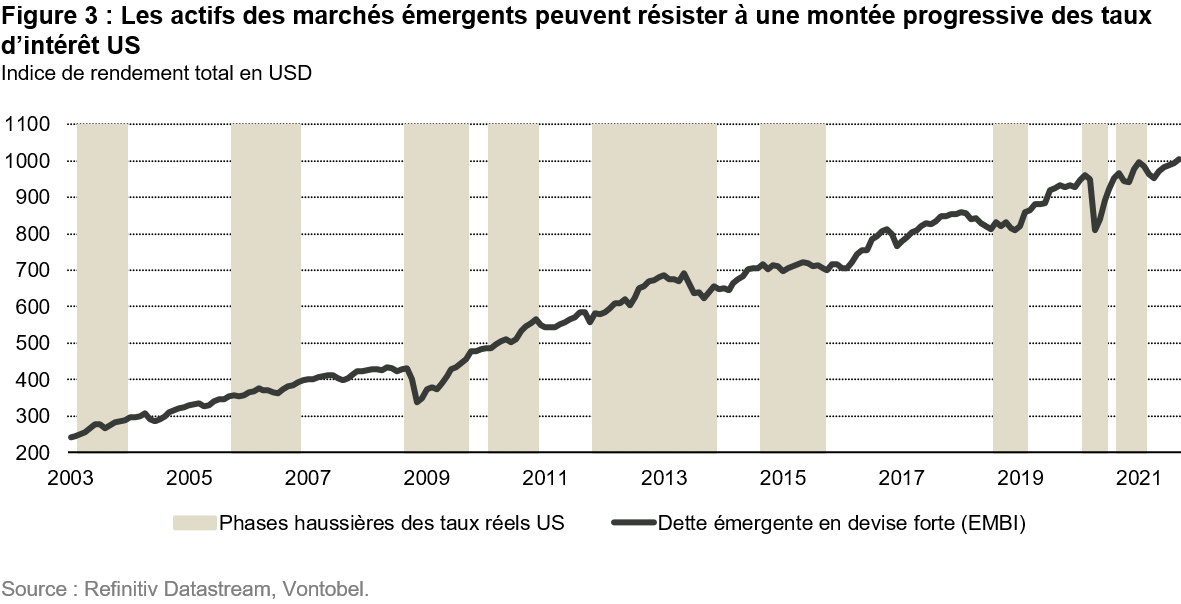

Notre point de vue sur les prix – nous avons, là encore, probablement déjà passé le sommet du « Pic de l’Inflation » – soutient également l’idée de se lancer dans ce segment obligataire. Avec un apaisement des pressions inflationnistes, les banques centrales ne verront plus d’urgence à durcir davantage les politiques monétaires par rapport à leur niveau actuel. Dans une telle situation, les obligations des ME libellées en devise forte pourront voir leur valeur augmenter, ce qui réduira l’écart de rendement avec les emprunts d’Etat américains. Les risques qui pèsent sur les obligations émergentes comprennent un possible durcissement des politiques monétaires occidentales : si la Réserve fédérale américaine augmentait les taux d’intérêt, entraînant donc une forte hausse du dollar US, les financements en dollar seraient plus onéreux, ce qui ferait vaciller les marchés émergents. Cependant, nous ne prévoyons pas que la banque centrale la plus puissante de la planète suive cette voie avant la fin de 2022. Tout regain de forme du billet vert ne se matérialiserait donc pas avant le deuxième semestre 2022. En outre, des phases d’appréciation modérée du dollar US et une lente montée des rendements des bons du Trésor américain ne sont pas nécessairement mauvaises pour les actifs des marchés émergents, qui ont montré leur résilience lors de périodes de hausse progressive des taux d’intérêt aux Etats-Unis (voir Figure 3).

Faut-il déjà acheter des actions émergentes ?

Même si les actifs émergents ont tendance à enregistrer de bonnes performances en période de ralentissement économique, les actions des ME ont jusqu’à présent sous-performé depuis le début de l’année. Entre février et fin août 2021, freinées par le poids lourd de l’indice, la Chine, les actions émergentes ont connu deux grandes chutes qui leur ont fait céder 10% chacune. Parallèlement, les actions d’Europe de l’Est et d’Amérique latine ont enregistré des performances honorables au premier semestre 2021. Ces marchés devraient conserver leur soutien à court terme étant donné que leurs économies affichent encore des trajectoires de croissance haussières, contrairement à leurs homologues d’Asie.

Deux raisons expliquent l’apathie générale des marchés actions émergents. L’économie chinoise a commencé à ralentir en février, plus ou moins au même moment que le début de la sous-performance de son marché actions. Cerise sur le gâteau, la répression réglementaire menée contre les sociétés technologiques et les promoteurs immobiliers du pays a déclenché un deuxième plongeon entre juin et août. Après une décennie de laisser-faire réglementaire, on peut interpréter l’initiative menée par les sentinelles chinoises comme une mesure compréhensible destinée à rattraper les normes réglementaires occidentales. Elle a malgré tout ouvert les yeux à de nombreux investisseurs mondiaux, qui n’avaient jamais envisagé la possibilité d’un tel tour de vis réglementaire contre les champions technologiques chinois.

Il faut donc considérer la récente correction face à la situation des acteurs du marché, qui essaient d’évaluer les risques réglementaires. En sommes-nous déjà à ce stade ? Les préoccupations pourraient perdurer, notamment parce que les autorités chinoises peuvent trouver un intérêt à ce durcissement réglementaire. La loi sur la protection des informations personnelle (LPIP), qui entrera en vigueur en novembre 2021, en est un exemple. Les investisseurs souhaiteront avant tout davantage de transparence dans le processus réglementaire. Une fois qu’ils auront obtenu satisfaction, la récente chute des actions émergentes sera probablement considérée comme une opportunité d’achat intéressante. En outre, la Chine va devoir trouver comment soutenir l’économie face à des données récentes décevantes. Pékin a récemment approuvé des mesures de relance supplémentaires, susceptibles de se traduire par une stabilisation du marché d’actions local.

Une dose de couverture contre l’inflation est logique

Même si notre modèle du cycle conjoncturel n’est pas conçu pour prédire les tendances d’inflation cycliques, il nous permet de tirer des conclusions sur le niveau des prix. Les séries de données que nous utilisons n’annoncent pas de pression inflationniste permanente et pointent même vers une baisse des taux d’inflation à l’avenir. Cependant, avec le raffermissement continu sur le front de l’emploi, le risque d’une accélération de la croissance des salaires augmente. Par ailleurs, nous observons l’émergence d’un éventuel facteur de croissance lié à l’adaptation des entreprises aux exigences en matière de durabilité. Pour inciter les sociétés à davantage d’écologie, les gouvernements ont tendance à augmenter les coûts des sources d’énergie fossile, au risque de faire grimper les prix des produits et des services. Dès lors, il nous semble avisé d’ajouter des matières premières à un portefeuille pour amortir l’inflation.

Soyez prêts au moment de repartir vers le camp de base

Tout semble avoir été facile lors de l’ascension du pic, mais aujourd’hui, nous faisons face à une nouvelle situation. De nombreuses équipes d’alpinistes se trouvent en difficulté lors de la descente en raison d’un manque de préparation ou d’erreurs de jugement. Les investisseurs intelligents, qui disposent de l’équipement adapté pour atténuer les risques, devraient arriver sains et saufs au camp de base, prêts à se lancer dans de nouveaux défis.

1. Voir également notre récent article « Point haut du cycle : des spéculations fondées ? » .

2. https://am.vontobel.com/insights/how-to-check-if-peak-talk-has-substance-to-it

Mentions légales importantes :

Certain information ©2021 MSCI ESG Research LLC. This report contains “Information” sourced from MSCI ESG Research LLC, or its affiliates or information providers (the “ESG Parties”). The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Although they obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages

© 2021 Vontobel Asset Management, Inc. All Rights Reserved.

Pour accéder au site, cliquez ICI.