Si Jackson Hole est une station de ski réputée aux États-Unis, c’est aussi l’occasion d’une réunion annuelle entre les grands argentiers de ce monde. Depuis la crise financière de 2007-2009, les présidents de la Réserve fédérale américaine (Fed) ont profité de leur intervention à la conférence - qui se tient généralement à la fin août - pour signaler d'importants changements dans la politique monétaire ou les perspectives économiques. Cette année Jerome Powell est ainsi attendu comme le lait sur le feu au milieu d’une récession économique quasi historique. Synthèse et analyse.

a. La circonstance de cette réunion

a. La circonstance de cette réunion

Les circonstances de cette réunion sont très spéciales cette année. Tout d’abord parce que le thème de cette année est un retour aux sources (Navigating the Decade Ahead: Implications for Monetary Policy (Naviguer dans la décennie à venir : Implications pour la politique monétaire) par rapport à Challenges for Monetary Policy en 2019 et Changing Market Structure and Implications for Monetary Policy en 2018).

Ensuite, parce que les investisseurs ont besoin de clarté après un discours ambigu de la Réserve fédérale américaine (Fed) et du récent manque de communication de la banque centrale européenne (BCE).

À cela on peut rajouter que les anticipations de hausse de l’inflation de la part des investisseurs deviennent de plus en plus importantes alors que les rendements des obligations d’État semblent nous dire le contraire…

Enfin, les risques liés à une deuxième vague de coronavirus sont dans l’esprit de tous les responsables politiques et monétaires.

b. Le discours bipolaire de la Fed sera-t-il clarifié ?

Lors de la dernière réunion de la Fed le communiqué du FOMC et la conférence de presse de Jerome Powell laissaient la porte ouverte à de nouvelles interventions monétaires (whatever it takes).

Cependant lors de la publication des Minutes de la Fed, le ton avait quelque peu changé, les membres de la Fed ne semblant plus aussi enclins à lancer un nouvel assouplissement quantitatif, à contrôler la courbe des taux ou même à lancer une opération twist.

Une clarification de la part du responsable de l’institution monétaire américaine était donc nécessaire.

c. Une focalisation sur l’inflation et le résultat d’un examen approfondi

Le président de la Réserve fédérale Jerome Powell pourrait prononcer à Jackson Hole un discours sur la révision tant attendue du cadre de politique monétaire de la banque centrale, qui s'est concentrée sur une nouvelle stratégie d'inflation.

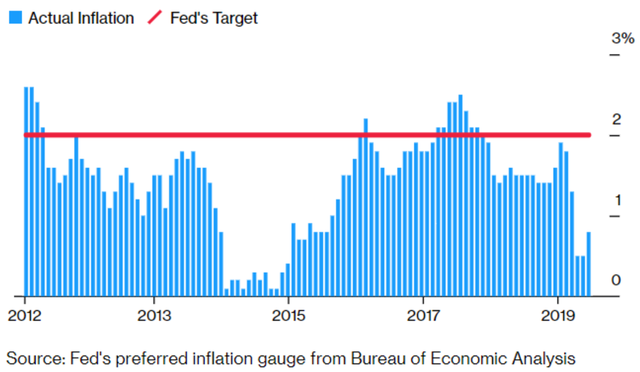

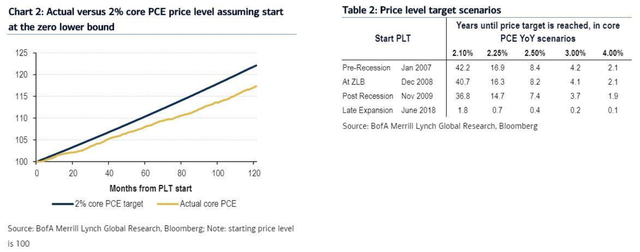

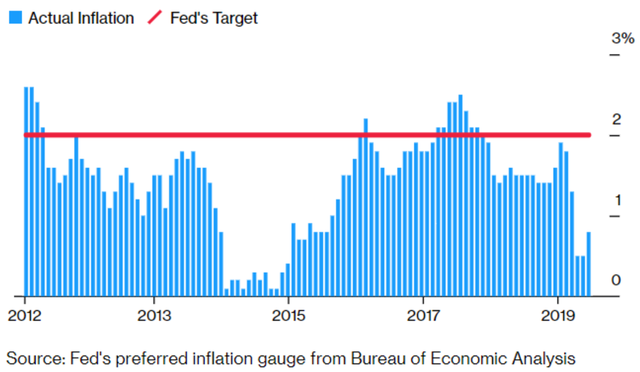

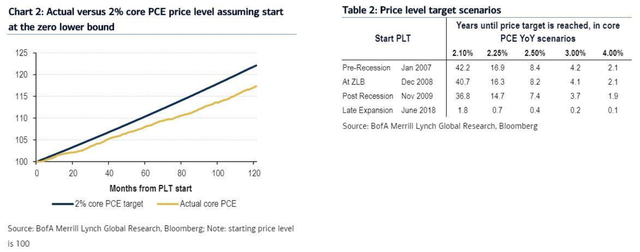

Poussée par une inflation et des taux d'intérêt inquiétants qui ont érodé la capacité de la banque centrale à lutter contre les récessions, la Fed a passé toute l'année 2019 et une grande partie de cette année à mener son premier examen complet du cadre.

Pour mémoire, les responsables de la Réserve fédérale se demandent depuis février 2019 s’ils doivent laisser l’inflation dépasser plus souvent leur objectif de 2 % alors qu’ils sont confrontés à la probabilité que les taux d’intérêt restent beaucoup plus bas que par le passé. Ceci avait alors poussé la Fed a lancé un réexamen du cadre de sa politique monétaire.

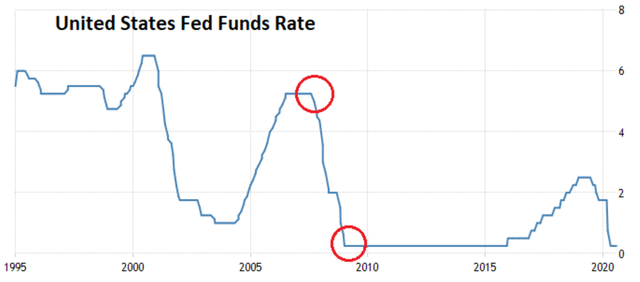

Des taux aussi bas laissent à la Fed moins de marge de manœuvre pour réduire les taux en cas de ralentissement économique et augmentent la possibilité qu’ils soient bloqués près de zéro plus longtemps lors de futures récessions.

Un cadre de politique monétaire plus souple face à une inflation plus élevée serait un moyen de signaler la détermination de la Fed à prendre des mesures plus audacieuses pour relancer la croissance après la récession actuelle. Pour mémoire depuis la fixation de l’objectif d’inflation de 2% en 2012, la moyenne de celle-ci n’a été que de 1.4%...

Le cas inverse serait aussi à envisager en cas de déflation, c’est-à-dire le recours à un outil souvent décrié par les membres de la Fed : les taux d’intérêt négatifs.

d. La question que personne n’ose poser

Une question à laquelle Powell et la Fed devront peut-être répondre, est de savoir pourquoi il est nécessaire de continuer à faire des gestes politiques agressifs.

Après tout, les marchés actions ont globalement récupéré toutes leurs pertes dues à la pandémie, le marché de l'emploi continue de se redresser tout en restant bien éloigné de ses niveaux antérieurs, et l'économie, bien que ralentie par un rythme de réouvertures réduites, devrait également rebondir de manière probante au troisième trimestre.

Compte tenu de ces faits et que la commercialisation d’un vaccin pourrait potentiellement être proche, la Fed pourrait théoriquement s'attacher davantage à prendre du recul par rapport à ce qu'elle a fait.

Rappelons que de plus en plus d’économistes et d’investisseurs accusent la Fed d’avoir créé une véritable bulle sur le marché des actions et d’avoir « écraser » les rendements des Treasuries.

Néanmoins, et c’est là où c’est paradoxal, le marché ne semble pourtant pas pouvoir vivre sans une aide accrue de la part de la Fed.

e. Que s’est-il passé lors de la réunion de 2019 ?

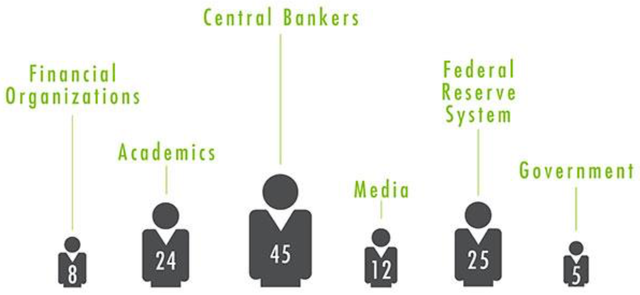

Il y a un an exactement, les banquiers centraux de la planète étaient arrivés à deux constats. Le premier était que le retour à ce que l’on considérait être la normalité avant que n’éclate la Grande Récession ne serait probablement pas possible.

Le second était que le populisme et les guerres commerciales d’un nombre grandissant de pays, dont les États-Unis, menaçaient non seulement la prospérité et la stabilité économiques des nations, mais réduisaient aussi la capacité d’aide des banques centrales, les acteurs publics qui avaient sans doute le plus contribué à éviter le pire durant la dernière crise.

f. La référence 2007

En pleine crise des subprimes en 2007, la réunion du 31 août (2007) aura marqué la réputation du symposium de Jackson Hole.

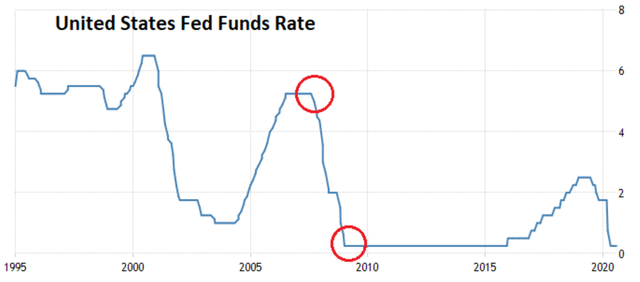

En effet, en signalant clairement que « La Réserve fédérale se tient prête à prendre des mesures supplémentaires, en fonction des besoins, pour apporter des liquidités et favoriser le fonctionnement harmonieux des marchés », Ben Bernanke donnera le coup d’envoi à un cycle de baisses de taux quasi sans précédent puisque ces derniers passeront de 5.25% le 18 septembre (soit la réunion de la Fed qui suivra Jackson Hole) à 0.25% en décembre 2008.

g. La surprise viendra-t-elle de la … BCE ?!

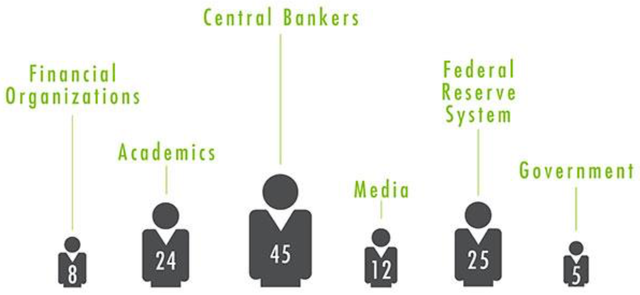

Si tout le monde surveillera le discours de Jerome Powell (le 27 août à 15h10 heure de Paris) la surprise pourrait néanmoins venir des responsables européens (la liste des participants n’est pas encore annoncée à l’heure qu’il est).

En effet, les responsables de la BCE se sont faits très discrets ces dernières semaines à part le compte-rendu de la dernière réunion de l’institution européenne : les fameuses Minutes de la BCE publiées le 20 août dernier.

Selon le document, les membres du conseil des gouverneurs de la BCE étaient alors d’avis que la trajectoire de l’inflation comme l’ampleur du rebond initial de l’activité (en zone euro) n’était pas nécessairement un bon guide de la rapidité et de la robustesse de la reprise.

L’instance de décision avait aussi indiqué qu’elle serait mieux placée pour réévaluer l’orientation de la politique monétaire et ses outils politiques lors de sa prochaine réunion en septembre.

Dans ce même document, les participants ont par ailleurs souligné que l’incertitude qui entourait les perspectives économiques restait très élevée, la trajectoire de l’économie dépendant fortement de celle du virus et de la réponse du secteur public à cela, c’est-à-dire de l’adoption d’un nouveau plan d’aide.

h. Quels sont les prochains rendez-vous ?

Plusieurs banques centrales se réuniront en septembre, dont :

• Banque du Canada (BoC) : 9 septembre

• Banque centrale européenne (BCE) : 10 septembre

• Banque d'Angleterre (BoE) : 17 septembre

• Banque du Japon (BoJ) : 17 septembre

• Réserve fédérale des États-Unis (Fed) : 16 septembre

• Banque nationale suisse (BNS) : 24 septembre

i. Synthèse

Le symposium de Jackson Hole tombe à point nommé cette année. En effet, en plein doute quant à la croissance mondiale et en pleine confusion concernant une potentielle deuxième vague de pandémie, les banques centrales doivent absolument apporter des réponses aux investisseurs quelques semaines avant leurs prochaines réunions déjà considérées comme cruciales.

2. Aujourd’hui

Aujourd’hui, ce sont les commandes de biens durables aux États-Unis (juillet) qui animeront la séance.

Les indices européens devraient ouvrir sans réelle tendance ce matin avec d’un côté les nouveaux records historiques pour le S&P 500 et le Nasdaq et d’un autre un effondrement de la confiance aux Etats-Unis (selon le Conference Board). Lorsque l’on parlait de schizophrénie…

Marchés asiatiques

Les indices asiatiques évoluent sans tendance ce matin dans une espèce de flou artistique concernant l’avancée des relations sino-américaines. Intéressant de noter qu’au Japon 1 seul secteur progresse (services de communication) sur les 11 sous-indices du Nikkei. Le Yen quant à lui est totalement atone face à un panier de devises.

Le pays du jour : Allemagne

Contrairement aux Etats-Unis, l’Allemagne fait (presque) un sans faute depuis le début de la crise liée au coronavirus. Dernier exemple en date ? Les partis de la coalition gouvernementale en Allemagne sont convenus de prolonger les mesures destinées à compenser l'impact économique de la crise liée au coronavirus, dont l'aide au chômage partiel et le gel des règles d'insolvabilité. Le gouvernement cherche à tout prix à contrer autant que possible les effets économiques de la crise sanitaire, en particulier en vue des élections prévues à l'automne 2021. Parmi les principales décisions, l'extension jusqu'à fin 2021 de l'aide pour les contrats de travail à temps réduit qui devait prendre fin en mars prochain, et l'extension jusqu'à la fin de l'année des subventions pour les PME. On devrait s’en inspirer Outre-Atlantique…

MIRABAUD Securities Limited Representative Office Switzerland Boulevard Georges-Favon 29, CH-1204 Geneva, T +41 (0)58 816 86 70, F +41 (0)58 816 96 60 Authorised and regulated by the Financial Conduct Authority. Mirabaud Securities Limited Member of the London Stock Exchange Authorised and regulated by the Financial Conduct Authority under reference number 762066 5th Floor, The Verde Building, 10 Bressenden Place, London SW1E 5DH, UK A member of the Mirabaud Group - www.mirabaudsecurities.co.uk www.mirabaud.com

Pour accéder au site, Cliquez ICI.

a. La circonstance de cette réunion

a. La circonstance de cette réunion