Alors que la fin d’année approche, le mois d’octobre fait vivre à tous les investisseurs des moments difficiles tant il jure avec un début d’année 2023 rempli d’espérance et de certitudes !

Matthieu Bailly, Directeur Général d'Octo AM

Matthieu Bailly, Directeur Général d'Octo AM

Certitudes qui n’étaient pas toutes justifiées, bien sûr, mais qui permettaient aux investisseurs de se positionner sereinement sur leurs classes d’actifs favorites, de se dire « j’y suis bien pour un bon moment ! » et de limiter ainsi la volatilité du marché.

Ainsi, beaucoup d’investisseurs avaient-ils par exemple vu dans l’année 2022 le grand soir de la hausse des taux et considéraient à tout crin que ces derniers ne pouvaient guère monter plus haut et se positionnaient vaillamment sur les obligations de haute qualité et souveraines ; d’autres étaient convaincus que les banques centrales reviendraient bien vite en arrière et que l’on pouvait continuer d’investir sur les actions aux multiples élevés sans crainte à moyen terme; d’autres encore dont nous faisions partie misaient sur le high yield comme le meilleur rapport rendement risque du moment.

Et tout est resté, bon an mal an, stable pendant 9 mois, les banques centrales continuant sur leur lancée avec une certaine constance, faisant grimper les taux courts régulièrement et les taux longs avec une certaine volatilité mais sans les secousses violentes de 2022, les entreprises publiant des résultats corrects et des prévisions modestes propres à dégrader les valorisations sans pour autant faire changer aux analystes leurs fusils d’épaules et aux plus « colombes » leurs certitudes sur les P/E, les spreads de crédit restaient d’une stabilité à toute épreuve conduisant les indices High Yield vers les meilleures performances du marché.

Et comme toujours dans les marchés, les imprévus se sont accumulés ces dernières semaines… Les banques centrales qui avaient suggéré qu’elles avaient pu atteindre leur fameux taux d’équilibre durant les semaines passées changent d’avis et réaffirment qu’elles ne sont peut-être pas encore assez restrictives, comme le faisait encore Monsieur Powell ce jeudi 19 octobre. « Mais alors jusqu’où ? » se demandent les marchés qui avaient acté des taux directeurs entre 3 et 4% mais qui commencent à s’inquiéter de niveaux entre 5 et 6% …

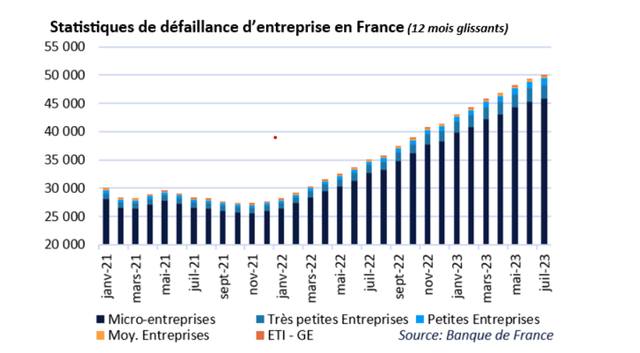

Dans ce contexte, l’humeur sur la microéconomie et les entreprises bascule elle aussi, la lecture des publications devient plus circonspecte et quelques-unes d’entre elles assorties de prévisions prudentes, voire médiocres, ont pu doucher les espoirs de croissance continue qui pourraient contrecarrer des taux d’actualisation plus élevés, faisant chuter massivement certaines actions encore plébiscitées quelques semaines auparavant. Dans le même temps, les petites entreprises non cotées montrent des signes majeurs de faiblesse et de difficulté avec des faillites en forte hausse, alors même que la croissance reste correcte et l’inflation élevée à peu près partout, ce qui empêche de croire à un retour de politique accommodante rapide. Serait-on alors dans le pire des deux mondes entre économie en stagnation économique et inflation, assorties d’une dichotomie majeure entre secteurs, pays, tailles d’entreprise et autres, dichotomie propre à créer énigmes et hiatus monétaires, politiques, économiques et sociaux insolvables ?

Les spreads de crédit des Etats trop endettés comme celui de la France ou de l’Italie commencent à s’écarter car, à partir d’un certain moment, le coût de la dette crée un effet ‘boule de neige’ sur le déficit public propre à augmenter l’endettement chaque année rien que par les intérêts. Mais si BCE et Etats ont des intérêts divergents alors même que leur concorde était justement la clé de la stabilité de la Zone Euro, n’arrive-t-on pas à un blocage ?

Et comble de tout, la guerre au Proche-Orient devient une probabilité significative et crée un climat d’incertitudes majeures et multiples. Quels pays impliqués, quelles alliances, quels impacts en Europe, quelles conséquences sur les échanges, la confiance, et in fine sur la politique, l’économie, les taux d’intérêts, les changes, les prix des matières premières ? Pour le moment, rien de tout cela n’est pris en compte dans aucune valorisation car, comme pour le Covid, cela sort du spectre d’analyse des marchés financiers. Ainsi, si d’un côté on lit partout « une guerre entraînerait le prix du pétrole à 150 dollars » et ailleurs encore « la guerre devient extrêmement probable », le prix du pétrole, lui, n’a pour le moment pas bougé… Et s’il grimpait effectivement à 150 dollars, doit-on alors conclure que l’inflation flamberait et que les banques centrales devraient encore réagir ou au contraire, que la récession serait immédiatement déclenchée et que les banques centrales feraient au contraire machine arrière ? De même les banques centrales évoquent le sujet avec parcimonie et ne l’intègrent pas encore dans leurs scenarii de taux et les obligations souveraines longues ou le dollar ne jouent pas encore leur rôle d’actif « flight to quality »… Tout semble pour le moment suspendu…

Et ce ne sont là que quelques questions en suspens en cette fin d’année qui a multiplié les champs du possible pour l’année 2024 que tout le monde espérait comme celle de la normalisation de la politique monétaire et de la stabilisation des marchés… Alors toutes ces questions, si elles ne peuvent trouver réellement de réponses tant que les déclencheurs ne sont pas activés, érodent chaque jour un peu plus les valorisations de tous les actifs : les actions ont continué de refluer, les spreads de crédit s’écartent modérément, les taux d’Etats touchent leurs plus hauts, l’immobilier se grippe totalement sur de nombreux pans de marché…

« Merci pour cette note d’optimisme et ces questions sans réponses, mais alors que faire ? » nous direz vous !

Malheureusement, nous ne donnerons ni ne trouverons de réponses définitive et certaine à toutes ces questions … Mais nous nous rassurons de savoir que, malgré parfois un petit retard de quelques jours ou quelques semaines, le marché obligataire a ceci de particulier qu’il est précisément l’actif adapté à l’incertitude et à la prudence et qu’il peut actuellement être à la fois très rémunérateur sur des maturités courtes (donc moins risquées) et protecteur pour un portefeuille sur les maturités les plus longues, si tant est qu’on choisisse bien ses catégories. Et derrière l’inquiétude des questions et la volatilité ambiante, nous retrouverons vite des bases de réflexion rassérénantes à moyen terme pour un portefeuille obligataire :

Car non, il serait fort peu probable d’observer 10% de faillites en 3 ans sur l’ensemble du marché obligataire

Car non, les Etats et les banques centrales quoiqu’on en dise, n’ont pas des intérêts divergents en dernier recours et visent tous d’abord la stabilité de la Zone Euro

Car oui l’inflation et les taux élevés permettent plus facilement de désendetter les Etats surendettés que les taux zéro (notamment parce que les hausses de taux jouent sur les intérêts marginaux de la nouvelle dette tandis que l’inflation érode tout le stock de dette existante)

Car oui les entreprises ont aussi toutes ces questions et ces incertitudes en tête et les prennent à bras le corps dans leur gestion financière

Car oui l’Eurozone reste une des deux zones de sécurité au monde capable d’attirer les flux de capitaux en cas de stress, notamment géopolitique.

Au final, et nous pourrons volontiers détailler ce point au cours d’entretiens à votre convenance, notre positionnement sur la partie obligataire pour la fin d’année :

-

Une part d’investissement sur le high yield ‘crossover’ de faible duration pour sa forte rémunération. Les flux récents sur notre fonds Octo Rendement 2025 nous montrent que beaucoup d’investisseurs partagent cette conviction.

-

Une part sur les obligations corporates investment grade plus longues qui offrent une prime (notamment les obligations bancaires et assurantielles) pour bénéficier d’un portage significatif tout en protégeant son portefeuille en cas de scenario « fligh to quality » et donc de baisse des taux et de chute des actifs risqués. Les obligations souveraines longues pourront aussi être utilisées mais resteront réservées aux investisseurs les plus actifs puisqu’il faudra être sélectif sur les pays autant que sur les maturités et opérer des bascules régulières au gré de la volatilité très forte sur ce pan de marché.

-

On pourra aussi conserver une part de trésorerie rémunérée entre 3.5% sur les fonds monétaires et 5% sur les fonds de trésorerie à quelques mois.

-

Enfin, certains fonds flexibles obligataires tel que notre fonds Octo Crédit Value, peuvent avoir ce positionnement global entre high yield court, investment grade plus long et quelques cartouches de trésorerie, ce qui peut éviter aux plus distants des marchés d’entre nous, de réaliser des arbitrages réguliers dans cet environnement volatil.

Matthieu Bailly, Directeur Général d'Octo AM

Pour accéder au site d'Amplegest, cliquez ICI.

Pour accéder au site d'OCTO AM, cliquez ICI.