Le CREDIT RISK MONITOR de Janus Henderson Investors suit les indicateurs clés qui ont un impact sur les portefeuilles de crédit.

-

Une augmentation du nombre de défaillances d'entreprises est attendue en raison des rendements élevés et de l'accès réduit à des capitaux abordables - bien que cet impact soit décalé dans le temps.

-

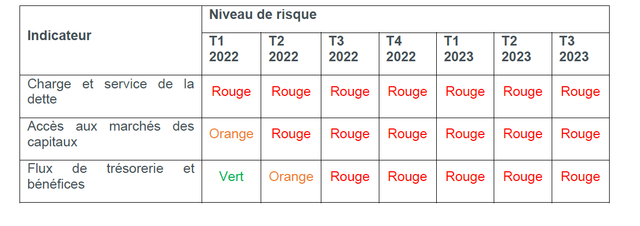

Les trois feux de signalisation surveillés par l'équipe de risque de crédit de Janus Henderson Investors clignotent en rouge depuis plus de 12 mois

-

Avec le ralentissement de l'inflation, le passage d'une déflation liée à l'offre à une déflation liée à la demande, la croissance nominale sera ralentie et les coûts d'emprunt pourraient dépasser considérablement les revenus, créant ainsi un risque supplémentaire pour les investisseurs en crédit d'entreprise

-

Des opportunités existent, mais une sélection rigoureuse des crédits reste essentielle pour les investisseurs dans cet environnement.

Londres, le 27 octobre 2023 - Selon la dernière analyse de Janus Henderson Investors, les signes annonciateurs d'un retournement du cycle du crédit sont toujours présents, comme ils l'ont été l'année dernière, avec des taux d'intérêt et des niveaux d'endettement élevés qui contribuent à la trajectoire descendante.

Londres, le 27 octobre 2023 - Selon la dernière analyse de Janus Henderson Investors, les signes annonciateurs d'un retournement du cycle du crédit sont toujours présents, comme ils l'ont été l'année dernière, avec des taux d'intérêt et des niveaux d'endettement élevés qui contribuent à la trajectoire descendante.

Bien que l'impact soit différé, la hausse vertigineuse des taux d'intérêt devrait avoir un effet domino sur le cycle de crédit actuel : le refinancement des dettes à des taux plus élevés peut entraîner une diminution des ratios de couverture des intérêts et, en fin de compte, une augmentation des défauts de paiement dans les années à venir.

Le dernier Credit Risk Monitor de Janus Henderson Investors suit les indicateurs fondamentaux et macroéconomiques des entreprises à l'aide d'un système de feux tricolores afin d'indiquer où nous en sommes dans le cycle du crédit et comment positionner les portefeuilles en conséquence. Les indicateurs clés suivis - "Flux de trésorerie et bénéfices", "Charge et service de la dette" et "Accès aux marchés des capitaux" - restent tous dans le rouge pour le quatrième trimestre consécutif.

Beaucoup d'entreprises ont des dettes importantes à refinancer. La hausse des taux d'intérêt entraînera une détérioration brutale des ratios de couverture des intérêts dans les années à venir et une escalade des défauts de paiement. Cela aura pour effet de resserrer encore les normes de prêt et de restreindre l'accès à des capitaux abordables. Toutefois, le résultat sera décalé. Pour la plupart des entreprises, les échéances ne seront pas atteintes avant 12 à 18 mois. Ce délai pourrait protéger les entreprises à court terme, mais les valorisations n'offrent qu'une faible récompense pour l'absorption d'un risque élevé de récession aux niveaux actuels.

Les entreprises les plus solides et à forte capitalisation peuvent se refinancer relativement facilement et continueront à le faire, même si la hausse des coûts d'emprunt devrait se faire sentir plus fortement au cours des prochains trimestres.En revanche, les petites et moyennes entreprises, qui dépendent généralement plus fortement du système bancaire pour leur financement, continueront à avoir du mal à emprunter et les défaillances dans ce segment seront plus prononcées. Le coût du capital, tant en termes nominaux que réels, constitue un autre défi. Le coût réel de l'emprunt est plus élevé qu'il ne l'a été depuis près de dix ans. Cela aura un impact significatif sur les entreprises, en particulier si les revenus ralentissent.

La hausse de l'inflation n'a pas été négative pour la plupart des entreprises. La forte croissance nominale a augmenté les revenus des sociétés et a profité à celles qui avaient auparavant obtenu des taux d'emprunt plus bas. La hausse des taux devrait commencer à freiner la consommation et, par conséquent, les bénéfices. La résilience des consommateurs a été sous-estimée, mais les vents contraires s'intensifient.L'inflation est actuellement en baisse, ce qui incitera les banques centrales à faire une pause. Mais si la déflation induite par l'offre se transforme en déflation induite par la demande, la croissance nominale sera nettement plus lente et les coûts d'emprunt pourraient dépasser considérablement la croissance des revenus.

Les spreads des entreprises, ou la relation entre les obligations d'État et les obligations non gouvernementales, ne semblent pas refléter pleinement les risques de l'économie mondiale. Les niveaux de rendement attractifs actuels devraient devenir de plus en plus attrayants pour les investisseurs à long terme et commencer à produire des rendements totaux élevés. Toutefois, les rendements relatifs des actifs à risque peuvent souffrir de la comparaison avec les segments de qualité du marché. Les secteurs défensifs du marché obligataire, tels que le crédit investment grade, devraient commencer à offrir non seulement des rendements totaux attrayants, mais aussi de solides avantages en termes de diversification.

Jim Cielinski, Responsable mondial des titres à revenu fixe chez Janus Henderson Investors, explique : « Le cycle du crédit ne tend à s'inverser que si trois conditions sont réunies : un niveau d'endettement élevé, un manque d'accès aux capitaux et un choc exogène sur les flux de trésorerie. Ces conditions - qui sont les trois indicateurs de notre moniteur de risque de crédit - sont toutes présentes aujourd'hui : la courbe de rendement est inversée, les normes de prêt se resserrent et la politique des banques centrales à l'échelle mondiale s'est agressivement resserrée. Chaque cycle est différent, mais la combinaison de niveaux d'endettement élevés et d'un environnement de taux d'intérêt plus élevés et plus longs exerce une pression sur les entreprises pour qu'elles assurent le service de la dette tout en leur coupant l'accès à des capitaux à un prix raisonnable. Dans un tel environnement, la sélection active des titres est essentielle. C'est le moment du cycle où il faut se concentrer sur la différence entre les rendements totaux et les rendements excédentaires. Les taux d'intérêt sont montés en flèche, produisant des niveaux de rendement parmi les plus élevés depuis plus de dix ans. Il y a seulement 18 mois, les banques centrales étaient des acheteurs aveugles d'obligations, mais elles sont maintenant devenues des vendeurs insensibles aux prix. Les déficits budgétaires explosent, atteignant 7 % du PIB aux États-Unis. Le rééquilibrage de l'offre et de la demande prend les investisseurs au dépourvu, car ils considèrent ces tendances budgétaires comme insoutenables. Les investisseurs obligataires exigent une compensation supplémentaire.»

Pour lire l'article dans son intégralité, cliquez ICI.

Pour accéder au site, cliquez ICI.