Jim Cielinski, Responsable mondial des obligations chez Janus Henderson, explique pourquoi dans un contexte de volatilité extrême des marchés obligataires, les mathématiques au cœur des obligations plaident en faveur de perspectives plus gratifiantes pour la classe d'actifs en 2024.

Jim Cielinski, CFA Responsable mondial de la gestion obligataire

Jim Cielinski, CFA Responsable mondial de la gestion obligataire

Points à retenir :

-

2024 devrait être l'année du pivot. Les banques centrales ont pris le dessus sur l'inflation, ce qui leur permet d'envisager des baisses de taux en cours d'année.

-

et devrait entraîner une baisse des rendements et donner l'occasion aux obligations de retrouver leur potentiel de diversification.

-

Le secteur des obligations d'entreprises pourrait être freiné par l'impact décalé du durcissement des politiques monétaires, mais les secteurs des spreads de meilleure qualité (obligations d'entreprises Investment grade et créances hypothécaires d'agences) devraient s'avérer attractifs.

La fin de l'ère des rendements faibles ou inférieurs à zéro a toujours été un problème pour une grande partie de l'univers des obligations. La bonne nouvelle qui accompagne des rendements plus élevés, c'est qu'il est mathématiquement plus difficile d'afficher des performances obligataires négatives et beaucoup plus facile de générer des performances positives. À l'horizon 2024, le monde des mathématiques peut offrir quelques enseignements utiles sur ce que les marchés des obligations peuvent nous réserver.

Calcul des performances : le profil de rendement/risque asymétrique

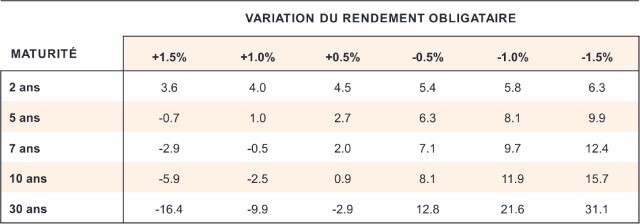

Les cours des obligations évoluent inversement à leur rendement. Lorsque les rendements baissent, les cours des obligations augmentent et vice versa. Les rendements ont grimpé en flèche au cours de ces trois dernières années, mais comme ils semblent avoir atteint leur point haut, nous pensons que les perspectives des obligations en 2024 sont de plus en plus prometteuses. Le tableau ci-dessous montre que les revenus procurés par les obligations constituent un amortisseur contre la hausse des taux, tandis que toute baisse des rendements offre la perspective d'une performance améliorée par les plus-values.

Illustration 1 : matrice de la performance absolue des bons du Trésor américain selon différents scénarios d'évolution des rendements

Performance absolue estimée sur 12 mois (en %)

Source : Bloomberg, sur la base des obligations du Trésor américain aux diverses échéances spécifiées, au 17 novembre 2023. À des fins d'illustration uniquement, les performances estimées reflètent des hypothèses basées uniquement sur les variations des rendements obligataires/taux d'intérêt et sur aucun autre facteur. Rien ne garantit que les prévisions se réalisent. Les rendements peuvent varier et ne sont pas garantis.

Source : Bloomberg, sur la base des obligations du Trésor américain aux diverses échéances spécifiées, au 17 novembre 2023. À des fins d'illustration uniquement, les performances estimées reflètent des hypothèses basées uniquement sur les variations des rendements obligataires/taux d'intérêt et sur aucun autre facteur. Rien ne garantit que les prévisions se réalisent. Les rendements peuvent varier et ne sont pas garantis.

Probabilité : des taux directeurs à leur point haut offrent une forte probabilité de performances positives.

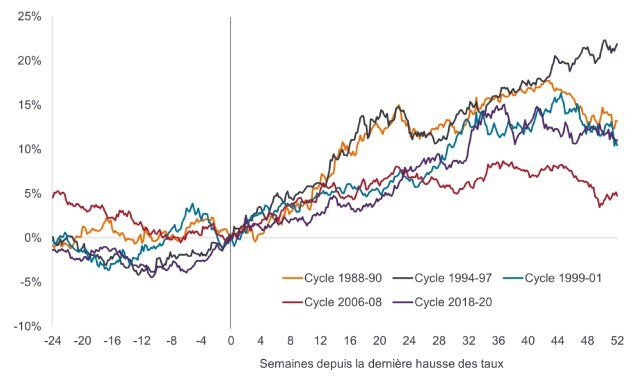

Les banques centrales ont assez bien réussi à freiner l'inflation. En dépit d'un choc idiosyncratique ‑ dont une crise géopolitique et le phénomène climatique El Niño sont des candidats évidents ‑ la trajectoire la plus probable pour l'inflation est baissière. Si l'on exclut la composante persistante des loyers de l'indice des prix à la consommation (IPC), l'inflation américaine avoisine les 2 %.1 Les pressions salariales ralentissent et les marchés des contrats à terme de type « futures » estiment déjà que la Réserve fédérale américaine (la Fed) en a fini avec ses relèvements de taux d'intérêt.2 Les performances passées ne sont pas nécessairement un guide, mais l'histoire a montré que les emprunts d'État se comportent généralement bien à la suite du dernier relèvement.

Illustration 2 : performance absolue de l'emprunt du Trésor américain à 10 ans lors de différents cycles de durcissement monétaire

Source : LSEG Datastream, pics du taux cible de la Réserve fédérale américaine lors du cycle, Indice de référence US 10-year Government Bond Total Return, en USD. Date de la dernière hausse de taux lors de chaque période du cycle : 1988-90 (24 fév1989), 1994-97 (01 fév 1995), 1999-01 (16 mai 2000), 2006-08 (29 juin 2006), 2018-20 (20 déc 2018). Les performances passées ne permettent pas de prédire les performances futures.

Source : LSEG Datastream, pics du taux cible de la Réserve fédérale américaine lors du cycle, Indice de référence US 10-year Government Bond Total Return, en USD. Date de la dernière hausse de taux lors de chaque période du cycle : 1988-90 (24 fév1989), 1994-97 (01 fév 1995), 1999-01 (16 mai 2000), 2006-08 (29 juin 2006), 2018-20 (20 déc 2018). Les performances passées ne permettent pas de prédire les performances futures.

Cette situation devrait avoir des conséquences sur l'allocation, les investisseurs étant plus enclins à profiter des rendements à plus long terme. Les obligations à échéance plus longue ont une duration plus élevée (sensibilité aux variations des taux d'intérêt). Les taux étant appelés à baisser, nous estimons que 2024 est une année au cours de laquelle il pourrait être avantageux de détenir de la duration.

Il y aura toutefois une limite à la baisse des taux courts en 2024. L'indicateur de l'inflation préféré par la Fed (« core Personal Consumption Expenditure ») est toujours supérieur à l'objectif fixé, à 3,7 %.4 Bien qu'il soit probable que les États-Unis procèdent à des baisses de taux, les marchés ont commencé à intégrer cette éventualité. L'inflation se comportera bien, mais tant qu'elle ne se rapproche de l'objectif de 2 %, les banques centrales agiront avec prudence et s'assureront qu'elles conservent bien leurs compétences en matière de lutte contre l'inflation. C'est particulièrement vrai dans la zone euro où la Banque centrale européenne a un mandat très précis axé sur la stabilité des prix.

Ratios : des signaux de la part des fondamentaux des entreprises

Pour les obligataires, les ratios sont importants, en particulier ceux liés à la solidité financière d'une entreprise. Le ratio d'endettement (dette nette/bénéfices) est un ratio très suivi qui indique approximativement le nombre d'années nécessaires à une entreprise pour rembourser sa dette. Un autre ratio clé est la couverture des intérêts (bénéfices/charges d'intérêt) qui mesure la facilité avec laquelle une entreprise peut payer les intérêts de sa dette. Ces deux ratios se sont récemment détériorés et nous nous attendons à ce que cette détérioration s'accentue en 2024.

La croissance économique nominale s'affaiblissant, les entreprises devraient avoir plus de mal à augmenter leurs chiffres d'affaires. Toutefois, les pressions sur les coûts persisteront et pourraient s'aggraver car les entreprises devront se refinancer à des taux plus élevés qu'il y a quelques années. Cela devrait conduire à séparer les « nantis » (les entreprises ayant un bilan solide et un potentiel de génération de flux de trésorerie) des « démunis » (les entreprises dont le bilan est tendu et qui auront du mal à refinancer leurs dettes). Il sera important de surveiller la désinflation.

« Le refinancement séparera les entreprises « nanties » des « démunies ».

La décompression (élargissement des écarts de crédit au fur et à mesure de la diminution de la qualité du crédit en réponse à des nouvelles négatives) n'a pas été très visible en dehors des obligations d'entreprises notées CCC au cours de l'année 2023. Cela s'explique par le fait que les variations des rendements des emprunts d'État ont eu tendance à prendre le pas sur les performances. Nous pensons toutefois que la décompression fera son retour en 2024 car une plus grande attention est accordée aux fondamentaux des entreprises, ce qui créera un environnement propice à la gestion active. Dans ce contexte, nous privilégions la qualité, en préférant les obligations Investment grade à celles à haut rendement et aux segments de qualité supérieure du marché des prêts.

Pour consulter le document dans son intégralité, cliquez ICI.

Pour accéder au site, cliquez ICI.

Informations importantes

La diversification ne garantit pas un bénéfice et n’élimine pas non plus le risque de perte.Les titres obligataires sont soumis aux risques de taux d’intérêt, d’inflation, de crédit et de défaut. Le marché obligataire est volatil. Lorsque les taux d’intérêt augmentent, le prix des obligations baisse généralement, et vice versa. Le remboursement du capital n’est pas garanti et les prix peuvent baisser si un émetteur n’honore pas ses paiements en temps voulu ou si sa solidité financière se détériore.

Les obligations high yield ou « junk » impliquent un plus grand risque de défaut et de volatilité des prix. Elles peuvent connaître des variations de prix soudaines et brutales.

Les produits titrisés, tels que les titres adossés à des créances hypothécaires ou à des actifs, sont plus sensibles aux variations de taux d'intérêt, présentent un risque d'extension et de remboursement anticipé et sont soumis à des risques de crédit, de valorisation et de liquidité plus importants que les autres titres obligataires.

Les opinions exprimées sont celles de l'auteur au moment de la publication et peuvent différer de celles d'autres personnes/équipes de Janus Henderson Investors. Les références faites à des titres individuels ne constituent pas une recommandation d'achat, de vente ou de détention d'un titre, d'une stratégie d'investissement ou d'un secteur de marché, et ne doivent pas être considérées comme rentables. Janus Henderson Investors, son conseiller affilié ou ses employés peuvent avoir une position dans les titres mentionnés. Les performances passées ne préjugent pas des résultats futurs. Toutes les données de performance tiennent compte du revenu, des gains et des pertes en capital mais n'incluent pas les frais récurrents ou les autres dépenses du fonds. La valeur d’un investissement et ses rendements peuvent augmenter ou diminuer et vous pourriez ne pas récupérer l’intégralité du montant investi à l’origine.

Les informations contenues dans cet article ne constituent pas une recommandation d'investissement.

Communication Publicitaire