Dans cette lettre, nous nous penchons sur les principales évolutions des marchés financiers de la semaine dernière et nous nous demanderons si le résultat du Super Bowl aura une incidence sur les investissements dans les mois à venir.

Les rendements des emprunts d'État américains ont atteint un nouveau plus haut, mais il serait plus juste de parler de marge de fluctuation pour résumer l’évolution des prix sur la plupart des marchés la semaine dernière. Le calme apparent n'était peut-être pas surprenant, étant donné qu'une grande partie de l'Asie était en vacances pour le Nouvel An lunaire et que les États-Unis se remettaient du Super Bowl LVIII entre les Kansas City Chiefs et les San Francisco 49ers à Las Vegas. Les aspects positifs et négatifs des données économiques publiées la semaine dernière se sont mutuellement neutralisés. Ce fut une bonne semaine pour les stratégies de portage.

En Asie, le taux de chômage australien a augmenté pour atteindre 4,1 %, avec seulement 500 emplois créés en janvier, ce qui confirme que la politique relative aux taux commence à faire effet. Toutefois, la prinicpale surprise est venue du Japon, qui est entré de manière inattendue dans une récession technique au quatrième trimestre suite à deux trimestres consécutifs de contraction. La croissance s'est contractée de -0,1 % d'un trimestre à l'autre (QoQ), alors que le consensus tablait sur une croissance de +0,2 %.

Le rapport sur la croissance souligne la dépendance du Japon à l'égard de la demande extérieure, avec une contraction de la consommation intérieure et des investissements des entreprises, et des pressions inflationnistes qui pèsent sur le pouvoir d'achat. Selon nous, cela compliquera et retardera peut-être la sortie de la politique de taux négatifs de la Banque du Japon, dont on s’attend à ce qu’elle augmente ses taux en mars ou en avril. Sur l'ensemble de l'année, l'économie japonaise a progressé de 1,9 %. Malheureusement, cela n'a pas suffi à empêcher l'Allemagne de prendre la place de troisième économie mondiale en 20231.

La récession au Royaume-Uni : Tout est lié aux facteurs techniques

En Europe, le Royaume-Uni a occupé le devant de la scène ; le taux de chômage a baissé de manière inattendue à 3,8 %, et bien que la croissance des salaires ait continué à baisser, elle a diminué plus lentement que ne le prévoyaient les économistes. Les prix à la consommation sont restés stables en janvier (inchangés par rapport à décembre), tandis que l’inflation globale et l’inflation sous-jacente (core) ont augmenté de 4,0 % et 5,1 % en glissement annuel (YoY).

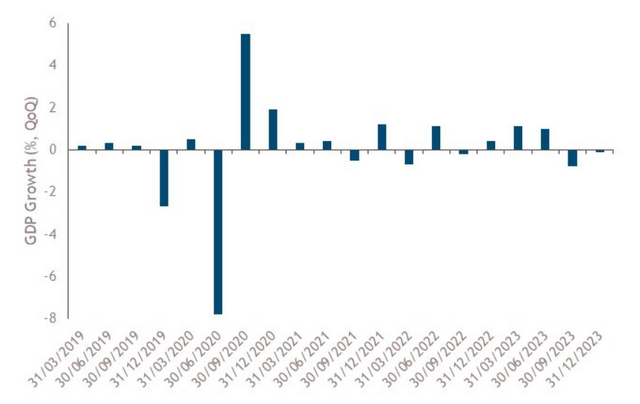

Les solides données sur l'emploi devraient être une bonne nouvelle pour la Banque d'Angleterre (BoE) ; l'inflation devrait poursuivre son recul en février à mesure que les effets de base se font sentir. Cette information a fait les gros titres en annonçant que le Royaume-Uni était entré en récession technique, la croissance s'étant contractée au quatrième trimestre de -0,3 % par rapport au trimestre précédent. Une récession technique est ressortie comme le consensus, mais la contraction du quatrième trimestre a été plus importante que prévu, le commerce net étant l'un des principaux responsables de cette contraction. L'économie britannique n'a donc progressé que de 0,1 % en 2023. Le marché des swaps de taux d'intérêt au jour le jour prévoit que la BoE réduira ses taux directeurs de 75 points de base à partir d’août 2024. Toutefois, la fragilité des chiffres pourrait faire pression sur la BoE pour qu'elle assouplisse ses taux plus tôt.

Aux États-Unis, les prix de base sont restés stables en janvier (inchangés par rapport à décembre), augmentant de 3,9 % en glissement annuel. Les économistes s'attendaient à une baisse des prix à 3,7 %, mais la hausse des loyers a pris les analystes par surprise, augmentant de 0,6 % d'un mois sur l'autre. Ces chiffres ont été suivis par la publication du rapport sur les ventes au détail qui a révélé une baisse généralisée des dépenses. Neuf des treize catégories ont affiché des baisses, le chiffre du « control group » (utilisé pour calculer le produit intérieur brut) s'étant contracté de 0,4 % d'un mois sur l'autre. La faiblesse du rapport pourrait être attribuée aux conditions météorologiques difficiles du mois de janvier. Il pourrait également s'agir d'un signe que les consommateurs se restreignent enfin face à l'augmentation des coûts d'emprunt.

Les investisseurs Bears, les investisseurs Bulls et le Superbowls

Une des particularités de l’art d’investir est de séparer les signaux du bruit. Cette semaine, les investisseurs bulls du marché du crédit se concentreront sur la faiblesse surprenante de la croissance et des chiffres sur la consommation, tandis que les investisseurs Bears citeront la rigidité des chiffres d'inflation.

Pour ceux qui s'intéressent au bruit, Leonard Koppett, journaliste sportif au New York Times, a introduit l'indicateur du Super Bowl en 19782. Cet indicateur prédit que si le vainqueur du Super Bowl fait partie de la American Football Conference (AFC), l'indice S&P 500 baissera au cours de l'année suivante. À l'inverse, la victoire d'une équipe de la National Football Conference (NFC) entraînera une hausse du marché boursier.

De 1967 à 2015, l'indicateur a affiché un taux de précision de 82 %. Au cours des six dernières années, cependant, l'indicateur a perdu de son éclat - il n'a été correct qu'une seule fois entre 2016 et 2023, ramenant son taux de réussite à 75 %. La victoire des Kansas City Chiefs de l'AFC devrait réjouir les bears.

Source : Bloomberg : Bloomberg, au16 février 2024. À des fins d'illustration uniquement.

1. Bloomberg News, "Japan Economy's Slide into Recession Prompts Caution on BoJ Bets",15 février 2024.

2. Forbes, "Super Bowl Indicator Says Market Should Rise in 2022 if Rams Win",31 janvier 2022.

Les performances passées ne sont pas un indicateur fiable des résultats actuels ou futurs.

La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter et ne sont pas garantis. Les investisseurs peuvent ne pas récupérer l'intégralité du montant investi.

Ce document ne doit pas être considéré comme une prévision, une recherche ou un conseil en investissement, et ne constitue pas une recommandation, une offre ou une sollicitation d'achat ou de vente de titres ou d'adoption d'une stratégie d'investissement. Les opinions exprimées par Muzinich & Co sont en date du 16 février 2024 et peuvent changer sans préavis. Toutes les données chiffrées proviennent de Bloomberg au 16 février 2024, sauf indication contraire.

Informations importantes

La société Muzinich & Co. mentionnée dans le présent document est définie comme Muzinich & Co., Inc. et ses sociétés affiliées. Ce document a été produit à des fins d'information uniquement et, en tant que tel, les opinions qu'il contient ne doivent pas être considérées comme des conseils d'investissement. Les opinions sont celles de la date de publication et peuvent être modifiées sans référence ni notification. Les performances passées ne sont pas un indicateur fiable des résultats actuels ou futurs et ne doivent pas être le seul facteur à prendre en considération lors de la sélection d'un produit ou d'une stratégie. La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter, et ne sont pas garantis. Les taux de change peuvent entraîner une hausse ou une baisse de la valeur des investissements. Les marchés émergents peuvent être plus risqués que les marchés plus développés pour diverses raisons, y compris, mais sans s'y limiter, une instabilité politique, sociale et économique accrue, une volatilité accrue des prix et une liquidité réduite du marché.

Toute recherche contenue dans ce document a été obtenue et peut avoir été mise en œuvre par Muzinich pour ses propres besoins. Les résultats de ces recherches sont mis à disposition à titre d'information et aucune garantie n'est donnée quant à leur exactitude. Les opinions et les déclarations sur les tendances des marchés financiers qui sont fondées sur les conditions du marché constituent notre jugement et ce jugement peut s'avérer erroné. Les points de vue et opinions exprimés ne doivent pas être interprétés comme une offre d'achat ou de vente ou une invitation à s'engager dans une quelconque activité d'investissement, ils sont uniquement destinés à des fins d'information.

Toute information ou déclaration prospective exprimée dans ce document peut s'avérer incorrecte. Muzinich ne s'engage pas à mettre à jour les informations, données et opinions contenues dans ce document.

Emis dans l'Union européenne par Muzinich & Co. (Ireland) Limited, qui est autorisée et réglementée par la Banque centrale d'Irlande. Enregistrée en Irlande, numéro d'enregistrement de la société : 307511. Adresse du siège social : 32 Molesworth Street, Dublin 2, D02 Y512, Irlande. Emis en Suisse par Muzinich & Co. (Suisse) AG. Enregistrée en Suisse sous le numéro CHE-389.422.108. Adresse du siège social : Tödistrasse 5, 8002 Zurich, Suisse. Emis à Singapour et à Hong Kong par Muzinich & Co. (Singapore) Pte. Limited, qui est autorisée et réglementée par l'Autorité monétaire de Singapour. Enregistrée à Singapour sous le numéro 201624477K. Adresse enregistrée : 6 Battery Road, #26-05, Singapour, 049909. Émis dans toutes les autres juridictions (à l'exception des États-Unis) par Muzinich & Co. Limited. qui est autorisée et réglementée par la Financial Conduct Authority. Enregistré en Angleterre et au Pays de Galles sous le numéro 3852444. Adresse enregistrée : 8 Hanover Street, Londres W1S 1YQ, Royaume-Uni.

Pour visiter le site, cliquez ICI.