Dans l'analyse hebdomadaire des principaux développements sur les marchés financiers et de l’économie de Muzinich & Co, l'équipe se penche sur les dernières données relatives à l'inflation et met l'accent sur la divergence entre les prix du pétrole et du gaz.

Alors que la confiance dans la stabilité de la croissance s'est renforcée ces dernières semaines, les investisseurs s'intéressent aux conséquences sur l'inflation et à ce que cela signifie pour les marchés. En conséquence, les données sur l'inflation ont occupé le devant de la scène la semaine dernière.

Le Japon a été le premier à publier des données, l'inflation dépassant les attentes et les prix à la consommation ralentissant moins que prévu. Les prix à la consommation de base pour le mois de janvier ont baissé conformément à l'objectif de 2 % de la Banque du Japon (BoJ), alors que les attentes étaient de 1,9 %. Toutefois, les prix des voyages à l'étranger ont été considérés comme un facteur technique qui a amplifié les données.

Les investisseurs continuent de débattre de la question de savoir si la fin de la politique de taux d'intérêt négatifs au Japon commencera en mars ou en avril. Toutefois, les récents commentaires du gouverneur de la BoJ, M. Ueda, suggèrent que la date de début pourrait être encore plus tardive : "Nous ne sommes pas encore en mesure de prévoir la réalisation d'un objectif d'inflation durable et stable", a-t-il déclaré1.

Les données américaines laissent présager une baisse des taux d'intérêt en juillet

En ce qui concerne les États-Unis, après les fortes données sur l'inflation de la semaine précédente, les investisseurs attendaient une confirmation de la part du Comité fédéral de l'open market (FOMC) dans son rapport sur les dépenses de consommation personnelle (PCE). Les données ont été conformes aux attentes, avec une augmentation de 0,4 % des PCE de base en janvier et une baisse à 2,8 % sur douze mois.

Les vendeurs obligataires se focaliseront sur l'accélération de l'indice PCE de base annualisé sur six mois, qui est passé de 1,9 % à 2,5 %, mais le rapport n'a fait que confirmer que le FOMC maintiendra son statu quo jusqu'à l'été. Le marché des swaps de taux d'intérêt au jour le jour évalue actuellement la première réduction complète de 25 points de base (pb) pour le mois de juillet.

Enfin, la zone euro a publié ses premières données sur les prix de février. La désinflation s'est poursuivie dans la région, mais pas de la même manière qu'ailleurs - à un rythme plus lent, avec une baisse des prix moins importante que prévue. L'inflation globale est tombée à 2,6 % et l'inflation de base à 3,1 %, contre des prévisions de 2,5 % et 2,9 % respectivement. La Banque centrale européenne (BCE) sera probablement encouragée par la baisse des prix et pourrait se sentir justifiée dans sa décision d'attendre l'été avant d'assouplir sa politique. Le marché des swaps de taux d'intérêt au jour le jour estime à 86 % la probabilité que la BCE réduise ses taux de 25 points de base en juin.

Le crédit HY et EM surperforme alors que les obligations d'État s'effondrent

Les banques centrales ayant tempéré les attentes d'un assouplissement au cours du deuxième trimestre, et les données inflationnistes étant peu encourageantes, le mois de février a été difficile pour les marchés des obligations d'État. La baisse sur l’obligataire a été entrainée par la partie courte de la courbe - les rendements des obligations américaines et allemandes à deux ans ont augmenté de 41 points de base et de 48 points de base respectivement.

Les nouvelles ont été meilleures pour le crédit corporate "high yield", qui a surperformé l'"investment grade" et a généré un rendement total positif pour le mois. Le crédit émergent (EM) a également été un grand gagnant. Les banques centrales des marchés émergents ont déjà commencé à assouplir leurs taux directeurs, et les valorisations ainsi que la hausse des coupons restent attrayantes. Par ailleurs, la pénurie importante de nouvelles offres et la sous-pondération des investisseurs mondiaux désireux d'accroître leur exposition favorisent une forte offre technique pour les titres.

Sur les marchés des actions, les Sept Magnifiques ont connu un nouveau mois fructueux, avec une hausse de plus de 8 %. Nvidia et Meta ont occupé le devant de la scène après avoir publié des résultats remarquables pour le quatrième trimestre. Toutefois, les marchés boursiers asiatiques ont enregistré des performances encore meilleures. Le Nikkei 225 du Japon a dépassé son record de 1989, avec une hausse de plus de 10 % en février, tandis que la Bourse de Shanghai s'est appréciée de plus de 9 %, sa meilleure performance mensuelle depuis novembre 2022. Dans le même temps, l'autorité de régulation chinoise a mis un frein aux activités quantiques perturbatrices et les fonds soutenus par l'État ont acheté pour 410 milliards de yuans (57 milliards de dollars) de fonds chinois négociés en bourse2.

Divergence du pétrole et du gaz

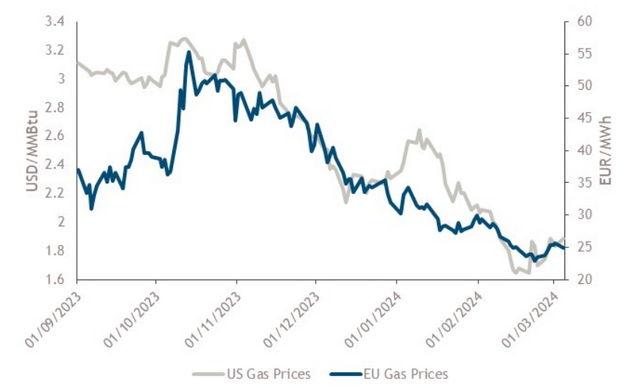

Les marchés des devises sont restés dans une large fourchette au cours du mois, ce qui est peut-être le signe que les tensions géopolitiques ne se sont pas aggravées. Dans le même temps, les marchés des matières premières ont été marqués par les divergences entre le pétrole et le gaz. Les prix du pétrole ont terminé le mois en hausse de 5 %, les coûts de transport et les contraintes d'approvisionnement de l'OPEP+ ayant fait sentir leurs effets.

En revanche, les prix du gaz aux États-Unis et en Europe ont chuté respectivement de plus de 40 % et de 50 % depuis octobre (voir le graphique de la semaine). Un hiver doux et une production américaine en plein essor ont entraîné une surabondance de l'offre dans le monde entier ; le stock actuel aux États-Unis est supérieur de 498 milliards de mètres cubes (BCF) à la moyenne quinquennale de 1 876 BCF3, et le stockage de gaz en Europe est rempli à 63 %, alors que la norme saisonnière quinquennale est de 46 % pour cette période de l'année4. C'est une bonne nouvelle pour l'activité industrielle et, avec la reconstitution des stocks, cela explique les prévisions de reprise de l'activité manufacturière mondiale dans les mois à venir.

Source : Bloomberg : Bloomberg, au 1er mars 2024. À des fins d'illustration uniquement.

Les références à des sociétés spécifiques ne sont faites qu'à titre d'illustration et ne reflètent pas les avoirs d'un portefeuille ou d'un compte spécifique, passé ou présent.

1 Bloomberg News, "BoJ's Ueda Keeps Market Players Guessing Over Rate Hike Timing",1er mars 2024.

2. South China Morning Post, "After the best run in 16 months, investors see Chinese stocks maintaining momentum on policy tailwinds,"1er mars 2024

3. FX Empire, "Natural Gas Storage Draw Exceeds Estimates",29 février 2024

4. Bloomberg News, "European Gas market Fundamentals Snapshot March 1",1er mars 2024

La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter et ne sont pas garantis. Les investisseurs peuvent ne pas récupérer l'intégralité du montant investi.

Ce document ne doit pas être considéré comme une prévision, une recherche ou un conseil en investissement, et ne constitue pas une recommandation, une offre ou une sollicitation d'achat ou de vente de titres ou d'adoption d'une stratégie d'investissement. Les opinions exprimées par Muzinich & Co sont en date du 01 mars 2024 et peuvent changer sans préavis. Toutes les données chiffrées proviennent de Bloomberg au 01 mars 2024, sauf indication contraire.

Informations importantes

La société Muzinich & Co. mentionnée dans le présent document est définie comme Muzinich & Co., Inc. et ses sociétés affiliées. Ce document a été produit à des fins d'information uniquement et, en tant que tel, les opinions qu'il contient ne doivent pas être considérées comme des conseils d'investissement. Les opinions sont celles de la date de publication et peuvent être modifiées sans référence ni notification. Les performances passées ne sont pas un indicateur fiable des résultats actuels ou futurs et ne doivent pas être le seul facteur à prendre en considération lors de la sélection d'un produit ou d'une stratégie. La valeur des investissements et les revenus qu'ils génèrent peuvent baisser ou augmenter, et ne sont pas garantis. Les taux de change peuvent entraîner une hausse ou une baisse de la valeur des investissements. Les marchés émergents peuvent être plus risqués que les marchés plus développés pour diverses raisons, y compris, mais sans s'y limiter, une instabilité politique, sociale et économique accrue, une volatilité accrue des prix et une liquidité réduite du marché.

Toute recherche contenue dans ce document a été obtenue et peut avoir été mise en œuvre par Muzinich pour ses propres besoins. Les résultats de ces recherches sont mis à disposition à titre d'information et aucune garantie n'est donnée quant à leur exactitude. Les opinions et les déclarations sur les tendances des marchés financiers qui sont fondées sur les conditions du marché constituent notre jugement et ce jugement peut s'avérer erroné. Les points de vue et opinions exprimés ne doivent pas être interprétés comme une offre d'achat ou de vente ou une invitation à s'engager dans une quelconque activité d'investissement, ils sont uniquement destinés à des fins d'information.

Toute information ou déclaration prospective exprimée dans ce document peut s'avérer incorrecte. Muzinich ne s'engage pas à mettre à jour les informations, données et opinions contenues dans ce document.

Emis dans l'Union européenne par Muzinich & Co. (Ireland) Limited, qui est autorisée et réglementée par la Banque centrale d'Irlande. Enregistrée en Irlande, numéro d'enregistrement de la société : 307511. Adresse du siège social : 32 Molesworth Street, Dublin 2, D02 Y512, Irlande. Emis en Suisse par Muzinich & Co. (Suisse) AG. Enregistrée en Suisse sous le numéro CHE-389.422.108. Adresse du siège social : Tödistrasse 5, 8002 Zurich, Suisse. Emis à Singapour et à Hong Kong par Muzinich & Co. (Singapore) Pte. Limited, qui est autorisée et réglementée par l'Autorité monétaire de Singapour. Enregistrée à Singapour sous le numéro 201624477K. Adresse enregistrée : 6 Battery Road, #26-05, Singapour, 049909. Émis dans toutes les autres juridictions (à l'exception des États-Unis) par Muzinich & Co. Limited. qui est autorisée et réglementée par la Financial Conduct Authority. Enregistré en Angleterre et au Pays de Galles sous le numéro 3852444. Adresse enregistrée : 8 Hanover Street, Londres W1S 1YQ, Royaume-Uni.

Pour visiter le site, cliquez ICI.