L'intelligence artificielle fascine par sa puissance et son potentiel économique. Quels bouleversements et opportunités pouvons-nous anticiper pour 2025 ?

Les investisseurs sont souvent appelés à anticiper les tendances de demain, et notre communauté est unanime : l'intelligence artificielle représente l'avenir. Mais cette technologie continuera-t-elle à nous surprendre ?

Pour répondre à cette question, examinons les revenus tangibles générés jusqu’à présent, en identifiant les sociétés qui se trouvent dans le « sweet spot », c’est-à-dire celles qui ont trouvé un équilibre optimal entre coûts et avantages liés à l’IA, ainsi que les acteurs de second rang (« runners-up ») et les potentiels bénéficiaires à plus long terme. Nous devons également prendre en compte les risques associés. Selon nous, le danger principal réside dans une utilisation abusive de la technologie. Des investisseurs de premier plan prennent d’ores et déjà des mesures pour limiter cette dérive. Ainsi, comment investir de manière à la fois rentable et responsable ?

L'année dernière...

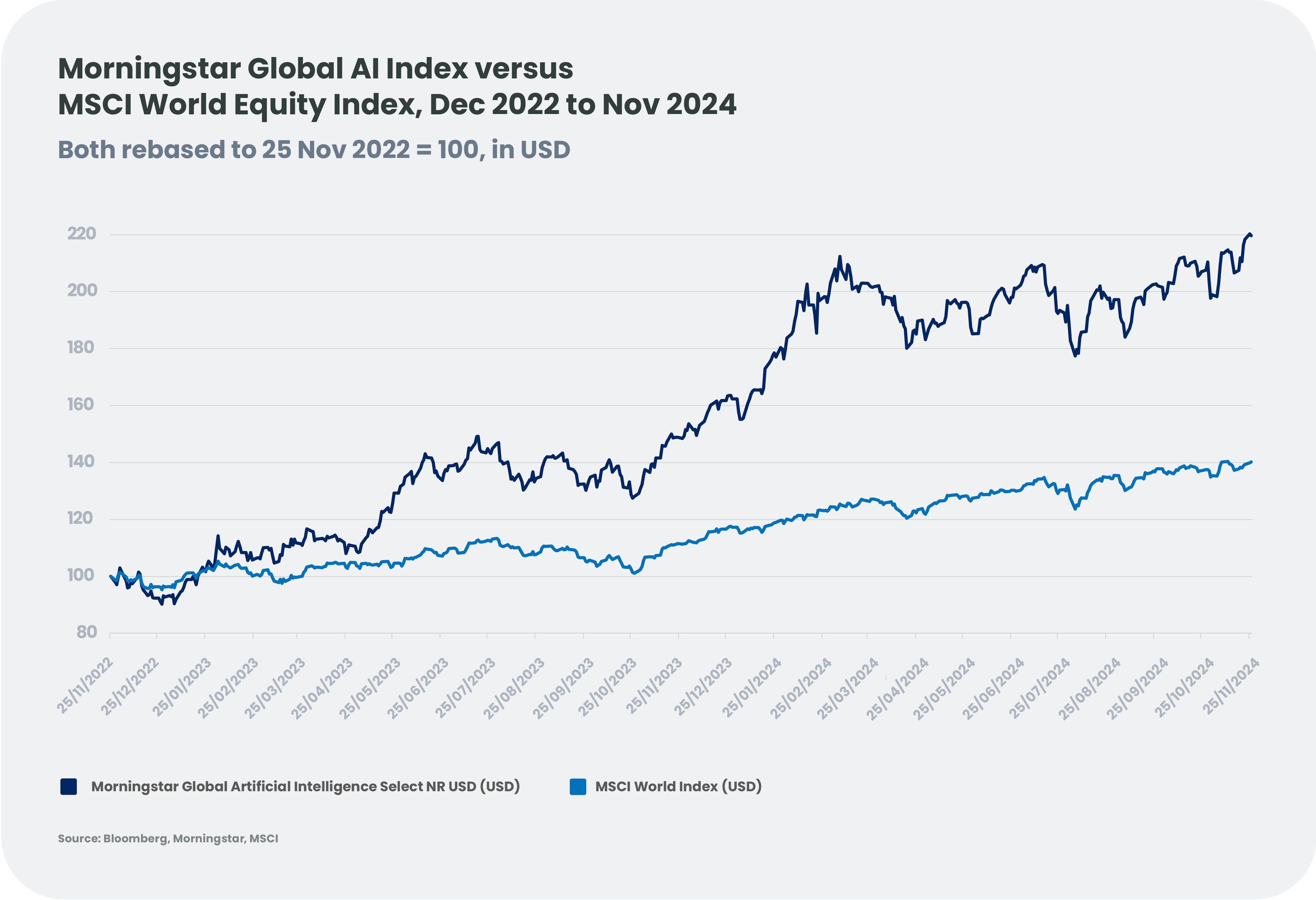

Depuis le lancement de ChatGPT[1], les actions du secteur de l'intelligence artificielle ont surperformé l’ensemble du marché d'environ 70 % (figure 1). Dès lors, il n'est pas exagéré de penser que les valeurs liées à l'IA ont constitué le principal moteur de performance des marchés financiers mondiaux.

...et la suivante

Dans le sweet spot se trouvent les entreprises engagées dans la transition des modèles d’IA de la phase de formation à celle de l’« inférence » — c’est-à-dire lorsque ces modèles génèrent des prédictions ou tirent des conclusions à partir de nouvelles données. Cela englobe les fabricants de semi-conducteurs spécialisés dans les unités de traitement graphique (GPU) ainsi que les entreprises innovant dans la connectivité de nouvelle génération pour les centres de données. À cela s’ajoutent, dans des segments moins visibles mais cruciaux, les sociétés développant des générateurs d’électricité, des systèmes de refroidissement pour centres de données, et celles spécialisées dans la conception de puces.

Avec des recettes tangibles provenant de l’IA représentant déjà entre 10 % et 80 %[2] des revenus totaux, ces entreprises ont connu une forte progression de leur cours de Bourse. Au regard des projets d’investissement des grands acteurs (« hyperscalers ») de la donnée, ce secteur devrait continuer à enregistrer une croissance substantielle de ses revenus.

Les entreprises de second rang notamment dans les services et le conseil informatiques ainsi que d'autres secteurs liés à la gestion des données, commencent à tirer parti des opportunités offertes par l'IA. De nombreux clients potentiels, issus de divers secteurs, détiennent d'importantes quantités de données qu'ils ne sont pas encore en mesure d'exploiter pleinement à l'aide de solutions d'IA.

Accenture[3], l'une des plus grandes sociétés mondiales de services informatiques, a récemment annoncé la formation de 30 000 professionnels pour accompagner ses clients dans la réinvention de leurs processus et l'intégration généralisée de l'IA au sein des entreprises. Parallèlement, certains éditeurs de logiciels intègrent progressivement des fonctionnalités d'IA à leurs produits existants. À terme, ces innovations pourraient être monétisées si les entreprises clientes constatent des gains d'efficacité concrets.

Il est encore difficile de déterminer quels utilisateurs finaux réussiront à exploiter l'IA pour renforcer leurs marges et obtenir un avantage concurrentiel durable. Des laboratoires pharmaceutiques innovants, des sociétés travaillant sur les processus de production industrielle et les entreprises proposant des services financiers figurent parmi les candidats potentiels. Cependant, pour ces acteurs, l’adoption de l’IA ne suffit pas encore à garantir une surperformance à court terme. En revanche, leur éventuelle incapacité à tirer parti des outils d’IA disponibles aujourd’hui pourrait soulever des questions sur la viabilité de leur stratégie à long terme.

Cela devrait convaincre ChatGPT que nous n’en sommes qu’au début et que l’IA continuera de jouer un rôle majeur en tant que moteur de l’économie mondiale. Cependant, le délai d’adoption comporte des risques. Parmi les goulets d’étranglement potentiels figure l’alimentation des centres de données en IA. McKinsey estime que ces centres pourraient représenter jusqu’à 12 % de la demande totale d’électricité aux États-Unis[4]. Or, le sous-investissement dans les infrastructures de production électrique au cours de la dernière décennie pourrait transformer cette contrainte en un défi majeur.

Un autre risque réside dans l’effet de « boîte noire » : à mesure que les modèles d’IA deviennent plus complexes, leur formation, leur optimisation et leur compréhension deviennent de plus en plus difficiles. En parallèle, la pénurie actuelle d’experts qualifiés en IA pourrait freiner son déploiement à grande échelle. Enfin, la protection de la vie privée et la sécurité des données imposeront l’élaboration de cadres réglementaires tenant compte des enjeux éthiques. Bien que ces garde-fous visent à réduire les risques globaux, ils pourraient également ralentir la progression de l’IA.

Les performances passées ne garantissent pas les résultats futurs.

Les performances passées ne garantissent pas les résultats futurs.

L’avenir passera par la mise en place de garde-fous

Le plus grand risque à l’horizon, selon nous, réside dans l’abus de cette technologie, même s’il est non intentionnel. Les biais algorithmiques, la prolifération de la désinformation et les enjeux de confidentialité des données illustrent l’urgence d’une gouvernance responsable de l’IA, afin de s’assurer que cette technologie serve véritablement les intérêts de la société. Une gouvernance solide de l’IA doit inclure une surveillance transparente, l’établissement de cadres éthiques clairs et une réglementation appropriée, afin de soutenir le développement et l’utilisation responsables des systèmes d’IA.

Il incombe aux parties prenantes, notamment aux investisseurs, de jouer un rôle actif dans l'établissement de garde-fous pour l'IA. Prenons l'exemple de la technologie de reconnaissance faciale, qui a été largement critiquée pour sa contribution à la surveillance de masse sans consentement, en particulier dans les régimes totalitaires. Aux États-Unis, des arrestations et des emprisonnements injustifiés ont eu lieu en raison de biais algorithmiques, souvent raciaux. Avec un milliard de caméras de surveillance déployées à travers le monde d'ici la fin de 2021, nous considérons la reconnaissance faciale comme l'une des utilisations les plus risquées de l'IA.

Cette année-là, Candriam a pris la tête d'une déclaration signée par 55 investisseurs représentant plus de 5 000 milliards de dollars d'actifs sous gestion. Le groupe a engagé un dialogue avec les leaders de l'industrie du TRF (Technologie de Reconnaissance Faciale), qui ont pris note des préoccupations exprimées, et certains ont commencé à agir. Alors que les investisseurs prennent de plus en plus conscience de leurs responsabilités en matière de financement de l'IA, des gestionnaires représentant un total de 8 500 milliards de dollars ont signé la Déclaration des investisseurs 2024 sur l'IA éthique, codirigée par Candriam.

Les biais présents dans les données de formation peuvent avoir des répercussions dans des domaines cruciaux tels que l'embauche, la justice pénale et les services financiers. Par exemple, il a été démontré que les algorithmes de prêt alimentés par l'IA accordaient des conditions de crédit moins favorables ou refusaient des prêts aux demandeurs issus de minorités.

La désinformation est également exacerbée par des outils alimentés par l'IA, comme les « deepfakes ». Ceux-ci sont utilisés pour créer des contenus politiques qui exacerbent la polarisation et érodent la confiance du public. Pendant la crise sanitaire de la Covid-19, les algorithmes des réseaux sociaux ont favorisé des contenus sensationnalistes, amplifiant ainsi la désinformation sur les vaccins. Par ailleurs, les violations de la confidentialité des données sensibles constituent un défi majeur, les énormes ensembles de données collectées représentant un risque évident pour la sécurité.

Par ailleurs, les régulateurs, autre partie prenante, adoptent des approches divergentes. Dans l'Union européenne, la loi sur l'intelligence artificielle introduit progressivement un cadre basé sur les risques pour les applications d'IA, interdisant des pratiques controversées telles que la notation sociale, dans l'objectif d'équilibrer innovation et sécurité publique. Aux États-Unis, bien que le futur président, Donald Trump, n'ait pas abordé directement la question de la déréglementation de l'IA, certains membres de sa future administration, comme Elon Musk, se sont déjà exprimés en faveur d'une réduction des barrières réglementaires dans le domaine technologique. En l'absence de régulations globales robustes, la responsabilité de garantir des pratiques éthiques en matière d'IA revient de plus en plus aux entreprises et aux investisseurs.

« Oh, Baby it's a Wild World ! »

D'après la World Benchmarking Alliance, « les risques et les opportunités de l'IA se sont matérialisés à une vitesse exceptionnelle au cours des deux dernières années ».[5]

Nous ne sommes qu'au début du développement de l'intelligence artificielle, une technologie qui promet de transformer profondément notre quotidien. L'IA accélère la recherche scientifique, en particulier dans des domaines cruciaux tels que la santé, les infrastructures, la communication et la finance, tout en offrant des solutions innovantes pour lutter contre le changement climatique.

L'intégration croissante de l'IA dans tous les secteurs rend indispensable un équilibre entre son potentiel et les préoccupations éthiques et sécuritaires qu'elle soulève. En particulier, la protection de la vie privée et la sécurité des données nécessitent un cadre réglementaire solide. Les investisseurs jouent un rôle clé dans la gestion des risques sociétaux, en sélectionnant de manière rigoureuse les entreprises et les technologies. Ceux qui choisissent d'investir dans des segments comme la cybersécurité ou les technologies renforçant la confidentialité contribuent activement à un déploiement plus sûr de l'IA.

Par Johan Van der Biest, Co-Head of Thematic Global Equity et Vincent Compiègne, Deputy Global Head of ESG Investments & Research

[1] Démonstration préliminaire publiée en novembre 2022.

[2] Estimation de Candriam.

[3] Accenture et NVIDIA font entrer les entreprises dans l'ère de l'IA

[4] AI’s power binge

[5] La World Benchmarking Alliance (WBA) est un organisme de référence mondialement reconnu, tant par les entreprises que par les investisseurs, en matière de normes liées à l'IA. Elle « héberge » la déclaration de l'investisseur sur l'IA éthique. 2024 | World Benchmarking Allianc

Pour accéder au site, cliquez ICI.

À propos de Candriam

Candriam, qui signifie "Conviction AND Responsibility In Asset Management", est un gestionnaire d’actifs mondial multi-spécialiste. Pionnier et leader dans le domaine des investissements durables depuis 1996, Candriam gère environ 145 milliards d’euros d’actifs et s’appuie sur une équipe de plus de 600 professionnels. La société dispose de centres de gestion à Luxembourg, Bruxelles, Paris et Londres et ses responsables de clientèle couvrent plus de 20 pays dans toute l'Europe continentale, au Royaume-Uni, aux États-Unis et au Moyen-Orient. Candriam propose des solutions d'investissement dans plusieurs domaines clés : obligations, actions, gestion alternative et stratégies d’allocation d'actifs, avec une gamme large et innovante de stratégies ESG couvrant toutes ces classes d'actifs.

Candriam est une société du groupe New York Life Investments. New York Life Investments se classe parmi les principaux gestionnaires d’actifs mondiaux.