L'équipe Octo AM est heureuse de vous adresser aujourd'hui leur dernier hebdo de 2020, année éprouvante s’il en est, de laquelle les investisseurs se sortiront finalement plutôt mieux que de l’économie réelle, merci les banques centrales !

Nous commencerons donc par quelques graphiques qui permettront de conclure cette année avant de vous proposer une ébauche de réflexion pour 2021 car cette période des fêtes, traditionnellement nommée « trêve » est bel et bien une période de transition, propice à l’élaboration des stratégies et à la réflexion… Et si 2020 était finalement relativement binaire entre le stress absolu du premier semestre et le soutien à tout prix du second, 2021 nécessitera probablement une analyse beaucoup plus minutieuse pour performer, pour laquelle les deux ou trois semaines de cette fin 2020 ne seront pas de trop !

Quelques illustrations de l’année 2020 :

En tant que spécialistes du marché obligataire, nous passerons les traditionnels graphes des divergences économiques, des chiffres sanitaires ou des perspectives de reprise que nous laisserons à nos confrères économistes, ou que vous pourrez retrouver dans nos anciens hebdos (book L’année 2020 en Hebdos Crédit disponible par courrier sur demande), pour nous concentrer aujourd’hui sur les sujets spécifiques de notre classe d’actif :

I - Evolution des taux souverains américain et européen

Commençons tout d’abord par un état des lieux des rendements souverains, première variable d’ajustement des banques centrales pour leur politique d’assistance puisqu’ils sont le vecteur :

1- Des injections de liquidités

2- Du maintien d’un relatif des budgets dans un contexte de surendettement et de politique de soutien massif de l’économie des gouvernements

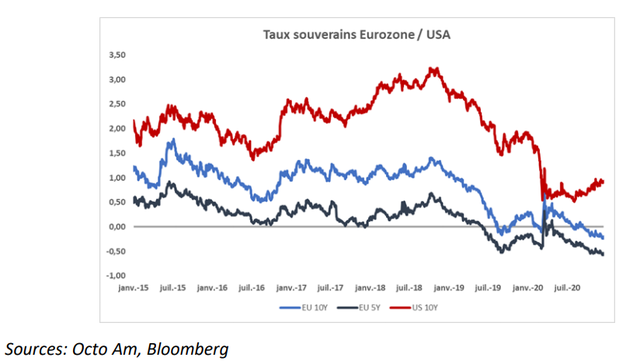

Ce graphique représente d’une part les taux européens de maturité 5 ans et 10 ans comme une moyenne pondérée par le PIB des rendements des Etats de la Zone Euro, et d’autre part le taux américain à 10 ans.

Nous remarquons ici deux choses :

- Premièrement, qu’il s’agisse de l’Eurozone ou des USA, les rendements souverains sont à leur plus bas historique, enfonçant largement les planchers de 2015-2018, qui sonnaient, à l’époque, l’apogée des quantitative easing… Il n’en était rien…

- Deuxièmement, la Covid n’a pas stoppé la tendance de fond de la divergence croissante entre les deux zones en termes de taux d’intérêt : dès la mi-année 2020, le rendement souverain américain s’est stabilisé voire est reparti à la hausse tandis que les rendements européens ont continué de s’enfoncer…

La différence de rapidité des redémarrages économiques, la puissance croissante des technos américaines dans l’économie post-covid face à une Europe inexistante sur le secteur, et plus généralement la capacité de rebond et d’agilité des USA face à l’Eurozone, toujours engluée dans sa crise pré-covid, ont immédiatement rétabli les anticipations plutôt négatives pour notre zone économique et positives pour les USA, anticipations qui se reflètent dans le niveau des taux d’intérêt, notamment par l’inflation à long terme.

En résumé, la Covid n’a en rien annihilé les tendances de fond de la décennie 2010, elle ne fera que les renforcer et les accélérer, malheureusement pour l’Eurozone qui n’était guère en position de force… Les marchés en reprennent acte dès à présent, comme sur les indices actions d’ailleurs…

II- Evolution des taux d’Etats européens

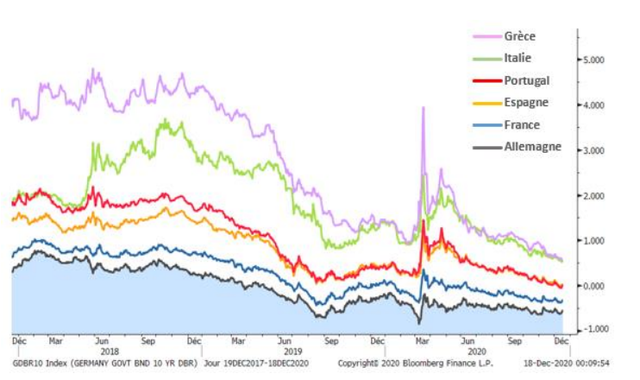

Ce second graphe nous montre encore une fois une poursuite des tendance pré-covid avec la convergence inexorable des rendements souverains de la zone Euro, les primes des expériphériques persistant « pour la forme » mais ne représentant économiquement plus rien. La Grèce emprunte au même taux que l’Italie, le Portugal devient un meilleur marché que l’Espagne, l’Irlande s’aligne au même niveau que la France et tout se joue entre -0.6% pour le bon élève allemand et +0.5% pour le dernier de la classe, l’Italie… sur une maturité de 10 ans ! Ne parlons pas des maturités de moins de 5 ans, qui traitent toutes en territoire négatif.

Cette convergence devrait se poursuivre en 2021, favorisée par la politique accommodante de la BCE qui continuera, mais également par le début d’entente sur un budget commun européen et par l’arrivée des nouvelles émissions de l’Union Européenne qui pourraient, d’ici quelques mois ou quelques années, devenir les véritables représentantes du taux de référence européen et les actifs achetés par les investisseurs étrangers, au détriment de l’Allemagne, moins représentative, moins diversifiée et donc finalement plus risquée à très long terme…

III – le rendement du marché obligataire « Investment-Grade »

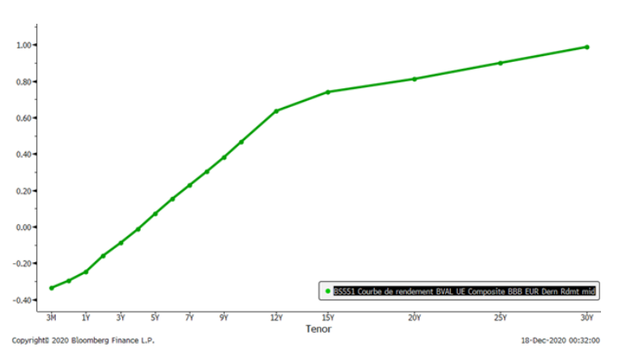

Cette courbe de rendement représentant les émetteurs BBB européens nous montre clairement qu’il est impossible de rémunérer sa trésorerie à moins de cinq ans, ce qui est déjà un horizon relativement long, sans aller se positionner sur le segment de qualité inférieure et donc « high yield » ou sans chercher des solutions alternatives de flexibilité, arbitrage et recherche d’opportunités.

Pour obtenir 1% de rendement sur le segment standard BBB du marché obligataire, segment compressé par les banques centrales et les grands investisseurs institutionnels contraints par leur règlementation, il faudra se positionner sur des maturités de 30 ans ! Un horizon hasardeux voire impensable pour beaucoup d’investisseurs, y compris institutionnels, dont les passifs se sont souvent raccourcis ces dernières années.

IV- Les corporates « high yield »

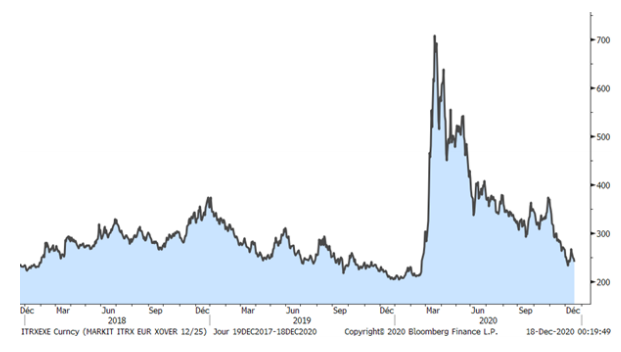

L’indice crossover, représentant approximativement le marché des obligations spéculatives liquides a lui aussi largement profité des largesses des banques centrales tout en conservant une prime d’une cinquantaine de points de base sur ses plus bas de début 2020.

Vu les montants d’acquisitions d’obligations corporates attendues par les banques centrales, combinées à la recherche de rendement des grands investisseurs, on peut imaginer des records à la baisse dans les mois à venir… Attention cependant aux accidents idiosyncrasiques, certains corporates étant, après un an de crise sanitaire et d’activité en berne, au bord de la rupture… Diversification et sélectivité seront donc d’autant plus importantes qu’en 2020, qui n’a fait que repousser la réalité à demain.

Nous noterons d’ailleurs que le taux de défaut des entreprises s’est révélé finalement plus bas en 2020 que par le passé ! Quand on parle des entreprises zombies qui profitent de la situation, nous sommes ici en plein cœur du sujet, puisque les largesses financières ont permis à des entreprises qui auraient dû faire défaut en 2020 sans crise sanitaire, de continuer à exister grâce à la crise ! Un danger donc à surveiller en 2021…

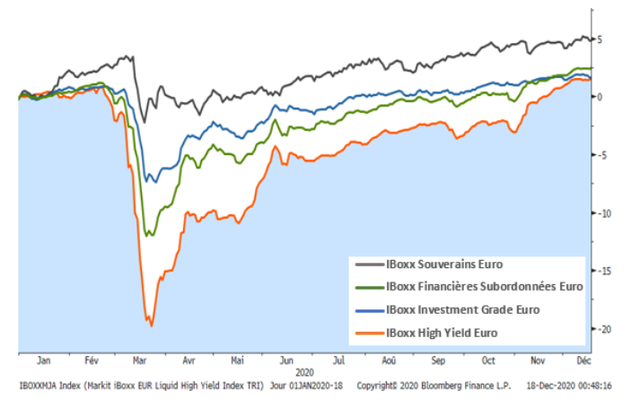

V- Les performances

Et on ne pourra pas quitter nos écrans sans faire le point sur les performances qui n’ont certes pas été à la hauteur de la volatilité, mais qui ont tout de même permis aux investisseurs patients d’être rémunérés sur la quasi-totalité des indices obligataires. Encore une fois, malgré leurs taux nuls, les souverains ont mené la danse avec une performance à date de +4.85% suivis par le high yield puis les corporates investment grade, tirés en fin d’année par la quête effrénée de rendement des investisseurs, augmentant significativement leur risque à partir de novembre.

VI- Quelques pistes de réflexion pour la stratégie 2021

Après ce résumé d’année, que nous espérions court, mais qui fut finalement long, nous nous contenterons donc d’une simple ébauche de quelques sujets sur lesquels réfléchir en cette période de fête pour entamer l’année 2021 gorgés d’idées d’investissements autant que de marrons et de chocolats :

- Les banques centrales peuvent-elles continuer sur le même rythme ?

- Arriveront-elles à transformer suffisamment leur politique monétaire pour passer de la reflation qui sauve le système financier mais se transmet peu à l’économie réelle, en inflation par les salaires et/ou par la consommation qui relancerait l’économie ?

- Comment vont-elles aborder la normalisation monétaire nécessaire après cette année de largesses incommensurables ?

- Quelle politique de normalisation vont adopter les gouvernements après cette ère choisie de mise sous cloche de l’économie compensée par des aides financières ?

- Après de forts mouvements sur les taux souverains, peut on observer des mouvements sur les taux de change ?

- Quels schémas de reprise de la consommation ?

- Quels risques financiers et économiques en cas de prolongement de la crise sanitaire sur 2021 ? Quels impacts sur un portefeuille ?

- Les anticipations d’inflation à long terme peuvent-elles bondir à la suite des politiques d’injections de liquidités puis de relance et entraîner une hausse des taux soudaine en 2021 ou 2022 ?

- Les taux relatifs des corporates sont attractifs, mais sont-ils, en moyenne, suffisants en absolu ? Faut-il se concentrer sur quelques segments niches spécifiques ?

- Les secteurs en crise majeure (tourisme, aéronautique, loisirs, immobilier commercial) peuvent-ils se passer d’une crise de crédit et/ou d’allègement de dette ?

- Quels sont les secteurs ou les émetteurs ayant prouvé leur résilience en cas de poursuite d’une situation sanitaire incertaine ?

- Quels sont les émetteurs ayant assuré leurs refinancements et leur trésorerie pour au moins 2 ans ?

- Quelles sont les banques de taille moyenne éligibles à une acquisition dans le cadre de la rationalisation du secteur bancaire européen ?

Toute l’équipe Octo AM et Matthieu Bailly vous souhaitent à tous de belles fêtes de fin d’année !

Pour accéder au site d'OCTO AM, cliquez ICI.