Forte de la fin de sa politique zéro-Covid en ce début d’année, et ainsi de la réouverture de son économie, la Chine a retrouvé de son lustre d’antan récemment. Sur le plan macroéconomique, la situation chinoise contraste fortement avec celle des pays occidentaux. Et si d’une part, l’Empire du Milieu devrait rester le fournisseur de prédilection de la demande mondiale pour les décennies à venir, son économie se recentre, par ailleurs, sur sa consommation domestique - l’un de plus puissants moteurs de sa croissance avec celui de la décarbonation à l’échelle mondiale. En ce début d’année, la dynamique boursière était bien orientée sur la région. Dans ce contexte, comment bien appréhender la complexité du marché chinois à plus long terme ? Explications.

La Chine a fêté avec entrain le passage à l’année du lapin en janvier dernier. La politique « zéro Covid » en place touchait à sa fin, l’économie connaissait ainsi un fort rebond, accompagné d’un rallye boursier, permettant ainsi au marché chinois de retrouver des couleurs après plusieurs mois atones. En cette fin de premier trimestre 2023, nous observons que les investisseurs deviennent plus circonspects quant aux perspectives d’investissements au sein de l’Empire du Milieu : les marchés auraient-ils déjà intégré les bonnes nouvelles si bien qu’ils n’auraient plus de réserve pour alimenter l’élan boursier à plus long terme ? Et qu’en est-il du risque géopolitique ?

La Chine présente des solides perspectives pour 2023

Une analyse approfondie montre bien que la croissance chinoise a encore de beaux jours devant elle. 88 % des 25 analystes de Fidelity basés en Chine s'attendent à ce que leur marché soit en phase d'expansion dans 12 mois, contre 35 % des analystes couvrant l'Amérique du Nord et 37 % de ceux couvrant l'Europe.1 A l’échelle mondiale, la Chine est le seul pays où nous prévoyons une augmentation globale des marges bénéficiaires et où le rendement moyen du capital devrait progresser en 2023, sous l'effet d'une réduction des coûts de production et d’une solide croissance de la demande finale. Dans nos récentes enquêtes, qui mettent en évidence les changements de sentiment à court terme, la Chine est également la seule région où les analystes de Fidelity font état d'un sentiment positif émanant des chefs d'entreprise.

Sur le plan macroéconomique, la situation en Chine contraste fortement avec celle des pays occidentaux. L’inflation reste faible et contenue, oscillant autour de 2,6% (mars 2023), le marché du travail n’est pas sous tension et le volume des exportations croit rapidement. Si l’on ajoute à tous ces indicateurs le fait que la Chine dispose de 3.000 milliards USD de réserves de change, il apparaît alors que les responsables politiques chinois ont une plus grande marge de manœuvre pour maintenir les taux à un niveau plus bas et financer des initiatives de relance ciblées pour stimuler la consommation domestique, soutenir la reprise et continuer à s'atteler aux problèmes de plus long terme liés aux retraites et à l'immobilier.

La Chine devrait également rester le fournisseur de prédilection du monde pour les décennies à venir. Les efforts de réindustrialisation entrepris par les pays occidentaux suite aux perturbations sur les chaînes d’approvisionnement mondiales vont prendre du temps à porter leurs fruits. Un retard important doit être comblé : outre le fait de devoir rebâtir un tissu industriel mis à mal, ils devront également composer avec l'impératif de décarbonation. A moyen-terme, la Chine restera donc encore le fournisseur privilégié de la demande mondiale. Mais à long terme, quelles sont ses réserves de croissance ?

Deux moteurs tirent la croissance chinoise à long terme : la consommation domestique et les enjeux de développement durable

L’économie chinoise se tourne vers la consommation et les services

Après plusieurs mois de confinement, les ménages chinois ont accumulé des réserves d’épargne qui devraient favoriser une reprise importante et durable de la consommation. En effet, en 2022, ils ont épargné un montant record de 17.800 milliards de renminbis (un peu moins de 2.600 milliards de dollars2), soit une hausse de 80 % par rapport à 2021. Le taux d'épargne brut des ménages, exprimé en pourcentage du revenu disponible, s'élevait à environ 35 %.

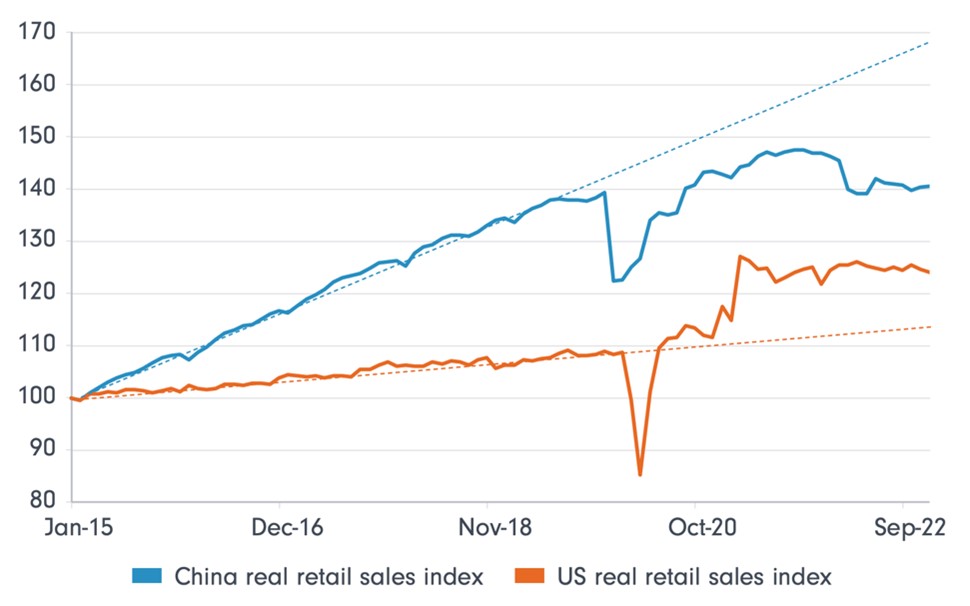

Malgré la vigueur de la reprise, les dépenses de consommation sont encore en dessous de leur tendance pré-COVID, contrairement à ce que l’on a observé aux Etats-Unis et en Europe occidentale.

Graphe 1 : Les dépenses de consommation chinoises sont restées en deçà de leur de la tendance pré-covid, contrairement aux États-Unis

Note : Indices construits en ajustant les ventes au détail nominales mensuelles à la variation mensuelle de l'indice des prix à la consommation.

Source : Fidelity International, Bloomberg, janvier 2023 Fidelity International, Bloomberg, janvier 2023.

Avec 1,4 milliard de consommateurs, la Chine reste l'un des marchés les plus importants et à la croissance la plus rapide au monde. L'augmentation des revenus, l'expansion de la classe moyenne et les politiques gouvernementales favorables font que l'économie chinoise s'éloigne de plus en plus des exportations et des projets d'infrastructure, qui ont été longtemps ses principaux moteurs de croissance, pour se tourner vers une économie davantage axée sur la consommation intérieure et les services.

La montée en gamme et la préférence croissante des consommateurs pour une série de marques nationales en plein essor sont deux tendances clés qui engendrent des changements structurels dans les schémas de consommation, favorisant un cercle vertueux d'investissement, d'innovation et de croissance.

La développement durable : un levier de création de valeur

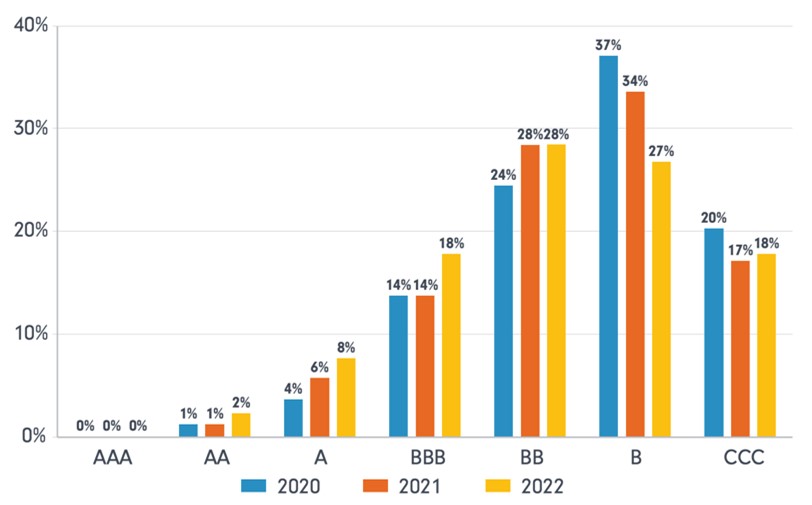

À l'instar de l'Asie en général, la Chine accuse un retard important au regard des enjeux ESG par rapport aux pays développés. Cela représente des défis, mais aussi de formidables opportunités d'investissement.

Ces dernières années, la notion de développement durable a commencé à imprégner le milieu entrepreneurial et des affaires, et gagne en importance dans toute la région. Les entreprises chinoises continuent d'améliorer leurs pratiques ESG, encouragées notamment par des évolutions réglementaires.

Graph 2 : Notations ESG MSCI des entreprises chinoises

Source : Fidelity International, Bloomberg, janvier 2023.

D’importants chantiers sont toujours en cours, au premier rang desquels se trouve celui de la décarbonation du secteur industriel, et la collecte de données sur les émissions de CO2. Des pas significatifs ont néanmoins été réalisés, comme le lancement par Pékin en 2021 de son propre système national d’échange de quotas d’émissions, permettant de mieux appréhender les niveaux d’émissions de gaz à effet de serre.

Les actionnaires nationaux se font également de plus en plus entendre, ce qui conduit à un renforcement des mécanismes de responsabilité et de gouvernance. Nous avons par exemple constaté une meilleure transparence, avec davantage de rapports ESG soumis au vote des actionnaires.

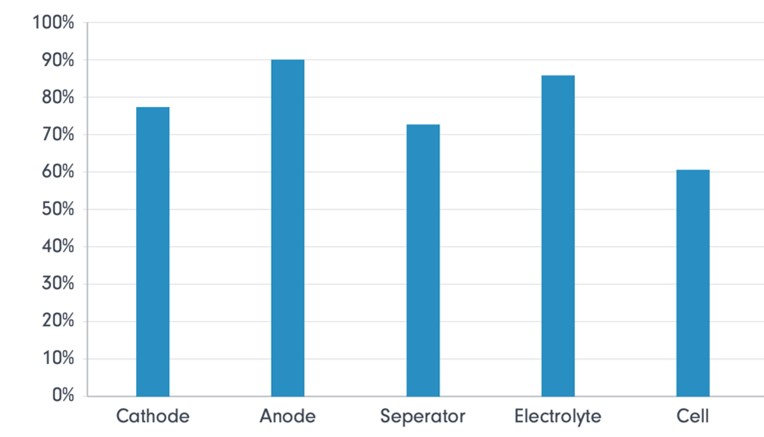

Il faut également garder en tête que la Chine a un rôle de premier plan dans l’avancée à l’échelle globale vers une économie plus durable. Son influence dans le développement des mobilités vertes en est certainement l’exemple le plus probant. 60 à 90 % des composants des batteries des véhicules électriques sont fabriqués en Chine, et elle entend bien rester en position de force dans ce domaine.

Graph 3 : 60 à 90 % des composants de batteries des véhicules électriques est produit en Chine (part de la Chine dans la production mondiale)

Source : Bernstein, WIND, FILe.

Faut-il craindre le réveil du « géant qui sommeille » ?

Les nombreux signaux positifs qui nous viennent de Chine ne doivent pas non plus nous empêcher de soulever les questions qui demeurent, en particulier sur le plan géopolitique.

Si l’on raisonne en termes de realpolitik, la Chine et les États-Unis ont toujours besoin l'un de l'autre et restent des partenaires commerciaux extrêmement importants. Les mesures prises par les États-Unis pour réduire leur dépendance en matière de semi-conducteurs de pointe sont certes brutales, mais très ciblées. Il en va de même pour les mesures réglementaires prises par la Chine dans le cadre de sa campagne de « prospérité commune » dans des secteurs tels que la technologie ou l'éducation : les mesures ont été douloureuses mais précises. Le marché a évalué ce type de nouveaux risques en conséquence et s'en est accommodé ; ils ne devraient pas modifier fondamentalement les perspectives à long terme de la Chine.

Alors que l’on parle de plus en plus de démondialisation, l'économie chinoise reste encore étroitement liée au reste du monde, et en particulier à ses voisins de la région Asie-Pacifique. L'Australie et d'autres économies régionales, y compris celles de l'Asie du Sud-Est, devraient bénéficier des retombées de la reprise actuelle de l'activité en Chine. Il existe d'autres domaines dans lesquels le statut de superpuissance de la Chine est susceptible de drainer davantage de flux de capitaux.

Nous pensons donc que la Chine offre non seulement des opportunités d’investissement à long terme considérables, mais dans l’environnement présent, une sous-pondération à celle-ci dans son allocation pourrait s’avérer dommageable. Néanmoins, la vigilance reste de mise. Les marchés chinois demeurent exceptionnellement complexes, si bien que la diversification et la sélectivité restent primordiales pour saisir les plus opportunités qu’offre la région.

1 Source : Enquête Analystes 2023, Fidelity International

2 Au 21 mars 2023

Pour accéder à l'intégralité de l'article, cliquez ICI.

Informations sur les risques

-

Ce document à caractère promotionnel est exclusivement destiné aux professionnels de l'investissement et ne doit pas être diffusé à des investisseurs particuliers

-

La valeur des investissements et des revenus qui en découlent peut évoluer à la hausse comme à la baisse et le client est susceptible de ne pas récupérer l’intégralité du montant initialement investi.

-

Les investisseurs doivent prendre note du fait que les opinions énoncées peuvent ne plus être d'actualité et avoir déjà été mises à exécution.

-

Les performances passées ne préjugent pas des performances futures.

-

Les investissements à l'étranger peuvent être affectés par l'évolution des taux de change des devises.

-

Les investissements sur les marchés émergents peuvent être plus volatils que ceux sur d’autres marchés plus développés.

-

Il est possible que les émetteurs d’obligations ne puissent pas rembourser les fonds qu’ils ont empruntés ou verser les intérêts dus. Le cours des obligations peut chuter quand les taux d’intérêt augmentent. La hausse des taux d’intérêt peut faire baisser la valeur de votre investissement.

-

Les obligations à haut rendement sont considérées comme des obligations plus risquées. Elles présentent un plus grand risque de défaut qui peut avoir des répercussions négatives sur les revenus et la valeur du capital du fonds qui y investit.

-

Compte tenu du plus grand risque de défaut, un investissement dans une obligation d’entreprise est généralement moins sûr qu’un investissement dans une obligation d’État

Pour accéder au site, cliquez ICI.