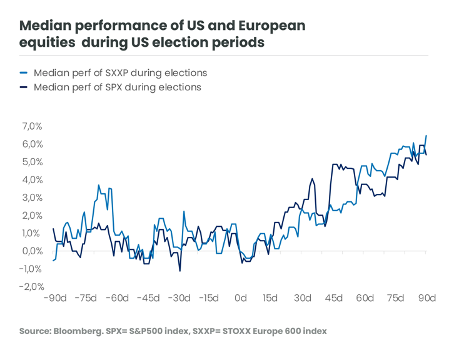

Les élections génèrent habituellement des incertitudes sur les marchés. De nombreuses statistiques paraissent sur la performance des marchés financiers à l’approche des élections américaines. Les occurrences ne sont pas suffisamment nombreuses pour être statistiquement significatives mais l’on observe généralement une hausse de la volatilité à partir de l’été précédent la date de l’élection, avec des marchés financiers hésitants, sans tendance marquée.

Nadège Dufossé,

Nadège Dufossé,

CFA, Global Head of Multi-Asset

Une fois l’élection passée, l’incertitude se dissipe, et un rallye de fin d’année peut se mettre en place sur la base des promesses du futur nouveau président.

L’année 2024 ne fait pas exception à la règle. L’incertitude sur le nom du prochain président des Etats-Unis est très élevée depuis la nomination de Kamala Harris comme candidate du parti démocrate. Dans une société toujours plus clivée, les électeurs vont être amenés à voter pour des programmes aux conséquences économiques et politiques parfois diamétralement opposés. Faut-il dès lors prendre des positions fortes dans nos portefeuilles, ou rester alignés sur les fondamentaux tout en se protégeant contre des scénarios extrêmes ?

Les performances passées, les simulations de performances passées et les prévisions de performances futures d’un instrument financier, d’un indice financier, d’une stratégie ou d’un service d’investissement ne sont pas un indicateur fiable des performances futures et ne sont pas garanties.

L’action de la Fed et les annonces de la Chine sont pour le moment plus déterminantes que les élections.

La décision de la Fed de baisser son taux directeur de 50 points de base au mois de septembre a relancé la dynamique haussière sur l’ensemble des actifs risqués. Ce choix d’une première baisse forte des taux éloigne en effet le risque de récession aux Etats-Unis. Il contribue à rassurer les investisseurs, la banque centrale américaine considérant que l’inflation n’est plus un risque et plaçant désormais la croissance et l’emploi au cœur de ses préoccupations. Les autorités chinoises ont lancé à leur tour un ensemble de mesures de relance monétaire et budgétaire coordonnées assorties d’une recapitalisation des six principales banques commerciales, ainsi que des mesures de soutien direct à l’immobilier et aux marchés actions. La réunion mensuelle du Politburo jeudi dernier, exceptionnellement consacrée à l’urgence économique, envoie un signal positif fort aux investisseurs. La prochaine réunion de la BCE au mois d’octobre sera également très attendue après les dernières données économiques décevantes en zone euro.

Ces actions volontaristes des banques centrales engagées dans un nouveau cycle d’assouplissement monétaire donnent la perspective d’un mix croissance/ inflation plus favorable, et ont propulsé la semaine dernière les indices actions vers de nouveaux points hauts (le S&P 500 a fait un plus haut historique[1], l’indice actions chinois a progressé de plus de 20 % sur le mois de septembre[2], retrouvant son niveau de début 2023). Les taux longs européens et américains sont restés très stables, facilitant la hausse des valorisations des marchés actions.

Tous les risques n’ont évidemment pas disparu. La campagne électorale américaine va s’intensifier dans les semaines à venir, et les mesures de relance chinoises ne résolvent pas les problèmes structurels. Dans nos portefeuilles diversifiés, avons néanmoins renforcé temporairement notre exposition aux actions chinoises et émergentes. Nous sommes actuellement surpondérés sur les actions tout en maintenant une duration longue sur les taux européens. Nous avons fait pour le moment le choix de nous aligner sur des fondamentaux en amélioration, il nous faut dès lors envisager les protections nécessaires pour faire face aux impacts économiques et politiques du résultat de l’élection présidentielle américaine.

Les différents scénarios envisagés après l’élection américaine sont dépendants à la fois de la couleur du parti remportant l’élection mais également de la composition du congrès. Les scénarios les plus extrêmes, évoquant une victoire totale démocrate ou républicaine (« sweep »), nous semblent aujourd’hui moins probables que ceux d’un gouvernement divisé, avec au moins une des chambres contrôlée par l’autre parti.

Quels sont les enjeux principaux de la campagne électorale américaine ? Ils s’articulent autour de la politique liée à l’immigration, de la mise en place de droits de douane, de la politique fiscale, et de la réglementation (environnement, IA…) - des sujets clivants entre démocrates et républicains.

Une victoire républicaine : un scénario plus ou moins disruptif par rapport à nos anticipations actuelles

Une présidence et un congrès républicains (sweep) constitueraient le scénario le plus disruptif par rapport à notre scénario et à notre positionnement actuel. En particulier, le projet d’une restriction plus forte de l’immigration et la menace de droits de douane plus largement imposés (10 % sur toutes les importations, 60 % sur la Chine ont été mentionnés) sont doublement inflationnistes et donc haussiers pour les taux américains et le dollar américain. Ce scénario est négatif pour la croissance des pays touchés par les restrictions sur les importations, et par conséquent jugé défavorable pour le reste du monde... Devrait-on pour autant continuer à surpondérer les actions américaines ? La mise en place de droits de douane pénalise non seulement les partenaires commerciaux des américains, mais également certaines entreprises américaines dont les marges absorberaient une partie de la hausse des coûts des achats. La prolongation de la « Tax Cuts and Jobs Act » et donc d’un taux d’impôts de 21 % est a contrario jugée comme positive pour les entreprises américaines et en particulier la partie domestique (petites et moyennes capitalisations). En résumé, l’implémentation totale du programme républicain serait négative pour la croissance américaine et mondiale, elle placerait la Fed dans une position délicate car faisant face à nouveau à une hausse de l’inflation. Avec des taux plus hauts et une croissance économique revue à la baisse, ce scénario extrême et relativement peu probable ne semble favorable ni aux actions, ni aux obligations. Il serait néanmoins encore plus pénalisant pour le reste du monde…

Une présidence républicaine et un congrès divisé constitueraient une voie intermédiaire avec une croissance plus ou moins inchangée par rapport à notre scénario actuel, mais des taux longs plus élevés et une politique monétaire moins accommodante sous la pression d’une inflation ravivée. Dans le cas d’un congrès divisé, le commerce international devrait néanmoins constituer à nouveau le terrain de jeu favori du président Trump. Il serait probablement plus positif pour les actions américaines que pour le reste du monde, soutenu par la prolongation des baisses d’impôts. Dans ce scénario d’une victoire républicaine, qui doperait instantanément les anticipations d’inflation, un moyen de se positionner est de conserver une relative prudence sur la duration américaine après la forte baisse déjà enregistrée sur les taux long américains cet été, et d’acheter des obligations américaines liées à l’inflation. Il conviendrait également de revoir notre surexposition aux actifs émergents et nos positions sur l’Europe.

D’un point de vue sectoriel, le point numéro 4 de l’agenda républicain interpelle : « Make America the dominant energy producer in the world, by far !». L’environnement est un point de divergence entre les deux programmes. L’augmentation de la production de pétrole et de gaz américains fait peser un risque baissier sur les prix. De même, la remise en cause des investissements liés à l’« Inflation Reduction Act » pénalise les véhicules électriques et les sociétés produisant une énergie propre.

Une victoire démocrate s’inscrirait dans la continuité avec un risque extrême dans le cas d’une contestation du résultat de l’élection.

Le scénario d’une victoire de Kamala Harris avec un congrès divisé devrait réserver moins de surprises à l’investisseur. Les politiques liées à l’immigration et au commerce international devraient s’inscrire dans la continuité de l’administration actuelle. Ce scénario semble à cet égard plus favorable au reste du monde. D’un point de vue domestique cependant, l’enjeu de cette élection se situera au niveau fiscal. Certaines mesures présentes à l’agenda des démocrates pourraient s’avérer pénalisantes pour les actions américaines : fin du Tax Cuts and Jobs Act avec un taux d’impôt sur les sociétés qui remonte de 21 % à 28 %, et augmentation de la taxe sur les rachats d’actions. Les mesures mises en avant par Kamala Harris viennent en soutien aux classes moyennes et populaires avec notamment une extension prévue des réductions d’impôts pour les revenus inférieurs à 400.000 USD, un élargissement du crédit d’impôt à la naissance et une aide pour les acheteurs d’un premier logement.

Ce scénario (victoire démocrate avec un congrès divisé) est assez proche de notre scénario central actuel : décélération attendue de la croissance économique et de l’inflation, poursuite de l’assouplissement monétaire prévu de la Fed. Ce scénario de « soft landing » est plus équilibré entre Etats-Unis et reste du monde, il est modérément constructif pour l’ensemble des actifs risqués, et dépendant de la résilience de l’activité économique. Sur les sujets environnementaux, nous ne disposons pas de mesures précises, mais une victoire démocrate est jugée par nature plus favorable aux énergies vertes.

Une victoire complète démocrate, quant à elle, présente un risque fiscal pour les entreprises américaines et serait prise négativement par le marché américain, en particulier pour les entreprises domestiques (les petites et moyennes capitalisation seraient plus fortement impactées).

Reste un dernier scénario : celui d’une victoire démocrate serrée sans majorité au congrès, contestée par Donald Trump et ses partisans. Ce risque d’instabilité politique et sociale même temporaire serait le plus négatif pour les marchés financiers avec une forte hausse de la volatilité. Des protections optionnelles seraient dans ce cas de figure le moyen le plus adapté pour s’en protéger en attendant de retrouver stabilité et gouvernement !

Scénarios de victoire aux élections et impact sur les différentes classes d’actifs

Source: estimations Candriam, 30/09/2024

[1] Source Bloomberg, 26/09/2024

[2] Source : Bloomberg, indice MSCI China, au 30/09/2024

Par Nadège Dufossé, CFA, Global Head of Multi-Asset

Ce document est destiné uniquement à l'attention des journalistes et des professionnels du secteur de la presse et des médias pour un usage éditorial. Il ne constitue pas une offre d'achat ou de vente d'instruments financiers, ni une recommandation d'investissement, ni la confirmation d'une quelconque transaction, sauf accord exprès. Bien que Candriam sélectionne soigneusement les données et les sources utilisées, des erreurs ou omissions ne peuvent être exclues a priori. Candriam ne saurait être tenue responsable des dommages directs ou indirects résultant de l’utilisation de ce document.

Pour accéder au site, cliquez ICI.

À propos de Candriam

Candriam, qui signifie "Conviction AND Responsibility In Asset Management", est un gestionnaire d’actifs mondial multi-spécialiste. Pionnier et leader dans le domaine des investissements durables depuis 1996, Candriam gère environ 145 milliards d’euros d’actifs et s’appuie sur une équipe de plus de 600 professionnels. La société dispose de centres de gestion à Luxembourg, Bruxelles, Paris et Londres et ses responsables de clientèle couvrent plus de 20 pays dans toute l'Europe continentale, au Royaume-Uni, aux États-Unis et au Moyen-Orient. Candriam propose des solutions d'investissement dans plusieurs domaines clés : obligations, actions, gestion alternative et stratégies d’allocation d'actifs, avec une gamme large et innovante de stratégies ESG couvrant toutes ces classes d'actifs.

Candriam est une société du groupe New York Life Investments. New York Life Investments se classe parmi les principaux gestionnaires d’actifs mondiaux.