Les investisseurs ayant les yeux rivés sur la reprise économique et les mesures de relance étant bien en place, les écarts de crédit devraient dépasser leurs précédents bas niveaux en 2021. Mais que pourrait-il se passer si tel est le cas ? Le CEO de TwentyFour Asset Management, Mark Holman, explique pourquoi il pense que le rééquilibrage des portefeuilles devrait constituer la décision stratégique clé pour les investisseurs obligataires cette année, et pourquoi il est temps de l’anticiper.

Parmi les éléments marquants en 2020 du point de vue des marchés, il est difficile de négliger la vitesse de transition entre l’ancien cycle économique et le nouveau.

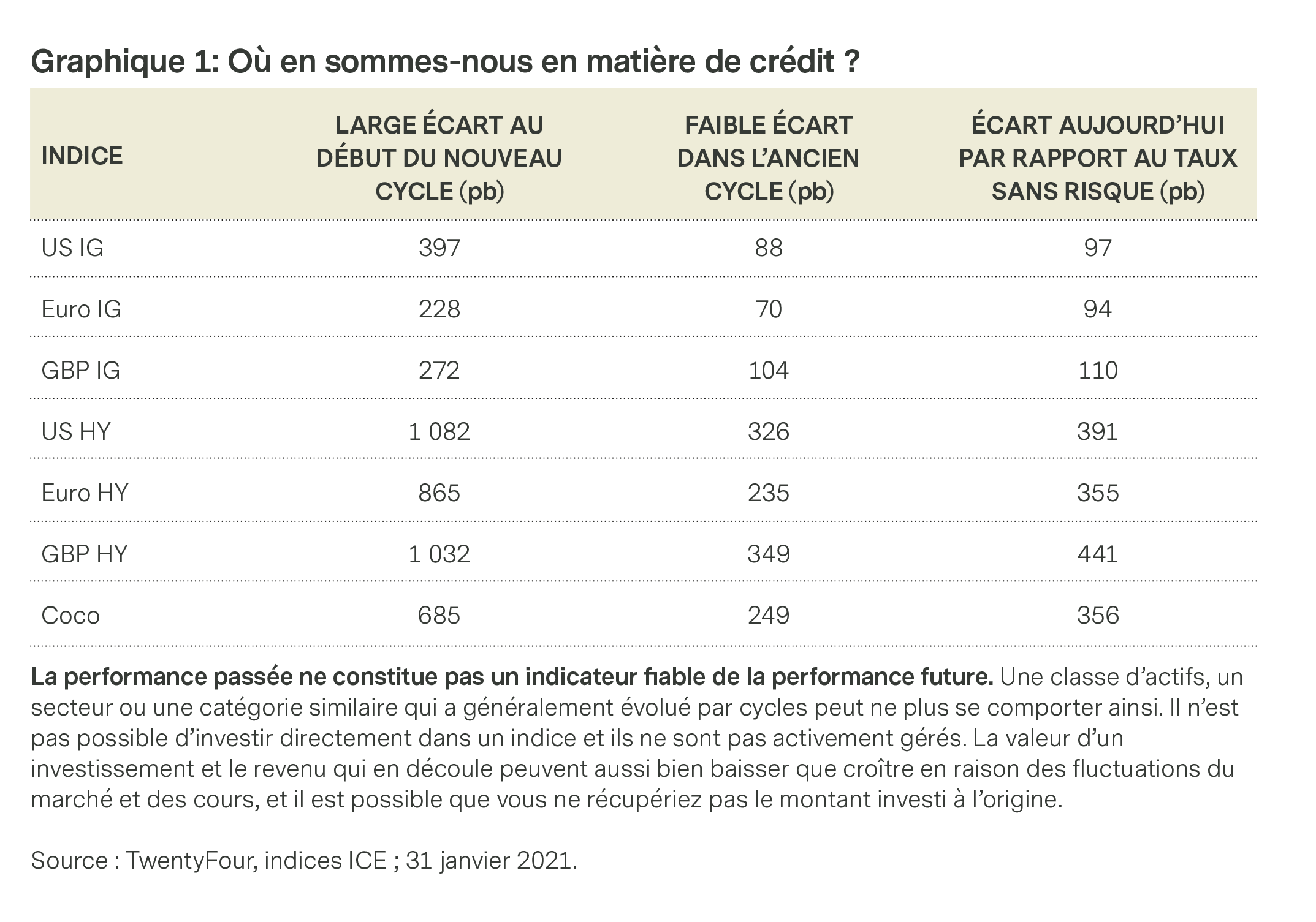

En quelques mois seulement, depuis que le COVID-19 a quasiment paralysé l’économie mondiale, les investisseurs ont assisté à un basculement rapide de fin de cycle économique à une grave récession, puis à la phase de reprise; un processus qui dure généralement plusieurs années. Cette accélération s’est reflétée dans les marchés obligataires ; les écarts des titres Investment Grade non seulement ont dépassé leurs bas niveaux d’avant la crise du COVID, mais menacent déjà de rattraper ceux du cycle précédent, tandis que les écarts sur les obligations à haut rendement ne sont plus très loin de leurs plus bas niveaux de 2020.

À notre avis, ce rebond colossal s’est jusqu’à présent justifié. Le déclenchement de mesures de relance impressionnantes en 2020 par les gouvernements et les banques centrales ainsi que le lancement d’un certain nombre de vaccins efficaces contre le COVID-19 nous font penser que la demande refoulée des consommateurs contribuera à une forte reprise économique plus tard dans l’année. Notre feuille de route pour le reste de l’année prévoit que les écarts de crédit continuent à se resserrer et que les rendements des emprunts d’État grimpent.

Ainsi, nous souhaitions être bien investis dans le crédit pour commencer l’année 2021. Un sentiment qui nous semble être partagé parmi les investisseurs ; les nouvelles émissions d’obligation au cours du mois de janvier n’ont pas tout à fait atteint le rythme que nous avons pu voir en 2020, mais la demande est restée ferme et il semble en être de même pour le besoin du de rendement, ce qui, selon nous, a contribué à précipiter la reprise du crédit.

En tant que gérant actif, une attitude bien conforme au consensus peut sembler quelque peu inconfortable, mais notre prévision selon laquelle il reste une marge de manœuvre à la reprise du crédit est une forte conviction. Nous voyons en effet les écarts IG dépasser leurs anciens bas niveaux du cycle précédent dès le premier trimestre, et nous tablons également sur une importante compression des écarts entre les tranches de notation cette année, à mesure que le haut rendement se redresse.

Je ne pense pas qu’une approche à contre-courant soit actuellement judicieuse. Les gouvernements et les banques centrales semblent déterminés à maintenir les mesures de relance monétaire et budgétaire, et, les courbes des emprunts d’État n’offrant des rendements que très faibles voire négatifs, il subsiste une demande importante pour des rendements de la part des investisseurs globalement qui devrait, selon nous, être satisfaite au mieux par le crédit.

Toutefois, je pense qu’il est important d’anticiper suffisamment tôt les possibilités de rééquilibrage si vous pensez atteindre vos objectifs en matière d’écarts. Quand et surtout comment les investisseurs en obligations pourront-ils donc trouver ce rééquilibrage ?

Le scénario de reflation ?

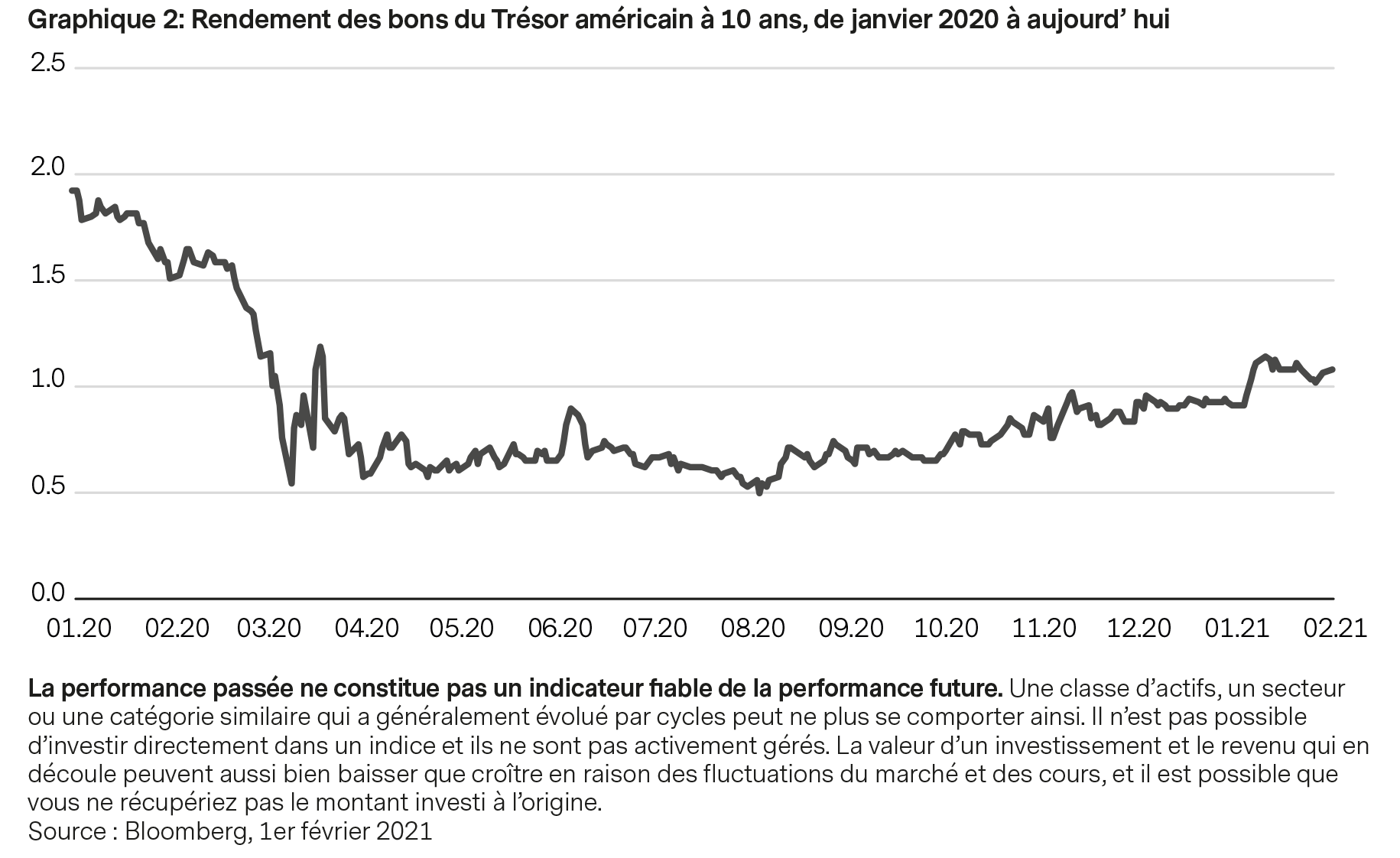

Nous sommes d’avis qu’une grande partie de la réponse à cette question viendra du marché des titres du Trésor américain. Les bons du Trésor sont généralement le produit actuel « risk-off » de choix dans le monde, et avec des rendements à 10 ans tombant bien en dessous de 1 % pour la majeure partie de l’année 2020, ils ont, selon nous, perdu beaucoup de leur utilité en tant qu’instrument d’équilibrage de portefeuille dans la mesure où nous ne les avons pas crus assez performants dans un contexte de marché baissier pour compenser le recul d’actifs à risque.

Pour ceux qui se sentent quelque peu exposés sans le contrepoids habituel des bons du Trésor américain, une évolution bienvenue a eu lieu dans les premiers jours de l’année 2021, lorsque les rendements des bons du Trésor américain à 10 ans ont rapidement grimpé de 92 pb le 4 janvier à un niveau de 115 pb le 11 janvier, leur procurant une plus grande marge de manœuvre pour protéger un portefeuille de titres obligataires dans un contexte de survente du crédit, une marge toutefois insuffisante selon nous.

Cette forte hausse des rendements s’explique principalement par la prise de contrôle du Sénat américain par les Démocrates, ouvrant la voie à des plans de relance plus ambitieux de la nouvelle administration Biden et attisant éventuellement les flammes de l’inflation. Les rendements à 10 ans sont depuis retombés à environ 1 %, mais notre scénario de base prévoit une pentification de la courbe du Trésor, où les rendements à long terme montent quand ceux à court terme restent ancrés, portant le rendement à environ 1,5 % d’ici à la fin de l’année.

À ce niveau, nous pensons que les bons du Trésor américain à plus long terme seraient des candidats plus sérieux dans les décisions d’allocation d’actifs des gestionnaires de portefeuille, ce pourquoi l’inflation, notamment aux États-Unis, sera l’un des paramètres les plus surveillés par les investisseurs obligataires cette année. Les indications prospectives de la Fed n’indiquent pas de changement sur le taux directeur d’ici 2023, laissant ainsi l’économie potentiellement en surchauffe si l’inflation surpasse le seuil de 2 %. En janvier, les prévisions d’inflation sur 10 ans aux États-Unis ont dépassé les 2 % pour la première fois depuis mai 2018, conduisant à des spéculations quant à l’ampleur de l’augmentation de l’inflation nécessaire pour que la Fed commence à discuter d’une atténuation de ses mesures de relance.

Nous sommes d’avis que l’inflation augmentera au cours de l’année 2021, mais nous ne la percevons pas comme un problème pour la Fed, ou même pour d’autres banques centrales, à court terme. L’économie américaine a perdu environ neuf millions d’emplois en 2020, et il est difficile de voir l’inflation s’envoler tant que ce fossé sur le marché du travail ne sera pas comblé. L’une des différences majeures entre ce cycle et celui qui l’a précédé est que les banques ne procèdent pas à leur désendettement comme elles en avaient été contraintes par les autorités réglementaires dans les années qui ont suivi la crise financière de 2008. Par conséquent, nous nous attendons à ce que l’expansion du bilan des banques contribue à stimuler l’inflation à mesure que l’année avance, mais dans l’ensemble, nous misons sur une inflation qui pourrait concerner un risque pour les marchés plutôt en 2022.

Le casse-tête du crédit

L’autre volet de ce débat est bien évidemment le marché du crédit, et la vitesse à laquelle le resserrement des niveaux de spread que l’on anticipe surviendra. Dans un monde idéal, cela aurait lieu de manière progressive, parallèlement à une pentification progressive de la courbe du Trésor américain, ce qui permettrait aux gestionnaires de portefeuille d’envisager une rotation tout aussi progressive vers l’exposition « risk-off ». Mais étant donné la vitesse du cycle économique actuel, nous ne pouvons pas exclure qu’un scénario se produise plus vite que l’autre.

Comme le graphique 1 le montre ci-dessus, les écarts pour certaines notations du marché Investment Grade sont proches de leurs bas niveaux du cycle précédent. Nous estimons que ces bas niveaux devraient être atteints. A ce stade, si notre raisonnement n’a pas changé et une fois ces niveaux atteint, nous pensons que la bonne solution serait plutôt de changer notre positionnement. Toute autre attitude pourrait conduire à un dérapage. Nous nous méfions déjà d’une exposition à duration trop longue, car nous ne pensons pas qu’il y ait suffisamment d’écart dans ces obligations mieux notées pour absorber la pentification de la courbe des taux d’intérêts américains.

Une autre possibilité consiste à bénéficier de la valeur relative entre les secteurs du crédit en favorisant ceux offrant de meilleures opportunités de valeur. Si l’on considère les indices mondiaux à haut rendement aujourd’hui, les écarts de l’indice du marché américain sont d’environ 50 points de base plus élevés par rapport à leurs bas niveaux du cycle précédent, alors que les écarts de l’euro sont d’environ 100 points de base plus élevés et ceux de la livre sterling de quelques 200 points de base.

Indépendamment du déroulement de cette année, nous estimons en tant qu’investisseurs avoir de solides raisons de penser que les écarts de crédit atteindront, voire dépasseront, leurs bas niveaux du cycle précédent en 2021. Il est important de souligner que, si tel est le cas, nous devons nous assurer si notre raisonnement amenant à notre positionnement initial a changé. Si tel n’est pas le cas, il pourrait être temps de rééquilibrer les portefeuilles.

Ce sont généralement les dernières étapes d’une phase de reprise qui mettent les investisseurs au défi de savoir s’ils doivent rester entièrement investis dans des actifs « risk-on » ou commencer à considérer certains produits « risk-off » dans le but d’équilibrer davantage leur portefeuille. Cependant, la vitesse de ce cycle pourrait vous faire atteindre vos objectifs en matière d’écarts plus tôt que d’ordinaire.

Nous estimons que nombreux sont les investisseurs obligataires qui atteindront ce point d’inflexion dans le courant de l’année 2021, et nous pensons que le temps est venu de s’y préparer.

Pour accéder au site, cliquez ICI.